Investment in Global Composites Growth Creates Balance to Building

Materials Market Weakness in 2008 TOLEDO, Ohio, Feb. 27

/PRNewswire-FirstCall/ -- Owens Corning (NYSE:OC) today reported

consolidated net sales of $4.98 billion in 2007 compared with $5.40

billion in fiscal 2006, a decrease of 7.8 percent. The reduction in

sales was primarily in the company's building materials businesses

where demand declined significantly in the new residential

construction and residential repair and remodeling markets. Owens

Corning's consolidated statement of earnings has been recast to

reflect the impact of discontinued operations following the

divestiture of its Siding Solutions and Fabwel businesses in 2007.

The results include two months of operations of the acquired

Saint-Gobain reinforcements and composite fabrics businesses. Owens

Corning achieved 2007 earnings from continuing operations of $27

million, or $0.21 per diluted share. Excluding comparability items,

adjusted earnings from continuing operations were $158 million, or

$1.21 per diluted share (see attached Table 5 for a discussion and

reconciliation of such items). Comparability items in 2007 included

items related primarily to the company's prior Chapter 11

proceedings, the employee emergence equity program, and

restructuring and other activities, which amounted to approximately

$199 million during 2007. Fourth-Quarter and Consolidated 2007

Results -- Earnings before interest and taxes (EBIT) from

continuing operations for the full year ending Dec. 31, 2007, were

$145 million compared with $407 million in fiscal 2006. Excluding

comparability items (see Table 3), adjusted EBIT from continuing

operations for 2007 was $344 million compared with $529 million

during 2006, a decrease of 35 percent. The decrease was primarily

due to lower sales in the company's building materials businesses

as the decline in the U.S. housing market continued. -- During the

fourth quarter of 2007, Owens Corning recorded sales of $1.30

billion compared with sales of $1.25 billion during the same period

in 2006, an increase of 4.0 percent. -- Fourth-quarter 2007 EBIT

from continuing operations was a loss of $46 million compared with

a loss of $1 million for the same period in 2006. Excluding

comparability items, adjusted EBIT from continuing operations for

the fourth quarter of 2007 was $85 million compared with $137

million during the same period in 2006. -- Gross margin as a

percentage of consolidated net sales was 15.6 percent during 2007

compared with 18.6 percent during fiscal 2006. Gross margin in 2007

was negatively impacted by approximately $98 million in charges

associated with curtailments in production capacity, an asset

impairment related to the company's previously announced sale of

its composite manufacturing facilities in Battice, Belgium, and

Birkeland, Norway, and the sale of inventories, the value of which

was written up as part of the acquisition of Saint-Gobain's

reinforcements and composite fabrics businesses. Gross margin in

2006 was negatively impacted by approximately $58 million in

charges associated with the sale of inventories, the value of which

was written up as a result of the adoption of fresh start

accounting and other charges associated with curtailments in

production capacity. -- Marketing and administrative expenses, as a

percentage of consolidated net sales, were 10.0 percent in 2007

compared with 9.1 percent during fiscal 2006. The increase was due

primarily to a reduction in building materials sales. "Business

results for 2007 were in line with our expectations," said Mike

Thaman, chairman and chief executive officer. "Owens Corning is

performing well through the severe downturn in the U.S. housing

market. We generated cash flow from operations of $182 million in

2007, which includes $57 million in cash out-flows related to our

emergence from Chapter 11 in 2006. We have taken aggressive action

to globalize our composites business which has transformed the

footprint of our company. We are also actively managing our

building materials capacity and cost structure to stay ahead of the

current demand weakness. "In 2008, we expect progress in our

operating margins in composites as we see the first-year benefits

of the acquisition of Saint-Gobain's reinforcements and composite

fabrics businesses," said Thaman. "We will continue to invest in

winning with our customers so that Owens Corning is well positioned

to further profit when the U.S. housing market recovers, as we know

it will." During 2007, Owens Corning acted decisively to perform

through the U.S. building materials cycle. The company: --

Completed its acquisition of Saint-Gobain's reinforcements and

composite fabrics businesses for $640 million. Owens Corning

anticipates annual synergies of more than $100 million to be

realized by the end of 2011. -- Divested its Siding Solutions and

Fabwel businesses for approximately $425 million of net proceeds.

-- Put in place cost-reduction initiatives to reduce company-wide

annualized operating costs in 2008 by at least $100 million. These

projects include capacity and headcount reductions, elimination of

operational costs, and reduced corporate and business unit

expenses. -- Completed the national rollout of the innovative

Duration(TM) Series Shingle featuring SureNail(R) technology six

months ahead of schedule. Other Financial Items -- In 2007,

depreciation and amortization from continuing operations totaled

$333 million, which includes $21 million of accelerated

depreciation related to curtailments in production capacity. -- At

the end of 2007, Owens Corning had net debt of $1.91 billion,

comprised of $2.05 billion of short- and long-term debt and

cash-on- hand of $135 million. -- During 2007, the company's cash

and debt positions were impacted by its acquisition of

Saint-Gobain's reinforcements and composite fabrics businesses. The

impact on net debt was partially offset by the sale of its Siding

Solutions and Fabwel businesses. -- Owens Corning's federal tax net

operating loss resulting from the distribution of cash and stock to

settle its prior Chapter 11 case was $3 billion at the end of 2007.

-- Owens Corning announced a share buy-back program in the first

quarter of 2007 under which the company is authorized to repurchase

up to 5 percent of Owens Corning's outstanding common stock. The

company did not repurchase any shares during 2007. -- The company's

continued focus on safety resulted in a 28-percent reduction in

injuries through 2007, as compared with its Dec. 31, 2006 rate.

Recent Developments In the fourth quarter of 2007, Owens Corning

commenced various cost savings projects to reduce headcount, close

facilities and curtail production, which resulted in restructuring

and other charges of $57 million. The company expects additional

charges of $7 million in 2008. Owens Corning is confident that

these cost-reduction initiatives will reduce company-wide

annualized operating costs in 2008 by at least $100 million. During

2007, Owens Corning announced its plans to divest its facilities in

Battice, Belgium, and Birkeland, Norway, to address regulatory

remedies associated with its purchase of the businesses acquired

from Saint-Gobain. The divestiture is expected to be completed

during the first quarter of 2008. On Feb. 26, 2008, Moody's

Investors Service announced that they elected to downgrade Owens

Corning's senior credit rating from Baa3 to Ba1 with a negative

outlook because of the adverse effects of the homebuilding

contraction. Outlook Owens Corning's acquisition of Saint-Gobain's

reinforcements and composite fabrics businesses will significantly

increase the company's presence in the global composites market and

diversify its exposure to the cyclical U.S. housing market. As it

begins to realize synergies from the acquisition, the company

expects operating margins in its composites business to approach

double digits in 2008, excluding the financial cost of leasing

precious metals. Most economists, including the National

Association of Home Builders, currently expect continued weakness

in the U.S. housing market through 2008, which will continue to

affect demand for Owens Corning's insulation products. Commercial

and industrial demand for insulating products is also likely to

weaken. Owens Corning will continue to focus on stimulating

insulation demand by promoting the vital role of insulation in

energy efficiency and greenhouse gas reduction, and developing new

products and customer promotions under the company's PINK is

GREEN(TM) initiative. The company currently estimates that

depreciation and amortization from continuing operations will total

approximately $315 million in 2008. Capital expenditures in 2008

are estimated to be about $325 million, which will allow the

company to invest to achieve synergies associated with its recent

composites acquisition. Owens Corning anticipates that its 2008

global effective tax rate will be approximately 30 percent. The

company expects its U.S. cash taxes will be minimal, and that its

cash effective tax rate at its international operations will be 15

percent or less in 2008. Based on U.S. housing starts of about 1

million, Owens Corning estimates that 2008 adjusted EBIT should be

at least $240 million. The company excludes from its estimate

reconciliation items as well as the financial cost of leasing

precious metals. Business Segment Highlights Composite Solutions --

Net sales for 2007 were $1.70 billion, a 23.2-percent increase from

$1.38 billion in fiscal 2006. The acquisition of Saint-Gobain's

reinforcements and composite fabrics businesses increased 2007

sales by approximately $160 million. Year-over-year improvements in

volume increased sales by approximately $70 million compared with

fiscal 2006. A positive foreign currency effect increased sales by

about $50 million. -- EBIT from continuing operations for 2007 was

$126 million compared with $154 million in fiscal 2006. However,

EBIT from continuing operations in fiscal 2006 included gains on

the sale of precious metal used in certain production tooling of

approximately $45 million and insurance recoveries of $20 million

related to a flood at the company's Taloja, India, production

facility, which were offset by approximately $8 million of downtime

cost. Excluding these items, EBIT from continuing operations

improved by $29 million in 2007, compared to fiscal 2006.

Insulating Systems -- Net sales for 2007 were $1.78 billion, a

15.2-percent decrease from $2.10 billion in fiscal 2006. Sales for

residential insulation products were significantly impacted by the

reduction in market demand in new residential construction and

repair and remodeling in the United States. Beginning in the third

quarter of 2007, the company also experienced some weakness in

commercial and industrial markets. -- EBIT from continuing

operations for 2007 was $192 million compared with $467 million in

fiscal 2006. Approximately one-third of the decline was due to

lower volumes and approximately one-third was due to lower selling

prices. In addition, results were negatively impacted by

approximately $37 million in additional depreciation and

amortization costs as a result of the adoption of fresh start

accounting. Roofing and Asphalt -- Net sales for 2007 were $1.38

billion, a 19.8-percent decrease from $1.72 billion in fiscal 2006.

Sales volume was impacted by the reduction in demand in existing

home sales and related roofing repair and remodeling, the continued

decline in new residential construction in the United States and by

lower storm-related demand. Sales were lifted by the introduction

of the company's innovative Duration(TM) Series Shingle with

SureNail(R) Technology, which was made available across the United

States six months ahead of schedule. -- EBIT from continuing

operations for 2007 was $27 million compared with $72 million in

fiscal 2006. Earnings were impacted by volume reductions resulting

from a decline in residential repair and remodeling activities,

lower storm-related demand and the slowdown of new residential

construction. Other Building Materials and Services -- Net sales

for 2007 were $301 million, a 20.2-percent decrease from $377

million in fiscal 2006. The closure of the company's HOMExperts

service line in the fourth quarter of 2006 negatively impacted

sales in 2007 by $76 million. Sales of the company's Masonry

Products business within this segment were positively impacted in

2007 by the inclusion of approximately $24 million in sales from

the company's acquisition of the Modulo(TM)/ParMur Group during the

third quarter of 2006. This increase was partially offset by

declines in volume related to the continued lower demand from new

construction in the United States. -- EBIT from continuing

operations for 2007 was $14 million compared with $1 million in

fiscal 2006. The improved performance was primarily due to the

impact of closing the company's HOMExperts service line in 2006.

First-quarter 2008 results are currently scheduled to be announced

on May 7, 2008. Conference Call and Presentation Wednesday, Feb.

27, 2008 11 a.m. ET All Callers Live dial-in telephone number:

1-888-713-4209 or 1-617-213-4863 (Please dial in 10 minutes before

conference call start time) Passcode: 41140851 Presentation To view

the slide presentation during the conference call, please log on to

the live webcast at http://www.owenscorning.com/investors. A

telephone replay will be available through March 12, 2008 at

1-888-286-8010 or 1-617-801-6888. Passcode: 41491827. A replay of

the webcast will also be available at

http://www.owenscorning.com/investors. About Owens Corning Owens

Corning (NYSE:OC) is a leading global producer of residential and

commercial building materials, glass fiber reinforcements and

engineered materials for composite systems. A Fortune 500 company

for 53 consecutive years, Owens Corning is committed to driving

sustainability through delivering solutions, transforming markets

and enhancing lives. Founded in 1938, Owens Corning is a

market-leading innovator of glass fiber technology with sales of $5

billion in 2007 and 19,000 employees in 26 countries on five

continents. Additional information is available at

http://www.owenscorning.com/. This news release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. These forward-looking statements are subject to risks,

uncertainties and other factors, many of which are outside the

control of the company, which could cause actual results to differ

materially from those projected in these statements and from the

company's historical results and experience. Such factors include

competitive factors, pricing pressures, availability and cost of

energy and materials, acquisitions and achievement of expected

synergies therefrom, general economic conditions and factors

detailed from time to time in the company's Securities and Exchange

Commission filings. Since it is not possible to predict or identify

all of the risks, uncertainties and other factors that may affect

future results, the above list should not be considered a complete

list. Any forward-looking statement speaks only as of the date on

which such statement is made, and the company undertakes no

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise.

Table 1 Owens Corning and Subsidiaries Year-to-Date Consolidated

Statements of Earnings (Loss) (Unaudited) (in millions, except per

share amounts) Successor Combined Successor Predecessor Twelve

Twelve Two Ten Months Months Months Months Ended Ended Ended Ended

December December December October 31, 31, 31, 31, 2007 2006 2006

2006 NET SALES $4,978 $5,399 $772 $4,627 COST OF SALES 4,201 4,397

656 3,741 Gross margin 777 1,002 116 886 OPERATING EXPENSES

Marketing and administrative expenses 498 494 86 408 Science and

technology expenses 63 78 30 48 Restructure costs 28 32 20 12

Chapter 11 related reorganization items - 55 10 45 Provision

(credit) for asbestos litigation claims (recoveries) - (13) - (13)

Employee emergence equity program 37 6 6 - (Gain) loss on sale of

fixed assets and other 6 (57) 8 (65) Total operating expenses 632

595 160 435 EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE

INTEREST AND TAXES 145 407 (44) 451 Interest expense, net 122 * 29

241 Gain on settlement of liabilities subject to compromise - * -

(5,864) Fresh-start accounting adjustments - * - (2,919) EARNINGS

(LOSS) FROM CONTINUING OPERATIONS BEFORE TAXES 23 * (73) 8,993

Income tax expense (benefit) (8) * (23) 980 EARNINGS (LOSS) FROM

CONTINUING OPERATIONS BEFORE MINORITY INTEREST AND EQUITY IN NET

EARNINGS OF AFFILIATES 31 * (50) 8,013 Minority interest and equity

in net earnings (loss) of affiliates (4) * (4) - EARNINGS (LOSS)

FROM CONTINUING OPERATIONS 27 * (54) 8,013 Discontinued Operations:

Earnings (loss) from discontinued operations, net of tax of $5,

$(5), and $45, respectively 9 * (11) 127 Gain on sale of

discontinued operations, net of tax of $40, $0, and $0,

respectively 60 * - - Total earnings (loss) from discontinued

operations 69 * (11) 127 NET EARNINGS (LOSS) $96 * $(65) $8,140

BASIC EARNINGS (LOSS) PER COMMON SHARE Earnings (loss) from

continuing operations $0.21 * $(0.42) $144.90 Earnings (loss) from

discontinued operations $0.54 * $(0.09) $2.30 DILUTED EARNINGS

(LOSS) PER COMMON SHARE Earnings (loss) from continuing operations

$0.21 * $(0.42) $133.77 Earnings (loss) from discontinued

operations $0.54 * $(0.09) $2.12 WEIGHTED AVERAGE COMMON SHARES

Basic 128.1 * 128.1 55.3 Diluted 128.8 * 128.1 59.9 * Due to

concerns regarding lack of comparability, separate historical

results of the Successor and Predecessor are presented individually

for this line item. Table 2 Owens Corning and Subsidiaries

Quarter-to-Date Consolidated Statement of Earnings (Loss)

(Unaudited) (in millions, except per share amounts) Combined

Successor Three Three Two Predecessor Months Months Months One

Month Ended Ended Ended Ended December December December October

31, 31, 31, 31, 2007 2006 2006 2006 NET SALES $1,304 $1,250 $772

$478 COST OF SALES 1,165 1,047 656 391 Gross margin 139 203 116 87

Operating Expenses Marketing and administrative expenses 133 117 86

31 Science and technology expenses 17 36 30 6 Restructure costs 31

22 20 2 Chapter 11 related reorganization items (4) 27 10 17

Provision (credit) for asbestos litigation claims - - - - Employee

emergence equity program 9 6 6 - (Gain) loss on sale of fixed

assets and other (1) (4) 8 (12) Total operating expenses 185 204

160 44 EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INTEREST

AND TAXES (46) (1) (44) 43 Interest expense, net 32 * 29 19 Gain on

settlement of liabilities subject to compromise - * - (5,864)

Fresh-start accounting adjustments - * - (2,919) EARNINGS (LOSS)

FROM CONTINUING OPERATIONS BEFORE TAXES (78) * (73) 8,807 Income

tax expense (benefit) (38) * (23) 1,149 EARNINGS (LOSS) FROM

CONTINUING OPERATIONS BEFORE MINORITY INTEREST AND EQUITY IN NET

EARNINGS OF AFFILIATES (40) * (50) 7,658 Minority interest and

equity in net earnings (loss) of affiliates - * (4) (2) EARNINGS

(LOSS) FROM CONTINUING OPERATIONS (40) * (54) 7,656 Discontinued

Operations: Earnings (loss) from discontinued operations, net of

tax of $0, $(5), and $30, respectively - * (11) 108 Gain on sale of

discontinued operations, net of tax of $1, $0, and $0, respectively

(6) * - - Total earnings (loss) from discontinued operations (6) *

(11) 108 NET EARNINGS (LOSS) $(46) * $(65) $7,764 BASIC EARNINGS

(LOSS) PER COMMON SHARE Earnings (loss) from continuing operations

$(0.31) * $(0.42) $138.45 Earnings (loss) from discontinued

operations $(0.05) * $(0.09) $1.95 DILUTED EARNINGS (LOSS) PER

COMMON SHARE Earnings (loss) from continuing operations $(0.31) *

$(0.42) $127.81 Earnings (loss) from discontinued operations

$(0.05) * $(0.09) $1.80 WEIGHTED AVERAGE COMMON SHARES Basic 128.1

* 128.1 55.3 Diluted 128.8 * 128.1 59.9 * Due to concerns regarding

lack of comparability, separate historical results of the Successor

and Predecessor are presented individually for this line item.

Table 3 Owens Corning and Subsidiaries Year-to-Date EBIT

Reconciliation Schedules (Unaudited) (in millions, except per share

amounts) When reviewing the operating performance of the company

with its Board of Directors and employees, management makes

adjustments to net earnings, earnings before interest and taxes

("EBIT") from continuing operations and diluted earnings per share.

To calculate "adjusted earnings", "adjusted EBIT" and "adjusted

diluted earnings per share", management excludes certain items from

earnings before interest and taxes from continuing operations,

including those related to the company's prior Chapter 11

proceedings, employee emergence equity program, restructuring and

other activities so as to improve comparability over time (the

"comparability items"). As described more fully in the following

financial schedules, such comparability items amounted to charges

of $199 million, $122 million, $117 million, and $5 million in the

Successor twelve months ended December 31, 2007, Combined twelve

months ended December 31, 2006, the Successor two months ended

December 31, 2006 and the Predecessor ten months ended October 31,

2006, respectively. Successor Combined Successor Predecessor Twelve

Twelve Two Ten Months Months Months Months Ended Ended Ended Ended

December December December October 31, 31, 31, 31, 2007 2006 2006

2006 RECONCILIATION TO ADJUSTED EARNINGS FROM CONTINUING OPERATIONS

BEFORE INTEREST AND TAXES: NET EARNINGS (LOSS) $96 * $(65) $8,140

Discontinued operations Earnings (loss) from discontinued

operations, net of tax of $5, $(5), and $45, respectively 9 * (11)

127 Gain on sale of discontinued operations, net of tax of $40, $0,

and $0, respectively 60 * - - Total earnings (loss) from

discontinued operations 69 * (11) 127 EARNINGS (LOSS) FROM

CONTINUING OPERATIONS 27 * (54) 8,013 Minority interest and equity

in net earnings (loss) of affiliates (4) * (4) - EARNINGS (LOSS)

FROM CONTINUING OPERATIONS BEFORE MINORITY INTEREST AND EQUITY IN

NET EARNINGS OF AFFILIATES 31 * (50) 8,013 Income tax expense

(benefit) (8) * (23) 980 EARNINGS (LOSS) FROM CONTINUING OPERATIONS

BEFORE TAXES 23 * (73) 8,993 Interest expense, net 122 * 29 241

Gain on settlement of liabilities subject to compromise - * -

(5,864) Fresh-start accounting adjustments - * - (2,919) EARNINGS

(LOSS) FROM CONTINUING OPERATIONS BEFORE INTEREST AND TAXES 145 407

(44) 451 Adjustments to remove items impacting comparability:

Chapter 11 related reorganization items $- $55 $10 $45 Asbestos

litigation (claims) recoveries - (13) - (13) Restructuring and

other (costs) credits 54 (2) 32 (34) Acquisition transaction costs

28 13 6 7 Impact of acquisition accounting 13 - - - Loss related to

the exit of our HOMExperts service line 7 - - - Employee emergence

equity program 37 6 6 - Fresh-start accounting impact - 63 63 -

Asset impairments 60 - - - Total adjustments to remove

comparability items 199 122 117 5 ADJUSTED EARNINGS FROM CONTINUING

OPERATIONS BEFORE INTEREST AND TAXES $344 $529 $73 $456 * Due to

concerns regarding lack of comparability, separate historical

results of the Successor and Predecessor are presented individually

for this line item. Table 4 Owens Corning and Subsidiaries

Quarter-to-Date EBIT Reconciliation Schedules (Unaudited) (in

millions, except per share amounts) When reviewing the operating

performance of the company with its Board of Directors and

employees, management makes adjustments to earnings before interest

and taxes ("EBIT") from continuing operations. To calculate

"adjusted EBIT", management excludes certain items from earnings

before interest and taxes from continuing operations, including

those related to the company's prior Chapter 11 proceedings,

employee emergence equity program, restructuring and other

activities so as to improve comparability over time (the

"comparability items"). As described more fully in the following

financial schedules, such comparability items amounted to charges

of $131 million, $138 million, $117 million, and $21 million in the

Successor three months ended December 31, 2007, Combined three

months ended December 31, 2006, the Successor two months ended

December 31, 2006 and the Predecessor one month ended October 31,

2006, respectively. Successor Combined Successor Predecessor Three

Three Two One Months Months Months Month Ended Ended Ended Ended

December December December October 31, 31, 31, 31, 2007 2006 2006

2006 RECONCILIATION TO ADJUSTED EARNINGS (LOSS) FROM CONTINUING

OPERATIONS BEFORE INTEREST AND TAXES: NET EARNINGS (LOSS) $(46) *

$(65) $7,764 Discontinued operations Earnings (loss) from

discontinued operations, net of tax of $0, $(5), and $30,

respectively - * (11) 108 Gain on sale of discontinued operations,

net of tax of $1, $0, and $0, respectively (6) * - - Total earnings

(loss) from discontinued operations (6) * (11) 108 EARNINGS (LOSS)

FROM CONTINUING OPERATIONS (40) * (54) 7,656 Minority interest and

equity in net earnings (loss) of affiliates - * (4) (2) EARNINGS

(LOSS) FROM CONTINUING OPERATIONS BEFORE MINORITY INTEREST AND

EQUITY IN NET EARNINGS (LOSS) OF AFFILIATES (40) * (50) 7,658

Income tax expense (benefit) (38) * (23) 1,149 EARNINGS (LOSS) FROM

CONTINUING OPERATIONS BEFORE TAXES (78) * (73) 8,807 Interest

expense, net 32 * 29 19 Gain on settlement of liabilities subject

to compromise - * - (5,864) Fresh-start accounting adjustments - *

- (2,919) EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE

INTEREST AND TAXES (46) (1) (44) 43 Adjustments to remove items

impacting comparability: Chapter 11 related reorganization items

$(4) $27 $10 $17 Asbestos litigation (claims) recoveries - - - -

Restructuring and other (costs) credits 57 33 32 1 Acquisition

transaction costs 7 9 6 3 Impact of acquisition accounting 13 - - -

Loss related to the exit of our HOMExperts service line - - - -

Employee emergence equity program 9 6 6 - Fresh-start accounting

impact - 63 63 - Asset impairments 49 - - - Total adjustments to

remove comparability items 131 138 117 21 ADJUSTED EARNINGS FROM

CONTINUING OPERATIONS BEFORE INTEREST AND TAXES $85 $137 $73 $64 *

Due to concerns regarding lack of comparability, separate

historical results of the Successor and Predecessor are presented

individually for this line item. Table 5 Owens Corning and

Subsidiaries Year-to-Date EPS Reconciliation Schedules (Unaudited)

(in millions, except per share amounts) When reviewing the

operating performance of the company with its Board of Directors

and employees, management makes adjustments to net earnings,

weighted-average shares outstanding used for diluted earnings per

share and diluted earnings per share. To calculate "adjusted

earnings", "adjusted diluted shares outstanding" and "adjusted

diluted earnings per share", management excludes certain items from

net earnings and weighted-average shares outstanding, including

those related to the company's prior Chapter 11 proceedings,

employee emergence equity program, restructuring and other

activities so as to improve comparability over time (the

"comparability items"). As described more fully in the following

financial schedules, such comparability items amounted to charges

of $199 million and $117 million in the Successor twelve months

ended December 31, 2007 and the Successor two months ended December

31, 2006, respectively. Successor Successor Twelve Months Two

Months Ended Ended December 31, December 31, 2007 2006

RECONCILIATION TO ADJUSTED EARNINGS FROM CONTINUING OPERATIONS NET

EARNINGS (LOSS) $96 $(65) Discontinued operations Earnings (loss)

from discontinued operations, net of tax of $5, $(5), and $45,

respectively 9 (11) Gain on sale of discontinued operations, net of

tax of $40, $0, and $0, respectively 60 - Total earnings (loss)

from discontinued operations 69 (11) EARNINGS (LOSS) FROM

CONTINUING OPERATIONS 27 (54) Adjustments to remove items impacting

comparability: Chapter 11 related reorganization items $- $10

Asbestos litigation (claims) recoveries - - Restructuring and other

(costs) credits 54 32 Acquisition transaction costs 28 6 Impact of

acquisition accounting 13 - Loss related to the exit of our

HOMExperts service line 7 - Employee emergence equity program 37 6

Fresh-start accounting impact - 63 Asset impairments 60 - Total

adjustments to remove comparability items 199 117 Tax effect of

adjustments at 34% in 2007 and 37% in 2006 (68) (40) ADJUSTED

EARNINGS FROM CONTINUING OPERATIONS $158 $23 RECONCILIATION TO

ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE FROM CONTINUING

OPERATIONS: DILUTED EARNINGS (LOSS) PER SHARE FROM CONTINUING

OPERATIONS $0.21 $(0.42) Total adjustments to remove comparability

items 1.52 0.89 Tax effect of adjustments at 34% in 2007 and 37% in

2006 (0.52) (0.30) ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE FROM

CONTINUING OPERATIONS $1.21 $0.17 DILUTED EARNINGS (LOSS) PER SHARE

FROM DISCONTINUED OPERATIONS $0.54 $(0.09) RECONCILIATION TO

ADJUSTED DILUTED SHARES OUTSTANDING: Weighted-average shares

outstanding used for diluted earnings per share 128.8 128.1 Shares

related to employee emergence program 2.3 3.0 Adjusted diluted

shares outstanding 131.1 131.1 Table 6 Owens Corning and

Subsidiaries Quarter-to-Date EPS Reconciliation Schedules

(Unaudited) (in millions, except per share amounts) When reviewing

the operating performance of the company with its Board of

Directors and employees, management makes adjustments to net

earnings, weighted-average shares outstanding used for diluted

earnings per share and diluted earnings per share. To calculate

"adjusted earnings", "adjusted diluted shares outstanding" and

"adjusted diluted earnings per share", management excludes certain

items from net earnings and weighted-average shares outstanding,

including those related to the company's prior Chapter 11

proceedings, employee emergence equity program, restructuring and

other activities so as to improve comparability over time (the

"comparability items"). As described more fully in the following

financial schedules, such comparability items amounted to charges

of $131 million and $117 million in the Successor three months

ended December 31, 2007 and the Successor two months ended December

31, 2006, respectively. Successor Successor Three Months Two Months

Ended Ended December 31, December 31, 2007 2006 RECONCILIATION TO

ADJUSTED EARNINGS (LOSS) FROM CONTINUING OPERATIONS NET EARNINGS

(LOSS) $(46) $(65) Discontinued operations Earnings (loss) from

discontinued operations, net of tax of $0, $(5), and $30,

respectively - (11) Gain on sale of discontinued operations, net of

tax of $1, $0, and $0, respectively (6) - Total earnings (loss)

from discontinued operations (6) (11) EARNINGS (LOSS) FROM

CONTINUING OPERATIONS (40) (54) Adjustments to remove items

impacting comparability: Chapter 11 related reorganization items

$(4) $10 Asbestos litigation (claims) recoveries - - Restructuring

and other (costs) credits 57 32 Acquisition transaction costs 7 6

Impact of acquisition accounting 13 - Loss related to the exit of

our HOMExperts service line - - Employee emergence equity program 9

6 Fresh-start accounting impact - 63 Asset impairments 49 - Total

adjustments to remove comparability items 131 117 Tax effect of

adjustments at 34% in 2007 and 37% in 2006 (45) (40) ADJUSTED

EARNINGS FROM CONTINUING OPERATIONS $46 $23 RECONCILIATION TO

ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE FROM CONTINUING

OPERATIONS: DILUTED EARNINGS (LOSS) PER SHARE FROM CONTINUING

OPERATIONS $(0.30) $(0.42) Total adjustments to remove

comparability items 1.00 0.89 Tax effect of adjustments at 34% in

2007 and 37% in 2006 (0.34) (0.30) ADJUSTED DILUTED EARNINGS (LOSS)

PER SHARE FROM CONTINUING OPERATIONS $0.36 $0.17 DILUTED EARNINGS

(LOSS) PER SHARE FROM DISCONTINUED OPERATIONS $(0.05) $(0.09)

RECONCILIATION TO ADJUSTED DILUTED SHARES OUTSTANDING:

Weighted-average shares outstanding used for diluted earnings per

share 128.8 128.1 Shares not included in above related to employee

emergence program 2.3 3.0 Adjusted diluted shares outstanding 131.1

131.1 Table 7 Owens Corning and Subsidiaries Condensed Consolidated

Balance Sheets (Unaudited) (in millions) Successor December 31,

December 31, 2007 2006 ASSETS Current Assets Cash and cash

equivalents $135 $1,089 Receivables, less allowances of $23 million

in 2007 and $26 million in 2006 721 573 Inventories 821 749

Restricted Cash - disputed distribution reserve 33 85 Assets held

for sale - current 53 - Other current assets 89 56 Total current

assets 1,852 2,552 Property, plant, and equipment, net 2,772 2,521

Goodwill 1,174 1,313 Intangible assets 1,210 1,298 Deferred income

taxes 487 549 Assets held for sale - noncurrent 178 - Other

noncurrent assets 199 237 TOTAL ASSETS $7,872 $8,470 LIABILITIES

AND STOCKHOLDERS' EQUITY Current Liabilities Accounts payable and

accrued liabilities $1,137 $1,081 Accrued interest 12 39 Short term

debt 47 1,401 Long term debt - current portion 10 39 Liabilities

held for sale - current 40 - Total current liabilities 1,246 2,560

Long-term debt, net of current portion 1,993 1,296 Pension plan

liability 146 312 Other employee benefits liability 293 325

Liabilities held for sale -non- current 8 - Minority interest 37 44

Other liabilities 161 247 Stockholders' equity 3,988 3,686 TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY $7,872 $8,470 Table 8 Owens

Corning and Subsidiaries Condensed Consolidated Statements of Cash

Flows (Unaudited) (in millions) Successor Predecessor Twelve Two

Ten Months Months Months Ended Ended Ended December December

October 31, 31, 31, 2007 2006 2006 NET CASH FLOW PROVIDED BY (USED

FOR) OPERATING ACTIVITIES Net earnings (loss) $96 $(65) $8,140

Adjustments to reconcile net earnings (loss) to cash provided by

(used for) operating activities: Provision for asbestos litigation

claims - - 21 Depreciation and amortization 343 69 209 Gain on sale

of businesses and fixed assets (104) - (61) Impairment of fixed and

intangible assets and investments in affiliates 76 - 2 Deferred

income taxes - (48) 208 Provision for pension and other employee

benefits liabilities 45 8 83 Provision for post-petition

interest/fees on pre- petition debt - - 247 Fresh start accounting

adjustments, net of tax - - (2,243) Gain on settlement of

liabilities subject to compromise - - (5,864) Employee emergence

equity program 37 6 - Stock based compensation expense 5 - -

Restricted cash 52 (85) - Payments related to Chapter 11 filings

(109) (131) - Payment to 524(g) trust - - (1,250) Payment of

interest on pre- petition debt - (31) (944) (Increase) decrease in

receivables (9) 185 (78) (Increase) decrease in inventories 3 97

(103) (Increase) decrease in prepaid and other assets - 1 (36)

Increase (decrease) in accounts payable and accrued liabilities

(106) 30 (107) Proceeds from insurance for asbestos litigation

claims, excluding Fibreboard - - 18 Pension fund contribution (121)

(6) (43) Payments for other employee benefits liabilities (25) (4)

(23) Increase in restricted cash - asbestos and Fibreboard - - (87)

Other (1) (11) 8 Net cash flow provided by (used for) operating

activities 182 15 (1,903) NET CASH FLOW PROVIDED BY (USED FOR)

INVESTING ACTIVITIES Additions to plant and equipment (247) (77)

(284) Investment in subsidiaries and affiliates, net of cash

acquired (620) - (47) Proceeds from the sale of assets or

affiliates 437 - 82 Net cash flow used for investing activities

(430) (77) (249) NET CASH FLOW PROVIDED BY (USED FOR) FINANCING

ACTIVITIES Payment of equity commitment fees - - (115) Proceeds

from long-term debt 617 5 21 Payments on long-term debt (85) (5)

(13) Proceeds from revolving credit facility 713 - - Payments on

revolving credit facility (573) - - Payment of contingent note to

524(g) trust (1,390) - - Net increase (decrease) in short-term debt

(13) 1 3 Payments to pre-petition lenders - (55) (1,461) Proceeds

from issuance of bonds - - 1,178 Proceeds from issuance of new

stock - - 2,187 Debt issuance costs - - (10) Other - - 2 Net cash

flow provided by (used for) financing activities (731) (54) 1,792

Effect of exchange rate changes on cash 25 - 6 NET INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS (954) (116) (354) Cash and

cash equivalents at beginning of period 1,089 1,205 1,559 CASH AND

CASH EQUIVALENTS AT END OF PERIOD $135 $1,089 $1,205 Table 9 Owens

Corning and Subsidiaries Year-to-Date Business Segment Information

(Unaudited) (in millions) Successor Combined Successor Predecessor

Twelve Twelve Two Ten Months Months Months Months Ended Ended Ended

Ended December December December October 31, 31, 31, 31, 2007 2006

2006 2006 NET SALES Insulating Systems $1,776 $2,097 $331 $1,766

Roofing and Asphalt 1,375 1,723 167 1,556 Other Building Materials

and Services 301 377 60 317 Composite Solutions 1,695 1,382 227

1,155 Total reportable segments 5,147 5,579 785 4,794 Corporate

Eliminations (169) (180) (13) (167) Consolidated $4,978 $5,399 $772

$4,627 EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INTEREST

AND TAXES Insulating Systems $192 $467 $59 $408 Roofing and Asphalt

27 72 (23) 95 Other Building Materials and Services 14 1 (1) 2

Composite Solutions 126 154 37 117 Total reportable segments $359

$694 $72 $622 RECONCILIATION TO CONSOLIDATED EARNINGS (LOSS) FROM

CONTINUING OPERATIONS BEFORE INTEREST AND TAXES Chapter 11 related

reorganization items $- $(55) $(10) $(45) Asbestos litigation

(claims) recoveries - 13 - 13 Restructuring and other (costs)

credits (54) (43) (32) (11) Acquisition transaction costs (28) (13)

(6) (7) Impact of acquisition accounting (13) - - - Loss related to

the exit of our HOMExperts service line (7) - - - Employee

emergence equity program (37) (6) (6) - Fresh-start accounting

impact - (63) (63) - Asset impairments (60) - - - General corporate

expense (15) (120) 1 (121) CONSOLIDATED EARNINGS (LOSS) FROM

CONTINUING OPERATIONS BEFORE INTEREST AND TAXES $145 $407 $(44)

$451 Table 10 Owens Corning and Subsidiaries Quarter-to-Date

Business Segment Information (Unaudited) (in millions) Combined

Successor Predecessor Three Three Two One Months Months Months

Month Ended Ended Ended Ended December December December October

31, 31, 31, 31, 2007 2006 2006 2006 NET SALES Insulating Systems

$454 $527 $331 $196 Roofing and Asphalt 276 303 167 136 Other

Building Materials and Services 67 92 60 32 Composite Solutions 543

354 227 127 Total reportable segments 1,340 1,276 785 491 Corporate

Eliminations (36) (26) (13) (13) Consolidated $1,304 $1,250 $772

$478 EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INTEREST AND

TAXES Insulating Systems $55 $108 $59 $49 Roofing and Asphalt (9)

(25) (23) (2) Other Building Materials and Services (4) (1) (1) -

Composite Solutions 46 50 37 13 Total reportable segments $88 $132

$72 $60 RECONCILIATION TO CONSOLIDATED EARNINGS FROM CONTINUING

OPERATIONS BEFORE INTEREST AND TAXES Chapter 11 related

reorganization items $4 $(27) $(10) $(17) Asbestos litigation

recoveries - - - - Restructuring and other (costs) credits (57)

(33) (32) (1) Acquisition transaction costs (7) (9) (6) (3) Impact

of acquisition accounting (13) - - - Loss related to the exit of

our HOMExperts service line - - - - Employee emergence equity

program (9) (6) (6) - Fresh-start accounting impact - (63) (63) -

Asset impairments (49) - - - General corporate expense (3) 5 1 4

CONSOLIDATED EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE

INTEREST AND TAXES $(46) $(1) $(44) $43 DATASOURCE: Owens Corning

CONTACT: Media Inquiries: Jason Saragian, +1-419-248-8987, or

Investor Inquiries: Scott Deitz, +1-419-248-8935, both of Owens

Corning Web site: http://www.owenscorning.com/ Company News

On-Call: http://www.prnewswire.com/comp/677350.html

Copyright

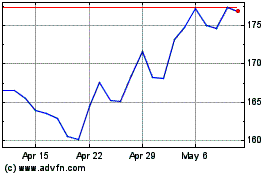

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jun 2024 to Jul 2024

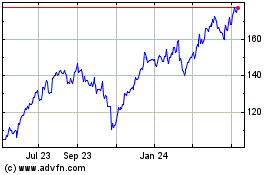

Owens Corning (NYSE:OC)

Historical Stock Chart

From Jul 2023 to Jul 2024