Mutual Fund Summary Prospectus (497k)

March 01 2013 - 12:56PM

Edgar (US Regulatory)

March 1, 2013

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

|

|

Calamos Growth and Income Fund

|

|

|

NASDAQ Symbol: CGIIX – Class I CGNRX – Class R

|

|

Before you

invest, you may want to review the Fund’s prospectus and statement of additional information, which contain more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other

information about the Fund online at http://fundinvestor.calamos.com/FundLit. You can also get this information at no cost by calling 800.582.6959 or by sending an e-mail request to prospectus@calamos.com. The current prospectus and statement

of additional information, both dated March 1, 2013 (and as each may be amended or supplemented), and the financial statements included in the Fund’s most recent report to shareholders, dated October 31, 2012, are incorporated by reference

into this summary prospectus.

Investment Objective

Calamos Growth and Income Fund’s investment objective is high long-term total return through growth and current income.

Fees and Expenses of the Fund

The following

table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. More information about the share classes is available from your financial professional and under “Fund Facts — What classes of shares

do the Funds offer?” on page 69 of the Fund’s prospectus and “Share Classes and Pricing of Shares” on page 59 of the Fund’s statement of additional information.

|

|

|

|

|

|

|

|

|

|

|

Shareholder Fees

(fees paid directly from your investment):

|

|

|

|

|

|

|

|

|

|

|

|

CLASS I

|

|

|

CLASS R

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price)

|

|

|

None

|

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the redemption price or offering

price)

|

|

|

None

|

|

|

|

None

|

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment):

|

|

|

|

|

CLASS I

|

|

|

CLASS R

|

|

|

Management Fees

|

|

|

0.67

|

%

|

|

|

0.67

|

%

|

|

Distribution and/or Service Fees (12b-1)

|

|

|

0.00

|

%

|

|

|

0.50

|

%

|

|

Other Expenses

|

|

|

0.17

|

%

|

|

|

0.17

|

%

|

|

Total Annual Operating Expenses

|

|

|

0.84

|

%

|

|

|

1.34

|

%

|

|

|

|

|

|

|

|

|

|

|

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest

$10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year, that all dividends and capital gain distributions are reinvested and that the Fund’s operating expenses remain the

same. Although your actual performance and costs may be higher or lower, based on these assumptions, whether or not you redeemed your shares at the end of the period, your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

I

|

|

|

R

|

|

|

1 Year

|

|

|

86

|

|

|

|

136

|

|

|

3 Years

|

|

|

268

|

|

|

|

424

|

|

|

5 Years

|

|

|

466

|

|

|

|

734

|

|

|

10 Years

|

|

|

1,038

|

|

|

|

1,612

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the

Fund’s portfolio turnover rate was 42.8% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in a diversified portfolio of convertible, equity and fixed-income securities of U.S. companies without regard to market

capitalization. In pursuing its investment objective, the Fund attempts to utilize these different types of securities to strike, in the investment adviser’s opinion, the appropriate balance between risk and reward in terms of growth and

income.

GIIRPRO 03/13

Calamos Growth and Income Fund

The Fund attempts to keep a consistent balance between risk and reward over the course of different market cycles, through various

combinations of stocks, bonds and/or convertible securities, to achieve what the Fund’s investment adviser believes to be an appropriate blend for the then-current market. As the market environment changes, portfolio securities may change in an

attempt to achieve a relatively consistent risk level over time. At some points in a market cycle, one type of security may make up a substantial portion of the portfolio, while at other times certain securities may have minimal or no

representation, depending on market conditions. The average term to maturity of the convertible and fixed-income securities purchased by the Fund will typically range from two to ten years. Interest rate changes normally have a greater effect on

prices of longer-term bonds than shorter-term bonds. The Fund’s investment adviser seeks to lower the risks of investing in stocks by using a “top-down approach” of diversification by company, industry, sector, country and currency

and focusing on macro-level investment themes. Consistent with the Fund’s investment objective and principal investment strategies the Fund’s investment adviser views the strategies as low volatility equity strategies and attempts to

achieve equity-like returns with lower than equity market risk by managing a portfolio that it believes will exhibit less volatility over full market cycles.

Principal Risks

An investment in the Fund is subject to risks, and you could lose money on

your investment in the Fund. There can be no assurance that the Fund will achieve its investment objective. The risks associated with an investment in the Fund can increase during times of significant market volatility. Your investment in the Fund

is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The principal risks of investing in the Fund include:

|

•

|

|

Convertible Securities Risk

— The value of a convertible security is influenced by changes in interest rates, with investment value declining as

interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value.

|

|

•

|

|

Synthetic Convertible Instruments Risk

— The value of a synthetic convertible instrument will respond differently to market fluctuations than a

convertible security because a synthetic convertible instrument is composed of two or more separate securities, each with its own market value. In addition, if the value of the underlying common stock or the level of the index involved in the

convertible component falls below the exercise price of the warrant or option, the warrant or option may lose all value.

|

|

•

|

|

Equity Securities Risk

— The securities markets are volatile, and the market prices of the Fund’s securities may decline generally. The

price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will

decline.

|

|

•

|

|

Growth Stock Risk

— Growth securities typically trade at higher multiples of current earnings than other securities and, therefore, may be more

sensitive to changes in current or expected earnings than other equity securities and may be more volatile.

|

|

•

|

|

Small and Mid-Sized Company Risk

— Small and mid-sized company stocks have historically been subject to greater investment risk than large

company stocks. The prices of small and mid-sized company stocks tend to be more volatile than prices of large company stocks.

|

|

•

|

|

Interest Rate Risk

— The value of fixed-income securities generally decreases in periods when interest rates are rising. In addition, interest

rate changes typically have a greater effect on prices of longer-term fixed-income securities than shorter-term fixed-income securities.

|

|

•

|

|

Credit Risk

— An issuer of a fixed-income security could be downgraded or default. If the Fund holds securities that have been downgraded, or

that default on payment, the Fund’s performance could be negatively affected.

|

|

•

|

|

Liquidity Risk

— Liquidity risk exists when particular investments are difficult to purchase or sell. The Fund’s investments in illiquid

securities may reduce the returns of the Fund because it may be unable to sell the illiquid securities at an advantageous time or price.

|

|

•

|

|

High Yield Risk

— High yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”) are subject

to greater levels of credit and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments.

|

|

•

|

|

Forward Foreign Currency Contract Risk

— Forward foreign currency contracts are contractual agreements to purchase or sell a specified currency at a

specified future date (or within a specified time period) at a price set at the time of the contract. The Fund may not fully benefit from, or may lose money on, forward foreign currency transactions if changes in currency exchange rates do not occur

as anticipated or do not correspond accurately to changes in the value of the Fund’s holdings.

|

|

•

|

|

Portfolio Selection Risk

— The value of your investment may decrease if the investment adviser’s judgment about the attractiveness, value

or market trends affecting a particular security, issuer, industry or sector or about market movements is incorrect.

|

2

Calamos Growth and Income Fund

Performance

The following bar chart and table indicate the risks of investing in the Fund by showing changes in the Fund’s performance from calendar year to calendar year

and how the Fund’s average annual total returns compare with those of a broad measure of market performance. All returns include the reinvestment of dividends and distributions. As always, please note that the Fund’s past performance

(before and after taxes) cannot predict how it will perform in the future. Updated performance information is available at no cost by visiting www.calamos.com or by calling 800.582.6959.

CLASS I ANNUAL TOTAL RETURN FOR YEARS ENDED 12.31

|

|

|

|

|

|

|

|

|

Best Quarter:

|

|

15.19% (9.30.09)

|

|

Worst Quarter:

|

|

-14.65% (12.31.08)

|

|

|

|

|

|

|

|

|

Average Annual Total Returns as of 12.31.12

The following table shows how the Fund’s average annual performance (before and after taxes) for the one-, five- and ten-year periods ended December 31, 2012 and since the Fund’s inception compared

with broad measures of market performance. “Since Inception” returns shown for each index are returns since the inception of the Fund’s Class I shares, or since the nearest subsequent month end when comparative index data is

available only for full monthly periods. The after-tax returns show the impact of assumed federal income taxes on an investment in the Fund. “Return After Taxes on Distributions” shows the effect of taxable distributions, but assumes that

you still hold the Fund shares at the end of the period and so do not have any taxable gain or loss on your investment. “Return After Taxes on Distributions and Sale of Fund Shares” shows the effect of taxable distributions and any

taxable gain or loss that would be realized if the Fund shares were purchased at the beginning and sold at the end of the specified period.

The

after-tax returns are shown only for Class I shares, are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an

investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

After-tax returns for classes other than Class I will vary from returns shown for Class I. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a

capital loss on the sale of Fund shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODS ENDED

12.31.12

|

|

|

|

|

INCEPTION

DATE OF CLASS

|

|

|

ONE YEAR

|

|

|

FIVE YEAR

|

|

|

TEN YEAR

|

|

|

SINCE

INCEPTION

|

|

|

Class I

|

|

|

9.18.97

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Load Adjusted Return Before Taxes

|

|

|

|

|

|

|

8.66

|

%

|

|

|

2.92

|

%

|

|

|

7.84

|

%

|

|

|

9.40

|

%

|

|

Load Adjusted Return After Taxes on Distributions

|

|

|

|

|

|

|

7.59

|

%

|

|

|

2.36

|

%

|

|

|

6.98

|

%

|

|

|

7.88

|

%

|

|

Load Adjusted Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

|

|

|

|

6.52

|

%

|

|

|

2.32

|

%

|

|

|

6.61

|

%

|

|

|

7.56

|

%

|

|

Class R

|

|

|

3.1.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Load Adjusted Return Before Taxes

|

|

|

|

|

|

|

8.13

|

%

|

|

|

2.41

|

%

|

|

|

—

|

|

|

|

3.71

|

%

|

|

S&P 500 Index

|

|

|

|

|

|

|

16.00

|

%

|

|

|

1.66

|

%

|

|

|

7.10

|

%

|

|

|

4.59

|

%

|

|

BofA Merrill Lynch All U.S. Convertibles EX Mandatory Index

|

|

|

|

|

|

|

14.41

|

%

|

|

|

4.89

|

%

|

|

|

7.32

|

%

|

|

|

6.23

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The BofA Merrill Lynch All U.S. Convertibles EX Mandatory Index represents the U.S. convertible market excluding

mandatory convertibles. The BofA Merrill Lynch All U.S. Convertibles EX Mandatory Index is provided to show how the Fund’s performance compares with the returns of an index of securities similar to those in which the Fund invests.

3

Calamos Growth and Income Fund

Investment Adviser

Calamos Advisors LLC

|

|

|

|

|

|

|

PORTFOLIO MANAGER/FUND TITLE (IF APPLICABLE)

|

|

PORTFOLIO MANAGER EXPERIENCE IN THE FUND

|

|

PRIMARY TITLE WITH INVESTMENT ADVISER

|

|

John P. Calamos, Sr. (President, Chairman)

|

|

since Fund’s inception

|

|

Chief Executive Officer, Global Co-CIO

|

|

Gary D. Black

|

|

since August 31, 2012

|

|

EVP, Global Co-CIO & CIO Alternative Strategies

|

|

Jeff Scudieri

|

|

10 years

|

|

SVP, Co-Head of Research and Investments

|

|

Jon Vacko

|

|

10 years

|

|

SVP, Co-Head of Research and Investments

|

|

Dennis Cogan

|

|

since March 1, 2013

|

|

VP, Co-Portfolio Manager

|

|

John Hillenbrand

|

|

10 years

|

|

SVP, Co-Portfolio Manager

|

|

Steve Klouda

|

|

10 years

|

|

SVP, Co-Portfolio Manager

|

|

Nick Niziolek

|

|

since March 1, 2013

|

|

VP, Co-Portfolio Manager

|

|

Joe Wysocki

|

|

5 years

|

|

VP, Co-Portfolio Manager

|

|

|

|

|

|

|

Buying and Redeeming Fund Shares

Minimum Initial Investment

Class I : $1,000,000

Class R : None

Minimum Additional Investment

Classes I and R : None

To Place Orders

Please contact your broker or other intermediary, or place your order directly:

Mail:

U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201

Phone: 800.582.6959

Transaction Policies

The Funds’ shares

are redeemable. In general, investors may purchase, redeem, or exchange Fund shares on any day the New York Stock Exchange is open by written request (to the address noted above), by wire transfer, by telephone (at the number noted above), or

through a financial intermediary. Orders to buy and redeem shares are processed at the next net asset value (share price or “NAV”) to be calculated only on days when the New York Stock Exchange is open for regular trading.

Tax Information

The Funds’

distributions may be taxable as ordinary income or capital gains, except when your investment is in an IRA, 401(k) or other tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the

Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Click here to view the Fund’s

statutory prospectus

or

statement of additional information

.

2020 Calamos Court

Naperville,

IL 60563-2787

800.582.6959

www.calamos.com

811-05433

4

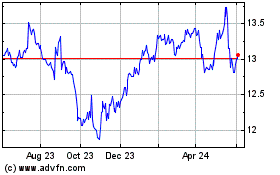

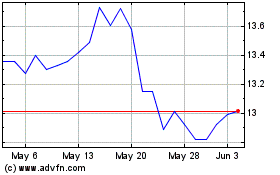

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Sep 2024 to Oct 2024

Nuveen California Select... (NYSE:NXC)

Historical Stock Chart

From Oct 2023 to Oct 2024