Northwest Natural Holding Company, (NYSE: NWN) (NW

Natural Holdings), reported financial results and highlights

including:

- Reported a net loss of $2.8 million ($0.07 per share) for the

second quarter of 2024, compared to net income of $1.2 million

($0.03 per share) for the same period in 2023

- Reported net income of $61.0 million ($1.60 per share) for the

first six months of 2024, compared to net income of $72.9 million

($2.03 per share) for the same period in 2023 primarily due to

regulatory lag

- Added nearly 16,000 gas and water utility connections in the

last 12 months for a combined growth rate of 1.8% as of June 30,

2024 mainly driven by strong water acquisitions

- Signed Puttman and ICH water acquisition agreement adding 4,200

customers and a strong pipeline of growth opportunities

- Reaffirmed 2024 earnings guidance in the range of $2.20 to

$2.40 per share and long-term earnings per share growth rate target

of 4% to 6% from 2022 through 2027. 2022 earnings per share were

$2.54

"The Company continues to perform well, and we're on track for

the year. Our focus for 2024 is operating safe, reliable systems

and executing on our capital plan, regulatory dockets, and growth

opportunities," said David H. Anderson, CEO of NW Natural Holdings.

"I'm happy to report that we're making good progress on all fronts.

Related to growth, I'm excited that we've signed an agreement to

acquire Puttman and ICH. Tom Puttman and his team have a proven

track record of leadership and a strong pipeline of water expansion

opportunities for years to come."

For the second quarter of 2024, net income decreased $4.0

million compared to the same period in 2023. For the first six

months of 2024, net income decreased $11.9 million compared to the

same period in 2023. Results reflected regulatory lag from higher

depreciation due to continued investment in our systems and

increased pension expense, partially offset by higher margin from

customer growth and lower operations and maintenance expense from

cost savings initiatives.

KEY EVENT

NW Natural Water Signs Acquisition Agreement for Puttman

& ICH Water

NW Natural Water has agreed to acquire all the interests of

Infrastructure Capital Holdings (ICH), which includes the assets of

Puttman Infrastructure (Puttman). The acquisition will add

approximately 4,200 water, wastewater and recycled water customers

across Oregon, Idaho and California. As part of the acquisition,

Tom Puttman, president of Puttman Infrastructure and ICH, will join

the company as president of NW Natural Water. The transaction

expands NW Natural Water’s utility portfolio as well as its

services business and marks its first investments in the recycled

water segment and entry into the California market.

SECOND QUARTER RESULTS

We primarily operate through our natural gas distribution

segment, which is a regulated utility principally engaged in the

delivery of natural gas to customers in Oregon and southwest

Washington. The segment also includes the portion of the Mist

underground storage facility used to serve gas utility customers,

the North Mist gas storage expansion, and renewable natural gas

development and procurement for the utility.

Other business activities are reported through "Other" results

and primarily include Interstate Storage Services and third-party

asset management services for the Mist facility in Oregon; NW

Natural Water, which holds our water and wastewater utility

operations; and NW Natural Renewables, which is a competitive

renewable fuels business.

NW Natural Holdings' second quarter results are summarized by

business segment in the table below:

Three Months Ended June 30,

2024

2023

Change

In thousands, except per share data

Amount

Per Share

Amount

Per Share

Amount

Per Share

Net income (loss):

Natural Gas Distribution segment

$

(2,987

)

$

(0.08

)

$

(271

)

$

(0.01

)

$

(2,716

)

$

(0.07

)

Other

200

0.01

1,515

0.04

(1,315

)

(0.03

)

Consolidated

$

(2,787

)

$

(0.07

)

$

1,244

$

0.03

$

(4,031

)

$

(0.10

)

Diluted Shares

38,260

36,062

2,198

Natural Gas Distribution Segment

Natural Gas Distribution segment net income decreased $2.7

million (or $0.07 per share) primarily reflecting regulatory lag

from higher depreciation, general taxes, and pension expenses.

Margin increased $0.4 million primarily due to customer growth

and the amortization of deferrals.

Operations and maintenance expense decreased $3.5 million as a

result of lower payroll, benefits and contractor labor costs;

partially offset by higher information technology costs and the

amortization of deferrals approved in the last rate case, which is

offset by revenues.

Depreciation and general taxes collectively increased by $2.5

million primarily due to continued investment in our system.

Other income, net reflected a $4.2 million decrease primarily

from higher pension expense, lower interest income from invested

cash, and lower equity Allowance for Funds Used During Construction

(AFUDC).

Interest expense increased $0.4 million due to higher long-term

debt balances.

Other

Net income from the Company's other business activities

decreased $1.3 million (or $0.03 per share) reflecting a $2.7

million gain on a settlement recognized in the second quarter of

2023, partially offset by $0.8 million higher asset management

revenues in the second quarter of 2024.

YEAR-TO-DATE RESULTS

NW Natural Holdings' year-to-date results by business segment

are summarized in the table below:

Six Months Ended June 30,

2024

2023

Change

In thousands, except per share data

Amount

Per Share

Amount

Per Share

Amount

Per Share

Net income (loss):

Natural Gas Distribution segment

$

62,728

$

1.65

$

71,680

$

2.00

$

(8,952

)

$

(0.35

)

Other

(1,692

)

(0.05

)

1,235

0.03

(2,927

)

(0.08

)

Consolidated

$

61,036

$

1.60

$

72,915

$

2.03

$

(11,879

)

$

(0.43

)

Diluted Shares

38,059

35,845

2,214

Natural Gas Distribution Segment

Natural Gas Distribution segment net income decreased $9.0

million (or $0.35 per share) primarily reflecting regulatory lag

from higher depreciation and general taxes, as well as lower other

income.

Margin increased $0.9 million primarily due to the amortization

of deferrals and customer growth which among other miscellaneous

items contributed $7.0 million. Partially offsetting these items

was a $4.5 million reduction in margin due to warmer comparative

weather and the effect of customers not covered by the weather

normalization mechanism. Weather was 13% warmer than average in the

first six months of 2024, compared to 2% colder than average

weather for the same period of 2023. In addition, there was a $1.6

million decline in gains on the Oregon gas cost incentive sharing

mechanism due to lower commodity price volatility and higher than

estimated gas costs during the cold weather event in January

2024.

Operations and maintenance expense decreased $3.8 million as a

result of lower employee benefit expenses and contractor costs;

partially offset by higher payroll, information technology costs,

and the amortization of deferrals approved in the last rate case,

which is offset by revenues.

Depreciation and general taxes increased by $4.5 million

primarily due to additional capital investments in the distribution

system.

Other income, net declined $8.0 million primarily from higher

pension expense, lower interest income due to a lower level of

invested cash, and lower equity AFUDC.

Interest expense increased $1.9 million due to higher long-term

debt balances.

Other

Net income from the Company's other business activities

decreased $2.9 million (or $0.08 per share) primarily reflecting a

$2.7 million gain on a settlement recognized in the second quarter

of 2023 and higher interest expense of $0.8 million.

BALANCE SHEET AND CASH FLOWS

During the first six months of 2024, the Company generated

$246.1 million in operating cash flows, compared to $297.9 million

for the same period in 2023. The Company used $200.4 million in

investing activities during the first six months of 2024 primarily

for natural gas utility capital expenditures, compared to $151.5

million used in investing activities during the same period in

2023. Net cash used in financing activities was $14.2 million for

the first six months of 2024, compared to net cash used by

financing activities of $32.2 million during the same period in

2023. As of June 30, 2024, NW Natural Holdings held cash of $65.2

million.

2024 GUIDANCE AND LONG-TERM TARGETS

NW Natural Holdings reaffirmed its long-term earnings per share

growth rate target of 4% to 6% compounded annually from 2022

through 2027. 2022 earnings were $2.54 per share. Holdings' 2024

earnings per share guidance is not in line with that goal primarily

due to regulatory lag from our natural gas distribution segment

mainly as a result of two factors. First, the natural gas

distribution segment is making substantial investments to provide

continued safe and reliable service for our customers. This

increased level of investment and the elevated investment in

technology, which is shorter lived and results in higher

depreciation expense, is exacerbating the regulatory lag in 2024.

Second, due to inflationary pressures, the natural gas distribution

segment's operating expenses are increasing in 2024 because of

several multi-year operations and maintenance contracts renewing,

higher personnel costs, the amortization of cloud computing

technology investments, and increased pension expense. These

factors are part of our request in the Oregon general rate case NW

Natural filed at the end of 2023. Based on Oregon statute, new

rates are expected to be effective on Nov. 1, 2024.

Primarily because of regulatory lag, NW Natural Holdings today

reaffirmed its 2024 annual earnings guidance in the range of $2.20

to $2.40 per share. This guidance assumes continued customer

growth, average weather conditions, and no significant changes in

prevailing regulatory policies, mechanisms, or outcomes, or

significant local, state or federal laws, legislation or

regulations.

While subject to change, the Company currently expects the

timing of the 2024 quarterly distribution of consolidated earnings

per share to be the following:

- Third quarter to be a loss in the range of -$0.74 to -$0.86,

and

- Fourth quarter to be earnings in the range of $1.43 to

$1.63.

DIVIDEND DECLARED

The board of directors of NW Natural Holdings declared a

quarterly dividend of 48.75 cents per share on the Company’s common

stock. The dividend is payable on August 15, 2024 to shareholders

of record on July 31, 2024. The Company's current indicated annual

dividend rate is $1.95 per share. Future dividends are subject to

board of director discretion and approval.

CONFERENCE CALL AND WEBCAST

As previously announced, NW Natural Holdings will host a

conference call and webcast today to discuss its second quarter

2024 financial and operating results.

Date and Time:

Friday, August 2, 2024

8 a.m. PT (11 a.m. ET)

Phone Numbers:

United States

1-833-470-1428

International 1-404-975-4839

Passcode 247925

The call will also be webcast in a listen-only format for the

media and general public and can be accessed at

ir.nwnaturalholdings.com. A replay of the conference call will be

available on our website and by dialing 1-866-813-9403 (U.S.) and

+44-204-525-0658 (international). The replay access code is

540828.

ABOUT NW NATURAL HOLDINGS

Northwest Natural Holding Company, (NYSE: NWN) (NW Natural

Holdings), is headquartered in Portland, Oregon and has been doing

business for over 165 years in the Pacific Northwest. It owns NW

Natural Gas Company (NW Natural), NW Natural Water Company (NW

Natural Water), NW Natural Renewables Holdings (NW Natural

Renewables), and other business interests.

We have a longstanding commitment to safety, environmental

stewardship and the energy transition, and taking care of our

employees and communities. NW Natural Holdings was recognized by

Ethisphere® for the third consecutive year in 2024 as one of the

World’s Most Ethical Companies®. NW Natural consistently leads the

industry with high J.D. Power & Associates customer

satisfaction scores. Learn more in our latest Community and

Sustainability Report at

nwnatural.com/about-us/the-company/sustainability.

NW Natural is a local distribution company that currently

provides natural gas service to approximately 2 million people in

more than 140 communities through more than 800,000 meters in

Oregon and Southwest Washington with one of the most modern

pipeline systems in the nation. NW Natural owns and operates 21.6

Bcf of underground gas storage capacity in Oregon.

NW Natural Water provides water distribution and water and

wastewater services to communities throughout the Pacific

Northwest, Texas and Arizona. NW Natural Water serves nearly

185,000 people through approximately 74,000 meters and provides

operation and maintenance services to an additional 19,000

connections. Learn more about our water business at

nwnaturalwater.com.

NW Natural Renewables is a competitive business committed to

leading in the energy transition by providing renewable fuels to

support decarbonization in the utility, commercial, industrial and

transportation sectors. Learn more at nwnaturalrenewables.com.

Additional information is available at

nwnaturalholdings.com.

“World’s Most Ethical Companies” and “Ethisphere” names and

marks are registered trademarks of Ethisphere LLC

Forward-Looking Statements

This press release, and other presentations made by NW Holdings

from time to time, may contain forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

"anticipates," "assumes," “continues,” “could,” "intends," "plans,"

"seeks," "believes," "estimates," "expects," "will" and similar

references to future periods. Examples of forward-looking

statements include, but are not limited to, statements regarding

the following: plans, objectives, assumptions, estimates,

expectations, timing, goals, strategies, commitments, future

events, financial positions, financial performance, investments,

timing and amount of capital expenditures, targeted capital

structure, risks, risk profile, stability, acquisitions and timing,

approval, completion and integration thereof, the likelihood and

success associated with any transaction, utility system, technology

and infrastructure investments, system modernization, reliability

and resiliency, global, national and local economies, customer and

business growth, continued expansion of service territories,

customer satisfaction ratings, weather, performance and service

during weather events, customer rates or rate recovery and the

timing and magnitude of potential rate changes and the potential

outcome of rate cases, including our Oregon general rate case,

environmental remediation cost recoveries, environmental

initiatives, decarbonization and the role of natural gas and the

gas delivery system, including decarbonization goals and timelines,

energy efficiency measures, use of renewable sources, renewable

natural gas purchases, projects, investments and other renewable

initiatives, including the construction of RNG facilities, and

timing, magnitude and completion thereof, unregulated renewable

natural gas strategy and initiatives, renewable hydrogen projects

or investments and timing, magnitude, approvals and completion

thereof, procurement of renewable natural gas or hydrogen for

customers, technology and policy innovations, strategic goals and

visions, water, wastewater and water services acquisitions,

personnel additions, partnerships, and investment strategy and

financial effects of water, wastewater and water services

acquisitions, expected growth and safety benefits of facility

upgrade investments, diversity, equity and inclusion initiatives,

operating plans of third parties, financial results, including

estimated income, availability and sources of liquidity, expenses,

positions, revenues, returns, cost of capital, timing, and

earnings, earnings guidance and estimated future growth rates,

future dividends, commodity costs and sourcing, asset management

activities, performance, timing, outcome, or effects of regulatory

proceedings or mechanisms or approvals, regulatory prudence

reviews, anticipated regulatory actions or filings, accounting

treatment of future events, effects of legislation or changes in

laws or regulations, effects, extent, severity and duration of

epidemics and pandemics, and any resulting economic disruption

therefrom, inflation, geopolitical uncertainty and other statements

that are other than statements of historical facts.

Forward-looking statements are based on current expectations and

assumptions regarding its business, the economy, geopolitical

factors, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Actual results may differ materially from

those contemplated by the forward-looking statements. You are

therefore cautioned against relying on any of these forward-looking

statements. They are neither statements of historical fact nor

guarantees or assurances of future operational, economic or

financial performance. Important factors that could cause actual

results to differ materially from those in the forward-looking

statements are discussed by reference to the factors described in

Part I, Item 1A "Risk Factors," and Part II, Item 7 and Item 7A

"Management's Discussion and Analysis of Financial Condition and

Results of Operations" and "Quantitative and Qualitative Disclosure

about Market Risk" in the most recent Annual Report on Form 10-K

and in Part I, Items 2 and 3 "Management's Discussion and Analysis

of Financial Condition and Results of Operations" and "Quantitative

and Qualitative Disclosures About Market Risk," and Part II, Item

1A, "Risk Factors," in the quarterly reports filed thereafter,

which, among others, outline legal, regulatory and legislative

risks, public health risks, financial, macroeconomic and

geopolitical risks, growth and strategic risks, operational risks,

business continuity and technology risks, environmental risks and

risks related to our water and renewables businesses.

All forward-looking statements made in this report and all

subsequent forward-looking statements, whether written or oral and

whether made by or on behalf of NW Holdings or NW Natural, are

expressly qualified by these cautionary statements. Any

forward-looking statement speaks only as of the date on which such

statement is made, and NW Holdings and NW Natural undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by law. New factors emerge

from time to time and it is not possible to predict all such

factors, nor can it assess the impact of each such factor or the

extent to which any factor, or combination of factors, may cause

results to differ materially from those contained in any

forward-looking statements.

NON-GAAP FINANCIAL MEASURES

In addition to presenting the results of operations and earnings

amounts in total, certain financial measures are expressed in cents

per share, which are non-GAAP financial measures. All references to

EPS are on the basis of diluted shares. Such non-GAAP financial

measures are used to analyze our financial performance because we

believe they provide useful information to our investors and

creditors in evaluating our financial condition and results of

operations. Our non-GAAP financial measures should not be

considered a substitute for, or superior to, measures calculated in

accordance with U.S. GAAP. Moreover, these non-GAAP financial

measures have limitations in that they do not reflect all the items

associated with the operations of the business as determined in

accordance with GAAP. Other companies may calculate similarly

titled non-GAAP financial measures differently than how such

measures are calculated in this report, limiting the usefulness of

those measures for comparative purposes. A reconciliation of each

non-GAAP financial measure to the most directly comparable GAAP

financial measure is provided in the tables above.

NORTHWEST NATURAL HOLDINGS

Consolidated Income Statement and

Financial Highlights (Unaudited)

Second Quarter 2024

Three Months Ended

Six Months Ended

Twelve Months Ended

In thousands, except per share amounts,

customer, and degree day data

June 30,

June 30,

June 30,

2024

2023

Change

2024

2023

Change

2024

2023

Change

Operating revenues

$

211,714

$

237,859

(11

)%

$

645,184

$

700,282

(8

)%

$

1,142,377

$

1,192,374

(4

)%

Operating expenses:

Cost of gas

72,970

102,433

(29

)

248,687

308,182

(19

)

440,342

512,509

(14

)

Operations and maintenance

64,950

66,819

(3

)

138,564

138,636

—

273,694

252,643

8

Environmental remediation

2,329

2,140

9

8,075

7,515

7

13,459

12,934

4

General taxes

11,853

10,889

9

27,321

25,108

9

48,461

45,046

8

Revenue taxes

9,211

9,185

—

27,455

28,227

(3

)

47,899

48,453

(1

)

Depreciation

33,762

31,293

8

66,860

62,758

7

129,683

122,926

5

Other operating expenses

933

1,257

(26

)

2,689

2,505

7

5,716

4,212

36

Total operating expenses

196,008

224,016

(13

)

519,651

572,931

(9

)

959,254

998,723

(4

)

Income from operations

15,706

13,843

13

125,533

127,351

(1

)

183,123

193,651

(5

)

Other income (expense), net

6

6,618

(100

)

(1,128

)

8,224

(114

)

8,503

10,155

(16

)

Interest expense, net

19,311

18,974

2

39,842

37,270

7

79,138

67,415

17

(Loss) income before income taxes

(3,599

)

1,487

(342

)

84,563

98,305

(14

)

112,488

136,391

(18

)

Income tax (benefit) expense

(812

)

243

(434

)

23,527

25,390

(7

)

30,499

35,127

(13

)

Net (loss) income

$

(2,787

)

$

1,244

(324

)

$

61,036

$

72,915

(16

)

$

81,989

$

101,264

(19

)

Common shares outstanding:

Average diluted for period

38,260

36,062

38,059

35,845

37,355

35,557

End of period

38,669

36,065

38,669

36,065

38,669

36,065

Per share of common stock

information:

Diluted (loss) earnings

$

(0.07

)

$

0.03

$

1.60

$

2.03

$

2.19

$

2.85

Dividends paid per share

0.4875

0.4850

0.9750

0.9700

1.9475

1.9375

Book value, end of period

34.83

34.39

34.83

34.39

34.83

34.39

Market closing price, end of period

36.11

43.05

36.11

43.05

36.11

43.05

Capital structure, end of

period:

Common stock equity

44.8

%

44.0

%

44.8

%

44.0

%

44.8

%

44.0

%

Long-term debt

52.5

%

46.0

%

52.5

%

46.0

%

52.5

%

46.0

%

Short-term debt (including current

maturities of long-term debt)

2.7

%

10.0

%

2.7

%

10.0

%

2.7

%

10.0

%

Total

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Natural Gas Distribution segment

operating statistics:

Meters - end of period

801,943

796,792

0.6

%

801,943

796,792

0.6

%

801,943

796,792

0.6

%

Volumes in therms:

Residential and commercial sales

117,290

122,977

419,289

453,642

701,402

778,860

Industrial sales and transportation

111,771

113,389

238,774

245,773

463,920

475,953

Total volumes sold and delivered

229,061

236,366

658,063

699,415

1,165,322

1,254,813

Operating Revenues

Residential and commercial sales

$

169,308

$

194,382

$

556,476

$

606,689

$

964,859

$

1,013,660

Industrial sales and transportation

19,437

23,238

43,725

52,382

89,229

98,393

Other distribution revenues

1,234

1,368

2,765

2,978

4,327

3,906

Other regulated services

4,883

4,726

9,760

9,435

19,227

19,245

Total operating revenues

194,862

223,714

612,726

671,484

1,077,642

1,135,204

Less: Cost of gas

73,026

102,490

248,799

308,295

440,565

512,736

Less: Environmental remediation

expense

2,329

2,140

8,075

7,515

13,459

12,934

Less: Revenue taxes

9,198

9,159

27,393

28,134

47,691

48,229

Margin, net

$

110,309

$

109,925

$

328,459

$

327,540

$

575,927

$

561,305

Degree days:

Average (25-year average)

297

296

1,633

1,619

2,700

2,674

Actual

208

273

(24

)%

1,424

1,658

(14

)%

2,246

2,779

(19

)%

Percent colder (warmer) than average

weather

(30

)%

(8

)%

(13

)%

2

%

(17

)%

4

%

NORTHWEST NATURAL HOLDINGS

Consolidated Balance Sheets

(Unaudited)

June 30,

In thousands

2024

2023

Assets:

Current assets:

Cash and cash equivalents

$

65,192

$

137,759

Accounts receivable

61,821

73,930

Accrued unbilled revenue

22,863

21,924

Allowance for uncollectible accounts

(3,758

)

(3,297

)

Regulatory assets

124,102

111,819

Derivative instruments

8,033

12,423

Inventories

107,332

67,502

Other current assets

37,535

35,797

Total current assets

423,120

457,857

Non-current assets:

Property, plant, and equipment

4,764,593

4,391,993

Less: Accumulated depreciation

1,234,148

1,181,230

Total property, plant, and equipment,

net

3,530,445

3,210,763

Regulatory assets

308,521

307,999

Derivative instruments

2,985

2,118

Other investments

83,795

104,330

Operating lease right of use asset,

net

69,813

72,096

Assets under sales-type leases

127,794

132,045

Goodwill

163,166

152,670

Other non-current assets

112,727

96,827

Total non-current assets

4,399,246

4,078,848

Total assets

$

4,822,366

$

4,536,705

Liabilities and equity:

Current liabilities:

Short-term debt

$

79,000

$

41,000

Current maturities of long-term debt

866

240,714

Accounts payable

93,564

101,369

Taxes accrued

11,302

12,217

Interest accrued

18,130

11,443

Regulatory liabilities

99,663

61,546

Derivative instruments

52,048

42,135

Operating lease liabilities

1,851

1,732

Other current liabilities

79,116

58,777

Total current liabilities

435,540

570,933

Long-term debt

1,574,751

1,294,578

Deferred credits and other non-current

liabilities:

Deferred tax liabilities

394,489

380,058

Regulatory liabilities

705,929

672,215

Pension and other postretirement benefit

liabilities

153,849

147,063

Derivative instruments

11,988

25,212

Operating lease liabilities

76,692

77,951

Other non-current liabilities

122,412

128,417

Total deferred credits and other

non-current liabilities

1,465,359

1,430,916

Equity:

Common stock

929,498

831,135

Retained earnings

423,718

414,398

Accumulated other comprehensive loss

(6,500

)

(5,255

)

Total equity

1,346,716

1,240,278

Total liabilities and equity

$

4,822,366

$

4,536,705

NORTHWEST NATURAL HOLDINGS

Consolidated Statements of Cash Flows

(Unaudited)

Six Months Ended June

30,

In thousands

2024

2023

Operating activities:

Net income

$

61,036

$

72,915

Adjustments to reconcile net income to

cash provided by operations:

Depreciation

66,860

62,758

Regulatory amortization of gas

reserves

1,085

1,678

Deferred income taxes

8,844

8,610

Qualified defined benefit pension plan

expense (benefit)

2,164

(1,129

)

Contributions to qualified defined benefit

pension plans

(3,390

)

—

Deferred environmental expenditures,

net

(14,128

)

(9,732

)

Environmental remediation expense

8,075

7,515

Asset optimization revenue sharing bill

credits

(29,198

)

(10,471

)

Other

15,698

14,068

Changes in assets and liabilities:

Receivables, net

118,562

163,965

Inventories

5,411

20,084

Income and other taxes

14,837

14,834

Accounts payable

(10,966

)

(48,935

)

Deferred gas costs

(14,418

)

(16,370

)

Asset optimization revenue sharing

4,284

12,056

Decoupling mechanism

4,085

(9,554

)

Cloud-based software

(16,424

)

(7,229

)

Regulatory accounts

14,866

8,992

Other, net

8,793

13,799

Cash provided by operating activities

246,076

297,854

Investing activities:

Capital expenditures

(198,929

)

(144,863

)

Acquisitions, net of cash acquired

—

(3,249

)

Purchase of equity method investment

(1,000

)

(1,000

)

Other

(512

)

(2,428

)

Cash used in investing activities

(200,441

)

(151,540

)

Financing activities:

Proceeds from common stock issued, net

34,986

22,072

Long-term debt issued

150,000

200,000

Long-term debt retired

(150,000

)

—

Changes in other short-term debt, net

(10,780

)

(217,200

)

Cash dividend payments on common stock

(35,600

)

(33,293

)

Payment of financing fees

(748

)

(1,883

)

Shares withheld for tax purposes

(1,314

)

(1,313

)

Other

(764

)

(578

)

Cash used in financing activities

(14,220

)

(32,195

)

Increase in cash, cash equivalents and

restricted cash

31,415

114,119

Cash, cash equivalents and restricted

cash, beginning of period

49,624

40,964

Cash, cash equivalents and restricted

cash, end of period

$

81,039

$

155,083

Supplemental disclosure of cash flow

information:

Interest paid, net of capitalization

$

34,802

$

36,376

Income taxes paid, net of refunds

10,251

12,163

Reconciliation of cash, cash equivalents

and restricted cash:

Cash and cash equivalents

$

65,192

$

137,759

Restricted cash included in other current

and non-current assets

15,847

17,324

Cash, cash equivalents and restricted

cash

$

81,039

$

155,083

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802944523/en/

Investor Contact: Nikki Sparley Phone: 503-721-2530

Email: nikki.sparley@nwnatural.com Media Contact: David Roy

Phone: 503-610-7157 Email: david.roy@nwnatural.com

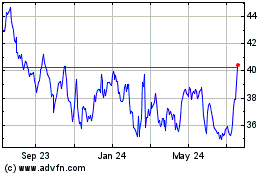

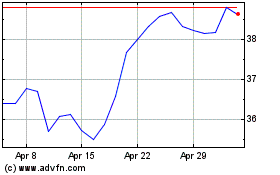

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Northwest Natural (NYSE:NWN)

Historical Stock Chart

From Nov 2023 to Nov 2024