New Jersey Natural Gas Reaches Agreement with Rate Counsel on Base Rate Case Proceeding

August 05 2008 - 7:00AM

Business Wire

New Jersey Natural Gas (NJNG) today announced that it has reached

an agreement with the New Jersey Department of the Public Advocate,

Division of Rate Counsel (Rate Counsel) on the principal financial

terms of its base rate case, originally filed in November 2007. The

agreement has been submitted to the presiding Administrative Law

Judge for her review. Her recommendation will go before the

Commissioners of New Jersey Board of Public Utilities (BPU) for

their final decision. Under the agreement, NJNG would increase its

total annual revenue by $32.5 million, effective October 1, 2008.

The agreement includes a return on equity of 10.3 percent, with a

51.2 percent common equity ratio. It reflects a rate base of $943.3

million for NJNG and an overall rate of return of 7.76 percent.

Additionally, the agreement calls for an expansion of the currently

approved Basic Gas Supply Service (BGSS) incentive programs, which

would continue through October 31, 2011. The utility would reduce

the overall depreciation rate from the previously approved 3

percent to 2.34 percent. It also agreed to include $1.4 million

annually in its base rate for operation and maintenance expenses

associated with pipeline integrity management and provide for a

deferred reconciliation of the actual costs incurred. (For more

details of the rate case agreement, please see the attached fact

sheet.) �We believe a reasonable agreement has been reached and

look forward to working with our regulators on the finalization of

the rate case,� said Laurence M. Downes, chairman and CEO of NJR.

�We are confident that the ultimate outcome will serve the best

interests of our customers and company.� As part of the agreement,

NJNG would also begin installing automated meter reading equipment

in a portion of its service territory and would transition to

monthly meter reads for all customers in an effort to provide

better service and more accurate information. This was the first

base rate case filed by NJNG since April 1993. Over that time, NJNG

has invested more than $650 million for system improvements and

expansion as well as compliance with new federal pipeline

regulations. In addition to absorbing cost increases associated

with inflation, the company has added over 1,500 miles of new main,

installed more than 132,000 new services and added approximately

157,000 new customers during that time period. NJNG originally

sought an increase of $58.4 million. Base rates are the portion of

the customers� bill designed to recover NJNG�s delivery costs,

including operating and maintenance expenses, and provide the

opportunity to earn a profit. Typically, natural gas bills consist

of two main parts: the delivery charge, which is the cost of

delivering the natural gas and maintaining the distribution system,

and the BGSS, or the portion of the bill that goes toward

purchasing the commodity and moving it through the interstate

system. Utilities do not make a profit on the sale of natural gas,

the cost of which is passed through to customers. While the impact

of this settlement upon the various classes of customers will not

be determined until later, it is expected that, if adopted, the

average residential customer using 100 therms a month could see an

overall increase between 4 and 4.5 percent. This adjustment would

help NJNG recover the costs of constructing, operating and

maintaining its infrastructure and enable the utility to continue

to provide customers with safe, reliable service. �As energy costs

continue to go up, we are acutely aware of the impact on our

customers, especially in these difficult economic times,� said

Downes. �While we continue to do everything we can to minimize the

impact of higher prices, we also encourage customers to save

through conservation and to take advantage of the many resources

available to help them meet their energy needs.� New Jersey Natural

Gas (NJNG) is the principal subsidiary of New Jersey Resources

(NYSE: NJR), a Fortune 1000 company. NJNG serves more than 483,000

customers in New Jersey�s Monmouth, Ocean, Middlesex and Morris

counties. This service area�s demographics and quality of life

contribute greatly to NJNG�s growth. NJNG�s progress is a tribute

to the dedicated employees who have shared their expertise and

focus on quality through more than 50 years of serving customers

and the community to make the company a leader in the competitive

energy marketplace. For more information, visit NJNG�s Web site at

www.njliving.com. Forward-Looking Statements This news release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. NJR cautions

readers that the assumptions forming the basis for forward-looking

statements include many factors that are beyond NJR�s ability to

control or estimate precisely, such as estimates of future market

conditions and the behavior of other market participants. Other

factors that could cause actual result to differ materially from

the company�s expectations include, but are not limited to, the

company�s ability to obtain governmental approvals, the impact of

regulation (including the regulation of rates), the regulatory and

pricing policies of federal and state regulatory agencies and

changes due to legislation at the federal and state level. More

detailed information about these factors is set forth in NJR�s

filings with the Securities and Exchange Commission (SEC),

available at www.sec.gov. NJR does not, by including this

paragraph, assume any obligation to review or revise any particular

forward-looking statement referenced herein in light of future

events. NEW JERSEY NATURAL GAS BASE RATE CASE AGREEMENT FACT SHEET

On July 30, 2008, New Jersey Natural Gas (NJNG) and the New Jersey

Department of the Public Advocate, Division of Rate Counsel (Rate

Counsel) executed an agreement to resolve the principal financial

terms of NJNG�s base rate case filing, which was originally made

November 20, 2007. The agreement has been submitted to the

presiding Administrative Law Judge for her review. Her

recommendation will go before the Commissioners of New Jersey Board

of Public Utilities (BPU) for their final decision. Agreements have

been reached in the following areas: An annual revenue increase of

$32.5 million supported by the following: (dollars in thousands) �

Rate base $ 943,346 Overall rate of return � 7.76 % Income

requirement $ 73,204 Pro-forma income $ 54,180 � Additional income

requirement $ 19,024 Revenue factor � 1.7084 � Revenue requirement

$ 32,500 The agreed-upon rate of return of 7.76 percent includes a

return on equity of 10.3 percent as follows: � Amount (dollars in

thousands) � Ratios � Cost Rate � Weighted Cost Rate Long-term debt

$ 411, 344 41.6 % 5.44 % 2.27 % Short-term debt 66,000 6.7 % 2.90 %

0.19 % Customer deposits 4,447 0.5 % 4.79 % 0.02 % Common equity �

506,322 51.2 % 10.30 % 5.28 % Total $ 988,113 100.0 % 7.76 % The

rate increase is expected to be effective on or about October 1,

2008, coincident with any BPU-approved rate change resulting from

the company�s annual filing to modify its gas supply tariff, Basic

Gas Supply Service (BGSS). -- Depreciation Reduction -- Overall

composite depreciation rate of 2.34 percent reduced from 3 percent

-- Annual amortization of $1.649 million associated with NJNG's

non-legal asset retirement obligation Effective with this base rate

change, the Conservation Incentive Program (CIP) baseline would be

reset to the test year usage level, which is lower than its

original value. Beginning with the effective date of the rate

increase agreed to in this agreement, the CIP would compare actual

customer usage to the new lower baseline value. The revenue

increase is inclusive of approximately $13 million of test year CIP

accrual based on the original CIP baseline value. Pipeline

Integrity Management expenditures of $1.4 million are included in

base rates. NJNG would be authorized to defer additional

expenditures up to $700,000 annually, to be reflected in future

rate determinations but no later than NJNG�s next base rate

proceeding. Expenditures less than the $1.4 million level would be

returned to customers. Automatic Meter Reading (AMR) installation

in NJNG�s Monmouth County service territory is approved. -- BGSS

Incentive Mechanisms -- The Ocean Peaking Power incentive mechanism

would terminate upon approval of new base rates -- The remaining

BGSS incentive mechanisms would remain in effect through October

31, 2011 -- The Financial Risk Management cost limitations would

move to $6.4 million from the currently approved $3.2 million --

The Storage Incentive volume would increase from 18 billion cubic

feet (bcf) to 20 bcf -- NJNG agrees to conduct a review of gas

procurement and capacity options for submission to the BPU and Rate

Counsel no later than March 1, 2009. � -- NJNG has charged the

following amounts to income in fiscal 2008: -- $1.1 million

associated with deferred lost revenues previously reserved by NJNG

-- $900,000 related to the deferred Corporate Business Tax

surcharge enacted in 2006 -- $744,000, in aggregate, related to the

accrual of Allowance for Funds Used During Construction (AFUDC)

through June 30, 2008. � -- NJNG would submit to the BPU and Rate

Counsel quarterly reports to include the following performance

measures: -- Percentage of calls answered within 30 seconds,

abandoned calls and the percentage of calls blocked -- Percentage

of meters read each cycle and the number of re-bills per 1,000

customers -- Percentage of leak or odor reports responded to within

60 minutes and the percentage of service appointments met -- The

number of escalated complaints to the BPU per 1,000 customers Rate

design and tariff issues are being addressed during final

negotiations.

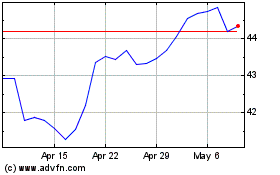

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From May 2024 to Jun 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Jun 2023 to Jun 2024