UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

12b-25

SEC

File Number:

1-8359

CUSIP

Number:

646025106

NOTIFICATION

OF LATE

FILING

(Check

One):

x

Form

10-K

o

Form

11-K

o

Form

20-F

o

Form 10-Q

o

Form

N-SAR

o

Form

N-CSR

For

Period Ended:

September 30, 2007

o

Transition

Report on Form 10-K

o

Transition

Report on Form 20-F

o

Transition

Report on Form 11-K

o

Transition

Report on Form 10-Q

o

Transition

Report on Form N-SAR

For

the

Transition Period Ended:

Nothing

in this form shall be construed to imply that the Commission has verified any

information contained herein.

If

the

notification relates to a portion of the filing checked above, identify the

item(s) to which the notification relates:

PART

I

REGISTRANT

INFORMATION

New

Jersey Resources

Corporation

Full

Name of Registrant

N/A

Former

Name if Applicable

1415 Wyckoff Road

Address

of Principal Executive Office (

Street and number

)

Wall,

New Jersey

07719

City,

State and Zip Code

PART

II

RULE

12b-25 (b) and (c)

If

the subject report could not be

filed without unreasonable effort or expense and the registrant seeks relief

pursuant to Rule 12b-25(b), the following should be

completed. (Check box if appropriate.)

|

|

(a)

|

The

reasons described in reasonable detail in Part III of this form could

not

be eliminated without unreasonable effort or

expense;

|

|

|

(b)

|

The

subject annual report, semi-annual report, transition report on

Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following

the prescribed due date;

|

|

x

|

or

the subject quarterly report or transition report on Form 10-Q or

subject distribution report on Form 10-D, or portion thereof, will

be

filed on or before the fifth calendar day following the prescribed

due

date; and

|

|

|

(c)

|

The

accountant's statement or other exhibit required by Rule 12b-25(c)

has been attached if applicable.

|

PART

III

NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR,

N-CSR or the transition report or portion thereof, could not be filed within

the

prescribed time period:

New

Jersey Resources Corporation (the “Company”) was unable to file its Annual

Report on Form 10-K for the year ended September 30, 2007, by the prescribed

due

date of November 29, 2007, without unreasonable effort and

expense.

In

connection with the Company’s preparation of its consolidated financial

statements for the fiscal year ended September 30, 2007, the Company reassessed

its accounting treatment and disclosures for its derivative instruments under

Statement of Financial Accounting Standards 133 “

Accounting for Derivative

Instruments and Hedging Activities

” (“SFAS 133”). The

requirements of SFAS 133 are highly technical and complex and have been subject

to an evolving interpretation by the accounting community, professional

standards organizations and the Securities and Exchange

Commission.

As

a result of this accounting assessment, the Company determined that certain

of

its derivative instruments have not qualified as cash flow hedges under SFAS

133

as they did not meet the definition for “critical-terms-match,” as defined under

paragraph 65 of SFAS 133 and related authoritative accounting literature issued

by various standard setting bodies and their related interpretations for all

fiscal periods. Therefore, the Company has determined that it must

amend and restate certain of its historical consolidated financial statements

and make appropriate changes in the preparation of its consolidated financial

statements

for the year ended September 30, 2007. The Chairman of the Company’s

Audit Committee, as authorized by the full Audit Committee, has discussed the

restatement with its independent registered public accounting firm for all

affected periods.

In

light of the restatement, investors should no longer rely on the Company’s

previously filed financial statements and other financial information for

each

of the fiscal years ended September 30, 2006 and September 30, 2005 and the

reports of its independent registered public accounting firm on such

financial statements, and the quarterly reports for the periods ended June

30,

2007, March 31, 2007 and December 31, 2006, as well as selected financial

data

for each of the fiscal years 2002 through 2006 as being in compliance with

Generally Accepted Accounting Principles (“GAAP”). Investors should

also no longer rely on the Company’s previously announced unaudited results for

the fourth quarter and fiscal year ended September 30, 2007 as being in

compliance with GAAP. Investors should also no longer rely on the

Company’s previously issued earnings guidance for fiscal 2008 of $3.20 to $3.30

per basic share on a GAAP basis.

To

economically hedge against market risk due to fluctuations in the price of

natural gas and the value of its transportation contracts, certain unregulated

subsidiaries of the Company, enter into futures contracts and swap agreements

to

hedge purchases, sales and transportation of natural gas. The Company

believed that these derivative instruments qualified as cash flow hedges as

a

result of matching critical terms between the derivative instrument and the

related forecasted transaction.

Based

on these determinations, certain unregulated subsidiaries of the Company

recorded changes in the fair value of the effective portion of these derivative

instruments qualifying as cash flow hedges under the “critical-terms-match”

criteria of SFAS 133, net of tax, as a component of comprehensive income, which

is included in “accumulated other comprehensive income” (“AOCI”), a component of

Total Common Stock Equity in the Consolidated Balance

Sheets.

As

the Company has determined the hedging relationships did not meet the

“critical-terms-match,” the related derivative instruments did not qualify as

cash flow hedges and the mark to market gains or losses on the derivative

instruments are required to be reflected in the Consolidated Statement of Income

for each period rather than deferred as a component of AOCI until the forecasted

transaction is settled.

The

Company believes that the changes to its accounting treatment of these

derivative instruments did not and will not affect its day to day operations,

cash flow or liquidity. By recognizing changes in the fair value of

derivative instruments in the Consolidated Statement of Income in each period

during the existence of the derivative instrument, rather than when the

forecasted transaction is settled, results in quarterly changes to previously

reported AOCI, retained earnings, operating income and net

income. However, over the life of the derivative instruments there is

no cumulative change in operating income, net income or total common stock

equity. Importantly, total cash flows from operating activities are

the same in any accounting period under either accounting

treatment. The Company will now recognize the changes in the fair

value of these derivative instruments in accounting periods earlier than those

in which the related purchases or sales of the natural gas actually

occur.

The

decision to delay the filing of the annual report on Form 10-K for the year

ended September 30, 2007, is to provide time for management and the Audit

Committee to complete the Company’s financial statements and for the Company’s

independent registered public accounting firm to complete its audit of the

financial statements. The Company is working diligently on the

process of revising its historical financial statements and completing the

fiscal 2007 financial statements and intends to complete the restatement

of its

financial statements as expeditiously as possible, but cannot predict when

the

audit of the restated financial statements by its independent registered

accounting firm will be completed or when the Company’s fiscal 2007 Form 10-K

will be filed.

PART

IV

OTHER

INFORMATION

(1) Name

and telephone number of person to contact in regard to this

notification

Glenn

C.

Lockwood

(

732)

9

38-1491

(Name) (Area

code) (Telephone

Number)

(2) Have

all other periodic reports required under Section 13 or 15(d) of the

Securities Exchange Act of 1934 or Section 30 of the Investment Company Act

of

1940 during the preceding 12 months or for such shorter period that the

registrant was required to file such report(s) been filed? If the

answer is no, identify report(s).

x

Yes

o

No

(3) Is

it anticipated that any significant change in results of operations from the

corresponding period for the last fiscal year will be reflected by the earnings

statements to be included in the subject report or portion thereof?

x

Yes

o

No

If

so,

attach an explanation of the anticipated change, both narratively and

quantitatively, and, if appropriate, state the reasons why a reasonable estimate

of the results cannot be made.

As

set forth in the Company’s previously released unaudited financial results on

November 15, 2007, the Company reported earnings per basic share for the fiscal

year ended September 30, 2007, of $88.4 million, or $3.17 per basic share,

compared with $78.5 million, or $2.82 per basic share, for fiscal

2006. The Company is still assessing what adjustments are necessary

to the Consolidated Statements of Income and cannot at this time estimate what

its earnings per basic share for the year ended September 30, 2007, will

ultimately be. The Company is in the process of determining the

impact on any individual year or quarter. Based upon these changes to

its accounting treatment of these derivative instruments, the Company estimates

that the results of the restatement will significantly decrease net income

for

the year ended September 30, 2007, will significantly increase net income for

the year ended September 30, 2006 and will significantly decrease net income

for

the year ended September 30, 2005. However, total cash flows are the

same in any accounting period under either accounting

treatment.

New

Jersey Resources Corporation

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned thereunto

duly authorized:

Date:

November 30,

2007

By: /s/ Glenn C. Lockwood

|

|

Senior

Vice President and Chief Financial

Officer

|

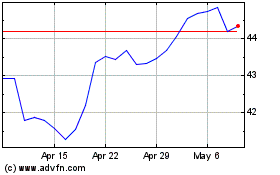

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Oct 2024 to Nov 2024

New Jersey Resources (NYSE:NJR)

Historical Stock Chart

From Nov 2023 to Nov 2024