Navios Maritime Partners L.P. (“Navios Partners”) (NYSE: NMM), an

international owner and operator of dry cargo and tanker vessels,

today reported its financial results for the second quarter and six

month period ended June 30, 2023.

Angeliki Frangou, Chairwoman and Chief Executive

Officer of Navios Partners stated, “I am pleased with the results

for the second quarter of 2023, in which we reported revenue of

$346.9 million and net income of $112.3 million. We are also

pleased to report net earnings per common unit of $3.65 for the

quarter.”

Angeliki Frangou continued, “The macro environment is

challenging. Trade patterns continue to be impacted by the war in

Ukraine, China’s anemic economic growth and Western countries

pre-occupation with inflation and recessionary

risks. Regardless of the shipping sector, there is a great

deal of uncertainty about future prospects. We continue to

focus on things that we can control, such as reducing our leverage

rate and replacing older vessels with younger, more technologically

advanced vessels in sectors that provide adequate returns. ”

Fleet update

• Sales YTD

- $242.2 million gross sale proceeds from sale of 13

vessels YTD

- Completed the sale of eight vessels for $160.3 million

in Q1 2023

During the first quarter of 2023, Navios Partners sold the Nave

Cosmos, the Nave Dorado, the Nave Polaris, the Star N, the Navios

Amaryllis, the Jupiter N, the Navios Prosperity I and the Nave

Photon, to various unrelated third parties, for an aggregate sales

price of $160.3 million.

-

- Completed the sale of four vessels for $59.6 million in

Q2 2023

During the second quarter of 2023, Navios Partners sold the

Aurora N, the Navios Anthos, the Navios Libertas and the Serenitas

N, to various unrelated third parties, for an aggregate sales price

of $59.6 million.

-

- Completed the sale of one vessel for $22.3 million in

Q3 2023

On July 7, 2023, Navios Partners sold the Lumen N, a 2008-built

LR1 Product Tanker vessel of 63,599 dwt, to an unrelated third

party, for a sales price of $22.3 million.

• Acquisitions YTD

- Acquisition of two newbuilding MR2 product tanker

vessels

During the second quarter of 2023, Navios

Partners agreed to acquire two newbuilding Japanese MR2 Product

Tanker vessels from an unrelated third party, under bareboat

contracts. Each vessel is being bareboat-in for ten years. Navios

Partners has the option to acquire the vessels starting at the end

of year four until the end of the charter period. Assuming the

exercise of the option at the end of the 10-year period, the

bareboat agreements reflect an implied price of approximately $40.2

million per vessel and an implied effective interest of

approximately 7.0%. The vessels are expected to be delivered into

Navios Partners’ fleet during the second half of 2026 and the first

half of 2027. The closing of the transaction is subject to

completion of customary documentation.

- Acquisition of one Kamsarmax vessel

In August 2023, Navios Partners agreed to

acquire from an unrelated third party, the Navios Horizon I, a

2019-built Kamsarmax vessel of 81,692 dwt (previously chartered-in)

for an acquisition price of $28.0 million. The delivery of the

vessel is expected within the third quarter of 2023.

- Delivery of three newbuilding Capesize

vessels

In March 2023, April 2023 and June 2023, Navios

Partners took delivery of three 2023-built Capesize vessels, the

Navios Altair of 182,115 dwt, the Navios Sakura of 182,169 dwt and

the Navios Amethyst of 182,212 dwt, respectively.

• Contracted revenue

- $131.3 million contracted revenue agreed in Q2 2023 |

$3.3 billion total contracted revenue

Navios Partners entered into new long-term

charters which are expected to generate revenue of $131.3

million.

-

- Two MR2 newbuilding product tanker vessels, agreed to be

acquired in Q4 2022, have been chartered-out for a period of five

years, at a rate of $22,959 net per day.

- Three MR2 product tanker vessels have been chartered-out for an

average period of two years, at an average rate of $21,831 net per

day.

Including the above long-term charters, Navios Partners

currently has $3.3 billion contracted revenue through 2037.

Financing update

In June 2023, Navios Partners entered into a new

credit facility with a commercial bank for up to $107.6 million in

order to refinance existing indebtedness of ten vessels. The credit

facility: (i) matures three years after the drawdown date; and (ii)

bears interest at Secured Overnight Financing Rate (“SOFR”) plus

250 bps per annum.

In June 2023, Navios Partners entered into a new

credit facility with a commercial bank for up to $77.8 million in

order to refinance existing indebtedness of ten vessels. The credit

facility: (i) matures five years after the drawdown date; and (ii)

bears interest at Term Secured Overnight Financing Rate (“Term

SOFR”) plus 215 bps per annum.

In June 2023, Navios Partners entered into a new

credit facility with a commercial bank for up to $62.4 million in

order to refinance existing indebtedness of seven vessels. The

credit facility: (i) matures three years after the drawdown date;

and (ii) bears interest at Term SOFR plus 250 bps per annum.

In June 2023, Navios Partners entered into a new

credit facility with a commercial bank for up to $40.0 million in

order to refinance existing indebtedness of nine vessels. The

credit facility: (i) matures three years after the drawdown date;

and (ii) bears interest at SOFR plus 250 bps per annum.

As discussed above, during the second quarter of

2023, Navios Partners agreed to enter into a bareboat-in agreement

for two Japanese newbuilding tanker vessels. The total implied

amount financed for the two vessels is approximately $62.4 million

and the implied effective interest rate is 7.0%. The closing of the

transaction is subject to completion of customary

documentation.

Cash distribution

The Board of Directors of Navios Partners

declared a cash distribution for the second quarter of 2023 of

$0.05 per unit. The cash distribution was paid on August 11, 2023

to unitholders of record as of August 8, 2023. The declaration and

payment of any further dividends remain subject to the discretion

of the Board of Directors and will depend on, among other things,

Navios Partners’ cash requirements as measured by market

opportunities and restrictions under its credit agreements and

other debt obligations and such other factors as the Board of

Directors may deem advisable.

Operating Highlights

Navios Partners owns and operates a fleet

comprised of 81 dry bulk vessels, 47 containerships and 47 tanker

vessels, including ten newbuilding tanker vessels (six Aframax/LR2

and four MR2 Product Tanker chartered-in vessels under bareboat

contracts), that are expected to be delivered through 2027 and 12

newbuilding containerships (ten 5,300 TEU and two 7,700 TEU), that

are expected to be delivered through 2025.

Navios Partners has entered into short, medium

and long-term time charter-out, bareboat-out and freight agreements

for its vessels with a remaining average term of 1.8 years. Navios

Partners has currently fixed 70.9% and 43.7% of its available days

for the remaining six months of 2023 and for 2024, respectively.

Navios Partners expects to generate contracted revenue of $505.9

million and $747.9 million for the remaining six months of 2023 and

for 2024, respectively. The average expected daily charter-out rate

for the fleet is $25,459 and $29,701 for the remaining six months

of 2023 and for 2024, respectively.

EARNINGS HIGHLIGHTS

For the following results and the selected

financial data presented herein, Navios Partners has compiled

condensed consolidated statements of operations for the three and

six month periods ended June 30, 2023 and 2022. The quarterly

information was derived from the unaudited condensed consolidated

financial statements for the respective periods. EBITDA, Adjusted

EBITDA, Adjusted Earnings per Common Unit basic and diluted and

Adjusted Net Income are non-GAAP financial measures and should not

be used in isolation or substitution for Navios Partners’ results

calculated in accordance with U.S. generally accepted accounting

principles (“U.S. GAAP”).

| |

Three MonthPeriod Ended |

|

Three MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

|

Six MonthPeriod Ended |

|

June 30, 2023 |

June 30, 2022 |

|

June 30, 2023 |

|

|

June 30, 2022 |

| (in $‘000 except per

unit data) |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

(unaudited) |

|

Revenue |

$ |

346,938 |

|

$ |

280,661 |

|

$ |

656,460 |

|

$ |

517,278 |

| Net Income |

$ |

112,308 |

|

$ |

118,160 |

|

$ |

211,473 |

|

$ |

203,825 |

| Adjusted Net Income |

$ |

102,157 |

(1) |

$ |

118,160 |

|

$ |

167,872 |

(2) |

$ |

203,825 |

| Net cash provided by operating

activities |

$ |

133,827 |

|

$ |

142,010 |

|

$ |

228,343 |

|

$ |

147,163 |

| EBITDA |

$ |

201,601 |

|

$ |

163,478 |

|

$ |

390,437 |

|

$ |

289,596 |

| Adjusted EBITDA |

$ |

191,450 |

(1) |

$ |

163,478 |

|

$ |

346,836 |

(2) |

$ |

289,596 |

| Earnings per Common Unit

basic |

$ |

3.65 |

|

$ |

3.84 |

|

$ |

6.87 |

|

$ |

6.62 |

| Earnings per Common Unit

diluted |

$ |

3.65 |

|

$ |

3.83 |

|

$ |

6.87 |

|

$ |

6.61 |

| Adjusted Earnings per Common

Unit basic |

$ |

3.32 |

(1) |

$ |

3.84 |

|

$ |

5.45 |

(2) |

$ |

6.62 |

| Adjusted Earnings per Common

Unit diluted |

$ |

3.32 |

(1) |

$ |

3.83 |

|

$ |

5.45 |

(2) |

$ |

6.61 |

|

(1) |

Adjusted Net Income, Adjusted EBITDA and Adjusted Earnings per

Common Unit basic and diluted for the three month period ended June

30, 2023 have been adjusted to exclude a $10.2 million gain related

to the sale of four of our vessels. |

| (2) |

Adjusted Net Income, Adjusted EBITDA and Adjusted Earnings per

Common Unit basic and diluted for the six month period ended June

30, 2023 have been adjusted to exclude a $43.6 million gain related

to the sale of 12 of our vessels. |

Three month periods ended June 30, 2023

and 2022

Time charter and voyage revenues for the three

month period ended June 30, 2023 increased by $66.2 million, or

23.6%, to $346.9 million, as compared to $280.7 million for the

same period in 2022. The increase in revenue was mainly

attributable to the increase in the size of our fleet and to the

slight increase in Time Charter Equivalent (“TCE”) rate. For the

three month periods ended June 30, 2023 and June 30, 2022, the time

charter and voyage revenues were affected by $7.5 million and $11.8

million, respectively, relating to the straight line effect of the

containerships and tankers charters with de-escalating rates. The

TCE rate increased by 0.3% to $23,900 per day, as compared to

$23,823 per day for the same period in 2022. The available days of

the fleet increased by 20.4% to 13,572 days for the three month

period ended June 30, 2023, as compared to 11,269 days for the same

period in 2022 mainly due to the acquisition of the 36-vessel dry

bulk fleet from Navios Maritime Holdings Inc. (“Navios Holdings”)

and the deliveries of newbuilding and secondhand vessels, partially

mitigated by the sale of vessels.

EBITDA of Navios Partners for the three month

periods ended June 30, 2023 and 2022 was affected by the items

described in the table above. Excluding these items, Adjusted

EBITDA increased by $28.0 million to $191.5 million for the three

month period ended June 30, 2023, as compared to $163.5 million for

the same period in 2022. The increase in Adjusted EBITDA was

primarily due to a $66.2 million increase in time charter and

voyage revenues, partially mitigated by: (i) a $20.3 million

increase in time charter and voyage expenses, mainly due to the

increase in (a) bunker expenses arising from the increased number

of freight voyages in the second quarter of 2023 and (b) bareboat

and charter-in hire expense of the tanker and dry bulk fleet; (ii)

an $8.6 million increase in vessel operating expenses in accordance

with our management agreements, mainly due to the expansion of our

fleet; (iii) a $6.3 million increase in general and administrative

expenses in accordance with our administrative services agreement,

mainly due to the expansion of our fleet; (iv) a $1.7 million

increase in direct vessel expenses (excluding the amortization of

deferred drydock, special survey costs and other capitalized

items); and (v) a $1.3 million increase in other expenses, net.

Net Income for the three month periods ended

June 30, 2023 and 2022 was affected by the items described in the

table above. Excluding these items, Adjusted Net Income decreased

by $16.0 million to $102.2 million for the three month period ended

June 30, 2023, as compared to $118.2 million for the same period in

2022. The decrease in Adjusted Net Income was primarily due to: (i)

an $18.8 million increase in interest expense and finance cost,

net; and (ii) a $27.7 million negative impact from the depreciation

and amortization, mainly due to a: (a) $12.3 million decrease in

the amortization of the unfavorable lease terms, (b) $12.3 million

increase in depreciation and amortization expense and (c) $3.1

million increase in amortization of deferred drydock, special

survey costs and other capitalized items, partially mitigated by a:

(i) $28.0 million increase in Adjusted EBITDA; and (ii) $2.5

million increase in interest income.

Six month periods ended June 30, 2023 and

2022

Time charter and voyage revenues for the six

month period ended June 30, 2023 increased by $139.2 million, or

26.9%, to $656.5 million, as compared to $517.3 million for the

same period in 2022. The increase in revenue was mainly

attributable to the increase in the size of our fleet and to the

slight increase in TCE rate. For the six month periods ended June

30, 2023 and June 30, 2022, the time charter and voyage revenues

were affected by $20.5 million and $16.5 million, respectively,

relating to the straight line effect of the containerships and

tankers charters with de-escalating rates. The TCE rate increased

by 1.0% to $22,337 per day, as compared to $22,107 per day for the

same period in 2022. The available days of the fleet increased by

22.1% to 27,480 days for the six month period ended June 30, 2023,

as compared to 22,497 days for the same period in 2022, mainly due

to the acquisition of the 36-vessel dry bulk fleet from Navios

Holdings and the deliveries of newbuilding and secondhand vessels,

partially mitigated by the sale of vessels.

EBITDA of Navios Partners for the six month

periods ended June 30, 2023 and 2022 was affected by the items

described in the table above. Excluding these items, Adjusted

EBITDA increased by $57.2 million to $346.8 million for the six

month period ended June 30, 2023, as compared to $289.6 million for

the same period in 2022. The increase in Adjusted EBITDA was

primarily due to a $139.2 million increase in time charter and

voyage revenues, partially mitigated by: (i) a $42.8 million

increase in time charter and voyage expenses, mainly due to the

increase in (a) bunker expenses arising from the increased number

of freight voyages in the first half of 2023 and (b) bareboat and

charter-in hire expense of the tanker and dry bulk fleet; (ii) an

$18.6 million increase in vessel operating expenses in accordance

with our management agreements, mainly due to the expansion of our

fleet; (iii) an $11.9 million increase in general and

administrative expenses in accordance with our administrative

services agreement, mainly due to the expansion of our fleet; (iv)

a $6.4 million increase in other expenses, net; and (v) a $2.3

million increase in direct vessel expenses (excluding the

amortization of deferred drydock, special survey costs and other

capitalized items).

Net Income for the six month periods ended June

30, 2023 and 2022 was affected by the items described in the table

above. Excluding these items, Adjusted Net Income decreased by

$35.9 million to $167.9 million for the six month period ended June

30, 2023, as compared to $203.8 million for the same period in

2022. The decrease in Adjusted Net Income was primarily due to a:

(i) $41.2 million increase in interest expense and finance cost,

net; and (ii) $56.0 million negative impact from the depreciation

and amortization, mainly due to a: (a) $26.5 million decrease in

the amortization of the unfavorable lease terms, (b) $23.7 million

increase in depreciation and amortization expense and (c) $5.8

million increase in amortization of deferred drydock, special

survey costs and other capitalized items, partially mitigated by a:

(i) $57.2 million increase in Adjusted EBITDA; and (ii) $4.1

million increase in interest income.

Fleet Employment Profile

The following table reflects certain key

indicators of Navios Partners’ core fleet performance for the three

and six month periods ended June 30, 2023 and 2022.

| |

Three MonthPeriod EndedJune 30, 2023 |

|

Three MonthPeriod EndedJune 30, 2022 |

|

Six MonthPeriod EndedJune 30, 2023 |

|

Six MonthPeriod EndedJune 30, 2022 |

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Available Days (1) |

|

13,572 |

|

|

|

11,269 |

|

|

|

27,480 |

|

|

|

22,497 |

|

| Operating Days (2) |

|

13,474 |

|

|

|

11,151 |

|

|

|

27,223 |

|

|

|

22,223 |

|

| Fleet Utilization (3) |

|

99.3 |

% |

|

|

99.0 |

% |

|

|

99.1 |

% |

|

|

98.8 |

% |

| TCE rate Combined (per day)

(4) |

$ |

23,900 |

|

|

$ |

23,823 |

|

|

$ |

22,337 |

|

|

$ |

22,107 |

|

| TCE rate Drybulk (per day)

(4) |

$ |

15,715 |

|

|

$ |

24,721 |

|

|

$ |

13,346 |

|

|

$ |

22,311 |

|

| TCE rate Containers (per day)

(4) |

$ |

35,466 |

|

|

$ |

31,613 |

|

|

$ |

35,226 |

|

|

$ |

29,417 |

|

| TCE rate Tankers (per day)

(4) |

$ |

30,947 |

|

|

$ |

16,391 |

|

|

$ |

29,664 |

|

|

$ |

15,864 |

|

| Vessels operating at period

end |

|

154 |

|

|

|

128 |

|

|

|

154 |

|

|

|

128 |

|

|

(1) |

Available days for the fleet represent total calendar days the

vessels were in Navios Partners’ possession for the relevant period

after subtracting off-hire days associated with scheduled repairs,

dry dockings or special surveys and ballast days relating to

voyages. The shipping industry uses available days to measure the

number of days in a relevant period during which a vessel is

capable of generating revenues. |

|

(2) |

Operating days are the number of available days in the relevant

period less the aggregate number of days that the vessels are

off-hire due to any reason, including unforeseen circumstances. The

shipping industry uses operating days to measure the aggregate

number of days in a relevant period during which vessels actually

generate revenues. |

|

(3) |

Fleet utilization is the percentage of time that Navios Partners’

vessels were available for generating revenue, and is determined by

dividing the number of operating days during a relevant period by

the number of available days during that period. The shipping

industry uses fleet utilization to measure efficiency in finding

employment for vessels and minimizing the amount of days that its

vessels are off-hire for reasons other than scheduled repairs, dry

dockings or special surveys. |

|

(4) |

TCE rate: TCE rate per day is defined as voyage, time charter

revenues and charter-out revenues under bareboat contract (grossed

up by currently applicable fixed vessel operating expenses) less

voyage expenses during a period divided by the number of available

days during the period. The TCE rate per day is a standard shipping

industry performance measure used primarily to present the actual

daily earnings generated by vessels on various types of charter

contracts for the number of available days of the fleet. |

Conference Call Details:

Navios Partners' management will host a

conference call on Wednesday, August 23, 2023 to discuss the

results for the second quarter and six month ended June 30,

2023.

Call Date/Time: Wednesday, August 23, 2023 at 8:30 am ETCall

Title: Navios Partners Q2 2023 Financial Results Conference

Call US Dial In: +1.800.579.2543International Dial In:

+1.785.424.1789Conference ID: NMMQ223

The conference call replay will be available two hours after the

live call and remain available for one week at the following

numbers:

US Replay Dial In: +1.888.562.3382International Replay Dial In:

+1.402.220.1192

Slides and audio webcast:

There will also be a live webcast of the

conference call, through the Navios Partners website

(www.navios-mlp.com) under “Investors”. Participants to the live

webcast should register on the website approximately 10 minutes

prior to the start of the webcast.

A supplemental slide presentation will be

available on the Navios Partners website at

www.navios-mlp.com under the "Investors" section at 8:00 am ET

on the day of the call.

About Navios Maritime Partners

L.P.

Navios Maritime Partners L.P. (NYSE: NMM) is an

international owner and operator of dry cargo and tanker vessels.

For more information, please visit our website at

www.navios-mlp.com.

Forward-Looking Statements

This press release contains and will contain

forward-looking statements (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended) concerning future

events, TCE rates and Navios Partners’ expected cash flow

generation, future contracted revenues, future distributions and

its ability to make distributions going forward, opportunities to

reinvest cash accretively in a fleet renewal program or otherwise,

potential capital gains, its ability to take advantage of

dislocation in the market and Navios Partners’ growth strategy and

measures to implement such strategy, including expected vessel

acquisitions and entering into further time charters and Navios

Partners’ ability to refinance its debt on attractive terms, or at

all. Words such as “may,” “expects,” “intends,” “plans,”

“believes,” “anticipates,” “hopes,” “estimates,” and variations of

such words and similar expressions are intended to identify

forward-looking statements.

These forward-looking statements are based on

the information available to, and the expectations and assumptions

deemed reasonable by Navios Partners at the time these statements

were made. Although Navios Partners believes that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. These statements involve risks and are based upon a

number of assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Partners. Actual results may differ

materially from those expressed or implied by such forward-looking

statements.

Factors that could cause actual results to

differ materially include, but are not limited to, risks relating

to: global and regional economic and political conditions including

global economic activity, demand for seaborne transportation of the

products we ship, the ability and willingness of charterers to

fulfill their obligations to us and prevailing charter rates, the

economic condition of the markets in which we operate, shipyards

performing scrubber installations, construction of newbuilding

vessels, drydocking and repairs, changing vessel crews and

availability of financing; potential disruption of shipping routes

due to accidents, wars, diseases, pandemics, political events,

piracy or acts by terrorists; uncertainty relating to global trade,

including prices of seaborne commodities and continuing issues

related to seaborne volume and ton miles, our continued ability to

enter into long-term time charters, our ability to maximize the use

of our vessels, expected demand in the dry and liquid cargo

shipping sectors in general and the demand for our drybulk,

containerships and tanker vessels in particular, fluctuations in

charter rates for drybulk, containerships and tanker vessels, the

aging of our fleet and resultant increases in operations costs, the

loss of any customer or charter or vessel, the financial condition

of our customers, changes in the availability and costs of funding

due to conditions in the bank market, capital markets and other

factors, fluctuation in interest rates and foreign exchange rates,

and the impact of the discontinuance of the London Interbank

Offered Rate for US Dollars, or LIBOR, after June 30, 2023,

increases in costs and expenses, including but not limited to:

crew, insurance, provisions, port expenses, lube oil, bunkers,

repairs, maintenance and general and administrative expenses, the

expected cost of, and our ability to comply with, governmental

regulations and maritime self-regulatory organization standards, as

well as standard regulations imposed by our charterers applicable

to our business, general domestic and international political

conditions, competitive factors in the market in which Navios

Partners operates; risks associated with operations outside the

United States; and other factors listed from time to time in Navios

Partners’ filings with the Securities and Exchange Commission,

including its Form 20-Fs and Form 6-Ks. Navios Partners expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Navios Partners’ expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based. Navios Partners

makes no prediction or statement about the performance of its

common units.

Contacts

Navios Maritime Partners L.P.+1 (212) 906

8645Investors@navios-mlp.com

Nicolas BornozisCapital Link, Inc.+1 (212) 661

7566naviospartners@capitallink.comEXHIBIT 1

NAVIOS MARITIME PARTNERS L.P.

SELECTED BALANCE SHEET DATA(Expressed in thousands

of U.S. Dollars except unit data)

| |

June 30,2023(unaudited) |

|

December 31,2022(unaudited) |

|

ASSETS |

|

|

|

|

|

| Cash and cash equivalents,

including restricted cash |

$ |

270,052 |

|

$ |

175,098 |

| Other current assets |

|

93,809 |

|

|

135,326 |

| Vessels, net |

|

3,734,043 |

|

|

3,777,329 |

| Other non-current assets |

|

867,661 |

|

|

807,951 |

| Total

assets |

$ |

4,965,565 |

|

$ |

4,895,704 |

| |

|

|

|

|

|

| LIABILITIES AND PARTNERS’

CAPITAL |

|

|

|

|

|

| Other current liabilities |

$ |

137,520 |

|

$ |

226,645 |

| Total borrowings, net (including

current and non-current) |

|

1,924,703 |

|

|

1,945,447 |

| Other non-current

liabilities |

|

351,984 |

|

|

380,649 |

| Total partners’ capital |

|

2,551,358 |

|

|

2,342,963 |

| Total liabilities and

partners’ capital |

$ |

4,965,565 |

|

$ |

4,895,704 |

NAVIOS MARITIME PARTNERS

L.P.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Expressed in thousands of U.S. Dollars except

unit and per unit data)

| |

Three MonthPeriod Ended |

|

Three MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

June 30, 2023 |

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Time charter and voyage revenues |

$ |

346,938 |

|

|

$ |

280,661 |

|

|

$ |

656,460 |

|

|

$ |

517,278 |

|

| Time charter and voyage

expenses |

|

(41,956 |

) |

|

|

(21,718 |

) |

|

|

(81,719 |

) |

|

|

(38,861 |

) |

| Direct vessel expenses |

|

(17,764 |

) |

|

|

(12,920 |

) |

|

|

(32,204 |

) |

|

|

(24,113 |

) |

| Vessel operating expenses |

|

(82,550 |

) |

|

|

(73,989 |

) |

|

|

(165,766 |

) |

|

|

(147,161 |

) |

| General and administrative

expenses |

|

(20,536 |

) |

|

|

(14,170 |

) |

|

|

(40,035 |

) |

|

|

(28,086 |

) |

| Depreciation and amortization

of intangible assets |

|

(54,037 |

) |

|

|

(41,684 |

) |

|

|

(108,255 |

) |

|

|

(84,550 |

) |

| Amortization of unfavorable

lease terms |

|

5,322 |

|

|

|

17,587 |

|

|

|

12,910 |

|

|

|

39,426 |

|

| Gain on sale of vessels,

net |

|

10,151 |

|

|

|

— |

|

|

|

43,601 |

|

|

|

— |

|

| Interest expense and finance

cost, net |

|

(33,330 |

) |

|

|

(14,522 |

) |

|

|

(68,854 |

) |

|

|

(27,749 |

) |

| Interest income |

|

2,483 |

|

|

|

22 |

|

|

|

4,100 |

|

|

|

24 |

|

| Other expense, net |

|

(2,413 |

) |

|

|

(1,107 |

) |

|

|

(8,765 |

) |

|

|

(2,383 |

) |

| Net

income |

$ |

112,308 |

|

|

$ |

118,160 |

|

|

$ |

211,473 |

|

|

$ |

203,825 |

|

Earnings per unit:

| |

Three MonthPeriod Ended |

|

Three MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Earnings per unit: |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common unit,

basic |

$ |

3.65 |

|

$ |

3.84 |

|

$ |

6.87 |

|

$ |

6.62 |

| Earnings per common unit,

diluted |

$ |

3.65 |

|

$ |

3.83 |

|

$ |

6.87 |

|

$ |

6.61 |

NAVIOS MARITIME PARTNERS

L.P.Other Financial Information(Expressed

in thousands of U.S. Dollars except unit data)

| |

Six MonthPeriod EndedJune 30,

2023 |

|

Six MonthPeriod EndedJune 30,

2022 |

| (in thousands of U.S.

dollars) |

(unaudited) |

|

(unaudited) |

|

Net cash provided by operating activities |

$ |

228,343 |

|

|

$ |

147,163 |

|

| Net cash provided by/ (used

in) investing activities |

$ |

31,665 |

|

|

$ |

(61,860 |

) |

| Net cash used in financing

activities |

$ |

(165,054 |

) |

|

$ |

(80,125 |

) |

| Increase in cash, cash

equivalents and restricted cash |

$ |

94,954 |

|

|

$ |

5,178 |

|

EXHIBIT 2

|

Owned Drybulk Vessels |

|

Type |

|

Built |

|

Capacity (DWT) |

| Navios Christine B |

|

Ultra-Handymax |

|

2009 |

|

58,058 |

| Navios Celestial |

|

Ultra-Handymax |

|

2009 |

|

58,063 |

| Navios Vega |

|

Ultra-Handymax |

|

2009 |

|

58,792 |

| Navios La Paix |

|

Ultra-Handymax |

|

2014 |

|

61,485 |

| Navios Hyperion |

|

Panamax |

|

2004 |

|

75,707 |

| Navios Orbiter |

|

Panamax |

|

2004 |

|

76,602 |

| Navios Hope |

|

Panamax |

|

2005 |

|

75,397 |

| Navios Taurus |

|

Panamax |

|

2005 |

|

76,596 |

| Navios Sun |

|

Panamax |

|

2005 |

|

76,619 |

| Navios Asteriks |

|

Panamax |

|

2005 |

|

76,801 |

| Navios Helios |

|

Panamax |

|

2005 |

|

77,075 |

| Navios Apollon I |

|

Panamax |

|

2005 |

|

87,052 |

| N Amalthia |

|

Panamax |

|

2006 |

|

75,318 |

| Navios Sagittarius |

|

Panamax |

|

2006 |

|

75,756 |

| Navios Galileo |

|

Panamax |

|

2006 |

|

76,596 |

| N Bonanza |

|

Panamax |

|

2006 |

|

76,596 |

| Navios Harmony |

|

Panamax |

|

2006 |

|

82,790 |

| Copernicus N |

|

Panamax |

|

2010 |

|

93,062 |

| Unity N |

|

Panamax |

|

2011 |

|

79,642 |

| Odysseus N |

|

Panamax |

|

2011 |

|

79,642 |

| Rainbow N |

|

Panamax |

|

2011 |

|

79,642 |

| Navios Avior |

|

Panamax |

|

2012 |

|

81,355 |

| Navios Centaurus |

|

Panamax |

|

2012 |

|

81,472 |

| Navios Victory |

|

Panamax |

|

2014 |

|

77,095 |

| Navios Sphera |

|

Panamax |

|

2016 |

|

84,872 |

| Navios Sky |

|

Panamax |

|

2015 |

|

82,056 |

| Navios Uranus |

|

Panamax |

|

2019 |

|

81,821 |

| Navios Herakles I |

|

Panamax |

|

2019 |

|

82,036 |

| Navios Galaxy II |

|

Panamax |

|

2020 |

|

81,789 |

| Navios Felicity I |

|

Panamax |

|

2020 |

|

81,962 |

| Navios Magellan II |

|

Panamax |

|

2020 |

|

82,037 |

| Navios Alegria |

|

Panamax |

|

2016 |

|

84,852 |

| Navios Meridian |

|

Panamax |

|

2023 |

|

82,010 |

| Navios Primavera |

|

Panamax |

|

2022 |

|

82,003 |

| Navios Beaufiks |

|

Capesize |

|

2004 |

|

180,310 |

| Navios Fantastiks |

|

Capesize |

|

2005 |

|

180,265 |

| Navios Stellar |

|

Capesize |

|

2009 |

|

169,001 |

| Navios Aurora II |

|

Capesize |

|

2009 |

|

169,031 |

| Navios Happiness |

|

Capesize |

|

2009 |

|

180,022 |

| Navios Bonavis |

|

Capesize |

|

2009 |

|

180,022 |

| Navios Phoenix |

|

Capesize |

|

2009 |

|

180,242 |

| Navios Sol |

|

Capesize |

|

2009 |

|

180,274 |

| Navios Lumen |

|

Capesize |

|

2009 |

|

180,661 |

| Navios Pollux |

|

Capesize |

|

2009 |

|

180,727 |

| Navios Antares |

|

Capesize |

|

2010 |

|

169,059 |

| Navios Symphony |

|

Capesize |

|

2010 |

|

178,132 |

| Navios Melodia |

|

Capesize |

|

2010 |

|

179,132 |

| Navios Luz |

|

Capesize |

|

2010 |

|

179,144 |

| Navios Etoile |

|

Capesize |

|

2010 |

|

179,234 |

| Navios Buena Ventura |

|

Capesize |

|

2010 |

|

179,259 |

| Navios Bonheur |

|

Capesize |

|

2010 |

|

179,259 |

| Navios Fulvia |

|

Capesize |

|

2010 |

|

179,263 |

| Navios Aster |

|

Capesize |

|

2010 |

|

179,314 |

| Navios Ace |

|

Capesize |

|

2011 |

|

179,016 |

| Navios Altamira |

|

Capesize |

|

2011 |

|

179,165 |

| Navios Azimuth |

|

Capesize |

|

2011 |

|

179,169 |

| Navios Koyo |

|

Capesize |

|

2011 |

|

181,415 |

| Navios Ray |

|

Capesize |

|

2012 |

|

179,515 |

| Navios Joy |

|

Capesize |

|

2013 |

|

181,389 |

| Navios Gem |

|

Capesize |

|

2014 |

|

181,336 |

| Navios Canary |

|

Capesize |

|

2015 |

|

180,528 |

| Navios Corali |

|

Capesize |

|

2015 |

|

181,249 |

| Navios Mars |

|

Capesize |

|

2016 |

|

181,259 |

| Navios Armonia |

|

Capesize |

|

2022 |

|

182,079 |

| Navios Azalea |

|

Capesize |

|

2022 |

|

182,064 |

| Navios Astra |

|

Capesize |

|

2022 |

|

182,393 |

| Navios Felix |

|

Capesize |

|

2016 |

|

181,221 |

| Navios Altair |

|

Capesize |

|

2023 |

|

182,115 |

| Navios Sakura |

|

Capesize |

|

2023 |

|

182,169 |

| Navios Amethyst |

|

Capesize |

|

2023 |

|

182,212 |

|

Owned Containerships |

|

Type |

|

Built |

|

Capacity(TEU) |

| Navios Summer |

|

Containership |

|

2006 |

|

3,450 |

| Navios Verano |

|

Containership |

|

2006 |

|

3,450 |

| Hyundai Hongkong |

|

Containership |

|

2006 |

|

6,800 |

| Hyundai Singapore |

|

Containership |

|

2006 |

|

6,800 |

| Hyundai Busan |

|

Containership |

|

2006 |

|

6,800 |

| Hyundai Shanghai |

|

Containership |

|

2006 |

|

6,800 |

| Hyundai Tokyo |

|

Containership |

|

2006 |

|

6,800 |

| Protostar N |

|

Containership |

|

2007 |

|

2,741 |

| Navios Spring |

|

Containership |

|

2007 |

|

3,450 |

| Matson Lanai |

|

Containership |

|

2007 |

|

4,250 |

| Navios Indigo |

|

Containership |

|

2007 |

|

4,250 |

| Navios Vermilion |

|

Containership |

|

2007 |

|

4,250 |

| Navios Verde |

|

Containership |

|

2007 |

|

4,250 |

| Navios Amarillo |

|

Containership |

|

2007 |

|

4,250 |

| Navios Azure |

|

Containership |

|

2007 |

|

4,250 |

| Navios Domino |

|

Containership |

|

2008 |

|

4,250 |

| Navios Delight |

|

Containership |

|

2008 |

|

4,250 |

| Navios Magnolia |

|

Containership |

|

2008 |

|

4,730 |

| Navios Jasmine |

|

Containership |

|

2008 |

|

4,730 |

| Navios Chrysalis |

|

Containership |

|

2008 |

|

4,730 |

| Navios Nerine |

|

Containership |

|

2008 |

|

4,730 |

| Spectrum N |

|

Containership |

|

2009 |

|

2,546 |

| Navios Devotion |

|

Containership |

|

2009 |

|

4,250 |

| Navios Destiny |

|

Containership |

|

2009 |

|

4,250 |

| Navios Lapis |

|

Containership |

|

2009 |

|

4,250 |

| Navios Tempo |

|

Containership |

|

2009 |

|

4,250 |

| Navios Miami |

|

Containership |

|

2009 |

|

4,563 |

| Navios Dorado |

|

Containership |

|

2010 |

|

4,250 |

| Zim Baltimore |

|

Containership |

|

2010 |

|

4,360 |

| Navios Bahamas |

|

Containership |

|

2010 |

|

4,360 |

| Zim Carmel |

|

Containership |

|

2010 |

|

4,360 |

| Navios Unison |

|

Containership |

|

2010 |

|

10,000 |

| Navios Constellation |

|

Containership |

|

2011 |

|

10,000 |

| Fleur N |

|

Containership |

|

2012 |

|

2,782 |

| Ete N |

|

Containership |

|

2012 |

|

2,782 |

|

Owned Tanker Vessels |

|

Type |

|

Built |

|

Capacity (DWT) |

| Hector N |

|

MR1 Product Tanker |

|

2008 |

|

38,402 |

| Nave Equinox |

|

MR2 Product Tanker |

|

2007 |

|

50,922 |

| Nave Pulsar |

|

MR2 Product Tanker |

|

2007 |

|

50,922 |

| Nave Orbit |

|

MR2 Product Tanker |

|

2009 |

|

50,470 |

| Nave Equator |

|

MR2 Product Tanker |

|

2009 |

|

50,542 |

| Nave Aquila |

|

MR2 Product Tanker |

|

2012 |

|

49,991 |

| Nave Atria |

|

MR2 Product Tanker |

|

2012 |

|

49,992 |

| Nave Capella |

|

MR2 Product Tanker |

|

2013 |

|

49,995 |

| Nave Alderamin |

|

MR2 Product Tanker |

|

2013 |

|

49,998 |

| Nave Bellatrix |

|

MR2 Product Tanker |

|

2013 |

|

49,999 |

| Nave Orion |

|

MR2 Product Tanker |

|

2013 |

|

49,999 |

| Nave Titan |

|

MR2 Product Tanker |

|

2013 |

|

49,999 |

| Bougainville |

|

MR2 Product Tanker |

|

2013 |

|

50,626 |

| Nave Pyxis |

|

MR2 Product Tanker |

|

2014 |

|

49,998 |

| Nave Luminosity |

|

MR2 Product Tanker |

|

2014 |

|

49,999 |

| Nave Jupiter |

|

MR2 Product Tanker |

|

2014 |

|

49,999 |

| Nave Velocity |

|

MR2 Product Tanker |

|

2015 |

|

49,999 |

| Nave Sextans |

|

MR2 Product Tanker |

|

2015 |

|

49,999 |

| Nave Ariadne |

|

LR1 Product Tanker |

|

2007 |

|

74,671 |

| Nave Cielo |

|

LR1 Product Tanker |

|

2007 |

|

74,671 |

| Nave Andromeda |

|

LR1 Product Tanker |

|

2011 |

|

75,000 |

| Nave Cetus |

|

LR1 Product Tanker |

|

2012 |

|

74,581 |

| Nave Cassiopeia |

|

LR1 Product Tanker |

|

2012 |

|

74,711 |

| Nave Estella |

|

LR1 Product Tanker |

|

2012 |

|

75,000 |

| Nave Rigel |

|

LR1 Product Tanker |

|

2013 |

|

74,673 |

| Nave Atropos |

|

LR1 Product Tanker |

|

2013 |

|

74,695 |

| Nave Galactic |

|

VLCC |

|

2009 |

|

297,168 |

| Nave Spherical |

|

VLCC |

|

2009 |

|

297,188 |

| Nave Constellation |

|

VLCC |

|

2010 |

|

296,988 |

| Nave Quasar |

|

VLCC |

|

2010 |

|

297,376 |

| Nave Synergy |

|

VLCC |

|

2010 |

|

299,973 |

| Nave Universe |

|

VLCC |

|

2011 |

|

297,066 |

| Nave Buena Suerte |

|

VLCC |

|

2011 |

|

297,491 |

|

Bareboat-in vessels |

|

Type |

|

Built |

|

Capacity(DWT) |

|

PurchaseOption |

| Navios Libra |

|

Panamax |

|

2019 |

|

82,011 |

|

Yes |

| Navios Star |

|

Panamax |

|

2021 |

|

81,994 |

|

Yes |

| Navios Amitie |

|

Panamax |

|

2021 |

|

82,002 |

|

Yes |

| Baghdad |

|

VLCC |

|

2020 |

|

313,433 |

|

Yes |

| Nave Electron |

|

VLCC |

|

2021 |

|

313,239 |

|

Yes |

| Erbil |

|

VLCC |

|

2021 |

|

313,486 |

|

Yes |

| Nave Celeste |

|

VLCC |

|

2022 |

|

313,418 |

|

Yes |

|

Newbuildings to be delivered |

|

Type |

|

ExpectedDelivery Date |

|

CapacityDWT / (TEU) |

| TBN I |

|

Containership |

|

H2 2023 |

|

5,300 |

| TBN II |

|

Containership |

|

H2 2023 |

|

5,300 |

| TBN VII |

|

Containership |

|

H2 2023 |

|

5,300 |

| TBN III |

|

Containership |

|

H1 2024 |

|

5,300 |

| TBN IV |

|

Containership |

|

H1 2024 |

|

5,300 |

| TBN VIII |

|

Containership |

|

H1 2024 |

|

5,300 |

| TBN V |

|

Containership |

|

H2 2024 |

|

5,300 |

| TBN VI |

|

Containership |

|

H2 2024 |

|

5,300 |

| TBN IX |

|

Containership |

|

H2 2024 |

|

5,300 |

| TBN X |

|

Containership |

|

H2 2024 |

|

5,300 |

| TBN XVII |

|

Containership |

|

H2 2024 |

|

7,700 |

| TBN XVIII |

|

Containership |

|

H1 2025 |

|

7,700 |

| TBN XI |

|

Aframax/LR2 |

|

H1 2024 |

|

115,000 |

| TBN XII |

|

Aframax/LR2 |

|

H2 2024 |

|

115,000 |

| TBN XIII |

|

Aframax/LR2 |

|

H2 2024 |

|

115,000 |

| TBN XIV |

|

Aframax/LR2 |

|

H2 2024 |

|

115,000 |

| TBN XV |

|

Aframax/LR2 |

|

H1 2025 |

|

115,000 |

| TBN XVI |

|

Aframax/LR2 |

|

H1 2025 |

|

115,000 |

| TBN XIX |

|

MR2 Product Tanker |

|

H2 2025 |

|

52,000 |

| TBN XX |

|

MR2 Product Tanker |

|

H1 2026 |

|

52,000 |

| TBN XXI |

|

MR2 Product Tanker |

|

H2 2026 |

|

52,000 |

| TBN XXII |

|

MR2 Product Tanker |

|

H1 2027 |

|

52,000 |

| |

|

|

|

|

|

|

|

Chartered-in vessels (with purchase options) |

|

Type |

|

Year Built |

|

Capacity(DWT) |

|

PurchaseOption |

|

Navios Lyra |

|

Handysize |

|

2012 |

|

34,718 |

|

|

Yes |

| Navios Venus |

|

Ultra-Handymax |

|

2015 |

|

61,339 |

|

|

Yes |

| Navios Amber |

|

Panamax |

|

2015 |

|

80,994 |

|

|

Yes |

| Navios Coral |

|

Panamax |

|

2016 |

|

84,904 |

|

|

Yes |

| Navios Citrine |

|

Panamax |

|

2017 |

|

81,626 |

|

|

Yes |

| Navios Dolphin |

|

Panamax |

|

2017 |

|

81,630 |

|

|

Yes |

| Navios Gemini |

|

Panamax |

|

2018 |

|

81,704 |

|

|

No (1) |

| Navios Horizon I (2) |

|

Panamax |

|

2019 |

|

81,692 |

|

|

– |

(1) Purchase option in the form of the right of

first refusal and profit share on sale of

vessel.(2) Vessel agreed to be acquired.

EXHIBIT 3

Disclosure of Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted Net Income and

Adjusted Earnings per Common Unit, basic and diluted are “non-U.S.

GAAP financial measures” and should not be used in isolation or

considered substitutes for net income/ (loss), cash flow from

operating activities and other operations or cash flow statement

data prepared in accordance with generally accepted accounting

principles in the United States.

EBITDA represents net income before interest and

finance costs, depreciation and amortization (including intangible

accelerated amortization) and income taxes. Adjusted EBITDA

represents EBITDA excluding certain items, as described under

“Earnings Highlights”. Navios Partners uses Adjusted EBITDA as a

liquidity measure and reconciles EBITDA and Adjusted EBITDA to net

cash provided by operating activities, the most comparable U.S.

GAAP liquidity measure. EBITDA in this document is calculated as

follows: net cash provided by operating activities adding back,

when applicable and as the case may be, the effect of: (i) net

increase/ (decrease) in operating assets; (ii) net decrease/

(increase) in operating liabilities; (iii) net interest cost;

(iv) amortization and write-off of deferred finance costs and

discount; (v) gain on sale of assets; (vi) non-cash

amortization of deferred revenue and straight line effect of the

containerships and tankers charters with de-escalating rates;

(vii) stock-based compensation; and (viii) amortization of

operating lease assets/ liabilities. Navios Partners believes that

EBITDA and Adjusted EBITDA are each the basis upon which liquidity

can be assessed and presents useful information to investors

regarding Navios Partners’ ability to service and/or incur

indebtedness, pay capital expenditures, meet working capital

requirements and make cash distributions. Navios Partners also

believes that EBITDA and Adjusted EBITDA are used: (i) by

potential lenders to evaluate potential transactions; (ii) to

evaluate and price potential acquisition candidates; and

(iii) by securities analysts, investors and other interested

parties in the evaluation of companies in our industry.

Each of EBITDA and Adjusted EBITDA have

limitations as an analytical tool, and should not be considered in

isolation or as a substitute for the analysis of Navios Partners’

results as reported under U.S. GAAP. Some of these limitations are:

(i) EBITDA and Adjusted EBITDA do not reflect changes in, or

cash requirements for, working capital needs; and

(ii) although depreciation and amortization are non-cash

charges, the assets being depreciated and amortized may have to be

replaced in the future. EBITDA and Adjusted EBITDA do not reflect

any cash requirements for such capital expenditures. Because of

these limitations, EBITDA and Adjusted EBITDA should not be

considered as a principal indicator of Navios Partners’

performance. Furthermore, our calculation of EBITDA and Adjusted

EBITDA may not be comparable to that reported by other companies

due to differences in methods of calculation.

We present Adjusted Net Income by excluding

items that we do not believe are indicative of our core operating

performance. Our presentation of Adjusted Net Income adjusts net

income for the items described above under “Earnings Highlights”.

The definition of Adjusted Net Income used here may not be

comparable to that used by other companies due to differences in

methods of calculation. Adjusted Basic Earnings per Common Unit is

defined as Adjusted Net Income divided by the weighted average

number of common units outstanding for each of the periods

presented, basic and diluted.

EXHIBIT 4

Navios Maritime Partners L.P.

Reconciliation of EBITDA and Adjusted EBITDA to Cash from

Operations

| |

Three MonthPeriod Ended |

|

Three MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

Six MonthPeriod Ended |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

|

($ ‘000) |

|

($ ‘000) |

|

($ ‘000) |

|

($ ‘000) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net cash provided by operating activities |

$ |

133,827 |

|

|

$ |

142,010 |

|

|

$ |

228,343 |

|

|

$ |

147,163 |

|

| Net (decrease)/ increase in

operating assets |

|

11,166 |

|

|

|

34,561 |

|

|

|

(10,193 |

) |

|

|

88,517 |

|

| Net decrease/ (increase) in

operating liabilities |

|

39,923 |

|

|

|

(8,033 |

) |

|

|

101,946 |

|

|

|

51,980 |

|

| Net interest cost |

|

30,847 |

|

|

|

14,500 |

|

|

|

64,754 |

|

|

|

27,725 |

|

| Amortization and write-off of

deferred finance costs and discount |

|

(1,587 |

) |

|

|

(1,353 |

) |

|

|

(3,618 |

) |

|

|

(2,677 |

) |

| Amortization of operating

lease assets/ liabilities |

|

(2,588 |

) |

|

|

211 |

|

|

|

(5,146 |

) |

|

|

422 |

|

| Non-cash amortization of

deferred revenue and straight line |

|

(20,137 |

) |

|

|

(18,378 |

) |

|

|

(29,248 |

) |

|

|

(23,452 |

) |

| Stock-based compensation |

|

(1 |

) |

|

|

(40 |

) |

|

|

(2 |

) |

|

|

(82 |

) |

| Gain on sale of vessels |

|

10,151 |

|

|

|

— |

|

|

|

43,601 |

|

|

|

— |

|

| EBITDA |

$ |

201,601 |

|

|

$ |

163,478 |

|

|

$ |

390,437 |

|

|

$ |

289,596 |

|

| Gain on sale of vessels |

|

(10,151 |

) |

|

|

— |

|

|

|

(43,601 |

) |

|

|

— |

|

| Adjusted

EBITDA |

$ |

191,450 |

|

|

$ |

163,478 |

|

|

$ |

346,836 |

|

|

$ |

289,596 |

|

| |

Three MonthPeriod Ended |

|

Three MonthPeriod Ended |

|

Six Month Period Ended |

|

Six MonthPeriod Ended |

|

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

Net cash provided by operating activities |

$ |

133,827 |

|

|

$ |

142,010 |

|

|

$ |

228,343 |

|

|

$ |

147,163 |

|

| Net cash (used in)/ provided

by investing activities |

$ |

(12,567 |

) |

|

$ |

(40,191 |

) |

|

$ |

31,665 |

|

|

$ |

(61,860 |

) |

| Net cash used in financing

activities |

$ |

(64,419 |

) |

|

$ |

(35,391 |

) |

|

$ |

(165,054 |

) |

|

$ |

(80,125 |

) |

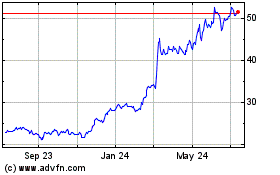

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Oct 2024 to Nov 2024

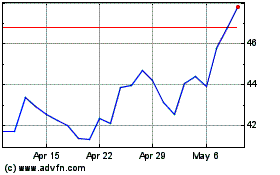

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Nov 2023 to Nov 2024