Today the Board of Directors of Natuzzi S.p.A. (NYSE:NTZ)

announced the first quarter 2010 financial results.

- Total Net Sales of €126.4

million as compared to €111.3 million in 1°Q 2009

- Industrial Margin of €48.7

million as compared to €28.4 million in 1°Q 2009

- Operating Income of €0.5 million

versus an Operating Loss of €16.6 million in 1° Q 2009

- Net Group Loss of €1.3 million

as compared to a Net Group Loss of €10.4 million of 1°Q 2009

- Positive Net Financial Position

of €54.9 million as compared to €58.5 million as of December 31,

2009

Total Net Sales for the first quarter 2010 were €126.4

million with an improvement of 13.6%. Upholstery Net Sales were

€111.3 million with an increase of 14.9% compared to the same

period of 2009. The contribution by Geographic area was the

following: Europe (excluding Italy) 42.4%, Americas 32.3%, Italy

14.1% and Rest of the World 11.2%.

The significant improvement of the Industrial Margin is

fundamentally due to a better product-mix sold, and to a constant

cost control activity, as well as to a positive euro/dollars

exchange rate that affected positively the cost of raw material

purchases.

Transportation costs were negatively influenced by a significant

increase of the freight fares recorded in some transportation

routes since January 2010. All the other SG&A costs slightly

improved as compared to the first quarter of 2009.

As a result of these figures, the Company highlights an

Operating Income of €0.5 million versus an Operating Loss of

€16.6 million in the first quarter of 2009 with a remarkable

improvement with respect to the same period of the previous

year.

Net Group Result shows a reduced loss of €1.3 million,

with respect to a loss of €10.4 million recorded in the same period

of 2009, mainly due to some improving actions obtained at a

production efficiency level.

Net Financial Position as of March 31, 2010 remains

strongly positive for €54.9 million notwithstanding the decrease

compared to December 31, 2009.

Pasquale Natuzzi, Chairman and Chief Executive Officer of

Natuzzi SpA., commented: “In the first quarter of 2010 we finally

recorded a net sales improvement. However, the economic crisis and

the worsening market conditions are not yet over and the Group

order flows for the first months of 2010 with respect to the last

months of 2009 confirm a slow down as compared to the previous

positive trend, even if with diversified trends among the various

brands and geographic areas. We promptly reacted, from a price

point of view, introducing in the Natuzzi Brand new “entry price”

products that could stimulate consumer demand coherently with the

brand positioning. The Italsofa and Editions brands are confirming

the success achieved during the Koln, Milan and High Point fairs

and the enormous potential of this new offer .

Along with these commercial initiatives, we have in progress an

internal restructuring plan that aims at simplifying the management

of company activities, at achieving further cost reductions and

innovation in order to improve the quality of products and customer

service.

We are confident that the strength of our brands and business

model, based on integration between production and distribution,

could help us face the adverse market situation. Furthermore,

thanks to the perseverance, enthusiasm, ethic values, and

commitment of all people working within our Group, we will be able

to achieve our goals in terms of service, quality, competitiveness

and profitability”.

About Natuzzi

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs and

manufactures a broad collection of residential upholstered

furniture. With consolidated revenues of EUR 515.4 million in 2009,

Natuzzi is Italy's largest furniture manufacturer. Natuzzi Group

exports its innovative high-quality sofas and armchairs to 130

markets on five continents under two brands, Natuzzi and Italsofa.

Cutting-edge design, superior Italian craftsmanship and advanced,

vertically integrated manufacturing operations underpin the

Company's market leadership. Natuzzi S.p.A. has been listed on the

New York Stock Exchange since May 1993. The Company is ISO 9001 and

14001 certified.

Tables follows

Natuzzi S.p.A. and Subsidiaries Unaudited Consolidated

Profit & Loss for the quarter ended on March 31, 2010 on the

basis of Italian GAAP (expressed in millions Euro except for

share data)

Three months ended on Change

Percent of Sales 31-mars-10 31-mars-09

% 31-mars-10 31-mars-09 Upholstery net

sales 111.3 96.9 14.9% 88.1% 87.1% Other sales 15.1 14.4 4.9% 11.9%

12.9%

Total Net Sales 126.4 111.3 13.6%

100.0% 100.0% Purchases (54.8) (43.1) 27.1%

-43.4% -38.7% Labor (19.6) (19.9) -1.5% -15.5% -17.9% Third-party

manufacturers (0.9) (1.1) -18.2% -0.7% -1.0% Manufacturing costs

(10.4) (11.6) -10.3% -8.2% -10.4% Net Inventoris 8.0 (7.2) -211.1%

6.3% -6.5%

Cost of Sales (77.7) (82.9)

-6.3% -61.5% -74.5%

Industrial Margin 48.7

28.4 71.5% 38.5% 25.5% Selling

Expenses (37.8) (34.1) 10.9% -29.9% -30.6% of which Transportation

(11.6) (9.1) of which Advertising (6.3) (5.7) G&A Expenses

(10.4) (10.9) -4.6% -8.2% -9.8%

Operating Income/(Loss) 0.5 (16.6)

103.0% 0.4% -14.9% Interest

Income/(Costs), Net (0.4) (0.2) 100.0% -0.3% -0.2% Foreign

Exchange, Net 0.9 6.2 -85.5% 0.7% 5.6% Other Income/(Cost), Net 0.3

1.8 -83.3% 0.2% 1.6%

Earning before Income Taxes 1.3 (8.8)

114.8% 1.0% -7.9% Current taxes (2.6)

(1.5) -2.1% -1.3%

Net

result (1.3) (10.3) 87.4% -1.0%

-9.3% Minority interest 0.0 0.1

Net Group Result (1.3)

(10.4) 87.4% -1.0% -9.3%

Net Group Result per Share

(0.02) (0.19)

Outstanding Shares 54,824,277 54,824,277

Key Figures in U.S.

dollars Three months ended on Change Percent

of Sales (millions)

31-mars-10 31-mars-09

% 31-mars-10 31-mars-09 Total Net

Sales 174.9 154.0

13.6% 100.0%

100.0% Gross Profit 67.4 39.3

71.5%

38.5% 25.5% Operating Income (Loss) 0.7

(23.0)

-103.0% 0.4% -14.9% Net Group

Result (1.8) (14.4)

87.4% -1.0%

-9.3% Net Group Result per Share (0.0) (0.3)

Average exchange rate (U.S.$ per €) 1.3837

UPHOLSTERY NET SALES BREAKDOWN

Geographic

breakdown Net sales million euro Net sales seats

3 months ended on 3 months ended on

31-mars-10 31-mars-09

Change % 31-mars-10 31-mars-09

Change % Americas 36.0

32.3% 29.4 30.3% 22.4% 197,694

42.4% 159,803 38.7% 23.7% Natuzzi 4.4

4.0% 4.0 4.1% 10.0% 11,547 2.5% 11,116 2.7% 3.9% Italsofa 31.6

28.3% 25.4 26.2% 24.4% 186,147 39.9% 148,687 36.0% 25.2%

Europe 47.2 42.4% 46.8 48.3%

0.9% 174,757 37.5% 179,958 43.6%

-2.9% Natuzzi 24.7 22.2% 22.5 23.2% 9.8% 60,103 12.9% 54,130

13.1% 11.0% Italsofa 22.5 20.2% 24.3 25.1% -7.4% 114,654 24.6%

125,828 30.5% -8.9%

Italy (Natuzzi) 15.6

14.1% 12.3 12.7% 26.8% 46,494

10.0% 37,107 9.0% 25.3% Rest

of the world 12.5 11.2% 8.4 8.7%

48.8% 47,368 10.1% 35,917 8.7%

31.9% Natuzzi 7.8 7.0% 5.0 5.2% 56.0% 18,393 3.9% 13,268

9.0% 38.6% Italsofa 4.7 4.2% 3.4 3.5% 38.2% 28,975 6.2% 22,649 5.5%

27.9%

Total 111.3 100.0%

96.9 100.0% 14.9% 466,313 100.0%

412,785 100.0% 13.0%

Brands breakdown Net sales million euro Net sales

seats

3 months ended on 3 months ended

on

31-mars-10

31-mars-09 Change % 31-mars-10

31-mars-09 Change % Natuzzi

52.5 47.2% 43.8 45.2% 19.9%

136,537 29.3% 115,621 28.0%

18.1% Italsofa 58.8 52.8%

53.1 54.8% 10.7% 329,776 70.7%

297,164 72.0% 11.0%

Total 111.3 100.0% 96.9 100.0%

14.9% 466,313 100.0% 412,785

100.0% 13.0% Natuzzi S.p.A. and Subsidiaries

Consolidated Balance Sheets (Expressed in millions of euro)

ASSETS 31-mars-10 31 Dec

09 Current assets: Cash and cash equivalents 64.2

66.3 Marketable debt securities 0.0 0.0 Trade receivables, net 92.9

97.1 Other receivables 56.2 54.4 Inventories 89.5 81.6 Unrealized

foreign exchange gains 0.5 0.3 Prepaid expenses and accrued income

1.2 1.4 Deferred income taxes 0.7 0.7

Total current assets 305.2 301.8

Non current assets: Net property, plant and equipment 193.6

193.8 Other assets 11.8 12.7

Total

current assets 205.4 206.5 TOTAL

ASSETS 510.6 508.3 LIABILITIES

AND SHAREHOLDERS' EQUITY Current

liabilities: Short-term borrowings 2.2 0.8 Current portion of

long-term debt 1.3 1.1 Accounts payable-trade 60.8 66.5 Accounts

payable-other 29.8 29.3 Unrealized foreign exchange losses 1.4 0.4

Accounts payable-shareholders for dividends 0.0 0.0 Income taxes

5.2 3.7 Salaries, wages and related liabilities 14.1 12.5

Total current liabilities 114.8

114.3 Long-term liabilities: Employees'

leaving entitlement 29.3 29.6 Long-term debt 5.8 5.9 Deferred

income for capital grants 10.8 11.2 Other liabilities 18.3 20.4

Total long-term liabilities

64.2 67.1

Minority interest 2.0 1.9

Shareholders' equity: Share capital 54.9 54.9 Reserves 42.8

42.8 Additional paid-in capital 8.3 8.3 Retained earnings 223.6

219.0

Total shareholders' equity

329.6 325.0 TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY 510.6 508.3 Natuzzi

S.p.A. and Subsidiaries

Consolidated Statements of Cash

Flows (Expressed in million of euro)

31-mars-10 31 Dec 09 Cash flows from

operating activities: Net earnings (loss) (1.3)

(17.7) Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 6.3 26.8 Employees' leaving entitlement (0.3) (2.1)

Deferred income taxes (0.0) 3.7 Minority interest 0.1 0.4 (Gain)

loss on disposal of assets (0.0) (0.1) Unrealized foreign exchange

losses and gains 0.8 (4.4) Deferred income for capital grants (0.2)

(1.0)

Non monetary operating costs 6.6 23.3

Change in assets and liabilities: Receivables, net

4.2 25.7 Inventories (8.0) 10.4 Prepaid expenses and accrued income

0.3 (0.2) Other assets (1.6) (8.2) Accounts payable (5.7) (2.1)

Income taxes 1.4 1.9 Salaries, wages and related liabilities (0.9)

(1.8) Other liabilities 0.2 2.5

Net working capital

(10.1) 28.2 Net cash provided by operating

activities (4.8) 33.8 Cash flows

from investing activities: Property, plant and equipment:

Additions (1.0) (9.1) Disposals 0.0 0.2 Government grants received

Net cash used in investing activities (1.0)

(8.9) Cash flows from financing activities:

Long-term debt: Proceeds 0.6 3.9 Repayments (0.4) (0.7)

Short-term borrowings 1.4 (8.9)

Net cash used in

financing activities 1.6 (5.7) Effect of

translation adjustments on cash 2.1 (0.2)

Increase

(decrease) in cash and cash equivalents (2.1)

19.0 Cash and cash equivalents, beginning of the

year 66.3 47.3 Cash and cash

equivalents, end of the year 64.2 66.3

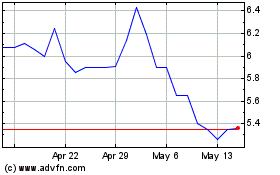

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

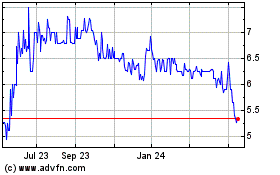

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024