The Board of Directors of Natuzzi S.p.A. (NYSE:NTZ) (�Natuzzi�

or �the Company�), the world leading manufacturer of

leather-upholstered furniture, today announced the first quarter

fiscal 2009 financial results.

First quarter 2009 Summary:

- Net Sales totaled �111,3 million

as compared to �172,8 million in 1Q 2008

- Operating loss was �16,6 million

as compared to �12,1 million in 1Q 2008

- Net loss totaled �10,4 million

compared to a loss of �23,4 million in 1Q 2008

First Quarter Results

Natuzzi Group Net Sales during the first quarter of 2009

decreased 35,6% to �111,3 million as compared to the same quarter

last year. Upholstery sales were � 96,9 million or 87,1% of net

sales, compared to �153,7 million or 88,9% of total net sales in

the first quarter of 2008. The contribution to the first quarter

2009 of upholstery net sales by geographic area was as follows:

Europe 61,0%, Americas 30,4%, and rest of the world 8,6%.

For the first quarter of 2009 the Group reported a Gross Profit

of �28,4 million, a decrease of 35,6% as compared to �44,1 million

for the same quarter last year. Gross Profit in the first quarter

of 2009 was 25,5% flat to the first quarter of 2008. The Gross

Profit deleveraging was offset by lower purchasing and labor costs,

indeed the total cost of sales decreased 35,6% passing from �128,7

million to �82,9 million in the first quarter of 2009. SG&A

expense for the first quarter of 2009 declined 20% to � 45,0

million. Operating loss was �16,6 million in the first quarter of

2009 as compared to a loss of �12,1 million in the same period last

year.

Net Group Result was a loss of �10,4 million as compared to a

loss of �23,4 million for the same period of 2008.

Pasquale Natuzzi, Chairman and CEO, commented: �The furniture

industry continues to be under pressure due to a challenging

economic environment; as a result, we were unable to increase gross

profit due to the decline in net sales although deleveraging was

partially offset by a significant reduction in production costs. In

the meantime, we continue, in line with our positive trend already

started in the last quarter 2008, to make meaningful progress in

certain initiatives to increase efficiencies and reduce costs in

our business which should lead to significant operating margin

expansion and a stronger cash position longer term.�

At the end of the first quarter 2009, stores worldwide totaled

323 (including Italsofa stores and Divani & Divani stores).

CASH AND SHAREHOLDERS EQUITY

The Natuzzi Group ended the first quarter of 2009 with no debit

and a cash of �65 million representing an increase of approximately

�18 million as compared to the end of 2008. Shareholder�s equity

was �334,1 million.

The Company will host a conference call on Thursday, May 28,

2009 at 10:00 a.m. Eastern Time to discuss first quarter fiscal

2009 financial results. A live web cast of the conference call will

be available online at http://www.natuzzi.com/ under the

Investor Relations section. A replay will be made available online

approximately 2 hours for a period of 30 days following the live

call. To access the telephone replay, participants should dial

(888) 203-1112 for domestic calls and (719) 457-0820 for

international calls. The access code for the replay is:

2708040.

About Natuzzi

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. designs and

manufactures a broad collection of residential upholstered

furniture. With 2008 year end consolidated revenues of EUR 666,0

million, Natuzzi is Italy's largest furniture manufacturer. The

Natuzzi group exports its innovative high-quality sofas and

armchairs to 123 markets on five continents under two brands,

Natuzzi and Italsofa.

Cutting-edge design, superior Italian craftsmanship, and

advanced, vertically integrated manufacturing operations underpin

the Company's market leadership.

Natuzzi S.p.A. has been listed on the New York Stock Exchange

since May 1993. The Company is ISO 9001 and 14001 certified.

Forward looking

statement

Statements in this press release other than statements of

historical fact are �forward-looking statements�. Forward�looking

statements are based on management�s current expectations and

beliefs and therefore you should not place undue reliance on them.

These statements are subject to a number of risks and

uncertainties, including risks that may not be subject to the

Group�s control, that could cause actual results to differ

materially from those contained in any forward-looking statement.

These risks include, but are not limited to, fluctuations in

exchange rates, economic and weather factors affecting consumer

spending, competitive and regulatory environment, as well as other

political, economical and technological factors, and other risks

identified from time to time in the Group�s filings with the

Securities and Exchange Commission, particularly in the Group�s

annual report on Form 20-F. Forward looking statements speak as of

the date they were made, and the Group undertakes no obligation to

update publicly any of them in light of new information or future

events.

Natuzzi S.p.A. and Subsidiaries Unaudited Consolidated

Profit & Loss for the quarter ended on March 31, 2009 on

the basis of Italian GAAP (expressed in millions Euro except

for share data) � � � � � � � � � � � �

Three months ended

on �

Change �

Percent of Sales � �

31 March

09 �

31 March 08 �

% �

31 March 09 �

31

March 08 � � Upholstery net sales 96.9 153.7 -37.0 % 87.1 %

88.9 % Other sales � 14.4 � � 19.1 � � -24.7 % � 12.9 % � 11.1 %

Total Net Sales �

111.3 � �

172.8 � �

-35.6 % �

100.0 % �

100.0

% � Purchases (43.1 ) (81.6 ) -47.2 % -38.7 % -47.2 % Labor

(19.9 ) (28.9 ) -31.0 % -17.9 % -16.7 % Third-party manufacturers

(3.5 ) (4.9 ) -28.3 % -3.2 % -2.8 % Manufacturing costs (9.1 )

(11.6 ) -21.5 % -8.2 % -6.7 %

Net Inventories

� (7.2 ) � (1.7 ) � 332.4 % � -6.5 % � -1.0 %

Cost of Sales

�

(82.9 ) �

(128.7 ) �

-35.6

% �

-74.5 % �

-74.5 % � � � � �

� � � � � �

Gross Profit �

28.4 � �

44.1 � �

-35.6 % �

25.5 % �

25.5 %

� Selling Expenses (34.1 ) (44.9 ) -24.1 % -30.6 % -26.0 % G&A

Expenses (10.9 ) (11.3 ) -3.8 % -9.8 % -6.5 % � � � � � � � � � � �

Operating Income/(Loss) �

(16.6 ) �

(12.1 ) �

-36.5 % �

-14.9

% �

-7.0 % � Other Income/(Cost), Net 7.8

(10.4 ) -175.3 % 7.0 % -6.0 % � � � � � � � � � � �

Earning

before Income Taxes �

(8.7 ) �

(22.5

) �

61.2 % �

-7.9 % �

-13.0 % � Current taxes (1.6 ) (1.0 ) 55.9 % -1.4 %

-0.6 % � � � � � � � � � � �

Net result �

(10.3

) �

(23.5 ) �

56.2 % �

-9.2 % �

-13.6 % � Minority interest

0.1 (0.1 ) -235.7 % � � � � � � � � � � �

Net Group Result �

(10.4 ) �

(23.4 ) �

55.8

% �

-9.3 % �

-13.6 % � � � � � �

� � � � �

Net Group Result per Share �

(0.19 )

�

(0.43 ) � � � � � � �

Outstanding Shares

54,824,277 54,824,277 � � � � � � � � � � �

Key

Figures in U.S. dollars Three months ended on

Change Percent of Sales (millions) �

31 March

09 �

31 March 08 �

% �

31 March 09 �

31

March 08 �

Total Net Sales 144.9 225.0

-35.6 % 100.0 % 100.0 %

Gross Profit 37.0 57.4

-35.6 %

25.5 % 25.5 % Operating Income

(Loss) (21.6 ) (15.8 )

-36.5 %

-14.9 % -7.0 % Net Group Result

(13.5 ) (30.5 )

55.8 % -9.3

% -13.6 % Net Group Result per Share

(0.2 ) (0.6 ) �

Average exchange rate (U.S. $

per �)

1.3020 UPHOLSTERY NET SALES BREAKDOWN �

Geographic

breakdown �

Net sales million euro � �

Net sales

seats � �

31 March 09

�

31 March 08

Change %

31 March 09 �

31 March 08

Change %

� � � �

Americas 29.4 30.4 %

49.6 32.3 % -40.7 %

159,803 38.7 % 307,881 42.8

% -48.1 % Natuzzi 14.7 15.2 % 26.8 17.4 %

-45.1 % 68,692 16.6 % 135,194 18.8 % -49.2 % Italsofa 14.7 15.2 %

22.8 14.8 % -35.5 % 91,111 22.1 % 172,687 24.0 % -47.2 % �

Europe 59.1 61.0 % 89.8

58.4 % -34.2 % 217,066

52.6 %

352,623

49.1 % -38.4 % Natuzzi 33.4 34.5 % 49.9

32.5 % -33.1 % 83,613 20.3 % 142,507 19.8 % -41.3 % Italsofa 25.7

26.6 % 39.9 26.0 % -35.5 % 133,452 32.3 % 210,116 29.2 % -36.5 % �

Rest of the world 8.3 8.6 % 14.3

9.3 % -41.6 % 35,917 8.7

% 58,121 8.1 % -38.2 %

Natuzzi 5.0 5.1 % 9.5 6.2 % -47.7 % 13,268 3.2 % 27,184 3.8 % -51.2

% Italsofa 3.4 3.5 % 4.8 3.1 % -29.5 % 22,649 5.5 % 30,937 4.3 %

-26.8 % � � � � � � � � � � � � � � � � � � � � �

Total

96.9 100.0 % 153.7 100.0

% -37.0 % 412,786 100.0 %

718,625 100.0 % -42.6 % � � � �

� � � � � � � � � � � � � � � � � �

Brands breakdown Net

sales million euro Net sales seats �

31 March 09

31 March 08

Change %

�

31 March 09 31 March 08

Change %

�

Natuzzi 53.1 54.8 % 86.2

56.1 % -38.4 % 165,573

40.1 % 304,885 42.4 %

-45.7 % �

Italsofa 43.8 45.2

% 67.5 43.9 % -35.1 %

247,213 59.9 % 413,740 57.6

% -40.2 % �

Total 96.9

100.0 % 153.7 100.0 %

-37.0 % 412,785 100.0 %

718,625 100.0 % -42.6 % Natuzzi

S.p.A. and Subsidiaries

Unaudited Consolidated Balance

Sheets (Expressed in millions of euro) � �

ASSETS �

31 March 09 �

31 Dec 08 �

Current assets: Cash

and cash equivalents 65.0 47.3 Marketable debt securities 0.0 0.0

Trade receivables, net 96.5 122.8 Other receivables 46.7 46.2

Inventories 84.8 92.0 Unrealized foreign exchange gains 1.0 4.7

Prepaid expenses and accrued income 1.8 1.3 Deferred income taxes �

3.8 � 4.2

Total current assets �

299.6 �

318.5

�

Non current assets: Net property, plant and equipment

206.9 211.8 Other assets 13.1 13.3 Deferred income taxes � 0.2 �

0.2

Total current assets �

220.1 �

225.3 �

TOTAL ASSETS �

519.8 �

543.8 �

LIABILITIES

AND SHAREHOLDERS' EQUITY � � �

Current liabilities:

Short-term borrowings 9.4 9.7 Current portion of long-term debt 0.7

0.5 Accounts payable-trade 58.1 68.6 Accounts payable-other 30.4

29.2 Unrealized foreign exchange losses 5.9 9.2 Accounts

payable-shareholders for dividends 0.6 0.6 Income taxes 2.7 1.8

Salaries, wages and related liabilities � 16.3 � 16.8

Total

current liabilities �

124.2 �

136.3 �

Long-term liabilities: Employees' leaving entitlement 31.7

31.7 Long-term debt 3.1 3.3 Deferred income for capital grants 11.9

12.1 Other liabilities � 13.8 � 14.4

Total current

liabilities �

60.5 �

61.4 � � � � �

Minority

interest �

0.9 �

0.8 �

Shareholders'

equity: Share capital 54.9 54.9 Reserves 42.8 42.3 Additional

paid-in capital 8.3 8.3 Retained earnings � 228.2 � 239.8

Total

shareholders' equity �

334.1 �

345.2 �

TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY �

519.8 �

543.8 Natuzzi S.p.A. and Subsidiaries

Unaudited

Consolidated Statements of Cash Flows � � (Expressed in million

of euro)

31 March 09 �

31 Dec 08 Cash flows from

operating activities: Net earnings (loss) (10.4

) (61.9 ) �

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation and amortization 7.2 30.5 Employees' leaving

entitlement 0.1 (1.7 ) Deferred income taxes 0.4 (3.1 ) Minority

interest 0.1 (0.4 ) (Gain) loss on disposal of assets 0.0 2.1

Unrealized foreign exchange losses and gains 0.5 5.4 Impairment of

long lived assets - 5.3 Deferred income for capital grants (0.2 )

(1.0 ) �

Change in assets and liabilities: Receivables, net

27.4 (5.1 ) Inventories 7.2 15.3 Prepaid expenses and accrued

income (0.5 ) 0.6 Other assets (0.5 ) 1.7 Accounts payable (10.5 )

(20.7 ) Income taxes 0.9 0.2 Salaries, wages and related

liabilities (0.5 ) (0.7 ) Other liabilities (2.0 ) 0.4 �

Total

adjustments 29.5 �

28.9 � �

Net cash provided

by operating activities �

19.1 � �

(33.1 )

�

Cash flows from investing activities: Property, plant and

equipment: Additions (2.0 ) (15.2 ) Disposals 0.0 0.2 Government

grants received - 1.4 Marketable debt securities: Proceeds from

sales - - Purchase of business, net of cash acquired - - Disposal

of business - � 1.1 � �

Net cash used in investing

activities �

(2.0 ) �

(12.5 ) �

Cash flows from financing activities: Long-term debt:

Proceeds - 2.0 Repayments - (0.7 ) Short-term borrowings (0.3 ) 2.1

Capital injection - 0.5 Dividends paid to minority interests - � -

� �

Net cash used in financing activities (0.3

) 4.0 � � Effect of translation adjustments on cash

0.9 � 1.4 � �

Increase (decrease) in cash and cash

equivalents 17.7 (40.2 ) �

Cash and

cash equivalents, beginning of the year 47.3 �

87.5 � �

Cash and cash equivalents, end of the year �

65.0 � �

47.3 �

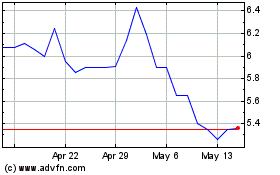

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

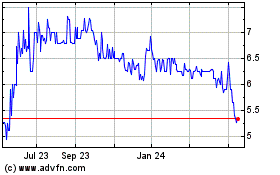

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024