3rd UPDATE: South Korea To Step Up Monitoring Of Foreign Banks

May 31 2011 - 5:27AM

Dow Jones News

SEOUL (Dow Jones)--South Korea said it would step up monitoring

of foreign banks operating in the country after finding cases of

improper outsourcing of key trading operations, marking the latest

step in the nation's efforts to contain potentially destabilizing

capital flows and adding another measure focusing on the role

foreign banks play in triggering volatility in local financial

markets.

Financial Supervisory Service Deputy Gov. Kim Yung-dae told

reporters at a briefing Tuesday that some foreign bank branches in

Korea were handing over day-to-day trading operations involving

money held in local accounts to a bigger foreign branch or regional

headquarters in places like Hong Kong and Singapore. Such

outsourcing is illegal in Korea.

"Such practices stem from the foreign banks' desire to manage

their entire Asian portfolio," Kim said. "In cases of big

investment banks, trading on a regional level can have a great

impact on the domestic financial markets as such management can

lead to sharp changes to the portfolios of the banks' local

branches."

Kim said HSBC Holdings PLC (HBC) and Credit Agricole S.A.

(CRARY) have already been sanctioned for improper outsourcing of

operations involving derivatives.

A person familiar with the situation told Dow Jones Newswires

later Tuesday that the Royal Bank of Scotland Group PLC (RBS) may

also be sanctioned for engaging in similar activity, with the FSS

likely to decide on the matter in June or July.

Credit Agricole declined to comment, while HSBC and RBS had no

immediate comment.

Local authorities have introduced several measures since last

June to safeguard the economy from potential shocks triggered by

so-called hot money. Asia has seen a surge of foreign capital into

its markets amid expectations for economic growth and higher

interest rates as the region's central banks combat inflation--and

Korea has been no exception to the trend.

South Korea fears that capital inflows could exit just as

swiftly, like they did during the 1997-1998 Asian financial crisis

and the 2008 economic crisis. So the local government last June

implemented a cap on the amount of foreign-exchange forwards

positions that banks operating in the country can carry, as such

contracts can be used to speculate on future market moves involving

the South Korean won.

Foreign banks have been under scrutiny because their Korean

branches tend to take on short-term foreign currency loans to do

business like corporate financing and trading of derivatives and

securities--activity which can lead to sharp swings in financial

markets, particularly the won. They are also often the

intermediaries for foreign investors looking to move money in and

out of the country.

While not directly related to the current issues, the emphasis

for greater regulatory supervision of foreign banks has been

heightened following a Nov. 11 incident when Deutsche Securities

Korea, the local unit of Deutsche Bank AG (DB), triggered a massive

drop in the local stock market in the last 10 minutes of trade by

selling KRW2.44 trillion worth of stocks.

Local authorities subsequently ruled the Deutsche unit

deliberately manipulated the market that day, dumping the shares on

the stock market to profit on "speculative derivative positions"

through the options and futures markets, and suspended the

brokerage's proprietary securities and exchange-listed derivative

trading operations for six months.

"Foreign banking branches (in Korea) are considered to have a

great effect in increasing the volatility of capital flows in and

out of the market," the FSS said in a separate statement,

explaining the need for greater monitoring of their business

operations.

A government official told Dow Jones Newswires Tuesday that Bank

of Korea and the FSS are jointly probing the Korean operations of

Mizuho Financial Group Inc. (MFG) unit Mizuho Corporate Bank and

Mitsubishi UFJ Financial Group Inc. (MTU) unit Bank of

Tokyo-Mitsubishi UFJ as part of their investigation on foreign

banks' role in the issuance of kimchi bonds--foreign-currency

denominated debt issued in Korea.

Mizuho and Bank of Tokyo-Mitsubishi UFJ declined to comment.

Local authorities are seeking to regulate the growing use of

kimchi bonds to circumvent local restrictions on foreign-currency

borrowings. The authorities suspect foreign banks are arranging

such kimchi bond deals, advising local companies that the

instrument could lower funding costs.

Under Korean law, banks can only provide loans in foreign

currencies if borrowers need the funds for overseas use. However,

the authorities suspect that the local companies selling kimchi

bonds are going into the swap market to change the proceeds into

won, with foreign banks acting as counterparties.

The FSS plans to inspect 15 of 37 foreign banks operating in

Korea annually to monitor their fund management from this year,

citing the need to proactively manage potential market risks. The

authority also said it will conduct inspections on foreign banks

whenever there are concerns about improper fund management or

whether they are complying with capital flow regulations, such as

in their foreign-exchange forward positions.

"We will expand our joint inspections with the Bank of Korea on

foreign-exchange transactions when necessary," the FSS said.

-By Se Young Lee, Dow Jones Newswires; +82 2 3700 1904;

vincent.lee@dowjones.com

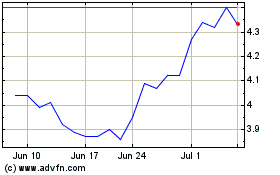

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From May 2024 to Jun 2024

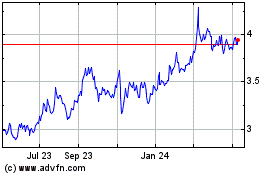

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2023 to Jun 2024