StanCorp Financial Upgraded - Analyst Blog

November 11 2011 - 12:02PM

Zacks

We are upgrading the recommendation on StanCorp

Financial Group Inc. (SFG) to Neutral from Underperform on

the back of strong third quarter results. Overall benefit ratio

declined compared with the last two quarters. Earnings per share of

96 cents also surpassed the Zacks Consensus Estimate by 30

cents.

StanCorp reported a benefit ratio of 80.7% in the third quarter,

lower than the past two quarters due to favorable group life

claims experience. Benefit ratio in second quarter was 84.8%, while the first quarter saw

84.2%. Also, Group insurance premiums, in the third

quarter, showed a 4.5% year-over-year growth, reflecting strong

group insurance sales and customer retention.

Furthermore, StanCorp enjoys a strong capital position. At

quarter-end, available capital was approximately $200 million, up

from $155 million at last quarter end. The increase in available

capital during the quarter was the result of higher income from our

insurance subsidiaries together with real estate sales partially

offset by share repurchases.

The company also remains focused on returning value to its

shareholders. In the third quarter, StanCorp bought back

approximately 0.4 million shares for $9.7 million. Year-to-date

buybacks totaled 2.2 million shares for $90 million. As of

September 30, StanCorp had approximately 3.1 million shares

remaining under its repurchase authorization.

On the flip side, StanCorp’s Asset Management segment, after

posting solid earnings over the past couple of quarters, witnessed

a decline in the third quarter. The decrease was mainly driven by

lower administrative fee revenues due to the decline in assets

under administration, coupled with the impact of lower

interest rates on the hedges used for the company’s equity-indexed

annuity product.

Also, Operating expense at StanCorp has increased year

over year in the last couple

of quarters. Third quarter operating expense increased 11% year

over year. The company expects to incur another $4 million in the

fourth quarter mainly associated with information technology

service efficiencies.

Also, StanCorp plans to

implement new accounting guidance related to deferred

acquisition costs (DAC) in the first quarter of 2012. Thus, the

company expects pre-tax expenses to increase by $3 million to $4

million annually. The company also estimates a reduction in book

value per share of approximately 1% to 2%.

The Zacks Consensus Estimate for fourth quarter 2011 is 78 cents

per share. For full years 2011 and 2012, the Zacks Consensus

Estimates are $3.04 and $3.76, respectively.

The quantitative Zacks #3 Rank (short-term Hold rating) for the

company indicates no clear directional pressure on the stock over

the near term.

Headquartered in Portland, Oregon, StanCorp Financial Group is

one of the largest providers of employee benefits products and

services in the U.S. The company operates across the country, with

a dominant position in western U.S. It competes with Unum

Group (UNM), MetLife, Inc. (MET) and

Principal Financial Group Inc. (PFG).

METLIFE INC (MET): Free Stock Analysis Report

PRINCIPAL FINL (PFG): Free Stock Analysis Report

STANCORP FNL CP (SFG): Free Stock Analysis Report

UNUM GROUP (UNM): Free Stock Analysis Report

Zacks Investment Research

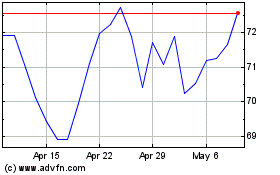

MetLife (NYSE:MET)

Historical Stock Chart

From May 2024 to Jun 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Jun 2023 to Jun 2024