Mesabi Trust Declares Distribution

January 15 2010 - 4:48PM

Business Wire

The Trustees of Mesabi Trust (NYSE: MSB) declared a distribution

of fifty-five cents ($0.55) per Unit of Beneficial Interest payable

on February 20, 2010 to Mesabi Trust unitholders of record at the

close of business on January 30, 2010. This compares to a

distribution of eleven cents ($0.11) per Unit for the same period

last year.

The forty-four cents ($0.44) per Unit increase in the current

distribution, as compared to the distribution for the same quarter

last year, is attributable to a significant increase in the volume

of shipments of iron ore pellets during the most recent quarter as

reported by Northshore Mining Company (“Northshore”), the

lessee/operator of the mine on Mesabi Trust lands. Even though the

average price per ton during the fourth quarter of 2009 was

approximately 25% lower than the average price per ton during the

fourth quarter of 2008, the increase in the volume of shipments as

compared to the same quarter last year resulted in a substantial

increase in the amount of the base royalty received by the Trust,

as compared to the fourth quarter of 2008. Additionally, the

current average sales price per ton of iron ore pellets shipped,

together with the increase in the volume of iron ore pellets

shipped, resulted in a significantly higher bonus royalty

payment.

The total royalty payment that Mesabi Trust expects to receive

from Northshore on January 29, 2010 is $8,421,808 (including a

royalty payment of $97,391 payable to the Mesabi Land Trust). The

total royalty payment expected to be received includes a base

royalty in the amount of $4,937,627 (representing royalties on

actual shipments of iron ore mined from Mesabi Trust lands of

1,754,342 tons), and a bonus royalty in the amount of $3,135,086

with respect to shipments during the fourth calendar quarter of

2009. The base royalty and bonus royalty amounts were increased by

$251,704, representing positive adjustments of $77,786 and

$173,918, respectively, to base royalty and bonus royalty amounts

credited to the Trust during the second and third quarter of 2009.

These pricing adjustments are the result of changes in the

estimated prices of iron ore pellets shipped under supply

agreements between Northshore, Northshore’s parent Cliffs Natural

Resources Inc. (“Cliffs”) and certain customers (the “Cliffs Pellet

Agreements”). As previously disclosed by Mesabi Trust, the prices

under the Cliffs Pellet Agreements are estimated and subject to

interim and final pricing adjustments, dependent in part on

multiple price and inflation index factors that are not known until

after the end of a contract year. This can result in significant

and frequent variations in royalties received by Mesabi Trust (and

in turn the resulting amount available for distribution to

Unitholders by the Trust) from quarter to quarter and on a

comparative historical basis. Cliffs has not provided Mesabi Trust

with any projections about possible pricing (and resulting royalty)

adjustments that might impact future distributions, although Cliffs

did indicate that the royalty payments being reported today are

based on estimated iron ore pellet prices under Cliffs Pellet

Agreements, which are subject to adjustment.

A portion of the royalty payment that the Trust expects to

receive from Northshore will be retained by the Trust and added to

the Trust’s cash reserve for potential future liabilities, which

was $2,068,574 as of October 31, 2009 (unaudited). As reflected on

the Trust’s unaudited balance sheet as of October 31, 2009, the

Trust is carrying a $2.25 million deferred royalty revenue

liability. See the discussion under the heading “Comparison of

Unallocated Reserve as of October 31, 2009, October 31, 2008 and

January 31, 2009,” in the Trust’s quarterly report on Form 10-Q for

the three months ended October 31, 2009 for additional information.

In making this decision, the Trustees considered the need for the

Trust to maintain adequate reserves to cover the Trust’s current

expenses, as well as present and future potential liabilities.

The royalties paid to Mesabi Trust are based on the volume of

shipments of iron ore pellets for the quarter and the year to date,

the pricing of the iron ore product sales, and the percentage of

iron ore pellet shipments from Mesabi Trust lands rather than from

other lands. The volume of shipments of iron ore pellets by

Northshore varies from quarter to quarter and year to year based on

a number of factors, including the requested delivery schedules of

customers, general economic conditions in the iron ore industry,

and weather conditions on the Great Lakes. Further, prices under

the Cliffs Pellet Agreements are subject to interim and final

pricing adjustments, dependent in part on multiple price and

inflation index factors that are not known until after the end of a

contract year. These adjustments can result in significant

variations in royalties received by Mesabi Trust (and in turn the

resulting amount available for distribution to Unitholders by

Mesabi Trust) from quarter to quarter and on a comparative

historical basis. These variations, which can be positive or

negative, cannot be predicted by the Trustees of Mesabi Trust.

Royalty payments received in 2007, 2008 and 2009 continue to

reflect pricing estimates for shipments of iron ore products that

may be subject to further adjustment (upward or downward) pursuant

to the Cliffs Pellet Agreements. It is possible that future

negative price adjustments could offset, or even eliminate,

royalties or royalty income that would otherwise be payable to the

Trust in any particular quarter, or at year end, thereby

potentially reducing, or even eliminating, cash available for

distribution to the Trust’s Unitholders in future quarters.

This press release contains certain forward-looking statements

with respect to iron ore pellet production, iron ore pricing and

adjustments to pricing, shipments by Northshore in 2009, royalty

(including bonus royalty) amounts, which statements are intended to

be made under the safe harbor protections of the Private Securities

Litigation Reform Act of 1995, as amended. Actual production,

prices, price adjustments and shipments of iron ore pellets, as

well as actual royalty levels (including bonus royalties) could

differ materially from current expectations due to inherent risks

such as general and industry economic trends, uncertainties arising

from war, terrorist events and other global events, macro economic

conditions, higher or lower customer demand for steel and iron ore,

environmental compliance uncertainties, higher imports of steel and

iron ore substitutes, processing difficulties, consolidation and

restructuring in the domestic steel market, indexing features in

Cliffs Pellet Agreements resulting in adjustments to royalties

payable to the Trust and other factors. Further, substantial

portions of royalties earned by Mesabi Trust are based on estimated

prices that are subject to interim and final adjustments, which can

be positive or negative, and are dependent on multiple price and

inflation index factors under agreements to which the Trust is not

a party and that are not known until after the end of a contract

year. Although the Mesabi Trustees believe that any such

forward-looking statements are based on reasonable assumptions,

such statements are subject to risks and uncertainties, which could

cause actual results to differ materially. Additional information

concerning these and other risks and uncertainties is contained in

the Trust’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K. Mesabi Trust undertakes

no obligation to publicly update or revise any of the

forward-looking statements that may be in this press release.

Mesabi (NYSE:MSB)

Historical Stock Chart

From May 2024 to Jun 2024

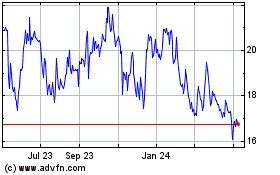

Mesabi (NYSE:MSB)

Historical Stock Chart

From Jun 2023 to Jun 2024