Network International Valued at GBP2.18 Billion in Mastercard-Backed IPO

April 10 2019 - 3:59AM

Dow Jones News

By Adam Clark

Network International has priced its initial public offering at

2.18 billion pounds ($2.85 billion) as it lists on the London Stock

Exchange.

The Dubai-based payment-processor priced its shares at 435 pence

a share when conditional dealings began on Wednesday. Network

International initially set its range at between 395p and 465p a

share at the beginning of April.

Shares rose to 513.10 pence in early trades in London, according

to FactSet.

Mastercard Inc. (MA) has already committed to taking a 10% stake

as part of a digital-payments push in Africa and the Middle East.

The U.S. card company's investment is subject to a 24-month lockup

period and a commitment not to buy further shares without Network

International's approval for three years.

Existing shareholders Emirates NBD Bank PJSC and U.S. private

equity firms Warburg Pincus and General Atlantic will sell an

additional 200 million shares, or a 40% stake, on top of the

Mastercard investment.

"The Middle East and Africa are at an early stage in the shift

from cash to digital payments and our new listing on the London

Stock Exchange will enable all new shareholders to benefit from

this structural growth opportunity," Chief Executive Simon Haslam

said.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

April 10, 2019 03:44 ET (07:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

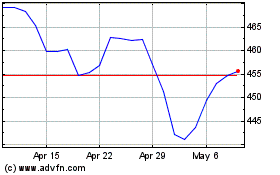

MasterCard (NYSE:MA)

Historical Stock Chart

From Jun 2024 to Jul 2024

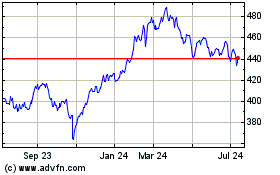

MasterCard (NYSE:MA)

Historical Stock Chart

From Jul 2023 to Jul 2024