Mastercard, Visa Propose Cutting Fees for European Merchants

December 04 2018 - 9:03AM

Dow Jones News

By Allison Prang

European Union regulators said Tuesday that Mastercard Inc. and

Visa Inc. have agreed to lower the fees assessed to merchants when

they accept debit or credit cards issued outside the region, a move

that comes after merchants alleged that networks and banks colluded

to inflate those fees.

The European Commission said both companies made offers to lower

these fees -- known as interregional interchange fees -- by a

minimum of 40%. The commission, which has asked for feedback on

those proposals, said the fees are applied to payments made in the

EU and three other European countries with cards issued outside of

the region.

The commission is worried that the fees could raise prices for

companies in Europe, potentially driving up prices for consumer

goods and services.

Under the proposals, interregional interchange fees would be

0.2% of the transaction value for debit cards and 0.3% for credit

cards when carried out in person. Fees for online purchases would

be lowered to 1.15% for debit cards and 1.5% for credit cards.

The European Commission plans to test these proposals in the

market before they become permanent, and the new rates would go

into effect six months after that decision is made. The commitments

would be effective for 5 1/2 years.

Mastercard said Tuesday in a securities filing that it took the

action to avoid prolonged litigation. It expects to record a

roughly $650 million charge in the fourth quarter in connection

with the matter.

Mastercard said it isn't admitting that its practices violated

EU competition rules.

Visa didn't immediately provide a comment on the matter.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

December 04, 2018 08:48 ET (13:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

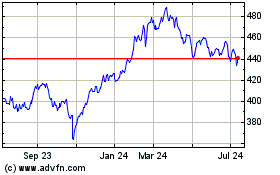

MasterCard (NYSE:MA)

Historical Stock Chart

From Jun 2024 to Jul 2024

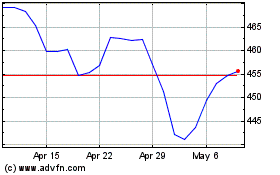

MasterCard (NYSE:MA)

Historical Stock Chart

From Jul 2023 to Jul 2024