LTC Properties, Inc. (NYSE: LTC), a real estate investment trust

that primarily invests in seniors housing and health care

properties, today announced operating results for its fourth

quarter ended December 31, 2018.

Net income available to common stockholders was

$30.6 million, or $0.77 per diluted share, for the 2018 fourth

quarter, compared with $19.8 million, or $0.50 per diluted

share, for the same period in 2017. The improvement was primarily

due to a net gain on sale of $8.0 million in 2018, compared

with a net loss of $1.2 million in 2017, one-time

non-recurring income of $3.1 million related to the write-off

of a contingent lease incentive and related earn-out liability,

higher rental and interest income resulting from acquisitions,

mortgage loan originations, and higher income from unconsolidated

joint ventures and mezzanine loans, partially offset by a reduction

in rental income resulting from properties sold in 2018 and the

non-payment of December rent by Senior Care Centers, LLC (“Senior

Care”) as a result of their bankruptcy filing.

Funds from Operations (“FFO”) was $32.1 million for the

2018 fourth quarter, compared with $30.4 million for the

comparable 2017 period. FFO per diluted common share was $0.81 and

$0.77 for the quarters ended December 31, 2018 and 2017,

respectively. Excluding the $3.1 million non-recurring income

in the fourth quarter of 2018, FFO decreased $1.4 million

compared with the fourth quarter of 2017 due to the non-payment of

December rent by Senior Care.

During the fourth quarter of 2018, LTC sold two skilled nursing

centers with a total of 169 beds in Florida and Georgia for an

aggregate of $10.5 million.

Subsequent to December 31, 2018, and as announced in January,

LTC entered into a real estate joint venture which acquired an

operational 74-unit assisted living and memory care community for

approximately $17.0 million. LTC’s economic interest in the real

estate joint venture is approximately 95%. The initial cash lease

rate is 7.4% with a 10-year lease term.

Conference Call

Information

LTC will conduct a conference call on Friday, March 1, 2019, at

8:00 a.m. Pacific Time (11:00 a.m. Eastern Time), to provide

commentary on its performance and operating results for the quarter

ended December 31, 2018. The conference call is

accessible by telephone and the internet. Telephone access will be

available by dialing 877-510-2862 (domestically) or 412-902-4134

(internationally). To participate in the webcast, go to LTC’s

website at www.LTCreit.com 15 minutes before the call to download

the necessary software.

An audio replay of the conference call will be available from

March 1 through March 15, 2019 and may be accessed by dialing

877-344-7529 (domestically) or 412-317-0088 (internationally) and

entering conference number 10128164. Additionally, an audio archive

will be available on LTC’s website on the “Presentations” page of

the “Investor Information” section, which is under the “Investors”

tab. LTC’s earnings release and supplemental information package

for the current period will be available on its website on the

“Press Releases” and “Presentations” pages, respectively, of the

“Investor Information” section which is under the “Investors”

tab.

About LTC

LTC is a real estate investment trust (REIT) investing in

seniors housing and health care properties primarily through

sale-leasebacks, mortgage financing, joint-ventures and structured

finance solutions including preferred equity and mezzanine lending.

LTC holds more than 200 investments in 28 states with 30 operating

partners. The portfolio is comprised of approximately 50% seniors

housing and 50% skilled nursing properties. Learn more at

www.LTCreit.com.

Forward Looking

Statements

This press release includes statements that are not purely

historical and are “forward looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the Company’s expectations, beliefs,

intentions or strategies regarding the future. All statements other

than historical facts contained in this press release are forward

looking statements. These forward looking statements involve a

number of risks and uncertainties. Please see LTC’s most recent

Annual Report on Form 10-K, its subsequent Quarterly Reports on

Form 10-Q, and its other publicly available filings with the

Securities and Exchange Commission for a discussion of these and

other risks and uncertainties. All forward looking statements

included in this press release are based on information available

to the Company on the date hereof, and LTC assumes no obligation to

update such forward looking statements. Although the Company’s

management believes that the assumptions and expectations reflected

in such forward looking statements are reasonable, no assurance can

be given that such expectations will prove to have been correct.

The actual results achieved by the Company may differ materially

from any forward looking statements due to the risks and

uncertainties of such statements.

LTC PROPERTIES, INC. CONSOLIDATED STATEMENTS OF

INCOME

(amounts in thousands, except per share

amounts)

Three Months Ended Twelve Months Ended

December 31, December 31, 2018 2017 2018 2017

(unaudited) (audited) Revenues: Rental income $ 32,759 $ 34,124 $

135,405 $ 137,657 Interest income from mortgage loans 7,290 6,719

28,200 26,769 Interest and other income 3,538

886 5,040 3,639 Total revenues

43,587 41,729 168,645

168,065 Expenses: Interest expense 7,215 7,683

30,196 29,949 Depreciation and amortization 9,396 9,424 37,555

37,610 Impairment charges — — — 1,880 Provision (recovery) for

doubtful accounts 11 (67 ) 87 (206 ) Transaction costs 65 — 84 56

General and administrative expenses 4,801

4,243 19,193 17,513 Total

expenses 21,488 21,283 87,115 86,802 Other operating income:

Gain (loss) on sale of real estate, net 7,984

(1,240 ) 70,682 3,814 Operating income

30,083 19,206 152,212 85,077 Income from unconsolidated joint

ventures 761 628 2,864

2,263 Net income 30,844 19,834 155,076 87,340 Income

allocated to non-controlling interests (78 ) —

(95 ) — Net income

attributable to LTC Properties, Inc. 30,766 19,834 154,981 87,340

Income allocated to participating securities (121 )

(81 ) (625 ) (362 ) Net income available to common

stockholders $ 30,645 $ 19,753 $ 154,356 $

86,978

Earnings per common share: Basic $ 0.78

$ 0.50 $ 3.91 $ 2.21 Diluted $ 0.77

$ 0.50 $ 3.89 $ 2.20

Weighted average shares used to

calculate earnings per common share:

Basic 39,501 39,429 39,477

39,409 Diluted 39,864

39,645 39,839 39,637

Dividends declared and paid per common share $ 0.57 $ 0.57

$ 2.28 $ 2.28

Supplemental Reporting

Measures

FFO and Funds Available for Distribution (“FAD”) are

supplemental measures of a real estate investment trust’s (“REIT”)

financial performance that are not defined by U.S. generally

accepted accounting principles (“GAAP”). Investors, analysts and

the Company use FFO and FAD as supplemental measures of operating

performance. The Company believes FFO and FAD are helpful in

evaluating the operating performance of a REIT. Real estate values

historically rise and fall with market conditions, but cost

accounting for real estate assets in accordance with GAAP assumes

that the value of real estate assets diminishes predictably over

time. We believe that by excluding the effect of historical cost

depreciation, which may be of limited relevance in evaluating

current performance, FFO and FAD facilitate like comparisons of

operating performance between periods. Occasionally, the Company

may exclude non-recurring items from FFO and FAD in order to allow

investors, analysts and our management to compare the Company’s

operating performance on a consistent basis without having to

account for differences caused by unanticipated items.

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), means net income available to common

stockholders (computed in accordance with GAAP) excluding gains or

losses on the sale of real estate and impairment write-downs of

depreciable real estate, plus real estate depreciation and

amortization, and after adjustments for unconsolidated partnerships

and joint ventures. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs that do not define the

term in accordance with the current NAREIT definition or have a

different interpretation of the current NAREIT definition from that

of the Company; therefore, caution should be exercised when

comparing our Company’s FFO to that of other REITs.

We define FAD as FFO excluding the effects of non-cash income,

such as straight-line rent, amortization of lease inducement,

effective interest income, and deferred income from unconsolidated

joint ventures, and non-cash expense, such as non-cash compensation

charges, capitalized interest and non-cash interest charges. FAD is

useful in analyzing the portion of cash flow that is available for

distribution to stockholders. Investors, analysts and the Company

utilize FAD as an indicator of common dividend potential. The FAD

payout ratio, which represents annual distributions to common

shareholders expressed as a percentage of FAD, facilitates the

comparison of dividend coverage between REITs.

While the Company uses FFO and FAD as supplemental performance

measures of our cash flow generated by operations and cash

available for distribution to stockholders, such measures are not

representative of cash generated from operating activities in

accordance with GAAP, and are not necessarily indicative of cash

available to fund cash needs and should not be considered an

alternative to net income available to common stockholders.

Reconciliation of FFO, AFFO and

FAD

The following table reconciles GAAP net income available to

common stockholders to each of NAREIT FFO attributable to common

stockholders and FAD (unaudited, amounts in thousands, except per

share amounts):

Three Months Ended Twelve Months Ended December 31,

December 31, 2018 2017 2018

2017 GAAP net income available to

common stockholders $ 30,645 $ 19,753 $ 154,356 $ 86,978 Add:

Depreciation and amortization 9,396 9,424 37,555 37,610 Add:

Impairment charges — — — 1,880 Less: (Gain) loss on sale of real

estate, net (7,984 ) 1,240 (70,682 )

(3,814 ) NAREIT FFO attributable to common stockholders

32,057 30,417 121,229 122,654 Less: Non-recurring income

(3,074 )

(1)

— (3,074 )

(1)

(842 )

(1)

FFO attributable to common stockholders excluding non-recurring

income (1) 28,983 30,417 118,155 121,812 Less: Non-cash

rental income (480 ) (2,804 ) (7,458 ) (8,485 ) Less: Effective

interest income from mortgage loans (1,438 ) (1,398 ) (5,703 )

(5,500 ) Less: Deferred income from unconsolidated joint ventures

(15 ) (36 ) (108 ) (177 ) Add: Non-cash compensation charges 1,486

1,282 5,870 5,249 Add: Non-cash interest related to earn-out

liabilities — 126 377 602 Less: Capitalized interest (398 )

(281 ) (1,248 ) (908 ) Funds available for

distribution (FAD) $ 28,138 $ 27,306 $ 109,885

$ 112,593

(1) Represents net write-off of a

contingent lease incentive and related earn-out liability.

NAREIT Basic FFO attributable to common stockholders per

share $ 0.81 $ 0.77 $ 3.07 $ 3.11

NAREIT Diluted FFO attributable to common stockholders per share $

0.81 $ 0.77 $ 3.06 $ 3.10 NAREIT

Diluted FFO attributable to common stockholders $ 32,178 $

30,498 $ 121,854 $ 123,016 Weighted average

shares used to calculate NAREIT diluted FFO per share attributable

to common stockholders 39,864 39,645

39,839 39,637

Diluted FFO attributable to common stockholders, excluding

non-recurring income $ 29,104 $ 30,498 $ 118,780

$ 122,174 Weighted average shares used to calculate

diluted FFO per share attributable to common stockholders,

excluding non-recurring income 39,864 39,645

39,839 39,637

Diluted FAD

$ 28,259 $ 27,387 $ 110,510 $ 112,113

Weighted average shares used to calculate diluted FAD per share

39,864 39,645 39,839

39,637

LTC PROPERTIES, INC. CONSOLIDATED

BALANCE SHEETS

(amounts in thousands, except per

share)

December 31, 2018 December 31, 2017

ASSETS

(audited) (audited) Investments: Land $ 125,358 $ 124,041 Buildings

and improvements 1,290,352 1,262,335 Accumulated depreciation and

amortization (312,959 ) (304,117 ) Operating real

estate property, net 1,102,751 1,082,259 Properties held-for-sale,

net of accumulated depreciation: 2018—$1,916; 2017—$1,916

3,830 3,830 Real property investments, net

1,106,581 1,086,089 Mortgage loans receivable, net of loan loss

reserve: 2018—$2,447; 2017—$2,255 242,939

223,907 Real estate investments, net 1,349,520 1,309,996

Notes receivable, net of loan loss reserve: 2018—$128; 2017—$166

12,715 16,402 Investments in unconsolidated joint ventures

30,615 29,898 Investments, net 1,392,850

1,356,296 Other assets: Cash and cash equivalents 2,656

5,213 Restricted cash 2,108 — Debt issue costs related to bank

borrowings 2,989 810 Interest receivable 20,732 15,050

Straight-line rent receivable, net of allowance for doubtful

accounts: 2018—$746; 2017—$814 73,857 64,490 Lease incentives

14,443 21,481 Prepaid expenses and other assets 3,985

2,230 Total assets $ 1,513,620 $ 1,465,570

LIABILITIES Bank borrowings $ 112,000 $ 96,500

Senior unsecured notes, net of debt issue costs: 2018—$938;

2017—$1,131 533,029 571,002 Accrued interest 4,180 5,276 Accrued

incentives and earn-outs — 8,916 Accrued expenses and other

liabilities 31,440 25,228 Total

liabilities 680,649 706,922

EQUITY Stockholders’

equity: Common stock: $0.01 par value; 60,000 shares authorized;

shares issued and outstanding: 2018—39,657; 2017—39,570 397 396

Capital in excess of par value 862,712 856,992 Cumulative net

income 1,255,764 1,100,783 Cumulative distributions

(1,293,383 ) (1,203,011 ) Total LTC Properties, Inc.

stockholders’ equity 825,490 755,160 Non-controlling interests

7,481 3,488 Total equity 832,971

758,648 Total liabilities and equity $

1,513,620 $ 1,465,570

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190228005896/en/

Wendy L. SimpsonPam Kessler(805) 981-8655

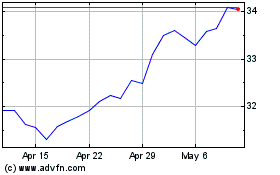

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Sep 2024 to Oct 2024

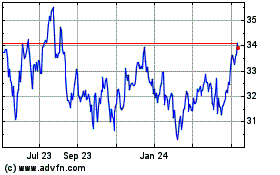

LTC Properties (NYSE:LTC)

Historical Stock Chart

From Oct 2023 to Oct 2024