Kosmos Energy Announces Successful Reserve-based Lending Facility Re-financing

April 29 2024 - 2:00AM

Business Wire

Kosmos Energy (NYSE/LSE: KOS) (“Kosmos” or the “Company”)

announced today that it has successfully re-financed its

reserve-based lending (“RBL”) facility extending the maturity by

approximately three years, with the RBL facility’s final maturity

now in December 2029.

In conjunction with the spring re-determination, the total RBL

facility size has been increased to $1.35 billion (from $1.25

billion) with current commitments of approximately $1.2 billion.

Discussions with additional potential lenders are ongoing and are

expected to increase commitments later this year towards the RBL

facility size. $800 million is currently drawn against the RBL

facility with the first amortization payment scheduled for April 1,

2027.

The RBL facility is secured against the Company’s production

assets in Ghana and Equatorial Guinea with the Company’s assets in

the US Gulf of Mexico and Mauritania & Senegal remaining

unencumbered. The resulting borrowing base following the spring

re-determination significantly exceeds the RBL facility size. The

interest margin payable on the RBL increased slightly compared to

the previous facility, reflecting the current banking market

environment, with the new interest margin on the RBL facility

commencing at 400 basis points above the Secured Overnight

Financing Rate (“SOFR”) for the first two years.

As part of the RBL facility re-financing, the Company has

downsized its revolving credit facility (“RCF”) from $250 million

to approximately $165 million with some banks transferring their

commitments from the RCF to the RBL in anticipation of the RCF

maturing at the end of 2024.

Neal Shah, Chief Financial Officer, said “Re-financing the RBL

facility is another important step to optimize Kosmos’ capital

structure and proactively address our debt maturities. With the

re-financing of the RBL and the recent convertible bond issuance,

we have no maturities until 2026 and lower interest expense going

forward. We thank our bank group for their continued support as we

grow the company.”

About Kosmos Energy

Kosmos is a full-cycle, deepwater, independent oil and gas

exploration and production company focused along the offshore

Atlantic Margins. Our key assets include production offshore Ghana,

Equatorial Guinea and U.S. Gulf of Mexico, as well as world-class

gas projects offshore Mauritania and Senegal. We also pursue a

proven basin exploration program in Equatorial Guinea and the U.S.

Gulf of Mexico. Kosmos is listed on the New York Stock Exchange and

London Stock Exchange and is traded under the ticker symbol KOS. As

an ethical and transparent company, Kosmos is committed to doing

things the right way. The Company’s Business Principles articulate

our commitment to transparency, ethics, human rights, safety and

the environment. Read more about this commitment in the Kosmos

Sustainability Report. For additional information, visit

www.kosmosenergy.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that Kosmos

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Kosmos’ estimates and

forward-looking statements are mainly based on its current

expectations and estimates of future events and trends, which

affect or may affect its businesses and operations. Although Kosmos

believes that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to several

risks and uncertainties and are made in light of information

currently available to Kosmos. When used in this press release, the

words “anticipate,” “believe,” “intend,” “expect,” “plan,” “will”

or other similar words are intended to identify forward-looking

statements. Such statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond the control of

Kosmos, which may cause actual results to differ materially from

those implied or expressed by the forward-looking statements.

Further information on such assumptions, risks and uncertainties is

available in Kosmos’ Securities and Exchange Commission (“SEC”)

filings. Kosmos undertakes no obligation and does not intend to

update or correct these forward-looking statements to reflect

events or circumstances occurring after the date of this press

release, except as required by applicable law. You are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

Management does not provide a reconciliation for forward looking

non GAAP financial measures where it is unable to provide a

meaningful or accurate calculation or estimation of reconciling

items and the information is not available without unreasonable

effort. This is due to the inherent difficulty of forecasting the

occurrence and the financial impact of various items that have not

yet occurred, are out of our control or cannot be reasonably

predicted. For the same reasons, management is unable to address

the probable significance of the unavailable information. Forward

looking non GAAP financial measures provided without the most

directly comparable GAAP financial measures may vary materially

from the corresponding GAAP financial measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240428898652/en/

Investor Relations Jamie Buckland +44 (0) 203 954 2831

jbuckland@kosmosenergy.com

Media Relations Thomas Golembeski +1-214-445-9674

tgolembeski@kosmosenergy.com

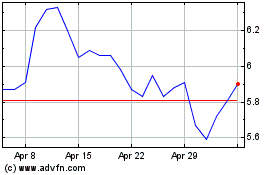

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Oct 2024 to Nov 2024

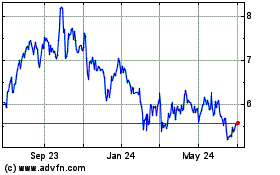

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Nov 2023 to Nov 2024