YRCW Beats, Yet to Turn Around - Analyst Blog

November 07 2011 - 3:00AM

Zacks

YRC Worldwide Inc.

(YRCW) reported improved financial results for the third quarter of

2011, beating the Zacks Consensus Estimates. Despite this, the

company is still far away from its business turnaround. Management

expects to improve its customer services in another six months so

that YRC Worldwide can regain those clients which it lost to its

competitors.

Furthermore, YRC Worldwide is

facing delisting threat from NASDAQ, since the stock price fell

significantly below $1. The company should maintain a closing share

price higher than $1 for 10 straight days by December 31, 2011. For

this, YRC Worldwide will ask for its shareholders’ approval for a

reverse stock split and its ratio in the annual general meeting of

November 30, 2011. The proposed reverse stock split is expected to

be completed by December 15, 2011.

Quarterly GAAP net loss from

continuing operations was $177.9 million or a loss of 51 cents per

share compared with a net loss of $61.7 million or $1.27 in the

year-ago quarter. Third-quarter 2011 adjusted (excluding

restructuring charges) EPS of a loss of 38 cents was lower than the

Zacks Consensus Estimate of a loss of 39 cents.

Quarterly operating revenues were

$1,276.4 million, up 12.3% year over year, slightly ahead of the

Zacks Consensus Estimate of $1,272 million. The increase was

primarily attributable to massive growth at the YRC National and

YRC Regional Transportation segments.

Quarterly consolidated operating

expense was $1,300.1 million, up 12.5% year over year. Operating

loss in third-quarter 2011 was $23.7 million compared with an

operating loss of $18.8 million in the year-ago quarter.

Quarterly consolidated operating ratio was 101.9% compared

with 101.7% in the prior-year quarter. Third-quarter adjusted

EBITDA was $56 million compared with $45.8 million in the year-ago

quarter.

During the first nine months of

2011, YRC Worldwide consumed $52.8 million of cash for operations

compared with $9.3 million in the prior-year period. Free cash flow

in the reported period was a negative $88.9 million compared with

$22.3 million in the year-ago period.

At the end of the third quarter of

2011, YRC Worldwide had $162.8 million of cash & cash

equivalents compared with $143 million at the end of fiscal 2010.

Total debt at the end of the reported quarter was nearly $1,341.1

million compared with $1,060.1 million at the end of fiscal

2010.

YRC National Transportation

Segment

Quarterly operating revenues were

$841.6 million, up 11.5% year over year. Operating loss was $14.3

million compared with $16.4 million in the prior-year quarter.

Third-quarter 2011 operating ratio was 101.7% compared with 102.2%

in the year-ago quarter. This division improves on several

operating metrics. Tons per day were up 4.2%, shipments per day

were up 5.5%, revenue per hundredweight was up 7.5% and revenue per

shipment was up 6.2%.

YRC Regional Transportation

Segment

Quarterly operating revenues were

$404.8 million, up 14.3% year over year. Operating income was $12.4

million compared with $9.9 million in the prior-year quarter.

Third-quarter 2011 operating ratio was 96.9% compared with 97.2% in

the year-ago quarter. This division also improves on several

operating metrics. Tons per day were up 5.6%, shipments per day

inched up 3.6%, revenue per hundredweight went up 8.2% and revenue

per shipment jumped 10.4%.

YRC Truckload

Segment

Quarterly operating revenues were

$26 million, down 9.9% year over year. Operating loss was nearly

$2.7 million compared with $2.2 million in the prior-year quarter.

Third-quarter 2011 operating ratio was 110.3% compared with 107.6%

in the year-ago quarter.

Recommendation

The trucking industry is highly competitive. YRC Worldwide is

gradually losing market share to its competitors Arkansas

Best Corp. (ABFS), Con-way Inc. (CNW) and

Knight Transportation Inc. (KNX). We maintain a

long-term Neutral recommendation on YRC Worldwide. Currently, the

company holds a short-term Zacks #2 Rank (Buy) on the stock.

ARKANSAS BEST (ABFS): Free Stock Analysis Report

CON-WAY INC (CNW): Free Stock Analysis Report

KNIGHT TRANSN (KNX): Free Stock Analysis Report

YRC WORLDWD INC (YRCW): Free Stock Analysis Report

Zacks Investment Research

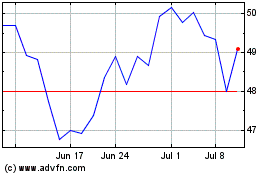

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From May 2024 to Jun 2024

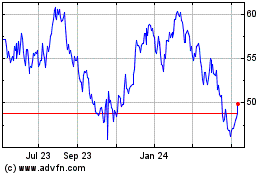

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Jun 2023 to Jun 2024