YRC Worldwide Adopts New Facility - Analyst Blog

July 12 2011 - 6:30AM

Zacks

The leading transportation service

provider in the world, YRC Worldwide (YRCW)

received a commitment for a three-year asset-based loan (ABL)

scheme worth $400 million. The introduction of this new facility

will bring in fresh capital into the company and also replace the

existing asset-backed securitization (ABS) facility. The deal is

expected to be completed by July 22, 2011.

Earlier, in April 2011, YRC

Worldwide entered into a deal with its creditors and labor union

Teamsters Brotherhood to restructure its sagging finances. The

lenders will inject fresh capital in return of equity capital and

convertible debts. If this deal succeeds, then the lenders will

gain a 72.5% equity control while the labor union will get a 25%

equity control, leaving a mere 2.5% for the existing shareholders

of the company. Thus, under this asset-backed securitization

facility, the company will significantly dilute the wealth of the

existing shareholders.

So, the introduction of this new

facility will favorably position YRC Worldwide to protect its

wealth. Moreover, the company has also decided to sell real estate

assets worth $40 million in 2011 in order to streamline its

existing debts.

Complying with its debt

restructuring plans, YRC Worldwide has already divested the

majority of the YRC Logistics division to a private equity firm,

Austin Ventures in August 2010. So, this new asset-based loan

scheme will most likely boost the company’s restructuring process

as well as improve their liquidity position.

During the last two and half years,

YRC Worldwide has been reeling under the threat of bankruptcy

resulting from a significant fall in freight volume coupled with

its highly leveraged balance sheet. Although the U.S. trucking

industry is recovering from the slowdown, YRC Worldwide fails to

cope with this current recovery. Currently, the company is also

facing intense competition from Arkansas Best

Corporation (ABFS), Heartland Express,

Inc. (HTLD) and Knight Transportation

Inc. (KNX).

We, thus, maintain our long-term

Neutral recommendation for YRC Worldwide. Currently, YRC Worldwide

has a Zacks#4 Rank, implying a short-term Sell rating on the

stock.

ARKANSAS BEST (ABFS): Free Stock Analysis Report

HEARTLAND EXP (HTLD): Free Stock Analysis Report

KNIGHT TRANSN (KNX): Free Stock Analysis Report

YRC WORLDWD INC (YRCW): Free Stock Analysis Report

Zacks Investment Research

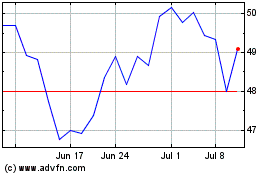

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From May 2024 to Jun 2024

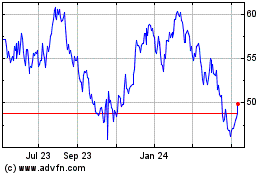

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Jun 2023 to Jun 2024