YRC Worldwide Revert to Neutral - Analyst Blog

June 29 2011 - 4:15AM

Zacks

We upgrade our recommendation on

YRC Worldwide Inc. (YRCW) on the basis of current

valuation. During the last two and half years, YRC Worldwide is

reeling under bankruptcy threat resulting from a significant fall

in freight volume coupled with its highly leveraged balance sheet.

Consequently, the stock price plummeted by a massive 90% in last

year. We believe this significant low-level of valuation may

provide a cushion and restrict further downslide to the stock

price.

YRC Worldwide reported a mixed

result for the first quarter of 2011. Although the U.S. trucking

industry is recovering from recession, YRC Worldwide fails to cope

with this current recovery. The company’s viability depends on its

ability to become profitable but unfortunately, we do not expect it

to reach that stage any time soon. Off late, management has taken

some measures such as an aggressive pricing strategy and emission

control to streamline operations.

In April 2011, YRC Worldwide

entered into a definitive agreement with its secured lenders,

pension funds, and the International Brotherhood of Teamsters to

inject new capital to improve the company’s sagging liquidity

condition. This restructuring plan will inject $100 million in new

capital to eliminate a portion of the debt and is expected to be

closed by July 22, 2011. However, if this deal is successful, then

the lenders will get 72.5% equity control and labor union will get

25% equity control, leaving a mere 2.5% control for the existing

shareholders of the company.

The trucking industry is highly

competitive. YRC Worldwide is gradually loosing market share to its

competitors Arkansas Best Corp. (ABFS),

Con-way Inc. (CNW) and Knight

Transportation Inc. (KNX). Additionally, as a truck

transportation company, YRC Worldwide is highly leveraged to the

domestic economy (particularly manufacturing and retail) and

inventory levels.

ARKANSAS BEST (ABFS): Free Stock Analysis Report

CON-WAY INC (CNW): Free Stock Analysis Report

KNIGHT TRANSN (KNX): Free Stock Analysis Report

YRC WORLDWD INC (YRCW): Free Stock Analysis Report

Zacks Investment Research

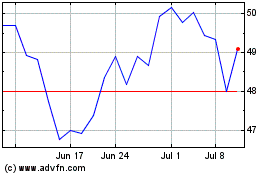

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From May 2024 to Jun 2024

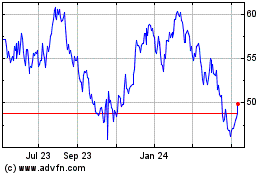

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Jun 2023 to Jun 2024