A Mixed Bag for YRC Worldwide - Analyst Blog

May 09 2011 - 5:00AM

Zacks

YRC Worldwide Inc.

(YRCW) reported mixed financial results for the first quarter of

2011. Quarterly GAAP net loss from continuing operations was $101.8

million or a loss of $2.14 per share compared with a net loss of

$274.1 million or $13.2 in the year-ago quarter. However,

first-quarter 2011 EPS of a loss of $2.14 was significantly higher

than the Zacks Consensus Estimate of a loss of $1.50.

Quarterly operating revenues were

$1,122.9 million, up 13.8% year over year, ahead of the Zacks

Consensus Estimate of $1,069 million. This was primarily

attributable to massive growth at the YRC National and YRC Regional

Transportation segments.

Quarterly consolidated operating

expense was $1,190.9 million, down 2.4% year over year. Operating

loss in first-quarter 2011 was $68 million compared with $233.2

million in the year-ago quarter. Operating ratio was 106.1%

compared with 123.6% in the prior-year quarter. First-quarter

adjusted EBITDA was a negative $3.4 million compared with a

negative $38.9 million in the year-ago quarter.

During the first quarter of 2011,

YRC Worldwide consumed $46.3 million of cash for operations

compared with a cash generation of $18.3 million in the prior-year

quarter. Free cash flow in the reported quarter was a negative

$56.3 million compared with $14.6 million in the year-ago

quarter.

At the end of the first quarter of

2011, YRC Worldwide had $156.7 million of cash & cash

equivalents compared with $143 million at the end of fiscal 2010.

Total debt at the end of the reported quarter was nearly $1,115.5

million compared with $1,060.1 million at the end of fiscal

2010.

YRC National Transportation

Segment

Quarterly operating revenues were

$730.1 million, up 10.1% year over year. Operating loss was $51.3

million compared with an operating loss of $185.1 million in the

prior-year quarter. First-quarter 2011 operating ratio was 107%

compared with 127.9% in the year-ago quarter.

YRC Regional Transportation

Segment

Quarterly operating revenues were

$366.1 million, up 18.4% year over year. Operating loss was $1.2

million compared with $39.6 million in the prior-year quarter.

First-quarter 2011 operating ratio was 100.3% compared with 112.8%

in the year-ago quarter.

YRC Truckload

Segment

Quarterly operating revenues were

$25.2 million, down 6.2% year over year. Operating loss was nearly

$3.9 million compared with $3.1 million in the prior-year quarter.

First-quarter 2011 operating ratio was 115.3% compared with 111.4%

in the year-ago quarter.

Outlook

Based on continued operating

momentum, the company expects to achieve positive adjusted EBITDA

in the second quarter of 2011. For fiscal 2011, management expects

gross capital expenditure in the range of $100 million to $125

million. Excess property sales are expected to range from $30

million to $40 million.

Recommendation

The trucking industry is highly

competitive. YRC Worldwide is gradually loosing market share to its

competitors Arkansas Best Corp. (ABFS),

Con-way Inc. (CNW) and Knight

Transportation Inc. (KNX). We maintain a long-term

Underperform recommendation on YRC Worldwide. Currently, the

company holds a short-term Zacks #5Rank (Strong Sell) on the

stock.

ARKANSAS BEST (ABFS): Free Stock Analysis Report

CON-WAY INC (CNW): Free Stock Analysis Report

KNIGHT TRANSN (KNX): Free Stock Analysis Report

YRC WORLDWD INC (YRCW): Free Stock Analysis Report

Zacks Investment Research

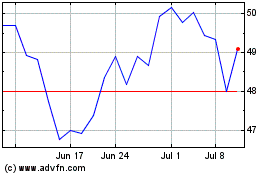

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From May 2024 to Jun 2024

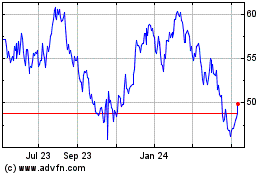

Knight Swift Transportat... (NYSE:KNX)

Historical Stock Chart

From Jun 2023 to Jun 2024