Current Report Filing (8-k)

March 13 2023 - 4:11PM

Edgar (US Regulatory)

0001822993

false

--12-31

0001822993

2023-03-10

2023-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 10, 2023

Jackson

Financial Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40274 |

|

98-0486152 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

|

1 Corporate Way,

Lansing, Michigan |

|

48951 |

| (Address of principal executive offices) |

|

(Zip Code) |

(517) 381-5500

(Registrant's telephone number, including area

code)

Not

Applicable

(Former name or address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of Exchange on which registered |

| Common Stock, Par Value $0.01 Per Share |

|

JXN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405)

or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 3.03 |

Material Modification to Rights of Security Holders. |

On March 13, 2023, Jackson Financial Inc. (the “Company”)

issued and sold 22,000,000 depositary shares (the “Depositary Shares”), each representing a 1/1,000th fractional interest

in a share of the Company’s Fixed-Rate Reset Noncumulative Perpetual Preferred Stock, Series A, $25,000 liquidation preference

per share (equivalent to $25 per Depositary Share), with a 5-year call/dividend rate reset period and noncumulative dividends (the “Series A

Preferred Stock”).

Under the terms of the Series A Preferred Stock, if the Company

has not declared and paid, or declared and set aside a sum sufficient for the payment of, dividends on the Series A Preferred Stock

for the immediately preceding dividend period (for the avoidance of doubt, there is no preceding dividend period for the initial dividend

period), then the Company’s ability to pay dividends or make distributions with respect to its common stock, or to repurchase or

otherwise acquire its common stock, is subject to certain restrictions. Similar restrictions would apply in respect of any preferred stock

ranking on parity with, or junior to, the Series A Preferred Stock, if any such preferred stock were to be issued by the Company.

The description of the terms of the Series A Preferred Stock is

qualified in its entirety by reference to the Certificate of Designations, which is included as Exhibit 3.1 to this Current Report

on Form 8-K and is incorporated by reference herein.

In connection with the issuance of the Depositary Shares, the Company

entered into a Deposit Agreement dated as of March 13, 2023 (the “Deposit Agreement”), among the Company, Equiniti Trust

Company, as depositary (the “Depositary”), and the holders from time to time of the depositary receipts (the “Depositary

Receipts”) evidencing the Depositary Shares. The Series A Preferred Stock was deposited with the Depositary against the delivery

of the Depositary Receipts pursuant to the Deposit Agreement. The Deposit Agreement is attached hereto as Exhibit 4.1 and the form

of Depositary Receipt is attached hereto as Exhibit 4.2. The foregoing description of the Deposit Agreement is entirely qualified

by reference to such exhibit, which is incorporated by reference herein.

On March 10, 2023, the Company filed a Certificate of Designations

(the “Certificate of Designations”) with the Secretary of State of the State of Delaware, establishing the voting rights,

powers, preferences and privileges, and the relative, participating, optional or other rights, and the qualifications, limitations or

restrictions thereof, of the Series A Preferred Stock. Holders of the Depositary Shares will be entitled to all proportional rights

and preferences of the Series A Preferred Stock (including dividend, voting, redemption and liquidation rights).

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws |

The Certificate of Designations became effective upon filing with the

Secretary of State of the State of Delaware on March 10, 2023, and it amends the Company’s Third Amended and Restated Certificate

of Incorporation. The terms of the Series A Preferred Stock are more fully described in Item 3.03 of this Current Report on Form 8-K

and the Certificate of Designations, which is attached hereto as Exhibit 3.1, both of which are incorporated by reference herein.

SAFE HARBOR

The information in this report contains forward-looking statements

about future events and circumstances and their effects upon revenues, expenses and business opportunities. Generally speaking, any statement

in this report not based upon historical fact is a forward-looking statement. Forward-looking statements can also be identified by the

use of forward-looking or conditional words, such as “could,” “should,” “can,” “continue,”

“estimate,” “forecast,” “intend,” “look,” “may,” “will,” “expect,”

“believe,” “anticipate,” “plan,” “remain,” “confident” and “commit”

or similar expressions. In particular, statements regarding plans, strategies, prospects, targets and expectations regarding the business

and industry are forward-looking statements. They reflect expectations, are not guarantees of performance and speak only as of the dates

the statements are made. We caution investors that these forward-looking statements are subject to known and unknown risks and uncertainties

that may cause actual results to differ materially from those projected, expressed, or implied. Factors that could cause actual results

to differ materially from those in the forward-looking statements include those reflected in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2022 and other reports filed with the SEC. Except as required by law, Jackson Financial Inc.

does not undertake to update such forward-looking statements. You should not rely unduly on forward-looking statements.

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

JACKSON FINANCIAL INC. |

| |

|

|

| Date: March 13, 2023 |

By: |

/s/ Marcia Wadsten |

| |

Name: |

Marcia Wadsten |

| |

Title: |

Executive Vice President and Chief Financial Officer |

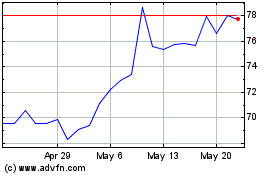

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Nov 2023 to Nov 2024