Interpublic Sells Half of Facebook Stake - Analyst Blog

August 16 2011 - 12:48PM

Zacks

Advertisement giant Interpublic Group of Companies,

Inc. (IPG), which bought approximately 0.5% stake in

Facebook (FB) way back in 2006, has reached an agreement to sell

approximately half of its investment for $133 million to an

undisclosed buyer.

The interest, amounting to about 0.5% of Facebook’s total

shares, was bought for less than $5 million in 2006, which Facebook

agreed to sell to Interpublic in exchange for the company’s

agreement to spend $10 million with Facebook for the clients of its

agencies.

Since then, the strategic value of Interpublic’s initial

investment in the social network has moderated, while the financial

value of the stake appreciated significantly over time. This has

brought a fair prospect for Interpublic to divest a portion of

their position for net cash proceeds of $133 million in a private

negotiation. Interpublic group expects a pre-tax gain of $132

million, upon closing of the sale.

The money will be utilized toward Interpublic’s existing program

of repurchasing shares of its common stock. The board has

authorized an increase in the share repurchase program by $150

million, a rise of $450 million from its initial $300 million;

creating opportunity to further enhance shareholder value,

reflecting long-term prospects.

Interpublic acquired the stake in 2006 in an effort to signal

the current and potential clients, the company’s presence in the

field of social marketing as well as its attempt in identifying

strategic partnerships while realizing financial gain.

Facebook, which was then valued in the range of $200 million to

$300 million, has increased more than fivefold in less than two

years, with a value of $66.5 billion in a recent share sale, ahead

of its expected initial public offering next year.

On this backdrop, Interpublic’s divestment of half of its stake

is being seen as an indication that the secondary market for the

social network’s shares may be at an all time high level.

New Yorkbased, Interpublic Group of Companies Inc. together with

its subsidiaries, provides advertising and marketing services

worldwide. The company directly competes with its peers, such

as Omnicom Group Inc. (OMC), Publicis Groupe SA

and WPP plc (WPPGY).

We currently maintain a long-term Neutral recommendation on the

stock. Interpublic Group has a Zacks #4 Rank, which translates into

a short-term Sell rating (1-3 months).

INTERPUBLIC GRP (IPG): Free Stock Analysis Report

OMNICOM GRP (OMC): Free Stock Analysis Report

WPP GRP PLC (WPPGY): Free Stock Analysis Report

Zacks Investment Research

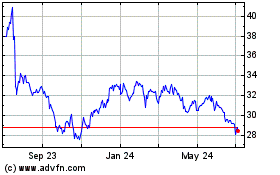

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From May 2024 to Jun 2024

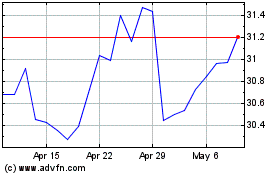

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Jun 2023 to Jun 2024