Hersha Hospitality Trust Announces Commitment for $225 Million Senior Secured Credit Facility

October 05 2010 - 4:01PM

Business Wire

Hersha Hospitality Trust (NYSE: HT), owner of select service and

upscale hotels in major metropolitan markets, today announced that

it has signed a commitment letter with TD Bank, N.A. and TD

Securities (USA) LLC for a proposed $225 million senior secured

revolving credit facility, which would replace Hersha’s current

$135 million senior secured credit facility. TD Bank will serve as

the sole administrative agent and TD Securities (USA) LLC will

serve as lead arranger and book manager.

The proposed $225 million senior secured revolving credit

facility matures in three years with an extension option for an

additional year and may be upsized to $250 million. Borrowings will

bear interest at a rate determined by a leverage-based pricing

grid. LIBOR loans will bear interest at LIBOR plus an applicable

margin of either 350 or 375 basis points per year, subject to a

LIBOR floor of 75 basis points per year. Hersha expects that other

terms, conditions and covenants of the new credit facility will be

generally consistent with the terms of its existing credit

facility.

“We appreciate the support of TD Bank, TD Securities and the

banking syndicate involved in the facility. We believe the ability

to materially increase our financial flexibility with this

increased revolving credit facility is testament to the progress we

have made over the years to position our portfolio in some of the

strongest lodging markets in the country and to the increased cash

flow our hotels are able to generate,” commented Jay H. Shah,

Hersha’s Chief Executive Officer. “This secured line of credit will

help us continue to execute on our strategy of acquiring

high-quality hotel properties in key urban gateway markets, which

in our experience have historically led economic recoveries.”

The Company expects to close on the revolving credit facility

during the fourth quarter of 2010, subject to satisfaction of

customary closing conditions and the negotiation and execution of

definitive loan documents.

About Hersha Hospitality Trust

Hersha Hospitality Trust is a self-advised real estate

investment trust, which owns interests in 76 hotels, totaling

10,071 rooms, primarily along the Northeast Corridor from Boston to

Washington D.C. Hersha also owns hotels in Northern California and

Scottsdale, Arizona. Hersha focuses on upscale, mid-scale and

extended stay hotels in major metropolitan markets.

Forward Looking Statement

Certain matters within this press release are discussed using

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, and, as such, may involve

known and unknown risks, uncertainties and other factors that may

cause the actual results or performance to differ from those

projected in the forward-looking statement. For a description of

these factors, please review the information under the heading

“Risk Factors” in Hersha Hospitality Trust’s filings with the SEC,

including its Annual Report on Form 10-K for the year ended

December 31, 2009.

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From May 2024 to Jun 2024

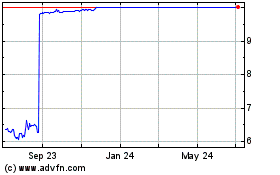

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

From Jun 2023 to Jun 2024