UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 25, 2014 (August 25, 2014)

GREIF, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-00566 |

|

31-4388903 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 425 Winter Road, Delaware, Ohio |

|

43015 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (740) 549-6000

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 – Other Events

Item 8.01. Other Events.

Attached as Exhibit 99.1 to

this Current Report on Form 8-K and incorporated herein by reference is a press release issued by Greif, Inc. on August 25, 2014.

Section 9

– Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Greif, Inc. on August 25, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

GREIF, INC. |

|

|

|

| Date: August 25, 2014 |

|

By |

|

/s/ Lawrence A. Hilsheimer |

|

|

|

|

Lawrence A. Hilsheimer, Executive Vice

President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Greif, Inc. on August 25, 2014. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Greif, Inc. Revises Guidance for Fiscal 2014

DELAWARE, Ohio (August 25, 2014) –Greif (NYSE: GEF, GEF.B), a world leader in industrial packaging products and services, today announced revised

guidance for its fiscal year ending October 31, 2014. Earnings per Class A share, excluding timberland gains and further impairment charges, are expected to be $1.98 to $2.08 per Class A share for the 2014 fiscal year compared to the

company’s previous guidance of $2.48 to $2.80 per Class A share, excluding timberland gains.

Subsequent to the second quarter 2014, the company

continued to take actions to strengthen its business portfolio. Certain of these actions resulted in non-cash asset impairment charges of $15.4 million, as well as $33 million of non-cash allocations of goodwill for divestitures reducing book gains

and generating no tax benefits. The company has incurred and anticipates higher SG&A expenses for the remainder of the fiscal year and slightly lower than expected results from operations.

The company will address the details of its third quarter performance and current actions and future plans related to its strategy review to improve

profitability, including reductions in SG&A expenses, during the third quarter 2014 conference call scheduled for Thursday, August 28, 2014 at 10:00 AM EST. The dial-in number is 877-485-3107 for U.S. callers and +1 201-689-8427 for

international callers.

About Greif

Greif is a world

leader in industrial packaging products and services. The company produces steel, plastic, fibre, flexible, corrugated, multiwall and reconditioned containers, intermediate bulk containers, containerboard and packaging accessories, and provides

blending, filling, packaging and industrial packaging reconditioning services for a wide range of industries. Greif also manages timber properties in North America. The company is strategically positioned in more than 50 countries to serve global as

well as regional customers. Additional information is on the company’s website at www.greif.com.

Forward-looking Statements

All statements, other than statements of historical facts, included in this news release, including without limitation statements regarding our future

financial position, business strategy, budgets, projected costs, goals and plans and objectives of management for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,”

“estimate,” “anticipate,” “project,” “believe,” “continue,” “on track” or “target” or the negative thereof or variations thereon or similar terminology. All forward-looking

statements made in this news release are based on information currently available to management. Although we believe that the expectations reflected in forward-looking statements have a reasonable basis, we can give no assurance that these

expectations will prove to be correct. Forward-looking statements are subject to risks and uncertainties that could cause actual events or results to differ materially from those expressed in or implied by the statements. Such risks and

uncertainties that might cause a difference include, but are not limited to, the following: (i) the current and future challenging global economy may adversely affect our business, (ii) historically, our business has been sensitive to

changes in general economic or business conditions, (iii) our operations are subject to currency exchange and political risks that could adversely affect our results of operations, (iv) the continuing consolidation of our customer base and

suppliers may intensify pricing pressure, (v) we operate in highly competitive industries, (vi) our business is sensitive to changes in industry demands, (vii) raw material and energy price fluctuations and shortages may adversely

impact our manufacturing operations and costs, (viii) we may encounter difficulties arising from acquisitions, (ix) we may incur additional restructuring costs and there is no guarantee that our efforts to reduce costs will be successful,

(x) tax legislation initiatives or challenges to our tax positions may adversely impact our results or condition, (xi) several operations are conducted by joint ventures that we cannot operate solely for our benefit, (xii) our ability

to attract, develop and retain talented and qualified employees, managers and executives is critical to our success, (xiii) our business may be adversely impacted by work stoppages and other labor relations matters, (xiv) we may be subject

to losses that might not be covered in whole or in part by existing insurance reserves or insurance coverage, (xv) our business depends on the uninterrupted operations of our facilities, systems and business functions, including our information

technology and other business systems, (xvi) legislation/regulation related to climate change and environmental and health and safety matters and corporate social responsibility could negatively impact our operations and financial performance,

(xvii) product liability claims and other legal proceedings could adversely affect our operations and financial performance, (xviii) we may incur fines or penalties, damage to our reputation or other adverse consequences if our employees,

agents or business partners violate, or are alleged to have violated, anti-bribery, competition or other laws, (xix) changing climate conditions may adversely affect our operations and financial performance, (xx) the frequency and volume

of our timber and timberland sales will impact our financial performance, (xxi) changes in U.S. generally accepted accounting principles and SEC rules and regulations could materially impact our reported results, and (xxii) if the company fails

to maintain an effective system of internal control, the company may not be able to

accurately report financial results or prevent fraud. Changes in business results may impact our book tax rates. The risks described above are not all inclusive, and given these and other

possible risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. For a detailed discussion of the most significant risks and uncertainties that could cause our actual

results to differ materially from those projected, see “Risk Factors” in Part I, Item 1A of our Form 10-K for the year ended Oct. 31, 2013 and our other filings with the Securities and Exchange Commission. All forward-looking

statements made in this news release are expressly qualified in their entirety by reference to such risk factors. Except to the limited extent required by applicable law, we undertake no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Contacts:

|

|

|

| Media: |

|

Analyst: |

| Scott Griffin |

|

Robert Lentz |

| Vice President, Corporate Communications |

|

(614) 876-2000 |

| Greif, Inc. |

|

|

| (740) 657-6516 |

|

|

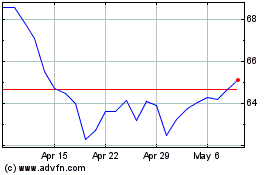

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

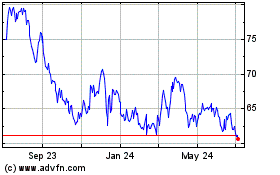

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024