Gray Reports Operating Results for the Three Months Ended March 31, 2004

May 06 2004 - 8:02AM

PR Newswire (US)

Gray Reports Operating Results for the Three Months Ended March 31,

2004 ATLANTA, May 6 /PRNewswire-FirstCall/ -- Gray Television, Inc.

(the "Company") today announced its results for the three months

("first quarter") ended March 31, 2004 as compared to the three

months ended March 31, 2003. Highlights - EBITDA(1) increased 37% -

Broadcast Revenue increased 18% - Local Broadcast Revenue increased

13% excluding political revenue - National Broadcast Revenue

increased 9% excluding political revenue - Cash increased to $24.7

million and Total Debt decreased to $655.0 million - New CBS

affiliate in Charlottesville, VA is awaiting FCC approval Revenues.

Total revenues for the three months ended March 31, 2004 increased

15% to $74.7 million reflecting increases in broadcasting and

newspaper publishing revenue. Broadcasting revenues increased 18%

to $61.9 million. The increase in broadcasting revenue reflects

increased political advertising revenue as well as increased

non-political broadcasting revenue. Political advertising revenue

increased to $3.5 million from $741,000. Political advertising

revenue for 2004 primarily reflects the cyclical influence of the

2004 Presidential election. Local broadcasting advertising revenue

increased 13% to $37.4 million from $33.0 million and national

broadcasting advertising revenue increased 9% to $16.2 million from

$14.9 million. The Company attributes the increases in

non-political broadcasting advertising revenues to generally

improving economic conditions in the markets in which we operate.

Newspaper publishing revenues increased 5% to $11.0 million from

$10.4 million. Publishing revenue increased primarily due to

increases in retail advertising of 7% and classified advertising of

6%. Operating expenses. Operating expenses before depreciation,

amortization and loss on disposal of assets increased 6% to $49.2

million. Balance Sheet. The Company's cash balance was $24.7

million at March 31, 2004 compared to $11.9 million at December 31,

2003. Total debt outstanding at March 31, 2004 was $655.0

million(2) compared to $655.9 million(2) at December 31, 2003. Gray

Television, Inc. (in thousands, except per share data and

percentages) Three Months Ended Selected operating data: March 31,

% 2004 2003 Change OPERATING REVENUES Broadcasting (less agency

commissions) $61,910 $52,601 18 % Publishing 10,963 10,397 5 %

Paging 1,856 1,977 (6)% TOTAL OPERATING REVENUES 74,729 64,975 15 %

EXPENSES Operating expenses before depreciation, amortization and

loss on disposal of assets: Broadcasting 37,398 34,898 7 %

Publishing 8,049 7,755 4 % Paging 1,353 1,469 (8)% Corporate and

administrative 2,373 2,136 11 % Depreciation 5,801 5,190 12 %

Amortization of intangible assets 283 1,862 (85)% Amortization of

restricted stock award 94 0 NA Loss on disposal of assets, net 4 13

(69)% TOTAL EXPENSES 55,355 53,323 4 % Operating income 19,374

11,652 66 % Miscellaneous income, net 143 78 83 % Interest expense

(10,461) (11,270) (7)% INCOME BEFORE INCOME TAXES 9,056 460 1869 %

Income tax expense 3,554 289 1130 % NET INCOME 5,502 171 3118 %

Preferred dividends 822 822 0 % NET INCOME (LOSS) AVAILABLE TO

COMMON STOCKHOLDERS $4,680 $(651) (819) Diluted per share

information: Net income (loss) per share available to common

stockholders $0.09 $(0.01) (816)% Weighted average shares

outstanding 50,503 50,327 0 % Political revenue $3,534 $741 377 %

Guidance for the Second Quarter of 2004 The Company currently

anticipates that its results of operations for the three months

ended June 30, 2004 will approximate the ranges presented in the

table below. Three Months Ended June 30, 2004 % 2004 % Guidance

Change Guidance Change Low From High From Actual Selected operating

data: Range 2003 Range 2003 2003 OPERATING REVENUES Broadcasting

(less agency commissions) $69,300 9 % $69,800 10 % $63,551

Publishing 11,150 0 % 11,300 1 % 11,143 Paging 1,850 (5)% 1,900

(3)% 1,953 TOTAL OPERATING REVENUES 82,300 7 % 83,000 8 % 76,647

OPERATING EXPENSES Operating expenses before depreciation,

amortization and other expenses: Broadcasting 37,100 4 % 37,300 4 %

35,744 Publishing 7,775 (2)% 7,850 (1)% 7,933 Paging 1,400 1 %

1,450 5 % 1,381 Corporate and administrative 1,950 (7)% 2,100 0 %

2,107 Depreciation and amortization of intangibles 6,200 (13)%

6,300 (12)% 7,117 Other expenses, net 125 238 % 200 441 % 37 TOTAL

OPERATING EXPENSES 54,550 0 % 55,200 2 % 54,319 OPERATING INCOME

$27,750 24 % $27,800 25 % $22,328 Other Selected Data Political

revenue $3,750 142 % $4,000 158 % $1,552 In addition the Company

currently estimates that non-cash 401(k) plan expense will range

between $450,000 and $475,000 for the three months June 30, 2004

and such estimate is included in the operating expense estimates

presented above. Conference Call Information Gray Television, Inc.

will release first quarter earnings and host a conference call to

discuss its first quarter operating results on May 6, 2004. The

call will begin at 2:00 PM Eastern Time. The live dial-in number is

(888) 280-8771 and the reservation number is T492906G. The call

will be webcast live and available for replay at

http://www.graytvinc.com/ . The taped replay of the conference call

will be available at (877) 888-3855 until May 20, 2004. The Company

Gray Television, Inc. is a communications company headquartered in

Atlanta, Georgia, and currently owns 29 television stations serving

25 television markets. The stations include 15 CBS affiliates,

seven NBC affiliates and seven ABC affiliates. Gray Television,

Inc. has 22 stations ranked #1 in local news audience and 22

stations ranked #1 in overall audience within their respective

markets based on the average results of the 2003 Nielsen ratings

reports. The TV station group reaches approximately 5.3% of total

U.S. TV households. The Company also owns five daily newspapers,

four in Georgia and one in Indiana. Notes: (1) Reconciliation of

Net Income to the Non-GAAP term "EBITDA" ($ in thousands): Three

Months Ended March 31, 2004 2003 Net income $5,502 $171 Add (less):

Income tax expense 3,554 289 Interest expense 10,461 11,270

Miscellaneous income, net (143) (78) Loss on disposal of fixed

assets, net 4 13 Amortization of restricted stock award 94 0

Amortization of intangible assets 283 1,862 Depreciation 5,801

5,190 EBITDA $ 25,556 $ 18,717 (2) Total debt as of March 31, 2004

and December 31, 2003 does not include $1.1 million and $1.2

million, respectively, of unamortized debt discount on the

Company's 9-1/4% Senior Subordinated Notes due March 2011.

Reclassifications Certain prior year amounts have been reclassified

to conform with the 2004 presentation. Specifically, the Company

has reclassified amounts relating to the loss on disposal of assets

from miscellaneous income (expense) to a separate line item

entitled "Loss on disposal of assets, net" included in operating

expenses. Cautionary Statements for Purposes of the "Safe Harbor"

Provisions of the Private Securities Litigation Reform Act The

preceding comments on Gray's current expectations of operating

results for the second quarter of 2004 are "forward looking" for

purposes of the Private Securities Litigation Reform Act of 1995.

Actual results of operations are subject to a number of risks and

may differ materially from the current expectations discussed in

this press release. See the Company's Annual Report on Form 10K for

a discussion of risk factors that may affect the Company.

DATASOURCE: Gray Television, Inc. CONTACT: Bob Prather, President

and Chief Operating Officer, +1-404-266-8333, or Jim Ryan, Senior

V. P. and Chief Financial Officer, +1-404-504-9828, both of Gray

Television, Inc. Web site: http://www.graytvinc.com/

Copyright

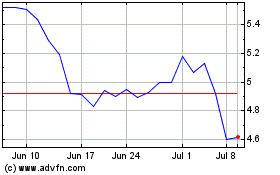

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jun 2024 to Jul 2024

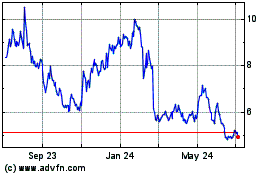

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jul 2023 to Jul 2024