2nd UPDATE: Citadel Fixed-Income Trading 'Positive' - Source

October 06 2010 - 6:14PM

Dow Jones News

Hedge-fund manager Citadel LLC's securities unit has had

positive fixed-income trading revenue this year, and has no massive

layoff plans in store for its investment-banking unit, a person

familiar with the situation said Wednesday.

A report earlier Wednesday by a website said the $11 billion

Chicago-based hedge-fund manager might plan to dismantle its

securities operations after suffering losses on some high-yield

loans.

"There is no plan for mass layoffs," the person said. "Citadel

is not shutting down Citadel Securities or its fixed-income

operations."

But the person said there could be staffing changes as the firm

is undertaking its annual business review. Such reviews, which take

place in the fourth quarter of each year, will decide what

adjustments the firm has to make in preparation for the new

year.

Business Insider, citing an "anonymous tipster," said Wednesday

that Citadel might have mass layoffs in the next few days, and they

are "connected to a wider dismantling" of Citadel Securities. The

report, citing the tipster, said several senior Citadel Securities

executives won't be with the firm for long.

The publication later backtracked. Citing another anonymous

source, it said that there has been chatter among Citadel staff

about the year-end review, though nothing has been decided yet.

Workers at hedge funds have been jittery about job security.

D.E. Shaw & Co., one of the largest hedge-fund firms, is

cutting 10% of its work force, demonstrating that the industry

still isn't out of the woods.

A Citadel spokeswoman, when asked about the Business Insider

report, said Citadel Securities continues to gain traction.

Citadel Securities is among Citadel's many efforts to expand

beyond its traditional hedge-fund business. Its two main funds

suffered losses of more than 50% in 2008, prompting it to suspend

redemptions at one point.

Citadel Securities has four core businesses: institutional

markets, execution services, institutional research and investment

banking.

But since launching in May 2008, the investment-banking division

has experienced high turnover, including the departure of three top

executives, The Wall Street Journal reported, in January. In

addition, Patrik Edsparr, the head of the division, was "let go" in

May, according to an internal memo. Founder Kenneth Griffin said at

the time he and other executives "did not see eye to eye" with

Edsparr.

The unit's chief executive, Rohit D'Souza, left in October last

year, followed by the head of Citadel's investment bank Todd

Kaplan, who used to work with D'Souza at Merrill Lynch before

joining Citadel. Peter Santoro left as Citadel's

institutional-trading chief in December.

The Wall Street Journal said Citadel's historically

trader-focused culture, where performance can often be easily

measured, clashed at times with work styles more typical of Wall

Street firms, where progress depends on long-term relationship

building.

As a budding investment bank, Citadel Securities' revenue is too

small to be compared to the likes of investment-banking giants

Goldman Sachs Group Inc. (GS) and Morgan Stanley (MS). But it was

involved in various equities, debt capital markets and

leveraged-loan deals, according to data provider Dealogic. They

include CBOE Holdings' (CBOE) $390 million initial public offering

in June, and high-yield bond issues by Equinox Holdings Inc. and

regional television-broadcast company Gray Television Inc. (GTN),

which raised a combined $790 million.

It was also the sole bookrunner for Freddie Mac's (FMCC) three

mortgage-backed-security issues between July and September, worth a

total $542 million, Dealogic said.

-By Amy Or, Dow Jones Newswires; +1 212 416 3142;

amy.or@dowjones.com

(Margot Patrick in London contributed to this article.)

-0

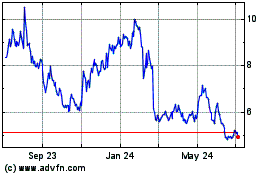

Gray Television (NYSE:GTN)

Historical Stock Chart

From May 2024 to Jun 2024

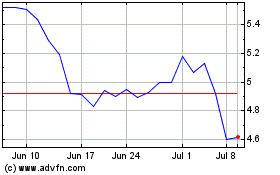

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jun 2023 to Jun 2024