ATLANTA, Nov. 5 /PRNewswire-FirstCall/ -- Gray Television, Inc.

("Gray," "we" or "us") (NYSE:GTN) today announced results from

operations for the three months (the "third quarter") and nine

months ended September 30, 2008 as compared to the three months and

nine months ended September 30, 2007. Comments on Results of

Operations for the Three Months Ended September 30, 2008: Revenues.

Total net revenue increased $9.0 million, or 12%, to $82.6 million

due primarily to increased political and internet advertising

revenue, partially offset by decreased local and national

advertising revenue in the third quarter of 2008. The increase in

political advertising revenue reflects increased advertising from

political candidates in the 2008 general elections. Spending on

political advertising during the third quarter of 2008 was the

strongest at our stations in Colorado, West Virginia, Wisconsin,

Michigan and North Carolina, accounting for approximately 67% of

the total political net revenue for the third quarter of 2008.

Increased internet advertising revenue reflects our internet sales

initiatives in each of our markets. The decrease in local and

national revenue was largely due to the general weakness in the

economy offset in part by $3.4 million of net revenue earned in the

third quarter attributable to the broadcast of the 2008 Summer

Olympics on our ten NBC stations. Political advertising revenue

increased $11.6 million, or 801%, to $13.1 million. Internet

advertising revenue increased $0.4 million, or 18%, to $3.0

million. Local advertising revenue decreased $1.5 million, or 3%,

to $46.3 million. National advertising revenue decreased $1.7

million, or 9%, to $17.5 million. Operating expenses. Broadcast

expenses (before depreciation, amortization and loss on disposal of

assets) increased $0.3 million, or 1%, to $49.9 million. This

modest increase primarily reflects the impact of increased national

sales representative commissions on the incremental political

advertising revenues offset in part by a slight reduction in

payroll related costs. Corporate and administrative expenses

(before depreciation, amortization and gain/loss on disposal of

assets) decreased $0.2 million, or 5%, to $3.8 million primarily

reflecting a decrease in incentive based compensation expenses. We

recorded non-cash stock-based compensation expense during the three

months ended September 30, 2008 and 2007 of $399,000 and $285,000,

respectively. Comments on Results of Operations for the Nine Months

Ended September 30, 2008: Revenues. Total net revenue increased

$9.4 million, or 4%, to $232.4 million due primarily to increased

political and internet advertising revenue, partially offset by

decreased local and national advertising revenue in the nine months

ended September 30, 2008. The increase in political advertising

revenue reflects increased advertising from political candidates in

the 2008 primary and general elections. Spending on political

advertising was the strongest at our stations in Colorado, West

Virginia, Wisconsin, Michigan and North Carolina, accounting for

approximately 60% of the total political net revenue for the nine

months ended September 30, 2008. Increased internet advertising

revenue reflects our internet sales initiatives in each of our

markets. The decrease in local and national revenue was largely due

to the general weakness in the economy and due to the change in

networks broadcasting the Super Bowl. During the first nine months

of 2008, we earned approximately $130,000 of net revenue relating

to the 2008 Super Bowl broadcast on our six Fox channels compared

to approximately $750,000 of net revenue relating to the 2007 Super

Bowl broadcast on our 17 CBS channels during the first nine months

of 2007. The decrease in local and national revenue was offset in

part by $3.4 million of net revenue earned in the third quarter

attributable to the broadcast of the 2008 Summer Olympics on our

ten NBC stations. Political advertising revenue increased $15.9

million, or 307%, to $21.1 million. Internet advertising revenue

increased $1.8 million, or 26%, to $8.6 million. Local advertising

revenue decreased $5.0 million, or 3%, to $141.5 million. National

advertising revenue decreased $3.8 million, or 7%, to $52.4

million. Operating expenses. Broadcast expenses (before

depreciation, amortization and gain/loss on disposal of assets)

increased $0.9 million, or 1%, to $148.4 million. This modest

increase primarily reflects the impact of increased national sales

representative commissions on the incremental political advertising

revenues. Corporate and administrative expenses (before

depreciation, amortization and loss on disposal of assets)

decreased $1.6 million, or 13%, to $10.0 million primarily

reflecting a decrease in incentive based compensation expenses. We

recorded non-cash stock-based compensation expense during the nine

months ended September 30, 2008 and 2007 of $1,088,000 and

$1,115,000, respectively. Internet Initiatives: We have continued

to expand our internet initiatives in each of our markets. Our

focus has been to expand local content to attract traffic to our

websites. This strong revenue growth reflects the significantly

increased traffic to our websites as illustrated below by the

aggregate page views reported by our websites in the three-month

and nine-month periods ended September 30, 2008 compared to the

three-month and nine-month periods ended September 30, 2007. Gray

Websites - Aggregate Page Views Three Months Ended September 30, %

2008 2007 Change (in millions) Total Aggregate Page Views

(including video plays and cell phone page views) 149.3 101.2 48%

Nine Months Ended September 30, % 2008 2007 Change (in millions)

Total Aggregate Page Views (including video plays and cell phone

page views) 461.8 304.8 52% We attribute the increase in our

website traffic to increased posting of local content and public

awareness of our websites as the result of our on-air promotion of

our websites. The aggregate internet revenues discussed above are

derived from two sources. The first source is advertising or

sponsorship opportunities directly on our websites. We call this

"direct internet revenue." The other source is television

advertising time purchased by our clients to directly promote their

involvement in our websites. We refer to this internet revenue

source as "internet related commercial time sales." In the future,

we anticipate our direct internet revenue will grow at a

significantly faster pace relative to our internet related

commercial time sales. Other Financial Data: September 30, December

31, 2008 2007 (in thousands) Cash and cash equivalents $32,575

$15,338 Total debt 830,446 925,000 Preferred stock 91,883 - Credit

commitment under senior credit facility 100,000 100,000 Nine Months

Ended September 30, 2008 2007 (in thousands) Net cash provided by

operating activities $36,692 $11,919 Net cash used in investing

activities (12,144) (22,575) Net cash (used in) provided by

financing activities (7,311) 7,148 On June 26, 2008, we issued 750

shares of Series D Perpetual Preferred Stock (the "Series D

Preferred Stock") having an aggregate liquidation value of $75.0

million in a privately placed transaction to qualified investors.

We received approximately $68.6 million in net proceeds after

issuance discounts and transaction expenses. Also on June 26, 2008,

we used $65.0 million of the net proceeds from the issuance to make

a voluntary prepayment on our term loan under our senior credit

facility. We retained the remaining $3.6 million of the net

proceeds for general corporate purposes. On July 15, 2008, we

issued an additional 250 shares of Series D Perpetual Preferred

Stock having an aggregate liquidation value of $25.0 million in a

privately placed transaction to qualified investors. We received

approximately $23.0 million in net proceeds after issuance

discounts and transaction expenses. Also on July 15, 2008, we used

the $23.0 million of net proceeds from the issuance to make a

voluntary prepayment on our term loan under our senior credit

facility. Subsequent Event: On October 3, 2008, we used cash on

hand to make a voluntary prepayment of $10 million on our term loan

under our senior credit facility. After applying this voluntary

prepayment, the total outstanding balance on our term loan was

$820.4 million and we had no amounts outstanding on our revolving

credit facility under our senior credit facility. Gray Television,

Inc. Selected Operating Data (Unaudited) (in thousands except for

per share data and percentages) Three Months Ended September 30, %

2008 2007 Change Revenues (less agency commissions) $82,631 $73,585

12% Operating expenses before depreciation, amortization and gain

on disposal of assets, net: Broadcast 49,907 49,583 1% Corporate

and administrative 3,754 3,932 (5)% Depreciation and amortization

of intangible assets 8,797 10,156 (13)% (Gain) loss on disposals of

assets, net (338) 5 (6860)% 62,120 63,676 (2)% Operating income

20,511 9,909 107% Other income (expense): Miscellaneous income, net

36 177 (80)% Interest expense (12,626) (16,812) (25)% Income (loss)

before income tax 7,921 (6,726) Income tax expense (benefit) 3,277

(2,546) Net income (loss) 4,644 (4,180) Preferred dividends

(includes accretion of issuance cost of $275 and $0, respectively)

3,167 - Net income (loss) available to common stockholders $1,477

$(4,180) Basic per share information: Net income (loss) available

to common stockholders $0.03 $(0.09) Weighted average shares

outstanding 48,370 47,760 1% Diluted per share information: Net

income (loss) available to common stockholders $0.03 $(0.09)

Weighted average shares outstanding 48,413 47,760 1% Political

revenue (less agency commission) $13,065 $1,450 801% Gray

Television, Inc. Selected Operating Data (Unaudited) (in thousands

except for per share data and percentages) Nine Months Ended

September 30, % 2008 2007 Change Revenues (less agency commissions)

$232,373 $223,015 4% Operating expenses before depreciation,

amortization and gain on disposal of assets, net: Broadcast 148,383

147,449 1% Corporate and administrative 10,015 11,577 (13)%

Depreciation and amortization of intangible assets 26,788 30,048

(11)% (Gain) loss on disposals of assets, net (1,343) 122 (1201)%

183,843 189,196 (3)% Operating income 48,530 33,819 43% Other

income (expense): Miscellaneous income, net 126 984 (87)% Interest

expense (41,827) (50,610) (17)% Loss on early extinguishment of

debt - (22,853) Income (loss) before income tax benefit 6,829

(38,660) Income tax expense (benefit) 2,820 (14,021) Net income

(loss) 4,009 (24,639) Preferred dividends (includes accretion of

issuance cost of $275 and $439, respectively) 3,292 1,626 102% Net

income (loss) available to common stockholders $717 $(26,265) Basic

per share information: Net income (loss) available to common

stockholders $0.01 $(0.55) Weighted average shares outstanding

48,253 47,728 1% Diluted per share information: Net income (loss)

available to common stockholders $0.01 $(0.55) Weighted average

shares outstanding 48,293 47,728 1% Political revenue (less agency

commission) $21,089 $5,181 307% Guidance for the Fourth Quarter of

2008 We currently anticipate that our broadcast results of

operations for the three months ending December 31, 2008 (the

"fourth quarter of 2008") will approximate the ranges presented in

the table below. % % 2008 Change 2008 Change Guidance From Guidance

From Low Actual High Actual Actual Selected Operating Data: Range

2007 Range 2007 2007 (dollars in thousands) OPERATING REVENUES:

Revenues (less agency commissions) $90,000 7% $95,000 13% $84,272

OPERATING EXPENSES: (before depreciation, amortization and other

expenses) Broadcast $51,500 (1)% $52,000 0% $52,238 Corporate and

administrative $3,000 (15)% $3,500 0% $3,513 OTHER SELECTED DATA:

Broadcast political revenues (less agency commissions) $26,000

$26,500 $2,627 Expense for non-cash contributions to 401(k) plan

$550 $600 $411 Expense for corporate non-cash stock-based

compensation $375 $400 $134 Comments on Guidance Total revenues

anticipated for the fourth quarter of 2008 reflect an incremental

increase in political revenues. Local non-political advertising

revenue for the fourth quarter of 2008 is currently anticipated to

be down approximately mid double digits compared to the results of

the three-month period ended December 31, 2007 (the "fourth quarter

of 2007"). National non- political advertising revenue is currently

anticipated to be down approximately 25% in the fourth quarter of

2008 compared to the fourth quarter of 2007. Internet advertising

revenue for the fourth quarter of 2008 is currently anticipated to

increase approximately 10% to 15% compared to the fourth quarter of

2007. Changes in the classification of certain items: The

classification of certain prior year amounts in the accompanying

consolidated financial statements have been changed in order to

conform to the current year presentation. In our disclosures issued

prior to December 31, 2007, we had included internet advertising

revenue with local advertising revenue and retransmission consent

revenue was included with production and other revenue. We are now

presenting internet advertising revenue and retransmission consent

revenue separately. The table below presents our expanded

disclosure for the three- month and nine month periods ended

September 30, 2008 and 2007, respectively (dollars in thousands):

Three Months Ended September 30, 2008 2007 Percent Percent Amount

of Total Amount of Total Broadcasting net revenues: Local $46,279

56.0% $47,761 64.9% National 17,546 21.2% 19,237 26.1% Internet

2,954 3.6% 2,505 3.4% Political 13,065 15.8% 1,450 2.0%

Retransmission consent 762 0.9% 501 0.7% Production and other 1,841

2.2% 1,951 2.7% Network compensation 184 0.3% 180 0.2% Total

$82,631 100.0% $73,585 100.0% Nine Months Ended September 30, 2008

2007 Percent Percent Amount of Total Amount of Total Broadcasting

net revenues: Local $141,493 60.9% $146,467 65.7% National 52,362

22.5% 56,192 25.2% Internet 8,631 3.7% 6,830 3.1% Political 21,089

9.1% 5,181 2.3% Retransmission consent 2,209 1.0% 1,443 0.6%

Production and other 6,025 2.6% 6,338 2.8% Network compensation 564

0.2% 564 0.3% Total $232,373 100.0% $223,015 100.0% The aggregate

internet revenue presented above are derived from two sources: (i)

direct internet revenue and (ii) internet related commercial time

sales. Conference Call Information We will host a conference call

to discuss our third quarter operating results on November 5, 2008.

The call will begin at 11:00 AM Eastern Time. The live dial-in

number is 1 (800) 533-7619 and the confirmation code is 8072046.

The call will be webcast live and available for replay at

http://www.gray.tv/. The taped replay of the conference call will

be available at 1 (888) 203-1112, Confirmation Code: 8072046 until

December 4, 2008. Reconciliations: Reconciliation of net income

(loss) to the non-GAAP terms (in thousands): As Reported Three

Months Ended September 30, 2008 2007 Net income (loss) $4,644

$(4,180) Adjustments to reconcile to Broadcast Cash Flow Less Cash

Corporate Expenses: Depreciation and amortization of intangible

assets 8,797 10,156 Amortization of non-cash stock based

compensation 399 285 (Gain) loss on disposals of assets, net (338)

5 Miscellaneous (income) expense, net (36) (177) Interest expense

12,626 16,812 Income tax expense (benefit) 3,277 (2,546)

Amortization of program broadcast rights 3,926 3,750 Common stock

contributed to 401(k) plan excluding corporate 401(k) contributions

553 550 Network compensation revenue recognized (184) (180) Network

compensation per network affiliation agreement 30 78 Payments for

program broadcast rights (3,708) (3,821) Broadcast Cash Flow Less

Cash Corporate Expenses 29,986 20,732 Corporate and administrative

expenses excluding amortization of non-cash stock-based

compensation 3,355 3,647 Broadcast Cash Flow $33,341 $24,379 As

Reported Nine Months Ended September 30, 2008 2007 Net income

(loss) $4,009 $(24,639) Adjustments to reconcile to Broadcast Cash

Flow Less Cash Corporate Expenses: Depreciation and amortization of

intangible assets 26,788 30,048 Amortization of non-cash stock

based compensation 1,088 1,115 (Gain) loss on disposals of assets,

net (1,343) 122 Miscellaneous (income) expense, net (126) (984)

Interest expense 41,827 50,610 Loss on early extinguishment of debt

- 22,853 Income tax expense (benefit) 2,820 (14,021) Amortization

of program broadcast rights 11,598 11,345 Common stock contributed

to 401(k) plan excluding corporate 401(k) contributions 1,751 1,750

Network compensation revenue recognized (564) (564) Network

compensation per network affiliation agreement 90 235 Payments for

program broadcast rights (10,149) (11,507) Broadcast Cash Flow Less

Cash Corporate Expenses 77,789 66,363 Corporate and administrative

expenses excluding amortization of non-cash stock-based

compensation 8,927 10,462 Broadcast Cash Flow $86,716 $76,825

Non-GAAP Terms This press release includes the non-GAAP financial

measure of Broadcast Cash Flow and Broadcast Cash Flow Less Cash

Corporate Expenses. These non- GAAP amounts are used by us to

approximate the amount used to calculate a key financial

performance covenant as defined in our senior credit facility.

Broadcast Cash Flow is defined as operating income, plus corporate

expense, depreciation and amortization (including amortization of

program broadcast rights), non-cash compensation and (gain) loss on

disposal of assets and cash payments received or receivable under

network affiliation agreements, less payments for program broadcast

obligations, less network compensation revenue and less income

(loss) from discontinued operations, net of income taxes. Corporate

expenses (excluding depreciation, amortization and non-cash stock-

based compensation) are deducted from Broadcast Cash Flow to

calculate "Broadcast Cash Flow Less Cash Corporate Expenses." These

non-GAAP terms are used in addition to and in conjunction with

results presented in accordance with GAAP and should be considered

as supplements to, and not as substitutes for, net loss calculated

in accordance with GAAP. Gray Television, Inc. Gray Television,

Inc. is a television broadcast company headquartered in Atlanta,

GA. We currently operate 36 television stations serving 30 markets.

Each of the stations are affiliated with either CBS (17 stations),

NBC (10 stations), ABC (8 stations) or FOX (1 station). In

addition, we currently operate 39 digital second channels including

1 ABC, 5 Fox, 7 CW and 16 MyNetworkTV affiliates plus 8 local

news/weather channels and 2 "independent" channels in certain of

our existing markets. Cautionary Statements for Purposes of the

"Safe Harbor" Provisions of the Private Securities Litigation

Reform Act The comments on our current expectations of operating

results for the fourth quarter of 2008 and other future events are

"forward-looking statements" for purposes of the Private Securities

Litigation Reform Act of 1995. Actual results of operations are

subject to a number of risks and uncertainties and may differ

materially from the current expectations discussed in this press

release. All information set forth in this release and its

attachments is as of November 5, 2008. We do not intend, and

undertake no duty, to update this information to reflect future

events or circumstances. Information about potential factors that

could affect our business and financial results and cause actual

results to differ materially from those in the forward-looking

statements are included under the captions, "Risk Factors" and

"Management's Discussion and Analysis of Financial Condition and

Results of Operations," in our Annual Report on Form 10-K for the

year ended December 31, 2007 which is on file with the SEC and

available at the SEC's website at http://www.sec.gov/. DATASOURCE:

Gray Television, Inc. CONTACT: Bob Prather, President and Chief

Operating Officer, +1-404-266-8333, or Jim Ryan, Senior V.P. and

Chief Financial Officer, +1-404-504-9828 Web site:

http://www.gray.tv/

Copyright

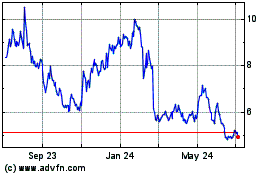

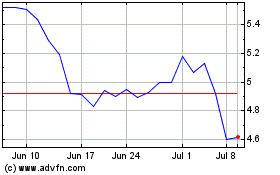

Gray Television (NYSE:GTN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Gray Television (NYSE:GTN)

Historical Stock Chart

From Sep 2023 to Sep 2024