Gray Reports Record Operating Results for the Three Months and Year

Ended December 31, 2004 ATLANTA, March 10 /PRNewswire-FirstCall/ --

Gray Television, Inc. ("Gray") (NYSE:GTN) today announced record

setting results from operations for the three months ("fourth

quarter") and year ended December 31, 2004 as compared to the three

months and year ended December 31, 2003. In addition, Gray

announced a record setting amount of net cash provided by operating

activities for the year ended December 31, 2004. Highlights for the

three months and year ended December 31, 2004: Three Months Ended

Year Ended December 31, 2004 December 31, 2004 EBITDA (1) increased

47% 36% Adjusted Media Cash Flow (2) increased 39% 32% Net Income

increased 1,070% 216% Total Broadcast Revenues increased 30% 21%

Local Broadcast Revenues, excluding political revenues increased 2%

7% Net Political Revenues were $20.8 million $41.7 million Net Cash

Provided by Operating Activities $20.3 million $102.7 million As of

December 31, 2004 2003 Cash on Hand $50.6 million $11.9 million

Total Debt $655.9 million $655.9 million Gray purchased a combined

total of 1.7 million shares of Gray Common Stock ("GTN") and Gray

Class A Common Stock ("GTNA") for $22.4 million during 2004. From

January 1, 2005 through March 9, 2005, Gray has purchased an

additional combined total of 367,700 shares of GTN and GTNA for

$5.2 million. On January 31, 2005, Gray completed the acquisition

of KKCO-TV, the #1 rated NBC-affiliate in Grand Junction, CO. The

purchase price was $13.5 million. Comments on Results of Operations

for the Three Months Ended December 31, 2004: Revenues. Total

revenues for the fourth quarter of 2004 increased 25% over the same

period of the prior year to $100.6 million. Broadcasting revenues

increased a combined total of 30% over the same period of the prior

year to $86.5 million. The increase in broadcasting revenues

reflects increased political advertising revenues as well as

increased non-political broadcasting advertising revenues.

Political advertising revenues increased to $20.8 million from $2.3

million reflecting the cyclical influence of the 2004 Presidential

election. Excluding political advertising revenues, local

broadcasting advertising revenues increased 2% to $42.2 million

from $41.4 million and national broadcasting advertising revenues

decreased 4% to $17.9 million from $18.7 million. We attribute the

increases in non-political local broadcasting advertising revenues

to improved economic conditions and broad based demand for

commercial time by local advertisers. We believe that commercial

time used for political advertising limited, in part, the amount of

commercial time available for sale by Gray to national advertisers

during the fourth quarter of 2004. Newspaper publishing and other

revenues increased 2% over the same period of the prior year to

$14.1 million from $13.9 million. Publishing and other revenues

increased primarily due to increases in newspaper retail

advertising of 9% and classified advertising of 7%. Operating

expenses. Operating expenses before depreciation, amortization and

loss on disposal of assets increased 17% over the same period of

the prior year to $60.2 million. The increase in expenses for the

current period includes non-cash charges of approximately $1.1

million for common stock contributed to Gray's 401(k) plan compared

to $980,000 for the same period of 2003. In addition, during the

fourth quarter of 2004 Gray incurred approximately $328,000 in

costs associated with complying with the Sarbanes- Oxley Act of

2002; the prior period did not have any similar costs. Comments on

Results of Operations for the Year Ended December 31, 2004:

Revenues. Total revenues for the year ended December 31, 2004

increased 17% over the same period of the prior year to $346.6

million. Broadcasting revenues increased 21% over the same period

of the prior year to $293.3 million. The increase in broadcasting

revenues reflects increased political advertising revenues as well

as increased non-political broadcasting revenues. Political

advertising revenues increased to $41.7 million from $5.7 million

as compared to the same period of 2003 reflecting the cyclical

influence of the 2004 Presidential election. Excluding political

advertising revenues, local broadcasting advertising revenues

increased 7% to $160.7 million from $150.1 million and national

broadcasting advertising revenues remained consistent with that of

the prior year at $70.8 million. We attribute the increases in

non-political local broadcasting advertising revenues to improved

economic conditions and broad based demand for commercial time by

local advertisers. We believe that commercial time used for

political advertising limited, in part, the amount of commercial

time available for sale by Gray to national advertisers during

2004. Newspaper publishing and other revenues increased 2% to $53.3

million from $52.3 million. Publishing and other revenues increased

primarily due to increases in newspaper retail advertising of 7%

and increases in classified advertising of 6%. Operating expenses.

Operating expenses before depreciation, amortization and (gain)

loss on disposal of assets increased 9% to $208.7 million. The 2004

expense includes non-cash charges of approximately $2.6 million for

common stock contributed to Gray's 401(k) plan compared to $2.5

million for the same period of 2003. In addition, during 2004 Gray

incurred approximately $1.0 million in costs associated with

complying with the Sarbanes-Oxley Act of 2002; the prior year did

not have any similar costs. Balance Sheet: Gray's cash balance was

$50.6 million at December 31, 2004 compared to $11.9 million at

December 31, 2003. The increase in cash reflects a record setting

$102.7 million of net cash generated by Gray's operations during

2004 compared to $62.3 million for 2003. The 2004 net cash

generated from operations was partially offset by the return of

$32.0 million of capital to Gray's common and preferred

shareholders through the payment of dividends and the purchase of

its common stock as well as $36.3 million of cash used for capital

expenditures. Total debt outstanding at December 31, 2004 and

December 31, 2003 was $655.9 million (3). Gray Television, Inc. (in

thousands, except per share data and percentages) Three Months

Ended Selected operating data: December 31, % 2004 2003 Change

OPERATING REVENUES Broadcasting (less agency commissions) $86,470

$66,537 30 % Publishing and other 14,103 13,860 2 % TOTAL OPERATING

REVENUES 100,573 80,397 25 % EXPENSES Operating expenses before

depreciation, amortization and (gain) loss on disposal of assets:

Broadcasting 45,543 39,422 16 % Publishing and other 10,396 9,727 7

% Corporate and administrative 4,242 2,367 79 % Depreciation 5,896

5,787 2 % Amortization of intangible assets 224 391 (43)%

Amortization of restricted stock awards 189 388 (51)% (Gain) loss

on disposal of assets, net 154 1,075 (86)% TOTAL EXPENSES 66,644

59,157 13 % Operating income 33,929 21,240 60 % Miscellaneous

income (expense), net 418 (192) (318)% Interest expense (10,621)

(10,637) (0)% INCOME BEFORE INCOME TAXES 23,726 10,411 128 %

Federal and state income tax expense 8,922 9,146 (2)% NET INCOME

14,804 1,265 1070 % Preferred dividends 814 822 (1)% NET INCOME

AVAILABLE TO COMMON STOCKHOLDERS $13,990 $443 3058 % Diluted per

share information: Net income per share available to common

stockholders $0.28 $0.01 2700 % Weighted average shares outstanding

49,280 50,210 (2)% Political revenue (less agency commission)

$20,783 $2,251 823 % Gray Television, Inc. (in thousands, except

per share data and percentages) Year Ended Selected operating data:

December 31, % 2004 2003 Change OPERATING REVENUES Broadcasting

(less agency commissions) $293,273 $243,061 21 % Publishing and

other 53,294 52,310 2 % TOTAL OPERATING REVENUES 346,567 295,371 17

% EXPENSES Operating expenses before depreciation, amortization and

(gain) loss on disposal of assets: Broadcasting 158,305 145,721 9 %

Publishing and other 38,701 37,566 3 % Corporate and administrative

11,662 8,460 38 % Depreciation 23,656 21,715 9 % Amortization of

intangible assets 975 5,622 (83)% Amortization of restricted stock

awards 512 454 13 % (Gain) loss on disposal of assets, net (451)

1,155 (139)% TOTAL EXPENSES 233,360 220,693 6 % Operating income

113,207 74,678 52 % Miscellaneous income (expense), net 1,016 20

4980 % Interest expense (41,974) (43,337) (3)% INCOME BEFORE INCOME

TAXES 72,249 31,361 130 % Federal and state income tax expense

27,964 17,337 61 % NET INCOME 44,285 14,024 216 % Preferred

dividends 3,272 3,287 (0)% NET INCOME AVAILABLE TO COMMON

STOCKHOLDERS $41,013 $10,737 282 % Diluted per share information:

Net income per share available to common stockholders $0.82 $0.21

290 % Weighted average shares outstanding 50,170 50,535 (1)%

Political revenue (less agency commission) $41,706 $5,668 636 %

Guidance for the First Quarter of 2005 We currently anticipate that

Gray's results of operations for the three months ended March 31,

2005 will approximate the ranges presented in the table below

(dollars in thousands). Three Months Ended March 31, 2005 % 2005 %

Guidance Change Guidance Change Low From High From Actual Selected

operating data: Range 2004 Range 2004 2004 OPERATING REVENUES

Broadcasting (less agency commissions) $57,000 -8% $57,500 -7%

$61,910 Publishing and other 12,700 -1% 12,850 0% 12,819 TOTAL

OPERATING REVENUES 69,700 -7% 70,350 -6% 74,729 OPERATING EXPENSES

Operating expenses before depreciation, amortization and other

expenses: Broadcasting 38,500 3% 38,750 4% 37,398 Publishing and

other 9,650 3% 9,750 4% 9,402 Corporate and administrative 2,500 5%

2,600 10% 2,373 Depreciation and amortization of intangibles 6,000

-1% 6,100 0% 6,084 Amortization of restricted stock 175 86% 200

113% 94 Loss on disposal of assets 25 525% 75 1775% 4 TOTAL

OPERATING EXPENSES 56,850 3% 57,475 4% 55,355 OPERATING INCOME

$12,850 -34% $12,875 -34% $19,374 Other Selected Data Political

revenues (less agency commissions) $200 -94% $225 -94% $3,534

Included within the operating expense estimates presented above, we

currently estimate that non-cash 401(k) plan expense will range

between $525,000 and $575,000 for the three months ended March 31,

2005 compared with $560,000 for the same period of 2004. Conference

Call Information Gray Television, Inc. will host a conference call

to discuss its fourth quarter operating results on March 10, 2005.

The call will begin at 11:00 AM Eastern Time. The live dial-in

number is 1-888-789-0150 and the reservation number is T553668G.

The call will be webcast live and available for replay at

http://www.graytvinc.com/ . The taped replay of the conference call

will be available at 1-888-509-0081 until March 24, 2005. The

Company Gray Television, Inc. is a communications company

headquartered in Atlanta, Georgia, and currently owns 31 television

stations serving 27 television markets. The stations include 16 CBS

affiliates, eight NBC affiliates and seven ABC affiliates. Gray

Television, Inc. has 23 stations ranked #1 in local news audience

and 22 stations ranked #1 in overall audience within their

respective markets based on the average results of the 2004 Nielsen

ratings reports. The TV station group reaches approximately 5.5% of

total U.S. TV households. Gray also owns five daily newspapers,

four in Georgia and one in Indiana. Notes: (1) Reconciliation of

Net Income to the Non-GAAP term "EBITDA" ($ in thousands): Three

Months Ended Twelve Months Ended December 31, December 31, 2004

2003 2004 2003 Net income $14,804 $1,265 $44,285 $ 14,024 Add:

Income tax expense 8,922 9,146 27,964 17,337 Interest expense

10,621 10,637 41,974 43,337 Amortization of restricted stock awards

189 388 512 454 Amortization of intangible assets 224 391 975 5,622

Depreciation 5,896 5,787 23,656 21,715 EBITDA $40,656 $27,614

$139,366 $102,489 (2) Reconciliation of Net Income to the Non-GAAP

term "Adjusted Media Cash Flow" ($ in thousands): Three Months

Ended Twelve Months Ended December 31, December 31, 2004 2003 2004

2003 Net income $14,804 $1,265 $44,285 $14,024 Add (subtract):

Income tax expense 8,922 9,146 27,964 17,337 Interest expense

10,621 10,637 41,974 43,337 Miscellaneous (income) expense, net

(418) 192 (1,016) (20) (Gain) loss on disposal of assets, net 154

1,075 (451) 1,155 Amortization of restricted stock awards 189 388

512 454 Amortization of intangible assets 224 391 975 5,622

Depreciation 5,896 5,787 23,656 21,715 Amortization of program

license rights 2,822 2,755 11,137 11,136 Common Stock contributed

to 401(k) Plan excluding corporate 401(k)contributions 1,164 947

2,548 2,372 Payments on program broadcast obligations (2,891)

(2,710) (11,055) (10,967) Adjusted Media Cash Flow $41,487 $29,873

$140,529 $106,165 Adjusted Media Cash Flow is a non-GAAP term the

Company uses as a measure of performance. Adjusted Media Cash Flow

is used by the Company to approximate the amount used to calculate

key financial performance covenants including, but not limited to,

limitations on debt, interest coverage, and fixed charge coverage

ratios as defined in the Company's senior credit facility and/or

subordinated note indenture. Adjusted Media Cash Flow is defined as

operating income, plus depreciation and amortization (including

amortization of program broadcast rights), non- cash compensation

and (gain) loss on disposal of assets, less payments for program

broadcast obligations. Accordingly, the Company has provided a

reconciliation of Adjusted Media Cash Flow to net income. (3) Total

debt as of December 31, 2004 and December 31, 2003 does not include

$1.0 million and $1.2 million, respectively, of unamortized debt

discount on Gray's 91/4% Senior Subordinated Notes due March 2011.

Cautionary Statements for Purposes of the "Safe Harbor" Provisions

of the Private Securities Litigation Reform Act The preceding

comments on Gray's current expectations of operating results for

the first quarter of 2005 are "forward looking" for purposes of the

Private Securities Litigation Reform Act of 1995. Actual results of

operations are subject to a number of risks and may differ

materially from the current expectations discussed in this press

release. See Gray's Annual Report on Form 10-K for a discussion of

risk factors that may affect its ability to achieve the results

contemplated by such forward looking statements. DATASOURCE: Gray

Television, Inc. CONTACT: Bob Prather, President and Chief

Operating Officer, +1-404-266-8333, or Jim Ryan, Senior V. P. and

Chief Financial Officer, +1-404-504-9828, both of Gray Television,

Inc. Web site: http://www.graytvinc.com/

Copyright

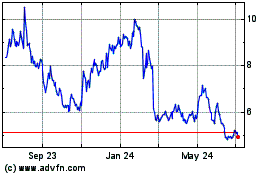

Gray Television (NYSE:GTN)

Historical Stock Chart

From May 2024 to Jun 2024

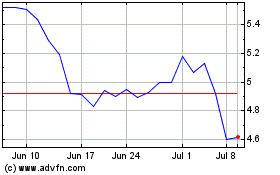

Gray Television (NYSE:GTN)

Historical Stock Chart

From Jun 2023 to Jun 2024