Current Report Filing (8-k)

April 12 2023 - 4:31PM

Edgar (US Regulatory)

00000349030001901876falsefalse 0000034903 2023-04-10 2023-04-10 0000034903 frt:FederalRealtyOPLPMember 2023-04-10 2023-04-10 0000034903 frt:CommonSharesOfBeneficialInterestMember 2023-04-10 2023-04-10 0000034903 frt:DepositorySharesMember 2023-04-10 2023-04-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 10, 2023

Federal Realty Investment Trust

(Exact name of registrant as specified in its charter)

Federal Realty Investment Trust

| |

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

Federal Realty OP LP

| |

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

909 Rose Avenue, Suite 200 , |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrants’ telephone number including area code:

301/998-8100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Federal Realty Investment Trust

| |

|

|

|

|

Title of Each Class |

|

Trading

Symbol |

|

Name of Each Exchange On Which Registered |

Common Shares of Beneficial Interest $.01 par value per share, with associated Common Share Purchase Rights |

|

FRT |

|

New York Stock Exchange |

Depositary Shares, each representing 1/1000 of a share of 5.00% Series C Cumulative Redeemable Preferred Stock, $.01 par value per share |

|

|

|

New York Stock Exchange |

Federal Realty OP LP

| |

|

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange On Which Registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2

of the Securities Exchange Act of 1934.

Federal Realty Investment Trust

☐

If an emerging growth company, indicate by checkmark if the registrant has elected not use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On April 10, 2023, Federal Realty Investment Trust (the “Company”) announced that its operating partnership, Federal Realty OP LP (the “Partnership”), entered into an underwriting agreement with J.P. Morgan Securities LLC, PNC Capital Markets LLC, TD Securities (USA) LLC and BofA Securities, Inc., as representatives of the several underwriters named in Schedule 1 to the underwriting agreement, whereby the Partnership agreed to issue and sell $350,000,000 aggregate principal amount of 5.375% Notes due 2028 (the “Notes”) in an underwritten public offering.

The offering of the Notes closed on April 12, 2023. The Notes are governed by the Indenture, dated as of September 1, 1998, as amended by the First Supplemental Indenture, dated as of January 5, 2022, between the Partnership and U.S. Bank Trust Company, National Association (successor to U.S. Bank National Association (successor trustee to Wachovia Bank, National Association (successor trustee to First Union National Bank))).

The Notes are senior unsecured obligations of the Partnership and rank equally with all of the Partnership’s existing and future senior unsecured indebtedness. The Notes bear interest at 5.375% per annum, and interest is payable on May 1 and November 1 of each year, beginning on November 1, 2023. The Notes will mature on May 1, 2028. The Notes will not be guaranteed by the Company or any of its or the Partnership’s subsidiaries.

Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FEDERAL REALTY INVESTMENT TRUST |

|

|

|

|

FEDERAL REALTY OP LP |

|

|

|

|

| Date: April 12, 2023 |

|

|

|

|

|

/s/ Dawn M. Becker |

|

|

|

|

|

|

Dawn M. Becker |

|

|

|

|

|

|

Executive Vice President-General Counsel and Secretary |

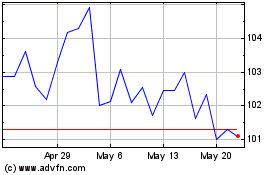

Federal Realty Investment (NYSE:FRT)

Historical Stock Chart

From Apr 2024 to May 2024

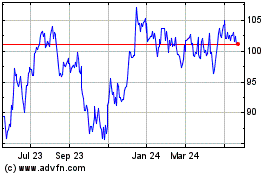

Federal Realty Investment (NYSE:FRT)

Historical Stock Chart

From May 2023 to May 2024