EOG Resources Stays Neutral - Analyst Blog

March 15 2012 - 10:00AM

Zacks

We maintain our Neutral

recommendation on EOG Resources Inc. (EOG). The

company’s better-than-expected fourth quarter 2011 results and

attractive growth profile were partially tempered by its natural

gas weighted production and reserves base.

EOG reported stellar fourth-quarter

2011 results on the back of an almost 54% growth in crude oil

production, which was aided by significant contributions from the

South Texas Eagle Ford play followed by the Fort Worth Barnett

Shale Combo. EOG Resources’ growing emphasis on liquids is

reflected through the growth in its liquid production volume.

We believe liquids rich production

growth is likely to facilitate significant future cash flow for EOG

and will be further augmented by its deep focus on major oil and

liquids rich plays, such as the South Texas Eagle Ford play and the

Fort Worth Barnett Shale Combo, as well as Colorado Niobrara,

Oklahoma Marmaton, West Texas Wolfcamp, Neuquen Basin and New

Mexico Leonard.

The company boosted its capex

guidance by 9.5% to $7.5 billion for this year. As much as 90% of

its drilling capital is directed toward liquids plays, while 10% is

allocated for dry gas drilling. Total organic liquids production

growth is expected at 30%, versus the company’s prior expectation

of 27% for 2012. The primary driver will likely be production in

Eagle Ford, Barnett and Permian.

Again, EOG appears on track to meet

its $1.2 billion divestiture target and below 30% net debt to

capitalization ratio at year-end 2012. The company has already sold

natural gas related properties and now anticipates selling up to

$800 million in non-operated liquids assets during 2012, reflecting

the weak natural gas price environment. In the current scenario of

declining natural gas prices, most of the independent exploration

and production companies are tilting their portfolio toward

oil-based assets and divesting gas-based assets. Notably, we view

redirecting capital from non-operated assets to its premier play as

logical, given the company’s estimation of its after-tax return on

investment in the Eagle Ford at 80%.

However, the company’s results are

particularly exposed to fluctuations in the U.S. natural gas

markets, since natural gas accounts for more than three quarters of

the company’s reserves. Moreover, though EOG has made some progress

in expanding internationally, it is still largely a North American

producer, lacking substantial international diversification.

EOG Resources, which competes with

Chesapeake Energy Corporation (CHK),has a Zacks #3

Rank (Hold rating) for the short term.

CHESAPEAKE ENGY (CHK): Free Stock Analysis Report

EOG RES INC (EOG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

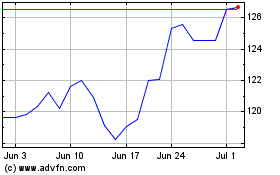

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Jun 2024 to Jul 2024

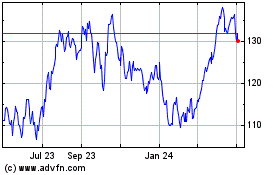

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Jul 2023 to Jul 2024