false0001541401000155307900015414012024-08-152024-08-150001541401esrt:EmpireStateRealtyOPLPMember2024-08-152024-08-150001541401us-gaap:CommonClassAMember2024-08-152024-08-150001541401esrt:SeriesESOperatingPartnershipUnitsMemberesrt:EmpireStateRealtyOPLPMember2024-08-152024-08-150001541401esrt:Series60OperatingPartnershipUnitsMemberesrt:EmpireStateRealtyOPLPMember2024-08-152024-08-150001541401esrt:Series250OperatingPartnershipUnitsMemberesrt:EmpireStateRealtyOPLPMember2024-08-152024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2024 (August 15, 2024)

EMPIRE STATE REALTY TRUST, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-36105 | | 37-1645259 |

(State or other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

EMPIRE STATE REALTY OP, L.P.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-36106 | | 45-4685158 |

(State or other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

111 West 33rd Street, | 12th Floor | |

| New York, | New York | 10120 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 687-8700

n/a

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Empire State Realty Trust, Inc. | | | | |

| Class A Common Stock, par value $0.01 per share | | ESRT | | The New York Stock Exchange |

| | |

| Empire State Realty OP, L.P. | | | | |

| Series ES Operating Partnership Units | | ESBA | | NYSE Arca, Inc. |

| Series 60 Operating Partnership Units | | OGCP | | NYSE Arca, Inc. |

| Series 250 Operating Partnership Units | | FISK | | NYSE Arca, Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 3.01. | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As previously disclosed in the Notification of Late Filing on Form 12b-25 filed by Empire State Realty Trust, Inc. ("ESRT") and Empire State Realty OP, L.P. ("ESROP" and together with ESRT, the “Registrants”) with the Securities and Exchange Commission (“SEC”) on August 12, 2024, each Registrant has determined that it is unable to file its Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (the “Form 10-Q”) by the prescribed due date because subsequent to the filing of the Registrants’ Form 10-Ks for the period ended December 31, 2023, the filing of the Registrants’ Form 10-Qs for the quarterly period ended March 31, 2024 and the Registrants’ Q2 2024 earnings release and call, Ernst & Young LLP (“EY”), the Registrants’ independent registered public accounting firm, informed the Registrants that following EY’s internal post-audit quality review of its audit of the Registrants’ consolidated financial statements for the year ended December 31, 2023, EY had identified control deficiencies in the design of certain information technology general controls for the Registrants’ information systems and applications which were relevant to the preparation of consolidated financial statements as of December 31, 2023.

On August 15, 2024, ESRT received a notice (the “NYSE Notice”) from the New York Stock Exchange (“NYSE”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, ESRT is not in compliance with Section 802.01E of the NYSE Listed Company Manual (the “NYSE Listing Standard”), which requires timely filing of all required periodic financial reports with the SEC. On August 16, 2024, ESROP received a notice (the “NYSE Arca Notice” and together with the NYSE Notice, the “Notices”) from the NYSE Arca, Inc. (“NYSE Arca” and together with “NYSE,” the “Exchanges”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, ESROP is not in compliance with Rule 5.3-E(i)(1) of the NYSE Arca Listed Company Manual (the “NYSE Arca Listing Standard” and together with the NYSE Listing Standard, the “Listing Standards”), which requires timely filing of all required periodic financial reports with the SEC.

Each Notice indicates that the applicable Registrant can regain compliance with the applicable Listing Standard by filing such Registrant's Form 10-Q within six months of the Form 10-Q’s filing due date. If either Registrant fails to file the Form 10-Q by such date, such Registrant may submit a request for the applicable Exchange's consideration that allows such Registrant’s securities to trade for an additional six-month trading period. If such Exchange determines that an additional six-month trading period is not appropriate, suspension and delisting procedures will commence pursuant to Section 804.00 of the NYSE Listed Company Manual or Rule 5.5-E(m) of the NYSE Arca Listed Company Manual, as applicable. If the applicable Exchange determines that an additional trading period of up to six months is appropriate and the applicable Registrant fails to regain compliance by the end of that period, suspension and delisting procedures for such Registrant will generally commence.

While the Registrants can provide no assurances as to timing, each Registrant is working diligently with EY to complete the assessment of the impacts of EY’s findings described above and plans to file the Form 10-Q as soon as practicably possible to regain compliance with the Listing Standard.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | The cover page from this Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | EMPIRE STATE REALTY TRUST, INC. (Registrant) |

| | | |

| Date: August 19, 2024 | | By: | | /s/ Stephen V. Horn |

| | Name: | | Stephen V. Horn |

| | Title: | | Executive Vice President, Chief Financial Officer & Chief Accounting Officer

|

| | | | | | | | | | | | | | |

| | | | |

| | EMPIRE STATE REALTY OP, L.P. (Registrant) By: Empire State Realty Trust, Inc., as general partner |

| | | |

| Date: August 19, 2024 | | By: | | /s/ Stephen V. Horn |

| | Name: | | Stephen V. Horn |

| | Title: | | Executive Vice President, Chief Financial Officer & Chief Accounting Officer |

EMPIRE STATE REALTY TRUST RECEIVES EXPECTED NOTICE FROM NYSE RELATED TO DELAYED FILING OF QUARTERLY REPORT ON FORM 10-Q

New York, New York, August 19, 2024 -- Empire State Realty Trust, Inc. (NYSE: ESRT) (“ESRT”) and Empire State Realty OP, L.P. (“ESROP” and together with ESRT, the “Issuers”), today announced that, as previously disclosed in the Notification of Late Filing on Form 12b-25 filed by each Issuer with the Securities and Exchange Commission (“SEC”) on August 12, 2024, each Issuer has determined that it is unable to file its Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (the “Form 10-Q”) by the prescribed due date because subsequent to the filing of the Issuers’ Form 10-Ks for the period ended December 31, 2023, the filing of the Issuers’ Form 10-Qs for the quarterly period ended March 31, 2024 and the Issuers’ Q2 2024 earnings release and call, Ernst & Young LLP (“EY”), the Issuers’ independent registered public accounting firm, informed the Issuers that following EY’s internal post-audit quality review of its audit of the Issuers’ consolidated financial statements for the year ended December 31, 2023, EY had identified control deficiencies in the design of certain information technology general controls for the Issuers’ information systems and applications which were relevant to the preparation of consolidated financial statements as of December 31, 2023.

On August 15, 2024, ESRT received a notice (the “NYSE Notice”) from the New York Stock Exchange (“NYSE”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, ESRT is not in compliance with Section 802.01E of the NYSE Listed Company Manual (the “NYSE Listing Standard”), which requires timely filing of all required periodic financial reports with the SEC. On August 16, 2024, ESROP received a notice (the “NYSE Arca Notice” and together with the NYSE Notice, the “Notices”) from the NYSE Arca, Inc. (“NYSE Arca” and together with “NYSE,” the “Exchanges”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, ESROP is not in compliance with Rule 5.3-E(i)(1) of the NYSE Arca Listed Company Manual (the “NYSE Arca Listing Standard” and together with the NYSE Listing Standard, the “Listing Standards”), which requires timely filing of all required periodic financial reports with the SEC.

Each Notice indicates that the applicable Issuer can regain compliance with the applicable Listing Standard by filing such Issuer’s Form 10-Q within six months of the Form 10-Q’s filing due date. If either Issuer fails to file the Form 10-Q by such date, such Issuer may submit a request for the applicable Exchange’s consideration that allows such Issuer’s securities to trade for an additional six-month trading period. If such Exchange determines that an additional six-month trading period is not appropriate, suspension and delisting procedures will commence pursuant to Section 804.00 of the NYSE Listed Company Manual or Rule 5.5-E(m) of the NYSE Arca Listed Company Manual, as applicable. If the applicable Exchange determines that an additional trading period of up to six months is appropriate and the applicable Issuer fails to regain compliance by the end of that period, suspension and delisting procedures for such Issuer will generally commence.

While the Issuers can provide no assurances as to timing, each Issuer is working diligently with EY to complete the assessment of the impacts of EY’s findings described above and plans to file the Form 10-Q as soon as practicably possible to regain compliance with the Listing Standard.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of modernized, amenitized, and well-located office, retail, and multifamily assets. ESRT’s flagship Empire State Building, the “World's Most Famous Building,” features its iconic Observatory that was declared the #1 Attraction in the World – and the #1 Attraction in the U.S. for the third consecutive year – in Tripadvisor’s 2024 Travelers’ Choice Awards: Best of the Best Things to Do. The Company is the recognized leader in energy efficiency and indoor environmental quality. As of June 30, 2024, ESRT’s portfolio is comprised of approximately 7.9 million rentable square feet of office space, 0.7 million rentable square feet of retail space and 727 residential units. More information about Empire State Realty Trust can be found at esrtreit.com and by following ESRT on Facebook, Instagram, TikTok, X, and LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the federal securities laws, including without limitation statements regarding each Issuer’s filing of the Form 10-Q and each Issuer’s ability to regain compliance with the applicable Listing Standards. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of complying with those safe harbor provisions. You can identify these statements by use of words such as “aims,” “anticipates,” “approximately,” “believes,” “contemplates,” “continues,” “estimates,” “expects,” “forecasts,” “hope,” “intends,” “may,” “plans,” “seeks,” “should,” “thinks,” “will,” “would” or the negative of these words and phrases or similar words or expressions that do not relate to historical matters. You should exercise caution in interpreting and relying on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Issuers’ control and could materially affect actual results, performance or achievements. These factors include, without limitation, the risks and uncertainties detailed from time to time in the Issuers’ filings with the SEC and any failure of the conditions or events cited in this release. Except as may be required by law, the Issuers do not undertake a duty to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Contact:

Investors

Empire State Realty Trust Investor Relations

(212) 850-2678

IR@esrtreit.com

Category: FINANCIAL

# # #

v3.24.2.u1

Cover

|

Aug. 15, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity Registrant Name |

EMPIRE STATE REALTY TRUST, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-36105

|

| Entity Tax Identification Number |

37-1645259

|

| Entity Address, Address Line One |

111 West 33rd Street,

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10120

|

| City Area Code |

212

|

| Local Phone Number |

687-8700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001541401

|

| Amendment Flag |

false

|

| Common Class A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.01 per share

|

| Trading Symbol |

ESRT

|

| Security Exchange Name |

NYSE

|

| Empire State Realty OP, LP |

|

| Entity Information [Line Items] |

|

| Entity Registrant Name |

EMPIRE STATE REALTY OP, L.P.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36106

|

| Entity Tax Identification Number |

45-4685158

|

| Entity Central Index Key |

0001553079

|

| Empire State Realty OP, LP | Series ES Operating Partnership Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series ES Operating Partnership Units

|

| Trading Symbol |

ESBA

|

| Security Exchange Name |

NYSEArca

|

| Empire State Realty OP, LP | Series 60 Operating Partnership Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series 60 Operating Partnership Units

|

| Trading Symbol |

OGCP

|

| Security Exchange Name |

NYSEArca

|

| Empire State Realty OP, LP | Series 250 Operating Partnership Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series 250 Operating Partnership Units

|

| Trading Symbol |

FISK

|

| Security Exchange Name |

NYSEArca

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=esrt_EmpireStateRealtyOPLPMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=esrt_SeriesESOperatingPartnershipUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=esrt_Series60OperatingPartnershipUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=esrt_Series250OperatingPartnershipUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

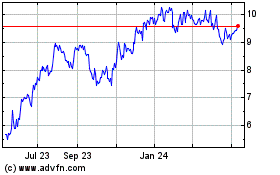

Empire State Realty (NYSE:ESRT)

Historical Stock Chart

From Sep 2024 to Oct 2024

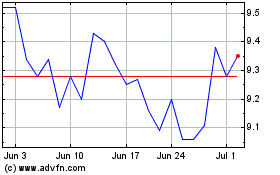

Empire State Realty (NYSE:ESRT)

Historical Stock Chart

From Oct 2023 to Oct 2024