Ecolab Arranges Committed Bank Financing

September 08 2011 - 4:15PM

Business Wire

Ecolab Inc. announced it has arranged committed bank financing

which will enable it to close its pending merger with Nalco Holding

Company.

Ecolab has entered into a $2.0 billion 364-day revolving credit

facility and a $1.5 billion 5-year revolving credit facility. These

senior credit facilities will be used for general corporate

purposes, including share repurchases, the repayment of other

indebtedness, acquisitions and support of commercial paper

issuances. The senior credit facilities will be used in connection

with the funding of Ecolab’s previously announced merger with Nalco

Holding Company. The transaction remains subject to other customary

closing conditions, including approval by the stockholders of both

companies. Subject to satisfaction of these other closing

conditions, the merger is expected to close in the fourth quarter

of 2011.

With sales of $6 billion and more than 26,000 associates, Ecolab

(NYSE: ECL) is the global leader in cleaning, sanitizing, food

safety and infection prevention products and services. Ecolab

delivers comprehensive programs and services to the foodservice,

food and beverage processing, healthcare, and hospitality markets

in more than 160 countries. More news and information is available

at www.ecolab.com.

Cautionary Statements Regarding Forward-Looking

InformationThis news release contains certain statements

relating to future events and our -more-intentions, beliefs,

expectations and predictions for the future which are

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. Words or phrases such as

"will likely result," "are expected to," "will continue," "is

anticipated," "we believe," "we expect," "estimate," "project,"

"may," "will," "intend," "plan," "believe," "target," "forecast"

(including the negative or variations thereof) or similar

terminology used in connection with any discussion of future plans,

actions or events generally identify forward-looking statements.

These forward-looking statements include, but are not limited to,

statements regarding uses of funds available under our credit

facilities, our plans with respect to share repurchases, benefits

of the Nalco merger, integration plans and expected synergies, the

expected timing of completion of the merger, and anticipated future

financial and operating performance and results, including

estimates for growth. These statements are based on the current

expectations of management of Ecolab and Nalco, as applicable.

There are a number of risks and uncertainties that could cause

actual results to differ materially from the forward-looking

statements included in this communication. These risks and

uncertainties include (i) the risk that the stockholders of

Nalco may not adopt the merger agreement, (ii) the risk that

the stockholders of Ecolab may not approve the issuance of Ecolab

common stock to Nalco stockholders in the merger, (iii) the

risk that the companies may be unable to obtain regulatory

approvals required for the merger, or that required regulatory

approvals may delay the merger or result in the imposition of

conditions that could have a material adverse effect on the

combined company or cause the companies to abandon the merger,

(iv) the risk that the conditions to the closing of the merger

may not be satisfied, (v) the risk that a material adverse

change, event or occurrence may affect Ecolab or Nalco prior to the

closing of the merger and may delay the merger or cause the

companies to abandon the merger, (vi) the risk that an

unsolicited offer by another company to acquire shares or assets of

Ecolab or Nalco could interfere with or prevent the merger,

(vii) problems that may arise in successfully integrating the

businesses of the companies, which may result in the combined

company not operating as effectively and efficiently as expected,

(viii) the possibility that the merger may involve unexpected

costs, unexpected liabilities or unexpected delays, (ix) the

risk that the credit ratings of the combined company or its

subsidiaries may be different from what the companies currently

expect, (x) the risk that the businesses of the companies may

suffer as a result of uncertainty surrounding the merger and

(xi) the risk that disruptions from the transaction will harm

relationships with customers, employees and suppliers.

Other unknown or unpredictable factors could also have material

adverse effects on future results, performance or achievements of

Ecolab, Nalco and the combined company. For a further discussion of

these and other risks and uncertainties applicable to the

respective businesses of Ecolab and Nalco, see the Annual Reports

on Form 10-K of Ecolab and Nalco for the fiscal year ended

December 31, 2010 and the companies' other public filings with

the Securities and Exchange Commission (the “SEC”). These risks, as

well as other risks associated with the merger, are more fully

discussed in the joint proxy statement/prospectus included in the

Registration Statement on Form S-4 that Ecolab filed with the

SEC on August 31, 2011 in connection with the merger. In light of

these risks, uncertainties, assumptions and factors, the

forward-looking events discussed in this communication may not

occur. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

communication. Neither Ecolab nor Nalco undertakes, and each of

them expressly disclaims, any duty to update any forward-looking

statement whether as a result of new information, future events or

changes in their respective expectations, except as required by

law.

Additional Information and Where to Find itEcolab filed

with the SEC on August 31, 2011 a registration statement on

Form S-4 that includes a joint proxy statement of Ecolab and

Nalco and that also constitutes a prospectus of Ecolab relating to

the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO

READ THE REGISTRATION STATEMENT AND JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS BECAUSE THEY

CONTAIN IMPORTANT INFORMATION about Ecolab, Nalco and the proposed

merger. Investors and security holders may obtain these materials

and other documents filed with the SEC free of charge at the SEC's

website, www.sec.gov. In addition, copies of the registration

statement and joint proxy statement/prospectus may be obtained free

of charge by accessing Ecolab's website at www.ecolab.com by

clicking on the "Investor" link and then clicking on the "SEC

Filings" link or by writing Ecolab at 370 Wabasha

Street North, Saint Paul, Minnesota, 55102,

Attention: Corporate Secretary or by accessing Nalco's website

at www.nalco.com by clicking on the "Investors" link and then

clicking on the "SEC Filings" link or by writing Nalco at

1601 West Diehl Road, Naperville, Illinois 60563,

Attention: Corporate Secretary, and security holders may also read

and copy any reports, statements and other information filed by

Ecolab or Nalco with the SEC, at the SEC public reference room at

100 F Street, N.E.,

Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 or visit the SEC's website for further information

on its public reference room.

Participants in the Merger SolicitationEcolab, Nalco and

certain of their respective directors, executive officers and other

members of management and employees may be deemed to be

participants in the solicitation of proxies in respect of the

proposed transaction. Information regarding Ecolab's directors and

executive officers is available in its proxy statement filed with

the SEC by Ecolab on March 18, 2011 in connection with its

2011 annual meeting of stockholders, and information regarding

Nalco's directors and executive officers is available in its proxy

statement filed with the SEC by Nalco on March 14, 2011 in

connection with its 2011 annual meeting of stockholders. Other

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, is contained in the registration

statement and joint proxy statement/prospectus and other relevant

materials filed by Ecolab and Nalco with the SEC.

Non-SolicitationThis communication does not constitute an

offer to sell or the solicitation of an offer to buy any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

(ECL-C)

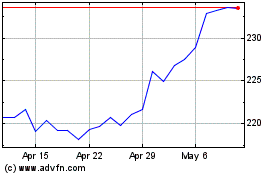

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2024 to Nov 2024

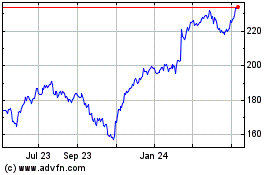

Ecolab (NYSE:ECL)

Historical Stock Chart

From Nov 2023 to Nov 2024