Earnings Preview: Ecolab - Analyst Blog

July 25 2011 - 11:00AM

Zacks

Leading cleaning and sanitation

products maker Ecolab Inc (ECL) is scheduled to

report its second-quarter fiscal 2011 results on July 27. The

Minnesota-based company expects adjusted earnings between 62 cents

and 64 cents a share.

Ecolab expects improved

year-over-year revenue growth in the second quarter. Adjusted gross

margin target for the quarter is roughly 50%. The current Zacks

Consensus Estimate for revenues and earnings for the second quarter

are $1,654 million and 64 cents, respectively.

With respect to earnings surprise,

Ecolab’s performance has been erratic over the preceding four

quarters. The company has posted two positive surprises over the

last four quarters while it has trailed and met the Zacks Consensus

Estimates on the other two occasions. Ecolab has produced an

average positive earnings surprise 1.24% over the same period,

implying that it has beaten the Zacks Consensus Estimate by that

measure.

First-Quarter

Recap

Ecolab’s first quarter adjusted

earnings of 45 cents beat the Zacks Consensus Estimate by a penny

while exceeding the year-ago earnings of 41 cents. Profit

(attributable to Ecolab) fell 2% year over year to $93.6 million,

hit by charges associated with the company’s European restructuring

and acquisition as well as higher tax. Revenues climbed 6% to

$1,518.3 million, also beating the Zacks Consensus

Estimate.

The results were boosted by strong

performances across the company’s core U.S. Cleaning &

Sanitizing business as well as Asia-Pacific and Latin American

operations. Moreover, currency exchange translation had a favorable

impact on the results. Ecolab raised its fiscal 2011 adjusted

earnings per share guidance.

Estimate Revisions

Trend

Agreement

Estimates for the forthcoming

quarter reflect bullishness among the analysts with 5 (out of 11

analysts) having raised their forecasts over the past week and

month with no reverse movements. A similar trend applies to the

estimates for fiscal 2011 with 7 analysts (out of 14) having lifted

their estimates over the corresponding periods with none moving in

the opposite direction. The current Zacks Consensus Estimate (of 64

cents) represents an estimated 13.64% year-over-year growth.

Magnitude

The upward revisions coupled with a

strong directional consensus have led to a rise in the estimates

for the second quarter and fiscal 2011. Estimates for the second

quarter as well as fiscal 2011 have increased by a penny over the

past 7 and 30 days. The current Zacks Consensus Estimate for 2011

is $2.53, representing an estimated year-over-year growth of

13.52%.

Ecolab in Neutral

Lane

Ecolab develops and markets

products and services for the hospitality, foodservice,

institutional and industrial markets. The company offers cleaning,

sanitation, pest elimination, maintenance and repair products as

well as systems and services.

Ecolab leads in cleaning,

sanitizing, pest elimination and food safety solutions with annual

sales of roughly $6 billion. The company is investing in strategic

areas such as product innovation and sales organization while

rationalizing operating costs to boost margins.

Ecolab is also active on the

acquisition front and continues to explore opportunities to expand

into emerging markets for growth. In this regard, we believe that

its recent decision to buy Nalco Holding Company

(NLC) is a strategic fit and highly complementary for the company,

enabling it to bolster its water management business. Moreover,

Ecolab remains committed to deliver incremental returns to

investors leveraging a solid balance sheet and healthy cash

flow.

To drive efficiency and

profitability, Ecolab is restructuring its European business. The

company expects savings from the restructuring to benefit its

second-half 2011 results, including opportunities for meaningful

margin expansion.

While we are encouraged by Ecolab’s

strong international exposure and recovery across its end-markets,

we remain concerned about aggressive competition. The company’s

U.S. Cleaning & Sanitizing and International divisions face

stiff competition from Clorox (CLX) and

Church & Dwight (CHD).

Moreover, raw material price

fluctuations represent a headwind for Ecolab and its aggressive

acquisition strategy has inherent integration risks. While Ecolab

will eventually benefit from the meaningful savings to be realized

from its European restructuring program, associated expenses may

weigh on its bottom line. We are currently Neutral on the

stock.

CHURCH & DWIGHT (CHD): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

ECOLAB INC (ECL): Free Stock Analysis Report

NALCO HLDG CO (NLC): Free Stock Analysis Report

Zacks Investment Research

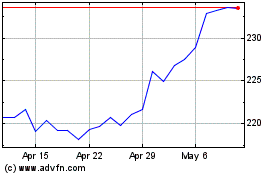

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jun 2024 to Jul 2024

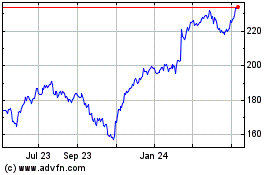

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jul 2023 to Jul 2024