SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 17)*

Ecolab Inc.

(Name of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

278865100

(CUSIP Number)

|

William A. Groll, Esq.

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, NY 10006

212-225-2000

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 10, 2008

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

o

.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7(b) for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

This Amendment No. 17 (this “Amendment”) amends and supplements the Schedule 13D filed on December 20, 1989, as previously amended (the “Schedule 13D”), of Henkel AG & Co. KGaA (formerly known as Henkel KGaA) (“KGaA” and, together with its affiliates, “The Henkel Group”) and Henkel Corporation (as successor by merger to HC Investments, Inc.), with respect to the Common Stock, par value $1.00 per share (“Common Stock”), of Ecolab Inc. (“Ecolab” or the “Company”). All capitalized terms used in this Amendment and not otherwise defined herein have the meanings ascribed to such terms in the Schedule 13D.

|

Item 4.

|

Purpose of Transaction

.

|

To facilitate Henkel’s previously disclosed intention to sell part or all Henkel’s stake in Ecolab, on November 10, 2008, KGaA entered into an agreement with Ecolab amending the Stockholder’s Agreement (Amendment No. 1 to Second Amended and Restated Stockholder’s Agreement, referred to herein as the “Stockholder’s Agreement Amendment”) and KGaA and Henkel Corporation entered into a Stock Purchase Agreement with Ecolab (the “Stock Purchase Agreement”), each as more fully described in this Amendment. The Stockholder’s Agreement Amendment is filed with this Amendment as Exhibit 26 and the Stock Purchase Agreement is filed with this Amendment as Exhibit 27, and each is incorporated herein by this reference in its entirety. The descriptions contained in this Amendment of various terms of the Stockholder’s Agreement

Amendment and the Stock Purchase Agreement are qualified in their entirety by reference to the respective agreement.

The Stockholder’s Agreement Amendment generally amends certain provisions of the Stockholder’s Agreement that restrict Henkel’s ability to dispose of its holdings by adding provisions that enable Henkel to undertake up to two registered public offerings of its stake in which Ecolab would provide certain cooperation and provisions that additionally enable Henkel

to undertake certain market sales after the successful completion of such public offering(s). In addition, in the Stock Purchase Agreement, Ecolab has agreed to purchase, and KGaA and Henkel Corporation have agreed to sell, shares of Common Stock in connection with a registered public offering meeting certain criteria.

Specifically, the Stockholder’s Agreement Amendment provides that Henkel may dispose of shares in up to two underwritten public offerings (the “Amendment Offerings”) conducted in accordance with the Stockholder’s Agreement except that the right of first refusal provided therein is not applicable and sales may be made to an agreed upon list of potential purchasers as long as such purchasers will not beneficially own more than 5% of the outstanding Voting Securities. Henkel may only complete the sale in the first such offering if at least 43,700,000 shares of Common Stock are sold (and, if such number of shares cannot be sold in the first offering, Henkel may only complete the sale in the second offering if at least that many shares are sold then). Ecolab agrees that, in connection with the two Amendment Offerings, it will make members of its senior

management available to participate in mutually acceptable road shows. Henkel will bear the cost of any such road show.

Under the Stock Purchase Agreement, if Henkel completes an offering of at least 43,700,000 shares of Common Stock, Henkel would also sell to Ecolab, and Ecolab would repurchase from Henkel, shares of Common Stock at a price of at least $300,000,000. Ecolab could also purchase additional shares. The number of shares that would be delivered by Henkel upon such purchase would provide Ecolab a discount of between $40,000,000 (if Ecolab purchased the minimum number of shares for $300,000,000) to $50,000,000 (if Ecolab purchased the number of shares it would obtain for $500,000,000), priced per share before the

discount at the net offering price at which Henkel sold shares in the offering (including the effect of any discretionary fees or underwriting discounts).

At Henkel’s request, on November 10, 2008, Ecolab filed a registration statement with the U.S. Securities and Exchange Commission to enable Henkel to undertake the sale of up to all its Shares in accordance with the Stockholder’s Agreement Amendment and the Stock Purchase Agreement.

Except as set forth herein, KGaA and Henkel Corporation have no current plans or proposals that relate to or would result in any of the actions or events enumerated in clauses (a) through (j) of Item 4 of Schedule 13D, as promulgated by the Securities and Exchange Commission.

|

Item 7.

|

Material to be filed as Exhibits

.

|

|

Exhibit 26

|

Amendment No. 1 to Second Amended and Restated Stockholder’s Agreement, dated as of November 10, 2008, between Ecolab and KGaA

|

|

Exhibit 27

|

Stock Purchase Agreement, dated as of November 10, 2008, by and among KGaA, Henkel Corporation and Ecolab

|

|

|

|

Signature

After reasonable inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement is true, complete and correct.

Dated: November 10, 2008

Henkel AG & Co. KGaA

By:

/s/

Thomas Gerd Kühn

Name: Thomas Gerd Kühn

Title: General Counsel

By:

/s/

Heinz Nicolas

Name: Heinz Nicolas

Title: Senior Corporate Counsel

Henkel Corporation

By:

/s/

Paul R. Berry

Name: Paul R. Berry

Title: Senior Vice President and

Chief Legal Officer

Exhibit Index

|

Exhibit 1

|

Stock Purchase Agreement by and among HC Investments, Inc., Henkel KGaA and Ecolab Inc. dated as of December 11, 1989

|

(i)

|

|

Exhibit 2

|

Amendment No. 1 to Stock Purchase Agreement by and among HC Investments,

Inc.,

Henkel KGaA and Ecolab Inc. dated as of December 11, 1989

|

(i)

|

|

Exhibit 3

|

Confidentiality Agreement between Henkel KGaA and Ecolab Inc. dated November 13, 1989

|

(i)

|

|

Exhibit 4

|

Press Release issued by Ecolab Inc. and Henkel KGaA on December 11, 1989

|

(i)

|

|

Exhibit 5

|

Amendment No. 2 to Stock Purchase Agreement by and among HC Investments,

Inc.,

Henkel KGaA and Ecolab Inc. dated as of September 11, 1990

|

(ii)

|

|

Exhibit 6

|

Umbrella Agreement by and between Henkel KGaA and Ecolab Inc. dated as of September 11, 1990

|

(ii)

|

|

Exhibit 7

|

Joint Venture Agreement by and between Henkel KGaA and Ecolab Inc. dated as of September 11, 1990

|

(ii)

|

|

Exhibit 8

|

Stockholder’s Agreement between Henkel KGaA and Ecolab Inc. dated as of September 11, 1990

|

(ii)

|

|

Exhibit 9

|

Amendment No. 3 to Stock Purchase Agreement by and among HC Investments,

Inc.,

Henkel KGaA and Ecolab Inc. dated as of March 8, 1991

|

(iii)

|

|

Exhibit 10

|

First Amendment to the Umbrella Agreement by and between Henkel KGaA and Ecolab Inc. dated as of March 8, 1991

|

(iii)

|

|

Exhibit 11

|

First Amendment to the Joint Venture Agreement by and between Henkel KGaA and Ecolab Inc. dated as of March 8, 1991

|

(iii)

|

|

Exhibit 12

|

First Amendment to the Stockholder’s Agreement between Henkel KGaA and Ecolab

Inc.

dated as of March 8, 1991

|

(iii)

|

|

Exhibit 13

|

Amended and Restated Umbrella Agreement by and between Henkel KGaA and Ecolab Inc. dated as of June 26, 1991

|

(iv)

|

|

Exhibit 14

|

Amended and Restated Joint Venture Agreement by and between Henkel KGaA and Ecolab Inc. dated as of June 26, 1991

|

(iv)

|

|

Exhibit 15

|

Amended and Restated Stockholder’s Agreement between Henkel KGaA and Ecolab Inc. dated as of June 26, 1991

|

(iv)

|

|

Exhibit 16

|

Press Release issued by Ecolab Inc. and Henkel KGaA on July 11, 1991

|

(iv)

|

|

Exhibit 17

|

Amendment No. 1 to Amended and Restated Stockholder’s Agreement between Henkel KGaA and Ecolab Inc. dated as of June 30, 2000

|

(v)

|

|

Exhibit 18

|

Master Agreement, dated as of December 7, 2000, between Ecolab Inc. and Henkel KGaA

|

(v)

|

|

Exhibit 19

|

Form of Amended Stockholder’s Agreement

|

(v)

|

|

Exhibit 20

|

Purchases of Common Stock from December 14, 2000 through October 5, 2001

|

(vi)

|

|

Exhibit 21

|

Purchases of Common Stock from October 9, 2001 through November 23, 2001

|

(vii)

|

|

Exhibit 22

|

Agreement to be Bound by Chemie dated as of December 31, 2002

|

(viii)

|

|

Exhibit 23

|

Agreement to be Bound by Henkel Corporation dated as of December 15, 2004

|

(ix)

|

|

Exhibit 24

|

Press release issued by Henkel KGaA on February 27, 2008

|

(x)

|

|

Exhibit 25

|

Letter from Henkel AG & Co. KGaA to Ecolab Inc. dated June 27, 2008

|

(xi)

|

|

Exhibit 26

|

Amendment No. 1 to Second Amended and Restated Stockholder’s Agreement, dated as of November 10, 2008, between Ecolab and KGaA

|

|

|

Exhibit 27

|

Stock Purchase Agreement, dated as of November 10, 2008, by and among KGaA, Henkel Corporation and Ecolab

|

|

|

(i)

|

Previously filed as an Exhibit to the Schedule 13D on December 20, 1989.

|

|

(ii)

|

Previously filed as an Exhibit to Amendment No. 2 to the Schedule 13D on September 17, 1990.

|

|

(iii)

|

Previously filed as an Exhibit to Amendment No. 3 to the Schedule 13D on March 15, 1991.

|

|

(iv)

|

Previously filed as an Exhibit to Amendment No. 4 to the Schedule 13D on July 16, 1991.

|

|

(v)

|

Previously filed as an Exhibit to Amendment No. 5 to the Schedule 13D on December 15, 2000.

|

|

(vi)

|

Previously filed as an Exhibit to Amendment No. 6 to the Schedule 13D on October 9, 2001.

|

|

(vii)

|

Previously filed as an Exhibit to Amendment No. 7 to the Schedule 13D on November 26, 2001.

|

|

(viii)

|

Previously filed as an Exhibit to Amendment No. 9 to the Schedule 13D on January 8, 2003.

|

|

(ix)

|

Previously filed as an Exhibit to Amendment No. 12 to the Schedule 13D on February 1, 2005.

|

|

(x)

|

Previously filed as an Exhibit to Amendment No. 15 to the Schedule 13D on February 27, 2008.

|

|

(xi)

|

Previously filed as an Exhibit to Amendment No. 16 to the Schedule 13D on July 7, 2008.

|

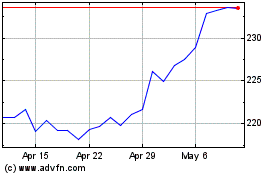

Ecolab (NYSE:ECL)

Historical Stock Chart

From Oct 2024 to Nov 2024

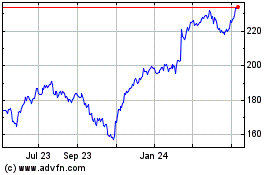

Ecolab (NYSE:ECL)

Historical Stock Chart

From Nov 2023 to Nov 2024