The Dow Chemical Company (NYSE: DOW):

Third Quarter 2011 Highlights

- Dow reported earnings of $0.69 per

share. This compares with reported earnings of $0.45 per share

in the same period last year. The Company delivered earnings of

$0.62 per share excluding certain items(1), compared with

$0.54 per share on the same basis in the year-ago period.

- On a reported basis, the Company

delivered EBITDA(2) of $2.1 billion. EBITDA excluding certain

items was $2.0 billion, the highest third quarter result in Dow’s

history. This contributed to record year-to-date EBITDA on the same

basis of $6.8 billion, up 21 percent year-over-year.

- Sales were $15.1 billion, up

17 percent versus the year-ago period. Double-digit sales

increases were reported across all operating segments and

geographic areas. Sales in emerging geographies reached

$5 billion, representing a new quarterly record, and the

Company also achieved record sales in China.

- Volume growth in Latin America

(7 percent) and Asia Pacific (5 percent) offset decreases

in the United States and Western Europe, which were each

down 3 percent. Volume growth in emerging geographies was

led by China (12 percent), India (11 percent) and Brazil

(10 percent).

- Price was up 17 percent, and rose

in all operating segments, more than offsetting a $1.7 billion

increase in purchased feedstock and energy costs. Double-digit

price gains were achieved in all geographic areas and in most

operating segments.

- Dow continued to deliver against its

innovation targets. Year-to-date sales from new products introduced

in the past five years represented 30 percent of the Company’s

total sales. Among its milestones, the Company recently announced

the commercial launch of the DOW™ POWERHOUSE™ Solar Shingle, first

in Colorado and rolling into targeted states through 2012.

- Equity earnings were $375 million

on a reported basis, or $289 million excluding certain items,

which represents a 15 percent increase year-over-year. The

Company achieved $964 million of equity earnings, or

$878 million excluding certain items through the third

quarter, a year-to-date record.

- Dow reduced debt by nearly $500 million

in the quarter, bringing its net debt(3) to total capitalization to

40.9 percent. Year to date, the Company has reduced debt by

$4.2 billion.

Comment

Andrew N. Liveris, Dow’s chairman and chief executive officer,

stated:

“Dow delivered broad-based sales gains and significant earnings

growth this quarter, reflecting the strength of our transformed

business portfolio. Our diversified geographic presence was also on

display, as our investments in emerging regions enabled us to

capitalize on growth where it is happening most rapidly, even as

developed regions paused in their economic recovery.

“We achieved record EBITDA for both the quarter and year to

date. This performance demonstrates that our strategy is delivering

results, as we commercialize our R&D pipeline, strengthen our

balanced and integrated portfolio, build upon our formidable

feedstock advantage, and drive efficiencies throughout our business

to deliver earnings growth.

“This quarter shows clearly that Dow has the agility and

flexibility to respond to rapidly changing economic conditions. We

took actions again this quarter to provide near-term flexibility in

anticipation of volatile economic environments, while also

continuing to invest for long-term growth. We are operating from a

position of financial strength. Dow is an enterprise that is built

for times like these – and is built to grow.”

Three Months Ended In millions, except per share amounts

Sept 30,

2011

Sept 30,

2010

Net Sales $15,109 $12,868 Net Income Available for Common

Stockholders $815 $512 Net Income Available for Common

Stockholders, excluding Certain Items

$729

$620

Earnings per Common Share – diluted $0.69 $0.45 Earnings per

Common Share – diluted, excluding Certain Items $0.62 $0.54

Review of Third Quarter Results

The Dow Chemical Company (NYSE: DOW) reported sales of

$15.1 billion, a 17 percent increase compared with the

same period last year, with top-line growth driven by price.

Double-digit sales gains were reported in all operating segments,

with the largest percentage increases in Feedstocks and Energy

(34 percent) and Agricultural Sciences (27 percent).

Double-digit sales increases were also reported in all geographic

areas, with the largest growth in Latin America (21 percent)

and Europe, Middle East and Africa (EMEA) (19 percent). In

emerging geographies, sales reached $5 billion, a new

quarterly record for the Company.

Price rose 17 percent at the Company level. Broad-based

price gains were achieved in all geographic areas, led by EMEA

(21 percent) and North America (17 percent). Double-digit

price gains were reported in all operating segments, except

Electronic and Functional Materials (up 8 percent) and Agricultural

Sciences (up 9 percent). Price gains offset a

$1.7 billion increase in purchased feedstock and energy

costs.

At the Company level, volume was flat versus the same quarter

last year, as demand gains in Latin America (7 percent) and

Asia Pacific (5 percent) offset decreases in North America

(3 percent) and EMEA (2 percent). Volume growth in

emerging geographies was 7 percent, led by China

(12 percent), India (11 percent) and Brazil

(10 percent). Across operating segments volume gains were

reported in Agricultural Sciences (18 percent), Electronic and

Functional Materials (3 percent) and Performance Plastics

(1 percent).

Dow delivered $2.1 billion of EBITDA. EBITDA excluding

certain items was $2.0 billion, representing the highest third

quarter result in the Company’s history. Electronic and Functional

Materials achieved a new quarterly EBITDA record. EBITDA for the

first nine months of the year was $6.4 billion. Year-to-date

EBITDA performance of $6.8 billion excluding certain items

represents a record and a 21 percent increase

year-over-year.

Reported earnings for the current quarter were $0.69 per

share, compared with reported earnings of $0.45 per share in

the same period last year. The Company delivered $0.62 per

share excluding certain items, compared with $0.54 per share

on the same basis in the year-ago period. Certain items in the

current quarter consisted of a pretax $86 million gain related to

cash collected on a previously impaired note receivable related to

Equipolymers, a nonconsolidated affiliate. The gain is shown as

"Equity in earnings of nonconsolidated affiliates" in the

consolidated statements of income and reflected in Performance

Plastics. (See Supplemental Information at the end of the release

for a description of certain items affecting results in all periods

presented.)

Dow’s global operating rate was 83 percent, down

3 percentage points from the year-ago period. Sequentially,

the Company’s operating rate decreased 1 percentage point.

Selling, General and Administrative (SG&A) expenses were up

8 percent versus the year-ago period, driven in part by

increased spending in Agricultural Sciences in support of product

launches and growth initiatives.

Research and Development (R&D) expenses were flat with the

year-ago period. The Company continued to preferentially invest in

its technology pipeline, most notably in Agricultural Sciences and

Electronic and Functional Materials, each with a double-digit

increase in R&D investment.

Equity earnings were $375 million on a reported basis.

Equity earnings were $289 million excluding certain items, which

represents a 15 percent increase. Dow has achieved

$964 million of equity earnings, or $878 million

excluding certain items through the third quarter, representing a

year-to-date record.

The Company continued to make solid progress in deleveraging its

balance sheet, reducing debt by nearly $500 million in the

third quarter of 2011. As a result, net debt to total

capitalization fell to 40.9 percent. Year to date Dow has reduced

debt by $4.2 billion.

The Company continued to surpass its growth synergy targets,

delivering $1.7 billion in sales on an annual run-rate basis.

Sequentially, the Company’s growth synergy run-rate grew 14

percent.

“Dow delivered broad-based sales gains and significant earnings

growth this quarter, reflecting the strength of our transformed

business portfolio,” said Andrew N. Liveris, Dow’s chairman and

chief executive officer. “Our diversified geographic presence was

also on display, as our investments in emerging regions enabled us

to capitalize on growth where it is happening most rapidly, even as

developed regions paused in their economic recovery.

“We achieved record EBITDA for both the quarter and year to

date. This performance demonstrates that our strategy is delivering

results, as we commercialize our R&D pipeline, strengthen our

balanced and integrated portfolio, build upon our formidable

feedstock advantage, and drive efficiencies throughout our business

to deliver earnings growth.

“This quarter shows clearly that Dow has the agility and

flexibility to respond to rapidly changing economic conditions. We

took actions again this quarter to provide near-term flexibility in

anticipation of volatile economic environments, while also

continuing to invest for long-term growth. We are operating from a

position of financial strength. Dow is an enterprise that is built

for times like these – and is built to grow.”

Electronic and Functional Materials

Sales in Electronic and Functional Materials were

$1.2 billion, up 11 percent from the same quarter last

year, driven by volume growth of 3 percent and a price gain of

8 percent.

Dow Electronic Materials reported the strongest demand growth in

the Semiconductor Technologies and Display Technologies businesses,

driven by new product introductions, positions in higher-growth

advanced technology nodes and solid growth in organic light

emitting diode (OLED) materials. In Asia Pacific, Dow Electronic

Materials reported demand growth across all business units. The

business recorded several customer wins in the quarter involving

chemical mechanical planarization pads and slurries, photoresist

and display films.

Functional Materials reported a double-digit increase in sales

versus the year-ago period, driven primarily by price. Dow Wolff

Cellulosics reported double-digit volume growth in EMEA and demand

gains in North America, driven by food and pharmaceuticals demand.

Dow Microbial Control continued to see volume growth in North

America, led by ongoing demand from energy end-markets. Dow Home

and Personal Care reported volume growth in all geographic areas

excluding North America, with the largest gains in Latin America

and Asia Pacific.

Equity earnings were $23 million, reflecting the contribution

from Dow Corning. This result was flat with the same period last

year. EBITDA for the segment was $306 million, which compares with

EBITDA of $277 million in the year-ago period.

Coatings and Infrastructure Solutions

Coatings and Infrastructure Solutions sales were $1.9 billion,

with volume down 4 percent and price up 14 percent.

Double-digit price gains were reported in all businesses except Dow

Water and Process Solutions, where price was up 5 percent.

Dow Building and Construction reported a double-digit price gain

overall, with increases in all geographic areas. Ongoing depressed

demand conditions in North America and EMEA were offset by

double-digit growth in the emerging regions. Results for the

business were partly impacted by ongoing investment in the DOW™

POWERHOUSE™ Solar Shingle, for which the business recently

announced its commercial launch. Dow Coating Materials reported

double-digit price gains across all geographic areas except EMEA,

offsetting soft demand conditions. Dow Water and Process Solutions

reported price and volume gains in EMEA, North America and Asia

Pacific. The business saw double-digit demand growth in the

emerging regions, fueled by strong gains in ion exchange resins,

notably in Greater China.

Equity earnings were $72 million, largely reflecting the

contribution from Dow Corning. This result is down slightly from

the $75 million reported in the year-ago period. EBITDA for

the segment was $372 million, which compares with EBITDA of

$382 million in the same period last year.

Agricultural Sciences

Agricultural Sciences reported record third quarter sales of

$1.2 billion, up 27 percent compared with the year-ago

period. Volume increased 18 percent and price rose 9 percent.

Double-digit sales and volume gains were reported in all geographic

areas, led by Latin America. The business continues to benefit from

solid industry fundamentals, with elevated farm income levels

providing strong incentive for farmers to maximize yields.

Agricultural Chemicals reported demand growth of more than

20 percent driven by continued adoption of new products and

increased sales of range and pasture herbicides in Latin America,

cereal herbicides in Europe, and corn and soybean herbicides in the

United States. In Seeds, Traits and Oils, corn seed volume grew

more than 15 percent versus the same period last year.

Year to date, Seeds, Traits and Oils has reported demand growth

of more than 25 percent, with significant gains in key crops,

including corn and cotton. The business finished a solid cotton

season in the United States, having grown 10 share points over

the last two seasons to nearly 20 percent in 2011, helped by

an increase in U.S. planted acres and continued penetration of

PhytoGen® cottonseeds. In corn, the business continued to report

good adoption of SmartStax® hybrids in North America.

EBITDA for the segment was $75 million, compared with a

loss of $12 million in the year-ago period.

Performance Materials

Sales in Performance Materials were $3.7 billion, with

volume down 3 percent and price up 15 percent.

Double-digit price gains were reported in all geographic areas and

in most businesses in response to higher raw material costs. Volume

growth in Latin America and North America was more than offset by

declines in EMEA and Asia Pacific.

Amines reported price and volume gains globally, with notable

demand growth in the emerging regions. The business continued to

see solid fundamentals in agriculture and energy end-markets. Dow

Automotive Systems reported price and volume expansion in all

geographic areas. The business reported double-digit demand growth

globally for its adhesives platform, and recorded gains for

technology-differentiated products in acoustical applications and

polyurethane-based formulations. Dow Formulated Systems reported

price increases in all geographic areas. However, demand continued

to be restrained by weak construction end-markets in developed

regions, as well as a pause in wind energy investments in Asia

Pacific.

Epoxy reported a modest sales gain versus the year-ago period,

with double-digit price increases in all geographic areas. Demand

grew in all geographic areas except EMEA, where the business chose

to forego low-margin volume. Oxygenated Solvents reported

double-digit price gains in all geographic areas, while volume fell

slightly as demand growth in emerging geographies partially offset

declines in developed regions. Polyglycols, Surfactants and Fluids

reported a double-digit price gain and modest volume growth

globally. The business recorded demand growth in de-icing

applications in anticipation of the winter season, and strong sales

of high temperature heat transfer fluids used in solar applications

in EMEA. Polyurethanes reported strong price gains globally and a

slight gain in volume. In North America, the business reported

double-digit volume growth driven by demand in furniture and

bedding applications. The business recently announced the

successful start-up of its new joint venture propylene oxide

facility in Thailand.

EBITDA for the quarter was $478 million, compared with $513

million in the year-ago period.

Performance Plastics

Sales in Performance Plastics rose 16 percent to $4.1 billion,

with a 1 percent gain on volume, and a 15 percent increase on

price. The division reported strong performance in Dow Elastomers,

which had double-digit volume growth and price increases.

Polyethylene recorded another strong quarter of volume growth in

Asia Pacific as it continues to benefit from its joint venture

facility in Thailand. However, the business experienced margin

contraction year-over-year due to higher planned turnaround

expenditures, an increase in ethylene production costs and a

softening in demand in the developed regions. Dow Packaging and

Converting reported a modest gain in volume driven by growth in

Asia Pacific and Latin America. Results in Dow Electrical and

Telecommunications were partially impacted by a decline in volume

due to monetary tightening policies and decreased infrastructure

activity from state-owned utilities in emerging geographies.

Equity earnings for the segment were $150 million, which

compares with $58 million in the year-ago period. Equity earnings

in the quarter included a pretax $86 million gain related to cash

collected on a previously impaired note receivable related to

Equipolymers, a nonconsolidated affiliate. Excluding this certain

item, equity earnings were $64 million. EBITDA for the segment

was $834 million, or $748 million excluding certain items. This

compares with EBITDA of $900 million in the same period last year,

or $898 million excluding certain items.

Feedstocks and Energy

Sales in Feedstocks and Energy were $2.9 billion, up 34 percent

from the same period last year. Volume decreased 2 percent and

price rose 36 percent.

The Chlor-Alkali/Chlor-Vinyl business reported strong sales

growth, with double-digit price increases in North America, Latin

America and Europe. The largest price gains were reported in

caustic soda, driven by tight supply and continued strong demand in

the alumina and pulp and paper industries. Vinyl chloride monomer

volume decreased due to the shutdown of an asset in Plaquemine,

coupled with an ongoing weak outlook in construction end-markets.

Ethylene Oxide/Ethylene Glycol sales increased 23 percent from the

year-ago period, driven by price.

Equity earnings were $153 million for the quarter, which

compares with $98 million in the year-ago period, driven by strong

results in MEGlobal and Kuwait Olefins Company. EBITDA for the

segment was $263 million, compared with $154 million in the

same period last year.

Outlook

Commenting on the Company’s outlook, Liveris said:

“As we said at our recent Investor Day, we see ongoing

volatility in the pace of global economic recovery, and

consequently are prepared for jagged economic conditions over the

near-term. Well-recognized headwinds in developed regions continue

to restrain consumer spending and business investment. However, in

emerging regions, growth in the middle class continues to drive

demand, particularly as it pertains to infrastructure and

urbanization. And we continue to see bright spots in

recession-resistant sectors such as agriculture, food packaging,

energy and water – markets where Dow commands leadership

positions.

“Our enhanced financial flexibility, industry-leading feedstock

strength and diverse, well-balanced portfolio provide a new

earnings foundation, and position us well to continue driving

toward our profitability targets with confidence. Our

diversification across sectors and geographies allows us to take

advantage of growth where it occurs around the world. In the midst

of these uncertain times, we have an enterprise that is strong and

stable, with the levers in place to mitigate risk and achieve our

financial targets.”

Dow will host a live Webcast of its third quarter earnings

conference call with investors to discuss its results, business

outlook and other matters today at 10:00 a.m. ET on

www.dow.com.

(1)

See Supplemental Information at the end of

the release for a description of these items.

(2)

EBITDA is defined as earnings (i.e., “Net

Income”) before interest, income taxes, depreciation and

amortization. A reconciliation of EBITDA to "Net Income Available

for The Dow Chemical Company Common Stockholders" is provided

following the Operating Segments table.

(3)

Net debt equals total debt (“Notes

payable” plus “Long-term debt due within one year” plus “Long-Term

Debt”) minus “Cash and cash equivalents.”

TMTrademark of The Dow Chemical Company or an affiliated company

of Dow.

®PhytoGen is a trademark of PhytoGen Seed Company, LLC.

®SmartStax multi-event technology developed by Dow AgroSciences

LLC and Monsanto. SmartStax is a trademark of Monsanto Technology

LLC.

About Dow

Dow (NYSE: Dow) combines the power of science and technology

with the “Human Element” to passionately innovate what is essential

to human progress. The Company connects chemistry and innovation

with the principles of sustainability to help address many of the

world’s most challenging problems such as the need for clean water,

renewable energy generation and conservation, and increasing

agricultural productivity. Dow’s diversified industry-leading

portfolio of specialty chemical, advanced materials, agrosciences

and plastics businesses deliver a broad range of technology-based

products and solutions to customers in approximately

160 countries and in high growth sectors such as electronics,

water, energy, coatings and agriculture. In 2010, Dow had annual

sales of $53.7 billion and employed approximately

50,000 people worldwide. The Company’s more than 5,000

products are manufactured at 188 sites in 35 countries

across the globe. References to "Dow" or the "Company" mean The Dow

Chemical Company and its consolidated subsidiaries unless otherwise

expressly noted. More information about Dow can be found at

www.dow.com.

Use of non-GAAP measures: Dow’s management believes that

measures of income excluding certain items (“non-GAAP” measures)

provide relevant and meaningful information to investors about the

ongoing operating results of the Company. Such measurements are not

recognized in accordance with accounting principles generally

accepted in the United States of America (“GAAP”) and should not be

viewed as an alternative to GAAP measures of performance.

Reconciliations of non-GAAP measures to GAAP measures are provided

in the Supplemental Information tables.

Note: The forward-looking statements contained in this document

involve risks and uncertainties that may affect the Company’s

operations, markets, products, services, prices and other factors

as discussed in filings with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, economic, competitive, legal, governmental and

technological factors. Accordingly, there is no assurance that the

Company’s expectations will be realized. The Company assumes no

obligation to provide revisions to any forward-looking statements

should circumstances change, except as otherwise required by

securities and other applicable laws.

Financial Statements (Note A)

The Dow Chemical Company and Subsidiaries Consolidated

Statements of Income Three Months Ended Nine Months

Ended In millions, except per share amounts (Unaudited) Sep

30, 2011 Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Net Sales $ 15,109

$ 12,868 $ 45,888

$ 39,903 Cost of sales 12,928 10,841 38,596

33,962 Research and development expenses 402 403 1,213 1,217

Selling, general and administrative expenses 691 640 2,086 1,950

Amortization of intangibles 125 124 373 377 Restructuring charges

(Note B) — — — 29 Acquisition and integration related expenses

(Note C) — 35 31 98 Equity in earnings of nonconsolidated

affiliates (Note D) 375 251 964 799 Sundry income (expense) - net

(Note E) 47 (10 ) (322 ) 168 Interest income 9 7 26 24 Interest

expense and amortization of debt discount 305

362 1,010 1,105

Income Before Income Taxes 1,089 711

3,247 2,156 Provision for

income taxes 186 114

546 348 Net Income 903

597 2,701

1,808 Net income attributable to noncontrolling interests 3

— 24

9 Net Income Attributable to The Dow Chemical Company 900

597 2,677

1,799 Preferred stock dividends 85

85 255 255 Net

Income Available for The Dow Chemical Company Common Stockholders

$ 815 $ 512 $

2,422 $ 1,544

Per Common

Share Data: Earnings per common share - basic $ 0.70 $ 0.45 $ 2.08

$ 1.37 Earnings per common share - diluted $ 0.69

$ 0.45 $ 2.07

$ 1.35

Common stock dividends declared

per share of common stock $ 0.25 $ 0.15 $ 0.65 $ 0.45

Weighted-average common shares outstanding - basic 1,152.3 1,128.0

1,147.2 1,123.6 Weighted-average common shares outstanding -

diluted 1,160.9 1,145.5

1,157.8 1,140.7

Depreciation $ 539 $ 555 $ 1,624 $ 1,717 Capital Expenditures

$ 651 $ 497 $

1,620 $ 1,188

Notes to the Consolidated Financial Statements:

Note A: The unaudited interim consolidated financial

statements reflect all adjustments which, in the opinion of

management, are considered necessary for a fair presentation of the

results for the periods covered. These statements should be read in

conjunction with the audited consolidated financial statements and

notes thereto included in the Company's Annual Report on Form 10-K

for the year ended December 31, 2010. Except as otherwise

indicated by the context, the terms "Company" and "Dow" as used

herein mean The Dow Chemical Company and its consolidated

subsidiaries.

Note B: In June 2009, Dow's Board of Directors approved a

restructuring plan that incorporated actions related to the

Company's acquisition of Rohm and Haas Company as well as

additional actions to advance the Company's strategy and respond to

continued weakness in the global economy. In the first half of

2010, the Company recorded adjustments to the 2009 restructuring

plan of $29 million. See Supplemental Information for additional

information.

Note C: On April 1, 2009, Dow completed the acquisition

of Rohm and Haas Company. During the first quarter of 2011, pretax

charges totaling $31 million were recorded for integration costs

related to the acquisition. During the third quarter of 2010,

integration costs totaled $35 million ($98 million year to

date).

Note D: In the third quarter of 2011, the Company

recognized an $86 million gain related to cash collected on a

previously impaired note receivable related to Equipolymers, a

nonconsolidated affiliate.

Note E: In the first half of 2011, the Company recognized

a pretax loss of $482 million on the early extinguishment of debt;

a pretax loss of $46 million was recognized in the third quarter of

2010.

The Dow Chemical Company and

Subsidiaries Consolidated Balance Sheets In

millions (Unaudited) Sep 30, 2011 Dec 31, 2010

Assets Current Assets Cash and cash equivalents (variable

interest entities restricted - 2011: $86; 2010: $145) $ 2,206 $

7,039 Accounts and notes receivable: Trade (net of allowance for

doubtful receivables - 2011: $124; 2010: $128) 5,081 4,616 Other

5,035 4,428 Inventories 8,416 7,087 Deferred income tax assets -

current 683 611 Other current assets 333

349 Total current assets 21,754

24,130 Investments Investment in nonconsolidated

affiliates 3,574 3,453 Other investments (investments carried at

fair value - 2011: $1,942; 2010: $2,064) 2,426 2,542 Noncurrent

receivables 333 388 Total

investments 6,333 6,383 Property

Property 52,839 51,648 Less accumulated depreciation 35,046

33,980 Net property (variable interest

entities restricted - 2011: $1,855; 2010: $1,388) 17,793

17,668 Other Assets Goodwill 12,994

12,967 Other intangible assets (net of accumulated amortization -

2011: $2,216; 2010: $1,805) 5,212 5,530 Deferred income tax assets

- noncurrent 2,001 2,079 Asbestos-related insurance receivables -

noncurrent 206 220 Deferred charges and other assets 658

611 Total other assets 21,071

21,407 Total Assets $ 66,951

$ 69,588

Liabilities and Equity

Current Liabilities Notes payable $ 887 $ 1,467 Long-term debt due

within one year 1,674 1,755 Accounts payable: Trade 4,429 4,356

Other 2,260 2,249 Income taxes payable 427 349 Deferred income tax

liabilities - current 110 105 Dividends payable 375 257 Accrued and

other current liabilities 2,725 3,358

Total current liabilities 12,887

13,896 Long-Term Debt (variable interest entities

nonrecourse - 2011: $891; 2010: $167) 17,042

20,605 Other Noncurrent Liabilities Deferred income

tax liabilities - noncurrent 1,298 1,295 Pension and other

postretirement benefits - noncurrent 7,042 7,492 Asbestos-related

liabilities - noncurrent 635 663 Other noncurrent obligations

2,906 2,995 Total other

noncurrent liabilities 11,881 12,445

Stockholders’ Equity Preferred stock, series A 4,000 4,000

Common stock 2,954 2,931 Additional paid-in capital 2,526 2,286

Retained earnings 19,400 17,736 Accumulated other comprehensive

loss (4,290 ) (4,399 ) Unearned ESOP shares (438 ) (476 ) Treasury

stock at cost — (239 ) The Dow Chemical

Company’s stockholders’ equity 24,152

21,839 Noncontrolling interests 989

803 Total equity 25,141

22,642 Total Liabilities and Equity $ 66,951

$ 69,588

See Notes to the Consolidated Financial Statements.

The Dow Chemical Company and

Subsidiaries Operating Segments Three Months

Ended Nine Months Ended In millions (Unaudited) Sep 30, 2011

Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Sales by operating segment

Electronic and Functional Materials $ 1,205 $ 1,087 $ 3,536 $ 3,144

Coatings and Infrastructure Solutions 1,905 1,734 5,639 5,049

Agricultural Sciences 1,205 948 4,311 3,593 Performance Materials

3,698 3,311 11,097 10,552 Performance Plastics 4,114 3,540 12,598

11,381 Feedstocks and Energy 2,905 2,176 8,456 5,951 Corporate

77 72 251

233 Total $ 15,109

$ 12,868 $ 45,888 $

39,903 EBITDA (1) by operating segment Electronic and

Functional Materials $ 306 $ 277 $ 850 $ 775 Coatings and

Infrastructure Solutions 372 382 990 979 Agricultural Sciences 75

(12 ) 768 568 Performance Materials 478 513 1,523 1,377 Performance

Plastics 834 900 2,773 2,623 Feedstocks and Energy 263 154 765 319

Corporate (229 ) (432 ) (1,296 )

(1,197 ) Total $ 2,099 $

1,782 $ 6,373 $ 5,444

Certain items increasing (decreasing) EBITDA by operating

segment (2) Electronic and Functional Materials $ — $ — $ — $ (8 )

Coatings and Infrastructure Solutions — — — (20 ) Agricultural

Sciences — — — — Performance Materials — — — 41 Performance

Plastics 86 2 86 12 Feedstocks and Energy — — — — Corporate

— (131 ) (513 )

(195 ) Total $ 86 $ (129 )

$ (427 ) $ (170 ) EBITDA excluding certain

items by operating segment Electronic and Functional Materials $

306 $ 277 $ 850 $ 783 Coatings and Infrastructure Solutions 372 382

990 999 Agricultural Sciences 75 (12 ) 768 568 Performance

Materials 478 513 1,523 1,336 Performance Plastics 748 898 2,687

2,611 Feedstocks and Energy 263 154 765 319 Corporate (229 )

(301 ) (783 ) (1,002 )

Total $ 2,013 $ 1,911

$ 6,800 $ 5,614

Continued

The Dow Chemical Company and

Subsidiaries Operating Segments (Continued) Three

Months Ended Nine Months Ended In millions (Unaudited) Sep

30, 2011 Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Equity in earnings (losses) of

nonconsolidated affiliates by operating segment (included in

EBITDA) Electronic and Functional Materials $ 23 $ 23

$ 72 $ 76 Coatings and Infrastructure Solutions 72 75

219 247 Agricultural Sciences — 2 3 3 Performance Materials (11 )

(4 ) (20 ) 9 Performance Plastics 150 58 271 182 Feedstocks and

Energy 153 98 446 294 Corporate (12 ) (1 )

(27 ) (12 ) Total $ 375

$ 251 $ 964

$ 799

(1)

The Company uses EBITDA (which Dow defines

as earnings (i.e., "Net Income") before interest, income taxes,

depreciation and amortization) as its measure of profit/loss for

segment reporting purposes. EBITDA includes all operating items

related to the businesses, except depreciation and amortization,

and excludes items that principally apply to the Company as a

whole. A reconciliation of EBITDA to "Net Income Available for The

Dow Chemical Company Common Stockholders" is provided below.

Reconciliation of EBITDA to "Net Income

Available for

The Dow Chemical Company Common

Stockholders"

Three Months Ended Nine Months Ended In millions (Unaudited)

Sep 30, 2011 Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 EBITDA $ 2,099 $ 1,782 $

6,373 $ 5,444 - Depreciation and amortization 714 716

2,142 2,207 + Interest income 9 7 26 24 - Interest expense and

amortization of debt discount 305 362

1,010 1,105 Income Before

Income Taxes $ 1,089 $ 711

$ 3,247 $ 2,156 - Provision for

income taxes 186 114 546 348 - Net income attributable to

noncontrolling interests 3 — 24 9 - Preferred stock dividends

85 85 255

255 Net Income Available for The Dow Chemical Company

Common Stockholders $ 815 $ 512

$ 2,422 $ 1,544

(2) See Supplemental Information for a description of certain

items affecting results in 2011 and 2010.

Sales by Geographic Area

Three Months Ended Nine Months Ended In millions (Unaudited)

Sep 30, 2011

Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 North America $ 5,375 $ 4,700 $ 16,473

$ 14,639 Europe, Middle East and Africa 5,125 4,293

16,196 13,761 Asia Pacific 2,659 2,257 7,885 7,119 Latin America

1,950

1,618 5,334

4,384 Total $

15,109 $ 12,868 $ 45,888

$ 39,903

Sales Volume and Price by Operating

Segment and Geographic Area

Three Months Ended Nine Months Ended September 30, 2011

September 30, 2011 Percentage change from prior year Volume

Price Total Volume

Price Total Electronic and Functional

Materials 3 % 8 % 11 % 5 %

7 % 12 % Coatings and Infrastructure Solutions

(4 ) 14 10 (3 ) 15 12 Agricultural Sciences 18 9 27 15 5 20

Performance Materials (3 ) 15 12 (9 ) 14 5 Performance Plastics 1

15 16 (4 ) 15 11 Feedstocks and Energy (2 ) 36

34 9

33 42 Total — % 17

% 17 %

(1

)%

16 % 15 % North America (3

)%

17 % 14 % (1 )% 14 % 13 % Europe, Middle East and Africa (2 ) 21 19

(2 ) 20 18 Asia Pacific 5 13 18 (1 ) 12 11 Latin America 7

14 21

7 15 22

Total — % 17 % 17 %

(1 )% 16 % 15 %

Sales Volume and Price by Operating Segment and

Geographic Area

Excluding Divestitures (3)

Three Months Ended Nine Months Ended September 30, 2011

September 30, 2011 Percentage change from prior year Volume

Price Total Volume

Price Total Electronic and Functional

Materials 3 % 8 % 11 % 5 %

7 % 12 % Coatings and Infrastructure Solutions

(4 ) 14 10 — 15 15 Agricultural Sciences 18 9 27 15 5 20

Performance Materials (3 ) 15 12 1 16 17 Performance Plastics 1 15

16 5 16 21 Feedstocks and Energy (2 ) 36

34 10

33 43 Total — %

17 % 17 % 5 % 17 %

22 % North America (3 )% 17 % 14 % 1 % 14 % 15 %

Europe, Middle East and Africa (2 ) 21 19 7 22 29 Asia Pacific 5 13

18 7 13 20 Latin America 7 14

21 11 15

26 Total — % 17 %

17 % 5 % 17 %

22 %

(3)

Excludes sales of the acrylic monomer

business and a portion of the specialty latex business divested on

January 25, 2010, sales of the Powder Coatings business divested on

June 1, 2010 and sales of Styron divested on June 17, 2010.

Supplemental Information

Description of Certain Items Affecting Results:

The following table summarizes the impact of certain items

recorded in the three-month periods ended

September 30, 2011 and September 30, 2010:

Certain Items Impacting Results Pretax Impact

(1)

Net Income (2)

EPS -

Diluted (3) Three Months Ended Three Months Ended Three Months

Ended In millions, except per share amounts (Unaudited) Sep

30, 2011 Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Excluding certain items (non-GAAP measures)

$ 729 $ 620 $ 0.62 $ 0.54

Certain items: Labor-related litigation matter $ — $ (50 ) — (33 )

— (0.03 ) Acquisition-related integration costs — (35 ) — (23 ) —

(0.02 ) Gain on collection of impaired note receivable 86 — 86 —

0.07 — Gain (Loss) on Divestiture of Styron — 2 — (23 ) — (0.02 )

Loss on early extinguishment of debt —

(46 ) — (29 ) —

(0.02 ) Total certain items $ 86

$ (129 ) $ 86 $

(108 ) $ 0.07 $ (0.09 ) Reported

(GAAP amounts) $

815 $ 512 $ 0.69

$ 0.45 (1) Impact on "Income Before

Income Taxes" (2) "Net Income Available for The Dow Chemical

Company Common Stockholders” (3) "Earnings per common share -

diluted"

Results in the third quarter of 2011 were favorably impacted by

one item:

- Pretax $86 million gain related to cash

collected on a previously impaired note receivable related to

Equipolymers, a nonconsolidated affiliate. The gain is shown as

"Equity in earnings of nonconsolidated affiliates" in the

consolidated statements of income and reflected in Performance

Plastics.

Results in the third quarter of 2010 were impacted by four

items:

- Pretax charge of $50 million for a

labor-related litigation matter included in “Cost of sales” and

reflected in Corporate.

- Pretax charges totaling

$35 million for integration costs related to the April 1,

2009 acquisition of Rohm and Haas Company (“Rohm and Haas”). The

charges are included in “Acquisition and integration related

expenses” in the consolidated statements of income and reflected in

Corporate.

- Net $2 million pretax increase in

the gain (net $23 million loss after tax) on the divestiture

of Styron, sold to an affiliate of Bain Capital Partners on

June 17, 2010. The adjustment included a net gain on the

subsequent sale of two small, related joint ventures, working

capital adjustments and additional costs to sell. The net pretax

gain was included in “Sundry income (expense) - net” and reflected

in Performance Plastics.

- Pretax loss of $46 million on the

early extinguishment of debt included in “Sundry income (expense) -

net” and reflected in Corporate.

The following table summarizes the impact of certain items

recorded in the nine-month periods ended

September 30, 2011 and September 30, 2010:

Certain Items Impacting Results Pretax Impact

(1)

Net Income (2)

EPS -

Diluted (3) Nine Months Ended Nine Months Ended Nine Months

Ended In millions, except per share amounts (Unaudited) Sep

30, 2011 Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Sep 30, 2011

Sep 30, 2010 Excluding certain items (non-GAAP measures)

$ 2,670 $ 1,725 $ 2.29 $ 1.50

Certain items: Labor-related litigation matter $ — $ (50 ) — (33 )

— (0.03 ) Restructuring charges — (29 ) — (16 ) — (0.02 )

Acquisition-related integration costs (31 ) (98 ) (20 ) (64 ) (0.02

) (0.05 ) Gain on collection of impaired note receivable 86 — 86 —

0.07 — Gain (Loss) on Divestiture of Styron — 53 — (39 ) — (0.03 )

Loss on early extinguishment of debt (482 )

(46 ) (314 ) (29 ) (0.27

) (0.02 ) Total certain items $ (427 )

$ (170 ) $ (248 ) $ (181 )

$ (0.22 ) $ (0.15 ) Reported (GAAP

amounts) $ 2,422

$ 1,544 $ 2.07

$ 1.35 (1) Impact on "Income Before

Income Taxes" (2) "Net Income Available for The Dow Chemical

Company Common Stockholders” (3) "Earnings per common share -

diluted"

In addition to the item described above for the third quarter of

2011, results for the nine-month period ended

September 30, 2011 were unfavorably impacted by two

items:

- Pretax charges totaling

$31 million for integration costs related to the April 1,

2009 acquisition of Rohm and Haas. The charges are included in

“Acquisition and integration related expenses” in the consolidated

statements of income and reflected in Corporate.

- Pretax loss of $482 million on the

early extinguishment of debt, included in “Sundry income (expense)

- net” and reflected in Corporate.

In addition to the items described above for the third quarter

of 2010, results for the nine-month period ended

September 30, 2010 were impacted by the following

items:

- Pretax adjustments to the 2009

restructuring charge of $29 million, including

$16 million related to additional asset impairments,

approximately half of which was related to a consolidated joint

venture, and $13 million for additional exit or disposal

activities related to the divestitures of certain acrylic monomer

assets and the hollow sphere particle business. The charges were

shown as “Restructuring charges” in the consolidated statements of

income and reflected in Electronic and Functional Materials

($8 million), Coatings and Infrastructure Solutions

($20 million) and Corporate ($1 million).

- Pretax charges totaling

$63 million in the first six months of 2010 for integration

costs related to the April 1, 2009 acquisition of Rohm and

Haas. The charges are included in “Acquisition and integration

related expenses” and reflected in Corporate.

- Pretax gain of $51 million

($16 million loss after tax) on the divestiture of Styron. The

pretax gain was included in “Sundry income (expense) - net” and was

reflected in Performance Materials ($41 million) and

Performance Plastics ($10 million).

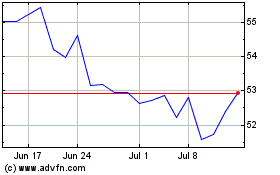

Dow (NYSE:DOW)

Historical Stock Chart

From May 2024 to Jun 2024

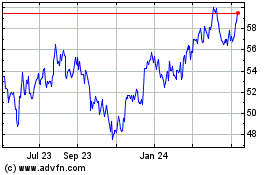

Dow (NYSE:DOW)

Historical Stock Chart

From Jun 2023 to Jun 2024