DaVita Inc. (NYSE: DVA) today announced results for the quarter

ended September 30, 2009. Net income attributable to DaVita Inc.

for the three and nine months ended September 30, 2009 was $110.9

million and $313.0 million, or $1.06 per share and $3.00 per share,

respectively. This compares to net income attributable to DaVita

Inc. for the three and nine months ended September 30, 2008 of

$93.9 million and $275.8 million, or $0.89 per share and $2.59 per

share, respectively.

Financial and operating highlights include:

- Cash Flow: For the

rolling 12 months ended September 30, 2009 operating cash flow was

$713 million and free cash flow was $533 million. For the three

months ended September 30, 2009 operating cash flow was $167

million and free cash flow was $125 million.

- Operating Income:

Operating income for the three and nine months ended September 30,

2009 was $245 million and $702 million, respectively, as compared

to $222 million and $646 million, respectively, for the same

periods of 2008.

- Volume: Total treatments

for the third quarter of 2009 were 4,339,195, or 54,927 treatments

per day, representing a per day increase of 6.1% over the third

quarter of 2008. Non-acquired treatment growth in the quarter was

5.2% over the prior year’s third quarter.

- Effective Tax Rate: Our

effective tax rate was 37.0% and 37.2% for the three and nine

months ended September 30, 2009, respectively. This effective tax

rate is impacted by the amount of third party owners’ income

attributable to non-tax paying entities. The effective tax rate

attributable to DaVita Inc. was 40.0% for the three and nine months

ended September 30, 2009 which was in the range of our previously

stated guidance. Our effective tax rate for 2009 is projected to be

in the range of 36.5% to 37.5% and our 2009 effective tax rate

attributable to DaVita Inc. is still projected to be in a range of

39.5% to 40.5%.

- Share Repurchases: During

the third quarter of 2009, we repurchased a total of 1,108,784

shares of our common stock for $62.4 million, or an average price

of $56.25 per share. For the first nine months of 2009 we

repurchased a total of 1,853,184 shares of our common stock for

$94.4 million, or an average price of $50.93 per share. In

addition, we repurchased 1,049,435 shares of our common stock for

$59.1 million, or an average price of $56.32 per share, from

October 1, 2009 through October 7, 2009. All of these share

repurchases were consummated pursuant to previously announced

authorizations by our Board of Directors. On October 8, 2009, our

Board of Directors authorized an additional $500 million for share

repurchases. We have not repurchased any additional shares of our

common stock under this authorization. Therefore, the total

outstanding authorization for share repurchases is currently $500

million.

- Center Activity: As of

September 30, 2009, we operated or provided administrative services

at 1,513 outpatient dialysis centers serving approximately 117,000

patients, of which 1,481 centers are consolidated in our financial

statements. During the third quarter of 2009, we acquired four

centers, opened 21 new centers, merged five centers, closed one

center and provided administrative and management services to one

additional third-party owned center.

Outlook

We are raising our operating income guidance range for 2009 from

$900-$930 million to $930-$950 million. Also, we may modestly

exceed the upper end of our previous operating cash flow guidance

of $550-$600 million. Currently we expect our operating income for

2010 to be in the range of $950 million to $1.02 billion. These

projections and the underlying assumptions involve significant

risks and uncertainties, including those described below, and

actual results may vary significantly from these current

projections.

DaVita will be holding a conference call to discuss its results

for the third quarter ended September 30, 2009 on November 3, 2009

at 5:00 p.m. Eastern Time. The dial in number is (800) 399-4406. A

replay of the conference call will be available on DaVita’s

official web page, www.davita.com, for the following 30 days.

This release contains forward-looking statements, including

statements related to our 2009 and 2010 operating income, 2009

operating cash flow and 2009 expected effective tax rate and the

expected effective tax rate attributable to DaVita Inc. Factors

which could impact future results include the uncertainties

associated with governmental regulations, general economic and

other market conditions, competition, accounting estimates, the

variability of our cash flows and the risk factors set forth in our

SEC filings, including our Form 10-K for the year ended December

31, 2008 and subsequent quarterly reports on Form 10-Q. The

forward-looking statements should be considered in light of these

risks and uncertainties.

These risks and uncertainties include those relating to:

- the concentration of profits

generated from commercial payor plans,

- continued downward pressure on

average realized payment rates from commercial payors, which may

result in the loss of revenue or patients,

- a reduction in the number of

patients under higher-paying commercial plans,

- a reduction in government

payment rates or changes to the structure of payments under the

Medicare ESRD program, including the implementation of a bundled

payment rate system which result in lower reimbursement for

services we provide to Medicare patients,

- changes in pharmaceutical or

anemia management practice patterns, payment policies, or

pharmaceutical pricing,

- our ability to maintain

contracts with physician medical directors,

- legal compliance risks,

including our continued compliance with complex government

regulations and compliance with the corporate integrity agreement

applicable to the dialysis centers acquired from Gambro Healthcare

and assumed in connection with such acquisition, and

- the resolution of ongoing

investigations by various federal and state governmental

agencies.

We undertake no obligation to update or revise any

forward-looking statements, whether as a result of changes in

underlying factors, new information, future events or

otherwise.

This release contains non-GAAP financial measures. For

reconciliations of these non-GAAP financial measures to their most

comparable measure calculated and presented in accordance with

GAAP, see the attached reconciliation schedules.

DAVITA INC.

CONSOLIDATED STATEMENTS OF

INCOME

(unaudited)

(dollars in thousands, except

per share data)

Three months

endedSeptember 30,

Nine months

endedSeptember 30,

2009 2008 2009

2008 Net operating revenues $ 1,573,915 $ 1,447,135 $

4,540,596 $ 4,199,163 Operating expenses and charges: Patient care

costs 1,095,857 1,005,648 3,153,622 2,909,143 General and

administrative 134,931 128,617 394,370 374,581 Depreciation and

amortization 56,813 54,970 172,121 160,673 Provision for

uncollectible accounts 42,021 37,305 119,990 109,433 Equity

investment income (708 ) (1,177 ) (1,066 )

(654 ) Total operating expenses and charges 1,328,914

1,225,363 3,839,037

3,553,176 Operating income 245,001 221,772 701,559 645,987

Debt expense (45,535 ) (54,505 ) (140,924 ) (168,891 ) Other income

999 2,481 3,026

10,331 Income before income taxes 200,465 169,748 563,661

487,427 Income tax expense 74,195 62,010

209,485 175,853 Net income

126,270 107,738 354,176 311,574 Less: Net income attributable to

noncontrolling interests (15,340 ) (13,828 )

(41,216 ) (35,779 ) Net income attributable to DaVita Inc. $

110,930 $ 93,910 $ 312,960 $ 275,795

Earnings per share: Basic earnings per share attributable to

DaVita Inc. $ 1.07 $ 0.90 $ 3.01 $ 2.61

Diluted earnings per share attributable to DaVita Inc. $ 1.06

$ 0.89 $ 3.00 $ 2.59 Weighted average

shares for earnings per share: Basic 104,127,334

104,556,770 103,904,768

105,569,971 Diluted 104,607,318

105,577,823 104,315,019 106,421,184

DAVITA INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(unaudited)

(dollars in thousands)

Nine months

endedSeptember 30,

2009 2008 Cash

flows from operating activities: Net income $ 354,176 $ 311,574

Adjustments to reconcile net income to cash provided by operating

activities: Depreciation and amortization 172,121 160,673

Stock-based compensation expense 33,850 29,975 Tax benefits from

stock award exercises 12,434 10,174 Excess tax benefits from stock

award exercises (8,115 ) (5,054 ) Deferred income taxes 45,417

56,157 Equity investment income (1,066 ) (654 ) Loss on disposal of

assets 7,826 9,688 Non-cash debt and non-cash rent charges 7,497

9,971 Changes in operating assets and liabilities, other than from

acquisitions and divestitures: Accounts receivable (68,235 )

(130,022 ) Inventories 15,858 (1,248 ) Other receivables and other

current assets (2,164 ) (28,684 ) Other long-term assets 5,641

(12,761 ) Accounts payable (58,995 ) (12,800 ) Accrued compensation

and benefits 20,733 (11,752 ) Other current liabilities (68,383 )

29,838 Income taxes 55,226 (3,086 ) Other long-term liabilities

(9,702 ) 3,163 Net cash provided by operating

activities 514,119 415,152

Cash

flows from investing activities: Additions of property and

equipment (205,653 ) (223,851 ) Acquisitions (64,001 ) (77,157 )

Proceeds from asset sales 6,256 451 Purchase of investments

available for sale (1,737 ) (1,695 ) Purchase of investments

held-to-maturity (16,942 ) (19,005 ) Proceeds from sale of

investments available for sale 16,537 5,323 Proceeds from

maturities of investments held-to-maturity 16,123 18,728

Distributions received on equity investments 929 802 Purchase of

intangible assets and other (260 ) (65 ) Net cash

used in investing activities (248,748 ) (296,469 )

Cash flows from financing activities: Borrowings 13,924,642

12,937,047 Payments on long-term debt (13,961,667 ) (12,938,297 )

Deferred financing costs (42 ) (130 ) Purchase of treasury stock

(61,223 ) (169,673 ) Excess tax benefits from stock award exercises

8,115 5,054 Stock award exercises and other share issuances, net

30,309 33,670 Distributions to noncontrolling interests (46,888 )

(43,391 ) Contributions from noncontrolling interests 11,117 13,525

Proceeds from sales of additional noncontrolling interests 7,733

8,422 Purchases from noncontrolling interests (6,668 )

(24,009 ) Net cash used in financing activities

(94,572 ) (177,782 ) Net increase (decrease) in cash and

cash equivalents 170,799 (59,099 ) Cash and cash equivalents at

beginning of period 410,881 447,046

Cash and cash equivalents at end of period $ 581,680 $

387,947

DAVITA INC.

CONSOLIDATED BALANCE

SHEETS

(unaudited)

(dollars in thousands, except

per share data)

ASSETS

September

30,2009

December 31,2008

Cash and cash equivalents $ 581,680 $ 410,881 Short-term

investments 20,680 35,532 Accounts receivable, less allowance of

$225,931 and $211,222 1,142,861 1,075,457 Inventories 69,014 84,174

Other receivables 235,785 239,165 Other current assets 34,816

33,761 Income tax receivable - 32,130 Deferred income taxes

223,697 217,196 Total current assets 2,308,533

2,128,296 Property and equipment, net 1,088,446 1,048,075

Amortizable intangibles, net 141,925 160,521 Investments in

third-party dialysis businesses 24,011 19,274 Long-term investments

7,567 5,656 Other long-term assets 34,262 47,330 Goodwill

3,932,964 3,876,931 $ 7,537,708 $

7,286,083

LIABILITIES AND EQUITY Accounts payable $

256,707 $ 282,883 Other liabilities 426,856 495,239 Accrued

compensation and benefits 314,677 312,216 Current portion of

long-term debt 100,677 72,725 Income taxes payable 14,592

- Total current liabilities 1,113,509

1,163,063 Long-term debt 3,555,853 3,622,421 Other long-term

liabilities 100,722 101,442 Alliance and product supply agreement,

net 31,980 35,977 Deferred income taxes 304,675

244,884 Total liabilities 5,106,739 5,167,787

Commitments and contingencies Noncontrolling interests subject to

put provisions 292,636 291,397 Equity: Preferred stock ($0.001 par

value, 5,000,000 shares authorized; none issued)

Common stock ($0.001 par value,

450,000,000 shares authorized; 134,862,283 shares issued;

103,232,774 and 103,753,673 shares outstanding)

135 135 Additional paid-in capital 638,253 584,358 Retained

earnings 2,202,410 1,889,450 Treasury stock, at cost (31,629,509

and 31,108,610 shares) (756,157 ) (691,857 ) Accumulated other

comprehensive loss (7,838 ) (14,339 ) Total DaVita

Inc. shareholders’ equity 2,076,803 1,767,747 Noncontrolling

interests not subject to put provisions 61,530

59,152 Total equity 2,138,333 1,826,899

$ 7,537,708 $ 7,286,083

DAVITA INC.

SUPPLEMENTAL FINANCIAL

DATA

(unaudited)

(dollars in millions, except

for per share and per treatment data)

Three months ended

Nine

monthsendedSeptember 30,2009

September

30,2009

June 30,2009

September

30,2008

1. Consolidated Financial Results: Revenues $ 1,574 $ 1,519

$ 1,447 $ 4,541 Operating income $ 245.0 $ 236.0 $ 221.8 $ 701.6

Operating income margin 15.6 % 15.5 % 15.3 % 15.5 % Net income

attributable to DaVita Inc. $ 110.9 $ 105.8 $ 93.9 $ 313.0 Diluted

earnings per share attributable to DaVita Inc. $ 1.06 $ 1.02 $ 0.89

$ 3.00

2. Consolidated Business Metrics:

Expenses

Patient care costs as a percent of

consolidated revenue(3)

69.6 % 69.2 % 69.5 % 69.5 %

General and administrative

expenses as a percent of consolidated revenue(3)

8.6 % 8.7 % 8.9 % 8.7 % Bad debt expense as a percent of

consolidated revenue 2.7 % 2.7 % 2.6 % 2.6 %

Consolidated effective tax rate

attributable to DaVita Inc.(1)

40.0 % 40.0 % 39.7 % 40.0 %

3. Segment Financial Results:

(dollar amounts rounded to nearest million) Dialysis and

related lab services Revenues $ 1,491 $ 1,441 $ 1,378 $ 4,309

Direct operating expenses 1,231 1,191

1,143 3,563 Dialysis segment margin $

260 $ 250 $ 235 $ 746

Other –

Ancillary services and strategic initiatives Revenues $ 83 $ 78

$ 69 $ 232 Direct operating expenses 87 81

73 243 Ancillary segment loss $

(4 ) $ (3 ) $ (4 ) $ (12 )

Total segment margin $ 256

$ 247 $ 231 $ 734 Reconciling items: Stock-based compensation (11 )

(11 ) (11 ) (34 ) Equity investment income 1 -

1 1 Consolidated operating

income $ 245 $ 236 $ 222 $ 702

DAVITA INC.

SUPPLEMENTAL FINANCIAL

DATA—continued

(unaudited)

(dollars in millions, except

for per share and per treatment data)

Three months ended

Nine

monthsendedSeptember 30,2009

September

30,2009

June 30,2009

September

30,2008

4. Segment Business Metrics: Dialysis and related lab

services: Volume Treatments 4,339,195 4,228,179

4,091,099 12,649,812 Number of treatment days 79.0 78.0 79.0 233.5

Treatments per day 54,927 54,207 51,786 54,175 Per day year over

year increase 6.1 % 5.2 % 5.1 % 5.4 % Non-acquired growth year over

year 5.2 % 4.5 % 3.8 % 4.5 %

Revenue Dialysis and

related lab services revenue per treatment $ 343.14 $ 340.35 $

336.42 $ 340.14 Per treatment increase from previous quarter 0.8 %

1.1 % 0.1 % - Per treatment increase from previous year 2.0 % 1.3 %

0.9 % 1.9 % Percent of consolidated revenue 94.7 % 94.9 % 95.2 %

94.9 %

Expenses Patient care costs Percent of segment

revenue 69.0 % 68.6 % 69.0 % 68.8 % Per treatment $ 237.21 $ 233.93

$ 232.50 $ 234.40 Per treatment increase from previous quarter 1.4

% 0.9 % 0.7 % - Per treatment increase from previous year 2.0 % 1.3

% 3.9 % 1.9 % General and administrative expenses Percent of

segment revenue 7.1 % 7.4 % 7.4 % 7.3 % Per treatment $ 24.39 $

25.14 $ 24.88 $ 24.90 Per treatment decrease from previous quarter

(3.0 %) (0.2 %) - - Per treatment (decrease) increase from previous

year (2.0 %) 1.1 % (1.5 %) 1.6 %

5. Cash Flow

Operating cash flow $ 167.5 $ 212.4 $ 160.2 $ 514.1 Operating cash

flow last twelve months $ 712.7 $ 705.4 $ 651.3 Free cash flow(1) $

125.5 $ 173.6 $ 119.0 $ 388.5 Free cash flow, last twelve months(1)

$ 533.3 $ 526.8 $ 490.6 Capital expenditures: Development and

relocations $ 42.4 $ 42.5 $ 51.6 $ 127.0 Routine maintenance/IT

other $ 25.0 $ 22.5 $ 27.2 $ 78.7 Acquisition expenditures $ 20.7 $

3.5 $ 30.4 $ 64.0

6. Accounts Receivable Net

receivables $ 1,143 $ 1,128 $ 1,057 DSO 70 70 70

DAVITA INC.

SUPPLEMENTAL FINANCIAL

DATA—continued

(unaudited)

(dollars in millions, except

for per share and per treatment data)

Three months ended

Nine months

endedSeptember

30,2009

September

30,2009

June 30,2009

September

30,2008

7. Debt and Capital Structure Total debt(2) $ 3,654 $ 3,669

$ 3,704 Net debt, net of cash(2) $ 3,072 $ 3,124 $ 3,316

Leverage ratio (see Note 1

below)

2.57x 2.66x 2.98x Overall effective weighted average interest rate

during the quarter 4.79 % 4.92 % 5.66 % Overall effective weighted

average interest rate at end of the quarter 4.76 % 4.87 % 6.09 %

Effective weighted average interest rate on the Senior Secured

Credit Facilities at end of the quarter 2.81 % 3.02 % 5.39 %

Economically fixed interest rates as a percentage of our total debt

61 % 64 % 70 % Share repurchases $ 62.4 $ - $ - $ 94.4

8.

Clinical (quarterly averages) Dialysis adequacy -% of patients

with Kt/V > 1.2 95 % 95 % 94 %

90 day patients with Hb >=

10

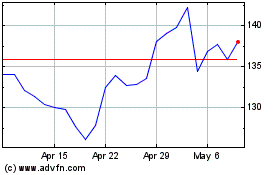

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

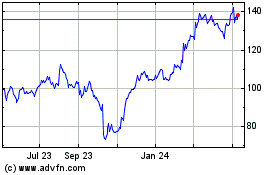

DaVita (NYSE:DVA)

Historical Stock Chart

From Jul 2023 to Jul 2024