Zacks highlights commentary from People and Picks Member

«MightyMo».

For more Voice of the People, visit

http://at.zacks.com/?id=7872

Featured Post

Six stocks to percolate on: Intelligent & common sense

non-random thinking

Momentum buying is a methodology where one buys a stock trending

up, has gone quite a bit upwards for a good while, and has strong

RSI. A stock that has moved up higher and is heading even

higher.

It's works as about as good as any strategy in a roaring bull

market. Here are some stocks to consider:

Home Depot (HD) - Stock is soaring as people

are fixing up their homes and the market anticipates the upcoming

housing rebound (need to stay ahead of the game,

right?)

Starbucks (SBUX) - There are always fools who

don't mind paying outrageous sums of money for a cup of coffee.

SBUX's margins are the best around and they do it better than

anyone else; making you feel better while robbing you blind!

Altria (MO) - People are killing themselves

buying this product; hell, someone should be making money on this

other than MO, don't u think?

Cincinnati Financial (CINF) - This insurance

stock is at an 3 year high but has plenty of room to go even

higher. Pays a nice dividend (4.63%) and has increased the

dividend each year for over 25 years. Has shown great strength

lately as it has even moved up on market down days!

Yum! Brands (YUM) or Darden

Restaurants (DRI) - take u'r choice. Good strong eatery

companies' stocks are very healthy. YUM taking China apart while

DRI three major restaurants are feeding the masses. Also consider

starlets Panera (PNRA) and

Chipotle (CMG) and of course our favorite BIG MAC

McDonald's (MCD). (Hint, go with the one that

sells Coke as someone once said it tastes better than Pepsi).

Microsoft (MSFT) or Intel

(INTC) - take u'r choice. These two stocks that have laid low for

10 years now are being re-booted for growth. INTC owns the chip

market and MSFT will someday own Yahoo (YHOO).

Options to above:

One can always buying the homebuilder stocks, Toll

Brothers (TOL) or Lennar (LEN) in lieu of

Home Depot.

If the market darling continues to drop, getting King

Apple (AAPL) at a good price is always nice. If

you already own AAPL, just hold it, the stock will always

have big ups and downs but the overall trend is up. If you spend

10,000 on AAPL stock 5 years ago, it's worth over $50,000

today.

Disney (DIS) - This entertainment stock is on

the move. Expect one hell of a summer at it's attraction parks and

expect it to grow even more in movies and TV ownership. Excellent

management is always nice.

Banking stocks will move up, abeit some near term concerns with

foreign banking ratings and the Greek Mess. It'll go away and y'all

with be pleased getting these stocks at a low price. Think

Bank of America (BAC) and Wells

Fargo (WFC).

Disclosure: trade option positions or ownership in MO,

DRI, MSFT, INTC, DIS, AAPL, BAC. Likely to own CINF very

shortly.

The most recent picks by «MightyMo» are:

A sell rating on Walgreens (WAG),

a buy rating on Occidental Petroleum (OXY) and

a buy rating on Brown & Brown (TRV).

About the Zacks Community

In 2008, Zacks Investment Research launched PeopleAndPicks.com,

a stock-picking website where members of the Zacks community can

test their strategies and share ideas with other members. Each user

is scored on the accuracy of his or her picks, and top users are

rewarded with free products from Zacks. Registration is free. To

learn more about People And Picks, visit

http://at.zacks.com/?id=7870

Follow us on Twitter: http://www.twitter.com/PeopleAndPicks

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD in mathematics

Len knew he could find patterns in stock market data that would

lead to superior investment results. Amongst his many

accomplishments was the formation of his proprietary stock picking

system; the Zacks Rank, which continues to outperform the market by

nearly a 3:1 margin. The best way to unlock the profitable stock

recommendations and market insights of Zacks Investment Research is

through our free daily email newsletter; Profit from the Pros. In

short, it's your steady flow of Profitable ideas GUARANTEED to be

worth your time! Register for your free subscription to Profit From

the Pros by going to http://at.zacks.com/?id=7867.

APPLE INC (AAPL): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

CHIPOTLE MEXICN (CMG): Free Stock Analysis Report

DARDEN RESTRNT (DRI): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

MCDONALDS CORP (MCD): Free Stock Analysis Report

ALTRIA GROUP (MO): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

PANERA BREAD CO (PNRA): Free Stock Analysis Report

STARBUCKS CORP (SBUX): Free Stock Analysis Report

TOLL BROTHERS (TOL): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

YUM! BRANDS INC (YUM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

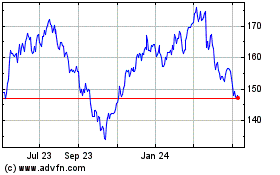

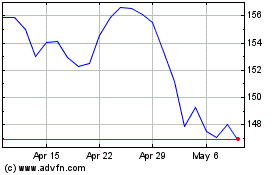

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From May 2024 to Jun 2024

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Jun 2023 to Jun 2024