Core Labs Poised at Neutral - Analyst Blog

March 07 2012 - 8:15AM

Zacks

We are maintaining a Neutral rating

on Core Laboratories (CLB), based on its package

of top-class products and services, strong international exposure

and healthy financial profile, partially offset by gas/oil price

volatility and emergence of advanced technologies.

Core Labs exhibits an array of

proprietary products and services that position it to operate

successfully in the current environment of low commodity prices.

Moreover, the company’s strong presence in the emerging shale plays

and its global footprint, including markets in the Middle East,

Asia Pacific, and East and West Africa, would facilitate steady

growth rates going forward.

During the fourth quarter of 2011,

Core Labs performed impressively with earnings per share, excluding

special items, of $1.09, beating the Zacks Consensus Estimate by a

penny. Total quarterly revenue of $243.8 million was also in line

with the Zacks Consensus Estimate. The company’s results were

backed by higher activities in the overseas regions along with

strong oil-field operations in North America.

Additionally, Core Labs’ focus on

various crude oil projects, resulting in a revenue mix of

approximately 80% oil and 20% natural gas (against the previous

70–30% mix). This strategy aided the company in posting strong

revenue growth in the reservoir description segment during the

fourth quarter. Coupled with the development of advanced

technologies, Core Labs is expected to sustain this growth momentum

over the next few quarters.

However, Core Labs’ has its

operations spread across the globe. Consequently, it remains

vulnerable to risks such as embargoes and/or expropriation of

assets, exchange rate risks, terrorism and political/civil

sentiment in critical countries like Iran, Iraq, Nigeria and

Venezuela.

The company is continuously engaged

in developing and acquiring essential products and technologies

that drive its operational performance and growth. If its

technologies and/or products become obsolete or cannot be brought

to market in a timely and competitive manner, it could face severe

operational and financial dilemmas.

Considering, these aspects we

recommend investors to hold the stock at current levels. Core Labs,

which competes with other players such as Baker Hughes

Incorporated (BHI) and Halliburton

Company (HAL), currently retains a Zacks #3 Rank,

translating into a short-term Hold rating.

BAKER-HUGHES (BHI): Free Stock Analysis Report

CORE LABS NV (CLB): Free Stock Analysis Report

HALLIBURTON CO (HAL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

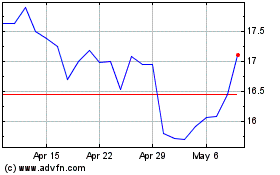

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From May 2024 to Jun 2024

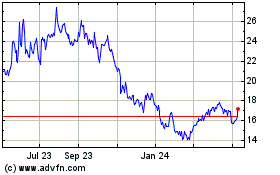

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From Jun 2023 to Jun 2024