UPDATE: Peru Poll Shows 40% Believe Minas Conga Won't Start

March 15 2012 - 11:18AM

Dow Jones News

A new poll shows that 41% believe that the stalled Minas Conga

copper and gold project will proceed, while 40% think the mine

project won't start operating.

Pollster Datum said in the poll published in newspaper Gestion

on Thursday that 19% had no opinion about the project.

Analysts say that if the project doesn't go forward, this could

harm investments in Peru.

Protests by residents concerned about potential damage to water

supplies led to a suspension of work on the $4.8 billion project

late last year. Minera Yanacocha, which is developing the deposit,

says it will be able to build reservoirs to ensure improved access

to water.

The poll found that 55% believe that if the Minas Conga project

doesn't advance, investments in mining in Peru will stall or

decline.

Three international consultants have started work on examining

the company's environmental impact study, which was approved by the

government of former President Alan Garcia in 2010. They are

expected to report to the government on their findings in the first

week of April.

"We are doing all that we can to ensure that the project moves

forward in accordance with what was decided by the previous

government," Prime Minister Oscar Valdes said on RPP radio

Thursday.

At a meeting with reporters this week, a high-level Yanacocha

official said that the company has complied with all legal

requirements to proceed with the project.

Peru is one of the world's largest mining companies for copper,

gold, silver, zinc, tin and other minerals.

Yanacocha hopes to have production up and running at Minas Conga

by the end of 2014 or early 2015.

Production is seen at an average annual output during the first

five years of 580,000 to 680,000 ounces of gold and 155 million to

235 million pounds of copper.

Compania de Minas Buenaventura SA (BVN, BUENAVC1.VL) has a

43.65% stake in Yanacocha, which is controlled by Newmont Mining

Corp. (NEM) The International Finance Corp. has a minority

stake.

The Datum poll of 1,206 persons was taken from March 9 to March

12, and has a margin of error of 2.9 percentage points.

-By Robert Kozak, Dow Jones Newswires; 51-1-99927 7269;

peru@dowjones.com

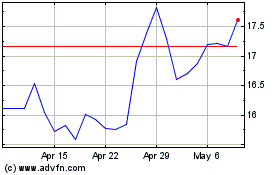

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jun 2024 to Jul 2024

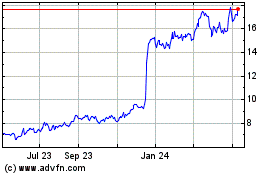

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jul 2023 to Jul 2024