0001058090FALSE12/3100010580902024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 06, 2024

CHIPOTLE MEXICAN GRILL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | | 1-32731 (Commission File Number) | | 84-1219301 (I.R.S. Employer Identification No.) |

610 Newport Center Drive, Suite 1100

Newport Beach, CA 92660

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (949) 524-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | |

| Common stock, par value $0.01 per share | CMG | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

Chipotle Mexican Grill, Inc. (“Chipotle”) held its 2024 annual meeting of shareholders on June 6, 2024 (“Annual Meeting”). At the Annual Meeting, Chipotle shareholders approved two amendments to Chipotle’s Amended and Restated Certificate of Incorporation (the “Charter”) to (1) to increase the number of authorized shares of common stock, par value $0.01 per share, from 230 million shares to 11.5 billion shares in connection with a 50-for-one stock split of Chipotle’s common stock, and (2) clarify that the Board of Directors, in certain circumstances and consistent with Delaware General Corporation Law, can amend the Charter without shareholder approval (collectively, the “Charter Amendments”). The Charter Amendments became effective upon Chipotle’s filing of a Certificate of Amendment with the Secretary of State of the State of Delaware on June 6, 2024.

As previously announced, each Chipotle stockholder of record at the close of business on June 18, 2024 (the “Stock Split Record Date”) will receive, after the close of business on June 25, 2024, 49 additional shares for every one share held as of the Stock Split Record Date. Trading is expected to begin on a split-adjusted basis on June 26, 2024.

This description of the Charter Amendments is not complete and is qualified in its entirety by reference to the text of the Charter, as amended and restated, a copy of which is filed as Exhibit 3.01 to this Form 8-K.

Item 5.07 Submission of Matters to a Vote of Security Holders

At the Annual Meeting, 24,726,922 shares of common stock were represented in person or by proxy. The final voting results for each proposal are set forth below.

Election of Directors

1. Chipotle shareholders elected each of the ten (10) director nominees to the Board of Directors, to serve for a one-year term. There were 1,519,315 broker non-votes.

| | | | | | | | | | | |

| DIRECTOR NOMINEE | FOR | AGAINST | ABSTAIN |

| Albert Baldocchi | 22,688,657 | | 507,313 | | 11,637 | |

| Matthew Carey | 23,041,201 | | 147,440 | | 18,966 | |

| Gregg Engles | 23,101,543 | | 91,332 | | 14,732 | |

| Patricia Fili-Krushel | 22,837,695 | | 354,206 | | 15,706 | |

| Laura Fuentes | 23,163,594 | | 28,474 | | 15,539 | |

| Mauricio Gutierrez | 23,144,218 | | 50,771 | | 12,618 | |

| Robin Hickenlooper | 23,008,371 | | 185,333 | | 13,903 | |

| Scott Maw | 22,907,855 | | 279,686 | | 20,066 | |

| Brian Niccol | 22,241,480 | | 891,257 | | 74,870 | |

| Mary Winston | 22,906,781 | | 285,300 | | 15,526 | |

Other Proposals

2. The shareholders approved, on a nonbinding, advisory basis, the compensation paid to Chipotle’s executive officers, as disclosed in the proxy statement.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 21,990,565 | | 1,190,480 | | 26,562 | | 1,519,315 | |

3. The shareholders approved the ratification of the appointment of Ernst & Young LLP as Chipotle’s independent registered public accounting firm for the year ending December 31, 2024.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 23,676,459 | | 1,033,543 | | 16,920 | | N/A |

4. The shareholders approved amendments to Chipotle’s Certificate of Incorporation to increase the number of authorized shares of common stock.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 24,575,721 | | 129,870 | | 21,331 | | N/A |

5. The shareholders approved amendments to Chipotle’s Certificate of Incorporation to clarify the Board’s authority to make future amendments.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 23,114,772 | | 73,651 | | 19,184 | | 1,519,315 | |

6. The shareholders did not approve a shareholder proposal requesting an audit of safety practices.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 6,862,580 | | 15,996,575 | | 348,452 | | 1,519,315 | |

7. The shareholders did not approve a shareholder proposal requesting adoption of a non-interference policy.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 2,300,017 | | 20,578,117 | | 329,473 | | 1,519,315 | |

8. The shareholders did not approve a shareholder proposal requesting a report on adoption of automation.

| | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 4,262,500 | | 18,596,213 | | 348,894 | | 1,519,315 | |

9. The shareholders did not approve a shareholder proposal requesting a report on harassment and discrimination statistics.

. | | | | | | | | | | | |

| FOR | AGAINST | ABSTAIN | BROKER NON-VOTES |

| 3,821,265 | | 19,270,269 | | 116,073 | | 1,519,315 | |

Item 9.01 Financial Statements and Exhibits.

Exhibit Index

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 3.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Chipotle Mexican Grill, Inc. |

| | |

| June 7, 2024 | By: | /s/ Roger Theodoredis |

| | General Counsel & Chief Legal Officer |

RESTATED

CERTIFICATE OF INCORPORATION

OF

CHIPOTLE MEXICAN GRILL, INC.

The undersigned, Roger Theodoredis, certifies that he is the General Counsel and Chief Legal Officer of Chipotle Mexican Grill, Inc., a corporation organized and existing under the laws of the State of Delaware (the "Corporation"), and does hereby further certify as follows:

(1) The name of the Corporation is Chipotle Mexican Grill, Inc.

(2) The name under which the Corporation was originally incorporated was Chipotle Mexican Grill, Inc., and the original certificate of incorporation of the Corporation was filed with the Secretary of State of the State of Delaware on January 30, 1998.

(3) This Restated Certificate of Incorporation only restates and integrates and does not further amend the provisions of the Certificate of Incorporation as theretofore amended or supplemented (the “Certificate of Incorporation”) and there is no discrepancy between the provisions of the Certificate of Incorporation as theretofore amended and supplemented and the provisions of this Restated Certificate of Incorporation.

(4) This Restated Certificate of Incorporation was duly adopted in accordance with the provisions of Section 245 of the DGCL.

(5) The text of the Restated Certificate of Incorporation hereby is integrated and restated to read in its entirety, as follows:

Article I - NAME

The name of the company is Chipotle Mexican Grill, Inc. (the “Corporation”).

Article II - AGENT

The registered office of the Corporation is located at 251 Little Falls Drive, Wilmington, New Castle County, DE 19808. The name of its registered agent at that address is Corporation Service Company.

Article III - PURPOSE

The purpose for which the Corporation is organized is to engage in any lawful act or activity for which corporations may be organized and incorporated under the General Corporation Law of the State of Delaware or any applicable successor act thereto, as the same may be amended from time to time (the “DGCL”).

Article IV - STOCK

Section 1. Authorized Stock. The Corporation shall have the authority to issue twelve billion one hundred million (12,100,000,000) shares of capital stock, consisting of eleven billion five

hundred million (11,500,000,000) shares of common stock with a par value of $0.01 per share (the “Common Stock”), and six hundred million (600,000,000) shares of preferred stock with a par value of $0.01 per share (the “Preferred Stock”).

Section 2. Common Stock.

(a) Voting – General. Except as otherwise provided by law or by the resolution or resolutions providing for the issue of any series of Preferred Stock, the holders of outstanding shares of Common Stock shall have the exclusive right to vote for the election of directors and for all other purposes. Except as otherwise required by law or this Certificate of Incorporation:

(i) The holders of the Common Stock are entitled to one vote for each share of Common Stock held at all meetings of stockholders; and

(ii) holders of Common Stock shall be entitled to cast votes in person or by proxy in the manner and to the extent permitted under the Bylaws of the Corporation (the “Bylaws”).

Section 3. Preferred Stock. The Preferred Stock may be issued from time to time in one or more classes or series. The Board of Directors of the Corporation (the “Board of Directors”) is hereby authorized to provide for the issuance of shares of Preferred Stock in one or more classes or series and, by filing a certificate pursuant to the applicable law of the State of Delaware (hereinafter referred to as “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such class or series, and to fix the designation, powers, preferences and rights of the shares of each such class or series and the qualifications, limitations and restrictions thereof prior to its issuance. Each such class or series of Preferred Stock shall have such voting powers, full or limited, or no voting powers, as shall be authorized by the Board of Directors and stated in the applicable Preferred Stock Designation.

The Common Stock shall be subject to the express terms of any series of Preferred Stock. Except as required by a Preferred Stock Designation or applicable law, holders of Preferred Stock shall not be entitled to vote at or receive notice of any meeting of shareholders.

Article V - BOARD OF DIRECTORS

Section 1. Number. The business and affairs of the Corporation shall be managed by or under the direction of a Board of Directors consisting of not fewer than three nor more than 20 directors (exclusive of directors referred to in the last paragraph of this Section 1), the exact number of directors to be determined from time to time by resolution adopted by the affirmative vote of a majority of the total number of directors then in office.

Each director shall hold office until the annual meeting for the year in which his or her term expires and until his or her successor shall be elected and shall qualify, subject, however, to prior death, resignation, retirement, disqualification or removal from office.

Elections of directors at an annual or special meeting of shareholders shall be by written ballot.

Notwithstanding the foregoing, whenever the holders of any one or more classes or series of Preferred Stock issued by the Corporation shall have the right, voting separately by class or series, to elect directors at an annual or special meeting of shareholders, the number of such directors and the election, term of office, filling of vacancies and other features of such directorships shall be governed by the provisions of Article V of this Certificate of Incorporation and any resolution or resolutions adopted by

the Board of Directors pursuant thereto, and such directors shall not be divided into classes unless expressly so provided therein.

Section 2. Vacancies. Any vacancy in the Board of Directors that results from an increase in the number of directors, from the death, disability, resignation, disqualification, removal of any director or from any other cause shall be filled by the affirmative vote of a majority of the total number of directors then in office, even if less than a quorum, or by a sole remaining director. Any director elected to fill a vacancy not resulting from an increase in the number of directors shall hold office for the remaining term of his or her predecessor.

Section 3. Removal. Any director or the entire Board may be removed from office at any time, with or without cause, but only by the affirmative vote of the holders of not less than a majority of the voting power of the outstanding Common Stock.

Section 4. Committees. Pursuant to the Bylaws, the Board of Directors may establish one or more committees to which may be delegated any of or all of the powers and duties of the Board of Directors to the full extent permitted by laws.

Article VI - LIABILITY OF DIRECTORS AND OFFICERS

Section 1. Elimination of Certain Liability of Directors. A director of the Corporation shall not be personally liable to the Corporation or its shareholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Corporation or its shareholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 of the DGCL; or (iv) for any transaction from which the director derived an improper personal benefit. If the DGCL is hereafter amended to permit further elimination or limitation of the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL as so amended.

Section 2. Indemnification and Insurance.

(a)Right to Indemnification. Each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter a “proceeding”), by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the DGCL, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, liens, amounts paid or to be paid in settlement and excise taxes or penalties arising under the Employee Retirement Income Security Act of 1974) reasonably incurred or suffered by such person in connection therewith and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her

heirs, executors and administrators; provided, however, that, except as provided in paragraph (b) hereof, the Corporation shall indemnify any such person seeking indemnification in connection with a proceeding (or part thereof) initiated by such person only if such proceeding (or part thereof) was authorized by the Board of Directors. The right to indemnification conferred in this Section shall be a contract right and shall include the right to be paid by the Corporation the expenses (including attorney’s fees) incurred in defending any such proceeding in advance of its final disposition provided, however, that, if the DGCL requires, the payment of such expenses incurred by a director or officer in his or her capacity as such in advance of the final disposition of a proceeding shall be made only upon delivery to the Corporation of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such director or officer is not entitled to be indemnified under this Section or otherwise (an “undertaking”); and provided further that such advancement of expenses incurred by any person other than a director or officer shall be made only upon the delivery of an undertaking to the foregoing effect and may be subject to such other conditions as the Board may deem advisable.

(b)Non-Exclusivity of Rights; Accrued Rights. The right to indemnification and the advancement of expenses conferred in this Section shall not be exclusive of any other right that any person may have or hereafter acquire under any statute, provision of this Certificate of Incorporation, Bylaw, agreement, vote of shareholders or disinterested directors or otherwise. Such rights shall be contract rights, shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Any repeal or modification of this Article VI shall not adversely affect any right or protection of a director of the Corporation in respect of any act or omission occurring prior to the time of such repeal or modification.

(c)Insurance. The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any such expense, liability or loss, whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the DGCL.

(d) Other Employees and Agents. The Corporation may, to the extent authorized from time to time by the Board of Directors, grant rights to indemnification and to the advancement of expenses to any employee not within the provisions of paragraph (a) of this Section or to any agent of the Corporation, subject to such conditions as the Board of Directors may deem advisable.

(e) Savings Clause. If this Article VI or any portion hereof shall be invalidated on any ground by any court of competent jurisdiction, then the Corporation shall nevertheless indemnify each person entitled to indemnification hereunder as to all expense, liability, and loss (including attorney’s fees, judgments, fines, ERISA excise taxes, penalties and amounts to be paid in settlement) actually and reasonably incurred or suffered by such person and for which indemnification is available to such person pursuant to this Article VI to the fullest extent permitted by any applicable portion of this Article VI that shall not have been invalidated and to the fullest extent permitted by applicable law.

Article VII - SECTION 203 OF THE DGCL

The Corporation expressly elects to be governed by Section 203 of the DGCL.

Article VIII - RESERVED

Article IX - CONSIDERATION OF OTHER CONSTITUENCIES

In addition to any other considerations which they may lawfully take into account in determining whether to take or to refrain from taking action on any matter and in discharging their duties under applicable law and this Certificate of Incorporation, the Board of Directors, its committees and each director may take into account the interests of customers, distributors, suppliers, creditors, current and retired employees and other constituencies of the Corporation and its subsidiaries and the effect upon the communities in which the Corporation and its subsidiaries do business; provided, however, that this Article shall be deemed solely to grant discretionary authority only and shall not be deemed to provide to any constituency a right to be considered.

Article X - SHAREHOLDER ACTION

Subject to the rights of the holders of Preferred Stock, any action required or permitted to be taken at any annual or special meeting of shareholders of the Corporation may be taken only upon the vote of the shareholders at an annual or special meeting duly called and may not be taken by written consent of the shareholders.

The Bylaws may establish procedures regulating the submission by shareholders of nominations and proposals for consideration at meetings of shareholders of the Corporation.

Article XI - AMENDMENT OF CERTIFICATE OF INCORPORATION

The Corporation reserves the right to amend or repeal any provision contained in this Certificate of Incorporation in the manner prescribed by the DGCL and all rights conferred upon shareholders are granted subject to this reservation.

Article XII - AMENDMENT OF BY-LAWS

The Board of Directors is expressly authorized and empowered to adopt, amend and repeal the Bylaws by the affirmative vote of a majority of the total number of directors present at a regular or special meeting of the Board of Directors at which there is a quorum (as defined from time to time in the Certificate of Incorporation) or by written consent. The shareholders of the Corporation may not adopt, amend or repeal any Bylaw, and no provision inconsistent therewith shall be adopted by the shareholders, unless such action is approved by the affirmative vote of the holders of not less than a majority of the voting power of the outstanding Common Stock.

The undersigned has executed this Restated Certificate of Incorporation of Chipotle Mexican Grill, Inc., effective as of the date of filing with the Secretary of State of the State of Delaware.

CHIPOTLE MEXICAN GRILL, INC.

By: /s/ Roger Theodoredis

Name: Roger Theodoredis

Title: General Counsel, Chief Legal Officer

v3.24.1.1.u2

Cover

|

Jun. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

CHIPOTLE MEXICAN GRILL, INC.

|

| Document Period End Date |

Jun. 06, 2024

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-32731

|

| Entity Tax Identification Number |

84-1219301

|

| Entity Address, Address Line One |

610 Newport Center Drive

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

Newport Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92660

|

| City Area Code |

949

|

| Local Phone Number |

524-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

CMG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001058090

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

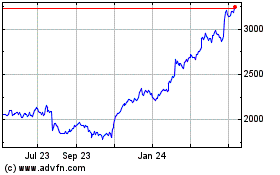

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From May 2024 to Jun 2024

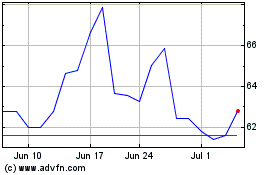

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Jun 2023 to Jun 2024