Statoil Caesar Tonga Comes Online - Analyst Blog

March 15 2012 - 9:15AM

Zacks

Norwegian energy company

Statoil ASA (STO) announced the commencement of

production from its Caesar Tonga deepwater project in the Gulf of

Mexico (GoM).

Caesar Tonga field, located in the

Green Canyon area of the deepwater GoM, is estimated to have a

reserve potential of 200–400 million barrels of oil equivalent

(MMBOE). The company, holding 23.55% working interest in the

project, expects the field production to reach about approximately

45,000 BOE per day from the first three subsea wells. A fourth

development well, which is part of the phase one development plan,

is expected to be drilled and completed later this year.

Anadarko Petroleum

Corporation (APC) holds an operational interest of 33.75%

in the project, and other associate partners include Shell

Offshore, a subsidiary of Royal Dutch Shell Plc

(RDS.A), and Chevron U.S.A., a subsidiary of Chevron

Corporation (CVX), with 22.45% and 20.25% stakes,

respectively.

The Caesar Tonga development venture

– that utilized Anadarko’s fully operated Constitution spar

floating production facility – also applied the steel lazy wave

riser technology for the first time in the GoM. The Constitution

spar, located in Green Canyon Block 680 in about 5,000 feet of

water, has a capacity of 70,000 barrels of oil per day and 200

million cubic feet of natural gas per day.

The Caesar Tonga development assumes

significance for Statoil as it demonstrates the company’s move to

significantly grow its production level in the GoM region over the

next several years. Statoil, the world’s largest offshore operator,

has operations in all major hydrocarbon-producing regions of the

world, but is mainly focused on the Norwegian Continental Shelf

(NCS).

We believe that the production

start-up at Caesar Tonga will help in driving the development and

expansion of Statoil’s international asset portfolio. Statoil is

also increasingly shifting its focus to the still-unexplored areas

of the Norwegian Sea and aims to achieve an equity production of

above 2.5 MMBOE in 2020.

However, we remain cautious about

the company’s weak production profile, which experienced a marginal

increment in the fourth quarter of 2011. In the reported quarter,

equity and entitlement production increased only by 2% and 1%,

respectively, from the year-earlier period. Hence, our long-term

Neutral recommendation remains unchanged and the company holds a

Zacks #3 Rank (short-term Hold rating).

ANADARKO PETROL (APC): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

ROYAL DTCH SH-A (RDS.A): Free Stock Analysis Report

STATOIL ASA-ADR (STO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

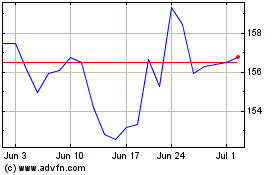

Chevron (NYSE:CVX)

Historical Stock Chart

From Jun 2024 to Jul 2024

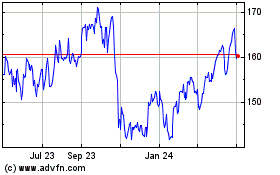

Chevron (NYSE:CVX)

Historical Stock Chart

From Jul 2023 to Jul 2024