Chemed Corporation (Chemed) (NYSE:CHE), which operates VITAS

Healthcare Corporation (VITAS), the nation’s largest provider of

end-of-life care, and Roto-Rooter, the nation’s largest commercial

and residential plumbing and drain cleaning services provider,

reported financial results for its third quarter ended September

30, 2011, versus the comparable prior-year period, as follows:

Consolidated operating results:

- Revenue increased 6.5% to $341

million

- GAAP Diluted EPS increased 14.3% to

$1.04

- Adjusted Diluted EPS increased 16.5% to

$1.20

VITAS segment operating results:

- Net Patient Revenue of $253 million, an

increase of 8.1%

- Average Daily Census (ADC) of 13,658,

an increase of 6.2%

- Admissions of 14,879, an increase of

2.7%

- Net Income of $21.0 million, an

increase of 5.9%

- Adjusted EBITDA of $37.8 million, an

increase of 6.3%

- Adjusted EBITDA margin of 15.0%, a

decrease of 25 basis points

Roto-Rooter segment operating results:

- Revenue of $88.5 million, an increase

of 2.3%

- Unit-for-unit job count of 157,466, an

increase of 0.5%

- Net Income of $8.0 million, an increase

of 3.5%

- Adjusted EBITDA of $14.9 million, an

increase of 8.7%

- Adjusted EBITDA margin of 16.9%, an

increase of 100 basis points

VITAS

Net revenue for VITAS was $253 million in the third quarter of

2011, which is an increase of 8.1% over the prior-year period.

Excluding the impact of Medicare Cap, revenue increased 7.9%. This

revenue growth was the result of increased ADC of 6.2%, driven by

an increase in admissions of 2.7%, combined with Medicare price

increases of approximately 2.1%. This growth was partially offset

by geographic and level of acuity mix shift of the patient

base.

Average revenue per patient per day in the quarter, excluding

the impact of Medicare Cap, was $201.00, which is 1.6% above the

prior-year period. Routine home care reimbursement and high acuity

care averaged $158.83 and $704.73, respectively, per patient per

day in the third quarter of 2011. During the quarter, high acuity

days of care were 7.7% of total days of care, 22 basis points lower

than the prior-year quarter.

In the third quarter of 2011, VITAS reversed a Medicare Cap

liability of $384,000. This compares to $117,000 of Medicare Cap

liability recorded in the third quarter of 2010.

Of VITAS’ 33 unique Medicare provider numbers, 29 provider

numbers have a Medicare Cap cushion of 10% or greater during the

trailing twelve-month period. Three provider numbers have a

Medicare Cap cushion of less than 10% and one small program has a

$282,000 Medicare Cap liability. VITAS generated an aggregate

Medicare Cap cushion of $211 million, or 24%, during the

trailing twelve-month period.

The third quarter of 2011 gross margin, excluding the impact of

Medicare Cap, was 22.2%, which is a decline of 87 basis points from

the third quarter of 2010. This decline in margin is primarily the

result of increased costs related to the 2011 mandated physician

visit for recertification, expansion of our community liaison

program, expansion of losses in start-up locations as well as

increased costs associated with expansion of inpatient units.

Selling, general and administrative expense was $18.9 million in

the third quarter of 2011, which is an increase of 3.1% when

compared to the prior-year quarter. Adjusted EBITDA totaled

$37.8 million in the quarter, an increase of 6.3% over the

prior-year period. Adjusted EBITDA margin, excluding the impact

from Medicare Cap, was 14.8% in the quarter which was 43 basis

points below the prior-year quarter.

Roto-Rooter

Roto-Rooter’s plumbing and drain cleaning business generated

sales of $88.5 million for the third quarter of 2011, an increase

of 2.3% over the prior-year quarter. This revenue growth was the

result of a combination of selective price increases and favorable

mix shift to higher value jobs, partially offset by a slight

decline in aggregate job count.

Unit for unit job count in the third quarter of 2011 increased

0.5% when compared to the prior-year period. During the third

quarter of 2011, total residential jobs decreased 0.6%, as

residential plumbing jobs increased 3.8% and residential drain

cleaning jobs decreased 3.0% when compared to the third quarter of

2010. Residential jobs represented 70% of total job count in the

quarter. Total commercial jobs increased 3.0%, with commercial

plumbing/excavation job count increasing 6.9% and commercial drain

cleaning increasing 1.9% when compared to the prior-year quarter.

The “All Other” residential and commercial job category, which

represents less than 2% of aggregate job count, decreased 5.3%.

Roto-Rooter’s gross margin was 45.0% in the quarter, a 42 basis

point increase when compared to the third quarter of 2010. Adjusted

EBITDA in the third quarter of 2011 totaled $14.9 million, an

increase of 8.7%, and the Adjusted EBITDA margin was 16.9% in the

quarter, an increase of 100 basis points, when compared to the

prior-year quarter.

Roto-Rooter continues to have periodic discussions with existing

franchisees to acquire franchise territories. Management will be

highly disciplined in terms of valuation, risk assessment and

overall return on investment of any potential acquisition. The

timing or actual completion of any acquisition cannot be

predicted.

Chemed Consolidated Debt

and Cash Flows

Chemed had total debt of $165 million at September 30, 2011.

This debt is net of the discount taken as a result of convertible

debt accounting requirements. Excluding this discount, aggregate

debt is $187 million and is due in May 2014. Chemed’s total

debt equates to less than one times trailing twelve-month adjusted

EBITDA.

In March 2011 Chemed replaced its existing credit facility with

a new Credit Agreement. Terms of this Credit Agreement consist of a

five-year $350 million revolving credit facility. The interest rate

on this Credit Agreement has a floating rate that is currently

LIBOR plus 175 basis points. This Credit Agreement provides Chemed

with increased flexibility in terms of acquisitions, share

repurchases, dividends and other corporate needs. In addition, an

expansion feature is included in this Credit Agreement that

provides Chemed the opportunity to increase its revolver and/or

enter into term loans for an additional $150 million. At September

30, 2011, this facility had approximately $321 million of undrawn

borrowing capacity after deducting $29 million for letters of

credit issued to secure the Company’s workers’ compensation

insurance.

Capital expenditures for the first nine months of 2011

aggregated $23.5 million and compares to depreciation and

amortization during the same period of $22.2 million.

The Company increased its quarterly dividend from $0.14 to $0.16

per share in the third quarter of 2011. In addition, the company

has purchased $106.5 million, or 1,871,543 shares, of Chemed stock

in the first nine months of 2011. As of September 30, 2011, $12.6

million is remaining under Chemed’s previously announced share

repurchase program. Management will continually evaluate cash

utilization alternatives, including share repurchase, debt

repurchase, acquisitions and increased dividends to determine the

most beneficial use of available capital resources.

Guidance for

2011

VITAS expects to achieve full-year 2011 revenue growth, prior to

Medicare Cap, of 7.5% to 8.0%. Admissions in 2011 are estimated to

increase approximately 5.0% to 5.5% and full-year Adjusted EBITDA

margin, prior to Medicare Cap, is estimated to be 15.2% to 15.7%.

Effective October 1, 2011, Medicare increased the average

hospice reimbursement rates by approximately 2.5%. Consistent with

prior years, our guidance assumes VITAS will incur an additional

$1.25 million of estimated Medicare contractual billing limitations

for the fourth quarter of 2011.

Roto-Rooter expects to achieve full-year 2011 revenue growth of

4.5% to 5.5%. The revenue estimate is a result of increased pricing

of approximately 2% to 3%, a favorable mix shift to higher revenue

jobs, with job count growth estimated at 0% to 1%. Adjusted EBITDA

margin for 2011 is estimated in the range of 17.0% to 18.0%.

Based upon the above, management estimates 2011 earnings per

diluted share, excluding non-cash expense for stock options, the

non-cash interest expense related to the accounting for convertible

debt and other items not indicative of ongoing operations, will be

in the range of $4.75 to $4.85. This compares to Chemed’s 2010

adjusted earnings per diluted share of $4.17.

Conference

Call

Chemed will host a conference call and webcast at 10 a.m., ET,

on Wednesday, October 26, 2011, to discuss the Company's quarterly

results and to provide an update on its business. The dial-in

number for the conference call is (866) 510-0708 for U.S. and

Canadian participants and (617) 597-5377 for international

participants. The participant passcode is 59588119. A live webcast

of the call can be accessed on Chemed's website at www.chemed.com by clicking on Investor Relations

Home.

A taped replay of the conference call will be available

beginning approximately 24 hours after the call's conclusion. It

can be accessed by dialing (888) 286-8010 for U.S. and Canadian

callers and (617) 801-6888 for international callers and will be

available for one week following the live call. The replay passcode

is 46875269. An archived webcast will also be available at

www.chemed.com.

Chemed Corporation operates in the healthcare field through its

VITAS Healthcare Corporation subsidiary. VITAS provides daily

hospice services to approximately 13,000 patients with severe,

life-limiting illnesses. This type of care is focused on making the

terminally ill patient's final days as comfortable and pain-free as

possible.

Chemed operates in the residential and commercial plumbing and

drain cleaning industry under the brand name Roto-Rooter.

Roto-Rooter provides plumbing and drain service through

company-owned branches, independent contractors and franchisees in

the United States and

Canada. Roto-Rooter also has licensed master franchisees in

Indonesia, Singapore, Japan, and the Philippines.

This press release contains information about Chemed’s EBITDA,

Adjusted EBITDA and Adjusted Diluted EPS, which are not measures

derived in accordance with GAAP and which exclude components that

are important to understanding Chemed’s financial performance. In

reporting its operating results, Chemed provides EBITDA, Adjusted

EBITDA and Adjusted Diluted EPS measures to help investors and

others evaluate the Company’s operating results, compare its

operating performance with that of similar companies that have

different capital structures and evaluate its ability to meet its

future debt service, capital expenditures and working capital

requirements. Chemed’s management similarly uses EBITDA, Adjusted

EBITDA and Adjusted Diluted EPS to assist it in evaluating the

performance of the Company across fiscal periods and in assessing

how its performance compares to its peer companies. These measures

also help Chemed’s management to estimate the resources required to

meet Chemed’s future financial obligations and expenditures.

Chemed’s EBITDA, Adjusted EBITDA and Adjusted Diluted EPS should

not be considered in isolation or as a substitute for comparable

measures calculated and presented in accordance with GAAP. We

calculated Adjusted EBITDA Margin by dividing Adjusted EBITDA by

service revenue and sales. A reconciliation of Chemed’s net income

to its EBITDA, Adjusted EBITDA and Adjusted Diluted EPS is

presented in the tables following the text of this press

release.

Forward-Looking

Statements

Certain statements contained in this press release and the

accompanying tables are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words "believe," "expect," "hope," "anticipate," "plan" and

similar expressions identify forward-looking statements, which

speak only as of the date the statement was made. Chemed does not

undertake and specifically disclaims any obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

statements are based on current expectations and assumptions and

involve various risks and uncertainties, which could cause Chemed's

actual results to differ from those expressed in such

forward-looking statements. These risks and uncertainties arise

from, among other things, possible changes in regulations governing

the hospice care or plumbing and drain cleaning industries;

periodic changes in reimbursement levels and procedures under

Medicare and Medicaid programs; difficulties predicting patient

length of stay and estimating potential Medicare reimbursement

obligations; challenges inherent in Chemed's growth strategy; the

current shortage of qualified nurses, other healthcare

professionals and licensed plumbing and drain cleaning technicians;

Chemed’s dependence on patient referral sources; and other factors

detailed under the caption "Description of Business by Segment" or

"Risk Factors" in Chemed’s most recent report on form 10-Q or 10-K

and its other filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on such

forward-looking statements and there are no assurances that the

matters contained in such statements will be achieved.

CHEMED CORPORATION AND

SUBSIDIARY COMPANIES CONSOLIDATED STATEMENT OF INCOME

(in thousands, except per share

data)(unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2011 2010

2011 2010 Service revenues and sales

$ 341,439

$ 320,451

$ 1,005,717 $ 944,259

Cost of services provided and goods sold

245,063

227,915

722,118 670,754 Selling, general and administrative

expenses (aa)

47,618 48,200

153,696 146,694

Depreciation

6,313 6,385

18,959 18,048 Amortization

1,134 1,196

3,243

3,707 Total costs and expenses

300,128 283,696

898,016

839,203 Income from operations

41,311

36,755

107,701 105,056 Interest expense

(3,555

) (2,995 )

(10,260 ) (8,946 ) Other

income--net (bb)

(1,935 ) 222

881 418 Income before income

taxes

35,821 33,982

98,322 96,528 Income taxes

(13,934 ) (12,994 )

(38,048

) (37,327 ) Net income

$ 21,887

$ 20,988

$ 60,274 $ 59,201

Earnings Per Share Net income

$

1.06 $ 0.93

$ 2.88 $ 2.62

Average number of shares outstanding

20,674

22,597

20,934

22,604

Diluted Earnings Per Share Net income

$ 1.04 $ 0.91

$ 2.82

$ 2.57 Average number of shares outstanding

21,055 22,996

21,400

23,006

(aa)

Selling, general and administrative ("SG&A") expenses comprise

(in thousands):

Three Months Ended September 30,

Nine Months Ended September 30,

2011 2010

2011 2010 SG&A expenses before

long-term incentive compensation and the impact of market gains and

losses of deferred compensation plans

$ 49,629 $

47,957

$ 149,888 $ 144,547 Market value

gains/(losses) on assets held in deferred compensation trusts

(2,011 ) 243

796 348 Long-term incentive

compensation

- -

3,012 1,799 Total SG&A expenses

$ 47,618 $ 48,200

$

153,696 $ 146,694 (bb) Other

income--net comprises (in thousands): Three Months Ended September

30,

Nine Months Ended September 30,

2011 2010

2011 2010 Market value gains/(losses) on

assets held in deferred compensation trusts

$ (2,011

) $ 243

$ 796 $ 348 Loss on disposal of

property and equipment

(79 ) (141 )

(68

) (293 ) Interest income

74 109

197 334 Other

81 11

(44 )

29 Total other income--net

$ (1,935

) $ 222

$ 881 $ 418

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED BALANCE

SHEET

(in thousands, except per share

data)(unaudited)

September 30,

2011 2010

Assets Current

assets Cash and cash equivalents

$ 21,342 $ 137,457

Accounts receivable less allowances

112,721 105,686

Inventories

8,888 7,951 Current deferred income taxes

14,850 14,650 Prepaid income taxes

764 337 Prepaid

expenses

10,031 9,925 Total

current assets

168,596 276,006 Investments of deferred

compensation plans held in trust

31,339 26,022 Properties

and equipment, at cost less accumulated depreciation

83,484

78,982 Identifiable intangible assets less accumulated amortization

55,983 56,097 Goodwill

460,747 450,095 Other assets

14,907 11,190 Total Assets

$ 815,056 $ 898,392

Liabilities Current liabilities Accounts payable

$

59,186 $ 52,552 Income taxes

8,267 4,575 Accrued

insurance

35,655 34,320 Accrued compensation

40,376

45,183 Other current liabilities

17,308

15,637 Total current liabilities

160,792 152,267

Deferred income taxes

23,262 23,045 Long-term debt

164,841 157,392 Deferred compensation liabilities

30,267 25,508 Other liabilities

9,559

6,624 Total Liabilities

388,721

364,836

Stockholders' Equity Capital

stock

30,913 30,207 Paid-in capital

394,822 354,473

Retained earnings

524,197 453,886 Treasury stock, at cost

(525,555 ) (306,977 ) Deferred compensation payable

in Company stock

1,958 1,967

Total Stockholders' Equity

426,335

533,556 Total Liabilities and Stockholders' Equity

$

815,056 $ 898,392

CHEMED CORPORATION AND SUBSIDIARY

COMPANIES CONSOLIDATED STATEMENT OF CASH FLOWS

(in thousands)(unaudited)

Nine Months Ended September 30,

2011 2010

Cash Flows from Operating Activities Net income

$

60,274 $ 59,201 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization

22,202 21,755 Stock option expense

6,903

6,365 Provision for uncollectible accounts receivable

6,640

7,248 Amortization of discount on convertible notes

5,633

5,265 Noncash long-term incentive compensation

2,595 1,580

Provision for deferred income taxes

(1,608 ) (3,886 )

Changes in operating assets and liabilities, excluding amounts

acquired in business combinations: Increase in accounts receivable

(5,991 ) (59,528 ) Increase in inventories

(1,160 ) (408 ) Decrease in prepaid expenses

254 463 Increase in accounts payable and other current

liabilities

2,654 12,479 Increase in income taxes

12,253 6,729 Increase in other assets

(3,811 )

(2,180 ) Increase in other liabilities

3,567 3,960 Excess

tax benefit on share-based compensation

(3,368 )

(1,823 ) Other sources

899 770

Net cash provided by operating activities

107,936

57,990

Cash Flows from Investing

Activities Capital expenditures

(23,459 ) (19,107

) Business combinations, net of cash acquired

(3,689

) (30 ) Other uses

(829 ) (448 )

Net cash used by investing activities

(27,977

) (19,585 )

Cash Flows from Financing

Activities Purchases of treasury stock

(110,288 )

(10,175 ) Dividends paid

(9,393 ) (8,682 ) Proceeds

from issuance of capital stock

7,979 3,632 Excess tax

benefit on share-based compensation

3,368 1,823 Debt

issuances costs

(2,723 ) -

Increase/(decrease) in cash overdrafts

payable

2,297 (184 ) Other sources

226

222 Net cash used by financing activities

(108,534 ) (13,364 )

Increase/(Decrease) in

Cash and Cash Equivalents (28,575 ) 25,041 Cash

and cash equivalents at beginning of year

49,917

112,416 Cash and cash equivalents at end of

period

$ 21,342 $ 137,457

CHEMED CORPORATION AND SUBSIDIARY COMPANIES

CONSOLIDATING STATEMENT OF INCOME FOR THE THREE MONTHS

ENDED SEPTEMBER 30, 2011 AND 2010

(in thousands)(unaudited)

Chemed

VITAS Roto-Rooter Corporate

Consolidated

2011

Service revenues and sales $ 252,944 $ 88,495

$ - $ 341,439 Cost of services provided and goods

sold 196,407 48,656 - 245,063 Selling, general and administrative

expenses (a) 18,945 25,057 3,616 47,618 Depreciation 4,123 2,058

132 6,313 Amortization 510 156

468 1,134 Total costs and expenses

219,985 75,927 4,216

300,128 Income/(loss) from operations 32,959 12,568 (4,216 )

41,311 Interest expense (a) (62 ) (132 ) (3,361 ) (3,555 )

Intercompany interest income/(expense) 834 451 (1,285 ) - Other

income/(expense)—net 62 (7 ) (1,990 )

(1,935 ) Income/(loss) before income taxes 33,793 12,880

(10,852 ) 35,821 Income taxes (a) (12,823 ) (4,864 )

3,753 (13,934 ) Net income/(loss) $ 20,970

$ 8,016 $ (7,099 ) $ 21,887

2010

Service revenues and sales $ 233,964 $ 86,487

$ - $ 320,451 Cost of services provided and goods

sold 179,997 47,918 - 227,915 Selling, general and administrative

expenses (b) 18,370 24,573 5,257 48,200 Depreciation 4,321 1,925

139 6,385 Amortization 694 133

369 1,196 Total costs and expenses

203,382 74,549 5,765

283,696 Income/(loss) from operations 30,582 11,938 (5,765 )

36,755 Interest expense (b) (48 ) (55 ) (2,892 ) (2,995 )

Intercompany interest income/(expense) 1,139 651 (1,790 ) - Other

income/(expense)—net (92 ) 11 303

222 Income/(loss) before income taxes 31,581

12,545 (10,144 ) 33,982 Income taxes (b) (11,778 )

(4,798 ) 3,582 (12,994 ) Net income/(loss) $

19,803 $ 7,747 $ (6,562 ) $ 20,988 The

"Footnotes to Financial Statements" are integral parts of this

financial information.

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATING STATEMENT

OF INCOME FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2011 AND

2010

(in thousands)(unaudited)

Chemed VITAS

Roto-Rooter Corporate Consolidated 2011

Service revenues and sales $ 731,712 $ 274,005

$ - $ 1,005,717 Cost of services provided and goods

sold 570,648 151,470 - 722,118 Selling, general and administrative

expenses (a) 57,392 76,181 20,123 153,696 Depreciation 12,489 6,067

403 18,959 Amortization 1,513 443

1,287 3,243 Total costs and expenses

642,042 234,161 21,813

898,016 Income/(loss) from operations 89,670 39,844

(21,813 ) 107,701 Interest expense (a) (172 ) (274 ) (9,814 )

(10,260 ) Intercompany interest income/(expense) 3,263 1,742 (5,005

) - Other income/(expense)—net 3 (2 )

880 881 Income/(loss) before income taxes

92,764 41,310 (35,752 ) 98,322 Income taxes (a) (35,080 )

(15,692 ) 12,724 (38,048 ) Net

income/(loss) $ 57,684 $ 25,618 $ (23,028 ) $ 60,274

2010 Service revenues and sales $ 683,542

$ 260,717 $ - $ 944,259 Cost of

services provided and goods sold 527,347 143,407 - 670,754 Selling,

general and administrative expenses (b) 54,920 73,523 18,251

146,694 Depreciation 11,909 5,826 313 18,048 Amortization

2,253 388 1,066 3,707

Total costs and expenses 596,429

223,144 19,630 839,203

Income/(loss) from operations 87,113 37,573 (19,630 ) 105,056

Interest expense (b) (127 ) (187 ) (8,632 ) (8,946 ) Intercompany

interest income/(expense) 3,778 2,126 (5,904 ) - Other

income/(expense)—net (85 ) 35 468

418 Income/(loss) before income taxes 90,679

39,547 (33,698 ) 96,528 Income taxes (b) (34,156 )

(15,127 ) 11,956 (37,327 ) Net income/(loss) $

56,523 $ 24,420 $ (21,742 ) $ 59,201

The "Footnotes to Financial Statements" are integral parts of this

financial information.

CHEMED CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATING

SUMMARY OF EBITDA FOR THE THREE MONTHS ENDED SEPTEMBER 30,

2011 AND 2010

(in thousands)(unaudited)

Chemed VITAS Roto-Rooter

Corporate Consolidated 2011 Net

income/(loss) $ 20,970 $ 8,016 $ (7,099 ) $ 21,887 Add/(deduct):

Interest expense 62 132 3,361 3,555 Income taxes 12,823 4,864

(3,753 ) 13,934 Depreciation 4,123 2,058 132 6,313 Amortization

510 156 468 1,134

EBITDA 38,488 15,226 (6,891 ) 46,823 Add/(deduct):

Intercompany interest expense/(income) (834 ) (451 ) 1,285 -

Interest income (43 ) (12 ) (19 ) (74 ) Legal expenses of OIG

investigation 212 - - 212 Acquisition expenses 2 - - 2 Expenses of

class action litigation - 770 - 770 Advertising cost adjustment (c)

- (585 ) - (585 ) Stock option expense - -

2,408 2,408 Adjusted EBITDA $

37,825 $ 14,948 $ (3,217 ) $ 49,556

2010 Net income/(loss) $ 19,803 $ 7,747 $ (6,562 ) $ 20,988

Add/(deduct): Interest expense 48 55 2,892 2,995 Income taxes

11,778 4,798 (3,582 ) 12,994 Depreciation 4,321 1,925 139 6,385

Amortization 694 133 369

1,196 EBITDA 36,644 14,658 (6,744 ) 44,558

Add/(deduct): Intercompany interest expense/(income) (1,139 ) (651

) 1,790 - Interest income (37 ) (10 ) (62 ) (109 ) Legal expenses

of OIG investigation 112 - - 112 Expenses of class action

litigation - 322 - 322 Advertising cost adjustment (c) - (571 ) -

(571 ) Stock option expense - -

1,968 1,968 Adjusted EBITDA $ 35,580 $

13,748 $ (3,048 ) $ 46,280 The "Footnotes to

Financial Statements" are integral parts of this financial

information.

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATING SUMMARY

OF EBITDA FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2011 AND

2010

(in thousands)(unaudited)

Chemed VITAS Roto-Rooter

Corporate Consolidated 2011 Net

income/(loss) $ 57,684 $ 25,618 $ (23,028 ) $ 60,274 Add/(deduct):

Interest expense 172 274 9,814 10,260 Income taxes 35,080 15,692

(12,724 ) 38,048 Depreciation 12,489 6,067 403 18,959 Amortization

1,513 443 1,287

3,243 EBITDA 106,938 48,094 (24,248 ) 130,784 Add/(deduct):

Intercompany interest expense/(income) (3,263 ) (1,742 ) 5,005 -

Interest income (86 ) (28 ) (83 ) (197 ) Legal expenses of OIG

investigation 1,209 - - 1,209 Acquisition expenses 117 (6 ) - 111

Expenses of class action litigation - 1,451 - 1,451 Advertising

cost adjustment (c) - (1,442 ) - (1,442 ) Stock option expense - -

6,903 6,903 Long-term incentive compensation -

- 3,012 3,012 Adjusted EBITDA $

104,915 $ 46,327 $ (9,411 ) $ 141,831

2010 Net income/(loss) $ 56,523 $ 24,420 $ (21,742 ) $

59,201 Add/(deduct): Interest expense 127 187 8,632 8,946 Income

taxes 34,156 15,127 (11,956 ) 37,327 Depreciation 11,909 5,826 313

18,048 Amortization 2,253 388

1,066 3,707 EBITDA 104,968 45,948 (23,687 )

127,229 Add/(deduct): Intercompany interest expense/(income) (3,778

) (2,126 ) 5,904 - Interest income (172 ) (37 ) (125 ) (334 ) Legal

expenses of OIG investigation 390 - - 390 Expenses of class action

litigation - 427 - 427 Advertising cost adjustment (c) - (1,639 ) -

(1,639 ) Stock option expense - - 6,365 6,365 Long-term incentive

compensation - - 1,799

1,799 Adjusted EBITDA $ 101,408 $ 42,573

$ (9,744 ) $ 134,237 The "Footnotes to

Financial Statements" are integral parts of this financial

information.

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES RECONCILIATION OF

ADJUSTED NET INCOME

(in thousands, except per share

data)(unaudited)

Three Months Ended Nine Months

Ended September 30, September 30,

2011 2010

2011 2010

Net income as reported

$ 21,887 $ 20,988

$

60,274 $ 59,201 Add/(deduct) impact of: After-tax

stock option expense

1,523 1,244

4,366 4,026

After-tax additional interest expense resulting from the change in

accounting for the conversion feature of the convertible notes

1,177 1,088

3,464 3,203 After-tax cost of legal

expenses of OIG investigation

131 69

749 242

After-tax cost of expenses of class action litigation

467

194

881 257 After-tax cost of acquisition expenses

2

-

69 - After-tax long-term incentive compensation

-

-

1,880 1,124 Adjusted net

income

$ 25,187 $ 23,583

$ 71,683 $

68,053 Earnings Per Share As Reported Net income

$ 1.06 $ 0.93

$ 2.88 $ 2.62 Average

number of shares outstanding

20,674 22,597

20,934 22,604 Diluted Earnings Per Share As

Reported Net income

$ 1.04 $ 0.91

$

2.82 $ 2.57 Average number of shares outstanding

21,055 22,996

21,400 23,006

Adjusted Earnings Per Share Net income

$

1.22 $ 1.04

$ 3.42 $ 3.01 Average number of

shares outstanding

20,674 22,597

20,934 22,604 Adjusted Diluted Earnings Per Share Net

income

$ 1.20 $ 1.03

$ 3.35 $ 2.96

Average number of shares outstanding

21,055

22,996

21,400 23,006 The "Footnotes to

Financial Statements" are integral parts of this financial

information.

CHEMED CORPORATION AND

SUBSIDIARY COMPANIES OPERATING STATISTICS FOR VITAS

SEGMENT (unaudited)

Three Months Ended Nine Months Ended September

30, September 30, OPERATING STATISTICS

2011 2010

2011

2010 Net revenue ($000) (d) Homecare

$ 184,155 $

169,306

$ 529,874 $ 490,044 Inpatient

28,292

25,963

82,861 78,244 Continuous care

40,113

38,812

117,950 113,588 Total

before Medicare cap allowance

$ 252,560 $ 234,081

$ 730,685 $ 681,876 Medicare cap allowance

384 (117 )

1,027 1,666 Total

$ 252,944 $ 233,964

$ 731,712 $

683,542 Net revenue as a percent of total before Medicare cap

allowance Homecare

72.9 % 72.3 %

72.5 %

71.8 % Inpatient

11.2 11.1

11.3 11.5 Continuous care

15.9 16.6

16.2

16.7 Total before Medicare cap allowance

100.0 100.0

100.0 100.0 Medicare cap allowance

0.2

(0.1 )

0.1 0.2 Total

100.2

% 99.9 %

100.1 %

100.2 % Average daily census ("ADC") (days) Homecare

9,485

8,586

9,185 8,350 Nursing home

3,118

3,250

3,062 3,212 Routine homecare

12,603 11,836

12,247 11,562 Inpatient

456 425

451 433 Continuous care

599 596

601 595 Total

13,658

12,857

13,299 12,590 Total

Admissions

14,879 14,483

45,971 43,750 Total

Discharges

14,682 14,076

45,104 42,767 Average length

of stay (days)

80.1 78.2

78.7 77.1 Median length of

stay (days)

15.0 15.0

14.0 14.0 ADC by major

diagnosis Neurological

34.3 % 33.4 %

34.4

% 33.2 % Cancer

17.5 18.5

17.7 18.4 Cardio

11.3 11.9

11.6 11.9 Respiratory

6.6 6.5

6.8 6.6 Other

30.3 29.7

29.5 29.9 Total

100.0 %

100.0 %

100.0 % 100.0 %

Admissions by major diagnosis Neurological

19.0 %

18.4 %

19.3 % 18.6 % Cancer

34.7 35.8

33.1 34.6 Cardio

10.4 11.1

10.9 11.3

Respiratory

7.8 7.5

8.5 8.1 Other

28.1

27.2

28.2 27.4 Total

100.0 % 100.0 %

100.0

% 100.0 % Direct patient care margins (e) Routine

homecare

52.4 % 52.7 %

52.0 % 52.2 %

Inpatient

12.4 12.3

12.9 13.3 Continuous care

20.7 21.1

20.5 21.0 Homecare margin drivers (dollars

per patient day) Labor costs

$ 53.13 $ 51.97

$

53.88 $ 52.79 Drug costs

8.26 7.89

8.14 7.78

Home medical equipment

6.64

6.54

6.65

6.71

Medical supplies

2.81 2.66

2.80 2.53 Inpatient margin

drivers (dollars per patient day) Labor costs

$

312.72 $ 304.42

$ 310.25 $ 297.63 Continuous

care margin drivers (dollars per patient day) Labor costs

$

555.63 $ 536.83

$ 550.09 $ 531.14 Bad debt

expense as a percent of revenues

0.8 % 0.9 %

0.7 % 0.9 % Accounts receivable --

Days of revenue outstanding - excluding

unapplied Medicare payments

38.9 39.7

n.a. n.a.

Days of revenue outstanding - including

unapplied Medicare payments

34.6 34.9

n.a. n.a. The "Footnotes to

Financial Statements" are integral parts of this financial

information.

CHEMED

CORPORATION AND SUBSIDIARY COMPANIES FOOTNOTES TO FINANCIAL

STATEMENTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30,

2011 AND 2010 (unaudited) (a)

Included in the results of operations 2011 are the following

significant credits/(charges) which may not be indicative of

ongoing operations (in thousands):

Three Months Ended September

30, 2011 VITAS Roto-Rooter Corporate

Consolidated Selling, general and administrative expenses:

Legal expenses of OIG investigation $ (212 ) $ - $ - $ (212 )

Acquisition expenses (2 ) - - (2 ) Expenses of class action

litigation - (770 ) - (770 ) Stock option expense - - (2,408 )

(2,408 ) Interest expense: Additional interest expense resulting

from the change in accounting for the conversion feature of the

convertible notes - - (1,861 )

(1,861 ) Pretax impact on earnings (214 ) (770 ) (4,269 )

(5,253 ) Income tax benefit on the above 81

303 1,569 1,953 After-tax impact

on earnings $ (133 ) $ (467 ) $ (2,700 ) $ (3,300 )

Nine

Months Ended September 30, 2011 VITAS Roto-Rooter

Corporate Consolidated Selling, general and

administrative expenses: Legal expenses of OIG investigation $

(1,209 ) $ - $ - $ (1,209 ) Acquisition expenses (117 ) 6 - (111 )

Expenses of class action litigation - (1,451 ) - (1,451 ) Stock

option expense - - (6,903 ) (6,903 ) Long-term incentive

compensation - - (3,012 ) (3,012 ) Interest expense: Additional

interest expense resulting from the change in accounting for the

conversion feature of the convertible notes -

- (5,476 ) (5,476 ) Pretax impact on earnings

(1,326 ) (1,445 ) (15,391 ) (18,162 ) Income tax benefit on the

above 504 568 5,681

6,753 After-tax impact on earnings $ (822 ) $ (877 )

$ (9,710 ) $ (11,409 ) (b) Included in the results of

operations 2010 are the following significant credits/(charges)

which may not be indicative of ongoing operations (in thousands):

Three Months Ended September 30, 2010 VITAS

Roto-Rooter Corporate Consolidated Selling,

general and administrative expenses: Legal expenses of OIG

investigation $ (112 ) $ - $ - $ (112 ) Expenses of class action

litigation - (322 ) - (322 ) Stock option expense - - (1,968 )

(1,968 ) Interest expense: Additional interest expense resulting

from the change in accounting for the conversion feature of the

convertible notes - - (1,721 )

(1,721 ) Pretax impact on earnings (112 ) (322 ) (3,689 )

(4,123 ) Income tax benefit on the above 43

128 1,357 1,528 After-tax impact

on earnings $ (69 ) $ (194 ) $ (2,332 ) $ (2,595 )

Nine

Months Ended September 30, 2010 VITAS Roto-Rooter

Corporate Consolidated Selling, general and

administrative expenses: Legal expenses of OIG investigation $ (390

) $ - $ - $ (390 ) Expenses of class action litigation - (427 ) -

(427 ) Stock option expense - - (6,365 ) (6,365 ) Long-term

incentive compensation - - (1,799 ) (1,799 ) Interest expense:

Additional interest expense resulting from the change in accounting

for the conversion feature of the convertible notes -

- (5,064 ) (5,064 ) Pretax impact on

earnings (390 ) (427 ) (13,228 ) (14,045 ) Income tax benefit on

the above 148 170 4,875

5,193 After-tax impact on earnings $ (242 ) $ (257 )

$ (8,353 ) $ (8,852 ) (c)

Under Generally Accepted Accounting

Principles ("GAAP"), the Roto-Rooter segment expenses all

advertising, including the cost of telephone directories,

immediately upon the initial release of the advertising. Telephone

directories are generally in circulation 12 months. If a directory

is in circulation for a time period greater or less than 12 months,

the publisher adjusts the directory billing for the change in

billing period. The timing of when a telephone directory is

published can and does fluctuate significantly on a quarterly

basis. This "direct expensing" results in significant fluctuations

in quarterly advertising expense. In the third quarters of 2011 and

2010, GAAP advertising expense for Roto-Rooter totaled $5,239,000

and $5,579,000, respectively. If the expense of the telephone

directories were spread over the periods they are in circulation,

advertising expense for the third quarters of 2011 and 2010 would

total $5,824,000 and $6,150,000, respectively.

Similarly, for the first nine months of

2011 and 2010, GAAP advertising expense for Roto-Rooter totaled

$16,461,000 and $16,815,00, respectively. If the expense of the

telephone directories were spread over the periods they are in

circulation, advertising expense for the first nine months of 2011

and 2010 would total $17,903,000 and $18,454,000, respectively.

(d)

VITAS has 7 large (greater than 450 ADC),

17 medium (greater than 200 but less than 450 ADC) and 28 small

(less than 200 ADC) hospice programs. For the current cap year

there is one program with a small cap liability and three programs

with Medicare cap cushion of less than 10%.

(e)

Amounts exclude indirect patient care and

administrative costs, as well as Medicare Cap billing

limitation.

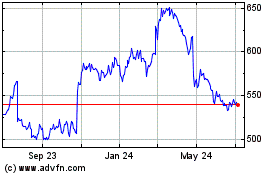

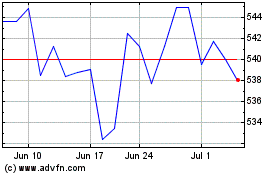

Chemed (NYSE:CHE)

Historical Stock Chart

From May 2024 to Jun 2024

Chemed (NYSE:CHE)

Historical Stock Chart

From Jun 2023 to Jun 2024