0001364954false00013649542023-08-222023-08-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 22, 2023

Chegg, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36180 | | 20-3237489 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 3990 Freedom Circle | | |

| Santa Clara, | California | | 95054 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 855-5700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | CHGG | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On August 22, 2023, Chegg, Inc. (the “Company”) entered into individual, privately negotiated exchange agreements (the “Exchange Agreements”) with a limited number of holders of its outstanding 0% Convertible Senior Notes due 2026 (“2026 Notes”) to exchange $169.7 million in aggregate principal amount for an aggregate cash repurchase price of approximately $135.8 million. The 2026 Notes exchange transactions were entered into in connection with our securities repurchase program and expected to close on August 31, 2023, subject to the satisfaction of customary closing conditions. Following the closing, approximately $244.5 million of aggregate principal amount of the 2026 Notes will remain outstanding and $153.7 million will remain under our securities repurchase program.

A copy of the Form of Exchange Agreement is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The foregoing description of the Form of Exchange Agreement is qualified in its entirety by reference to such exhibits.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report, including statements regarding the amount of the 2026 Notes to be exchanged, the amount of the 2026 Notes to remain outstanding following completion of the exchange transactions, the amount to remain under our securities repurchase program following completion of the exchange transactions, the ability to complete the exchange transactions on the timeline described herein or at all, and the final aggregate cash repurchase price for the exchange transactions are forward-looking statements. The words “will,” “plans,” “expects” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including changes in the price of our common stock and changes in the convertible note or other capital markets. In addition, new risks may emerge from time to time, and it is not possible for the Company to predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements made. In light of these risks, uncertainties and assumptions, the future events discussed in this Current Report on Form 8-K may not occur and actual future results may be materially different from those anticipated or implied in the forward-looking statements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| |

| CHEGG, INC. |

| |

| By: /s/ Andrew Brown |

| Name: Andrew Brown |

| Title: Chief Financial Officer |

Date: August 23, 2023

CHEGG, INC.

EXCHANGE AGREEMENT

August 22, 2023

[●] (the “Undersigned”), for itself and on behalf of the beneficial owners listed on Exhibit A hereto (the “Accounts”) for whom the Undersigned holds contractual and investment authority (each Account, as well as the Undersigned if it is exchanging Outstanding Notes (as defined below), referred to hereunder as a “Holder”), enters into this Exchange Agreement (this “Agreement”) with Chegg, Inc., a Delaware corporation (the “Company”), as of the date first written above, whereby the Holders will exchange the Exchanged Notes (as defined below) for an amount in cash equal to the Exchange Consideration (as defined below). The “Exchange Consideration” shall be calculated as follows: For each $1,000 principal amount of such Holder’s Exchanged Notes as set forth on Exhibit A, an amount of cash equal to [●].

On and subject to the terms hereof, the parties hereto agree as follows:

Article I

Defined Terms

Section 1.1 Defined Terms. In addition to the terms defined above and in Articles II through IV, the following terms used in this Agreement shall be construed to have the meanings set forth or referenced below.

“Business Day” means any day other than a Saturday, a Sunday or a day on which the Federal Reserve Bank of New York is authorized or required by law or executive order to close or be closed.

“Placement Agent” means J. Wood Capital Advisors.

Article II

Exchange

Section 2.1 Exchange. On and subject to the terms set forth in this Agreement, at the Closing (as defined herein), the Undersigned hereby agrees to cause each Holder to deliver to the Company the aggregate principal amount of the Company’s outstanding 0% Convertible Senior Notes due 2026 (such principal amount of notes, the “Outstanding Notes”) specified for such Holder on Exhibit A under the heading “Exchanged Notes” in exchange for, and the Company hereby agrees to pay to such Holder, the Exchange Consideration for such Exchanged Notes specified for such Holder on Exhibit A. The Outstanding Notes delivered to the Company pursuant to the terms of this Agreement in exchange for the Exchange Consideration are referred to herein as the “Exchanged Notes.” The transactions contemplated by this Agreement, including the issuance, delivery and acceptance of the Exchange Consideration and the exchange of the Exchanged Notes are collectively referred to herein as the “Transactions.”

Section 2.2 Closing. Subject to the satisfaction (or waiver by the applicable parties) of the conditions set forth in Section 5.1 below, the closing of the Transactions (the “Closing”) will take place remotely on August 31, 2023 or at such time and place as the Company and the parties may agree in writing (the “Closing Date”).

At the Closing, (a) each Holder shall deliver or cause to be delivered to the Company all right, title and interest in and to its Exchanged Notes as specified on Exhibit A hereto, free and clear of any mortgage, lien, pledge, charge, security interest, encumbrance, title retention agreement, option, equity or other adverse claim thereto (collectively, “Liens”), together with any documents of conveyance or transfer that the Company may deem necessary or desirable to transfer to and confirm in the Company all right, title and interest in and to the Exchanged Notes, free and clear of any Liens (no later than 12:00 noon Eastern Daylight Time on the day of Closing), and (b) the Company shall deliver or cause to be delivered to each Holder the Exchange Consideration specified for such Holder on Exhibit A hereto, as specified on, and pursuant to the wire instructions provided by each Holder on,

Exhibit B hereto, which Exhibit B, may be provided within one (1) Business Day of the date set forth at the top of this Agreement.

For the avoidance of doubt, in the event of any delay in the Closing as described above, the Holders shall not be required to deliver the Exchanged Notes until the Closing occurs. The Company may at any time (whether before, simultaneously with or after the Closing) deliver the Exchange Consideration to one or more other holders of Outstanding Notes or to other investors (any such issuances pursuant to agreements dated as of the date hereof, the “Aggregated Transactions”). The delivery of the Exchanged Notes shall be effected promptly following the receipt by such Holder of the Exchange Consideration through the direction by the Holder of the eligible DTC participant through which the Holder holds a beneficial interest in the Exchanged Notes to perform a free delivery through DTC for the aggregate principal amount of Exchanged Notes set forth on Exhibit A.

Article III

Covenants, Representations and Warranties of the Holders

Each Holder (and, where specified below, the Undersigned) hereby covenants as follows, and makes, severally and not jointly, the following representations and warranties, each of which is and shall be true and correct on the date hereof and at the Closing, and all such covenants, representations and warranties shall survive the Closing.

Section 3.1 Power and Authorization. Each of the Undersigned and each Holder is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation. The Undersigned has the power, authority and capacity to execute and deliver this Agreement, to perform its obligations hereunder, and to consummate the Transactions. If the Undersigned is executing this Agreement on behalf of Accounts, (a) the Undersigned has all requisite discretionary and contractual authority to enter into this Agreement on behalf of, and bind, each Account, and (b) Exhibit A hereto is a true, correct and complete list of (i) the name of each Account, and (ii) the principal amount of such Account’s Outstanding Notes.

Section 3.2 Valid and Enforceable Agreement; No Violations. This Agreement has been duly executed and delivered by the Undersigned and constitutes a legal, valid and binding obligation of the Undersigned and each Holder, enforceable against the Undersigned and each Holder in accordance with its terms, except that such enforcement may be subject to (a) bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or other similar laws affecting or relating to enforcement of creditors’ rights generally, and (b) general principles of equity, whether such enforceability is considered in a proceeding at law or in equity (the “Enforceability Exceptions”). This Agreement and consummation of the Transactions will not violate, conflict with or result in a breach of or default under (i) the Undersigned or the applicable Holder’s organizational documents (or any similar documents governing each Account), (ii) any agreement or instrument to which the Undersigned or the applicable Holder is a party or by which the Undersigned or the applicable Holder or any of their respective assets are bound, or (iii) any laws, regulations or governmental or judicial decrees, injunctions or orders applicable to the Undersigned or the applicable Holder. No consent, approval, authorization, order, registration or qualification of or with any court or arbitrator or governmental or regulatory authority is required in connection with the execution, delivery and performance of this Agreement and the consummation by the Holders of the Transactions.

Section 3.3 Title to the Exchanged Notes. (a) Each Holder is the sole beneficial owner and, at the Closing, will be the sole legal and beneficial owner of the Exchanged Notes set forth opposite its name on Exhibit A hereto; (b) each Holder has good, valid and marketable title to its Exchanged Notes, free and clear of any Liens (other than pledges or security interests that such Holder may have created in favor of a prime broker under and in accordance with its prime brokerage agreement with such broker); (c) no Holder has, in whole or in part, except as described in the preceding clause (b), (i) assigned, transferred, hypothecated, pledged, exchanged or otherwise disposed of any of its Exchanged Notes or its rights, title or interest in or to its Exchanged Notes or (ii) given any person or entity (other than the Undersigned) any transfer order, power of attorney or other authority of any nature whatsoever with respect to its Exchanged Notes; and (d) upon each Holder’s delivery of its Exchanged Notes to the Company pursuant to the Transactions, such Exchanged Notes shall be free and clear of all Liens.

Section 3.4 Qualified Institutional Buyer. Each Holder is (i) a “qualified institutional buyer” within the meaning of Rule 144A promulgated under the Securities Act of 1933, as amended (the “Securities Act”), and (ii) an “Institutional Account” as defined in FINRA Rule 4512(c).

Section 3.5 Full Satisfaction of Obligations under the Notes. Each Holder acknowledges that upon payment of the Exchange Consideration to the Holder, the obligations of the Company to the Holder under the Exchanged Notes will have been satisfied in full.

Section 3.6 No Affiliates. No Holder is, or has been at any time during the consecutive three-month period preceding the date hereof, a director, officer or “affiliate” within the meaning of Rule 144 promulgated under the Securities Act (an “Affiliate”) of the Company. To each Holder’s knowledge, such Holder did not acquire any of the Exchanged Notes, directly or indirectly, from an Affiliate of the Company.

Section 3.7 Adequate Information; No Reliance. The Undersigned acknowledges and agrees on behalf of itself and each Holder that (a) the Undersigned has been furnished with all materials it considers relevant to making an investment decision to enter into the Transactions and has had the opportunity to review the Company’s filings and submissions with the U.S. Securities and Exchange Commission (the “SEC”), including, without limitation, all information filed or furnished pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”), (b) the Undersigned has had a full opportunity to ask questions of the Company concerning the Company, its business, operations, financial performance, financial condition and prospects and the terms and conditions of the Transactions, (c) the Undersigned and each Holder has had the opportunity to consult with their respective accounting, tax, financial and legal advisors to be able to evaluate the risks involved in the Transactions and to make an informed investment decision with respect to such Transactions, (d) each Holder has evaluated the tax and other consequences of the Transactions with its tax, accounting or legal advisors, (e) the Company is not acting as a fiduciary or financial or investment advisor to the Undersigned or any Holder, and (f) neither the Undersigned nor any Holder is relying, and none of them has relied, upon any statement, advice (whether accounting, tax, financial, legal or other), representation or warranty made by the Company or any of its Affiliates or representatives, except for (i) the publicly available filings and submissions made by the Company with the SEC under the Exchange Act and (ii) the representations and warranties made by the Company in this Agreement.

Section 3.8 Taxpayer Information. The Undersigned agrees that it shall obtain from each Holder and deliver to the Company a complete and accurate IRS Form W-9 or IRS Form W-8BEN, W-8BEN-E or W-8ECI, as appropriate.

Section 3.9 Disclosure. The Undersigned acknowledges and agrees that it and each Holder has not disclosed, and will not disclose, to any third party any information regarding the Company or the Transactions, and that it has not transacted, and will not transact in any securities of the Company, including, but not limited to, any hedging transactions, from the time the Holder was first contacted by the Company or the Placement Agent with respect to the Transactions until after the confidential information (as described in the confirmatory email received by the Holder from the Placement Agent (the “Wall Cross Email”)) is made public.

Section 3.10 Further Action. The Holder agrees that it shall, upon request, execute and deliver any additional documents deemed by the Company to be necessary or desirable to complete the Transactions.

Article IV

Covenants, Representations and Warranties of the Company

The Company hereby covenants as follows, and makes the following representations and warranties, each of which is and shall be true and correct on the date hereof and at the Closing:

Section 4.1 Power and Authorization. The Company is duly organized, validly existing and in good standing under the laws of its jurisdiction of incorporation, and has the power, authority and capacity to execute and deliver this Agreement, to perform its obligations hereunder, and to consummate the Transactions. No consent, approval, order or authorization of, or registration, declaration or filing with any governmental entity is required on the part of the Company in connection with the execution, delivery and performance by it of this Agreement and the

consummation by the Company of the Transactions, except as may be required under any state or federal securities laws or that may be obtained after the Closing without penalty or such that would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the financial position or results of operations of the Company and its subsidiaries, taken as a whole.

Section 4.2 Valid and Enforceable Agreements; No Violations. This Agreement has been duly executed and delivered by the Company and constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except that such enforcement may be subject to the Enforceability Exceptions. This Agreement and consummation of the Transactions by the Company will not violate, conflict with or result in a breach of or default under (a) the charter, bylaws or other organizational documents of the Company, (b) any material agreement or instrument to which the Company is a party or by which the Company or any of its assets are bound, or (c) any laws, regulations or governmental or judicial decrees, injunctions or orders applicable to the Company, except in the case of clauses (b) or (c), where such violations, conflicts, breaches or defaults would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the financial position or results of operations of the Company and its subsidiaries, taken as a whole, or affect the Company’s ability to consummate the Transactions in any material respect.

Section 4.3 Disclosure. At or prior to 9:00 a.m., New York City time, on the first Business Day after the date hereof, the Company shall file with the SEC a current report on Form 8-K announcing the Transactions, which current report the Company acknowledges and agrees will disclose all confidential information (as described in the Wall Cross Email) to the extent the Company believes such confidential information constitutes material non-public information, if any, with respect to the Transactions or otherwise communicated by the Company to the Undersigned in connection with the Transaction. Without the prior written consent of the Undersigned, the Company shall not disclose the name of the Undersigned or any Holder in any filing or announcement, unless such disclosure is required by applicable law, rule, regulation or legal process based on advice of counsel.

Section 4.4 No Litigation. There is no action, lawsuit, arbitration, claim or proceeding pending or, to the knowledge of the Company, threatened, against the Company that would reasonably be expected to impede the consummation of the Transactions.

Article V

Closing Conditions & Notification

Section 5.1 Conditions to Obligations of the Undersigned, each Holder and the Company. The obligations of the Undersigned to cause each Holder to deliver the Exchanged Notes and of the Company to deliver the Exchange Consideration are subject to the satisfaction at or prior to the Closing of the condition precedent that the representations and warranties of the Holders and the Company contained in Articles III and IV, respectively, shall be true and correct as of the Closing in all material respects with the same effect as though such representations and warranties had been made as of the Closing and, unless notice is given pursuant to Section 5.2 below, each of the representations and warranties contained therein shall be deemed to have been reaffirmed and confirmed as of the Closing Date.

Section 5.2 Notification. The Undersigned hereby covenants and agrees to notify the Company upon the occurrence of any event prior to the Closing that would cause any representation, warranty, or covenant contained in Article III to be false or incorrect in any material respect. The Company hereby covenants and agrees to notify the Undersigned upon the occurrence of any event prior to the Closing that would cause any representation, warranty, or covenant contained in Article IV to be false or incorrect in any material respect.

Article VI

Miscellaneous

Section 6.1 Notice. All notices, requests, and other communications given, made or delivered pursuant to this Agreement shall be in writing and shall be deemed effectively given, made or delivered upon the earlier of actual receipt or: (a) personal delivery to the party to be notified; (b) when sent, if sent by electronic mail (to the

extent an electronic mail address is provided) during the recipient’s normal business hours, and if not sent during normal business hours, then on the recipient’s next Business Day; (c) five days after having been sent by registered or certified mail, return receipt requested, postage prepaid; or (d) one Business Day after the Business Day of deposit with a nationally recognized overnight courier, freight prepaid, specifying next-day delivery, with written verification of receipt. The addresses for any such notices shall be, unless changed by the applicable party via notice to the other parties in accordance herewith:

| | | | | |

If to the Company: | |

To: | Chegg, Inc. |

| 3990 Freedom Circle |

| Santa Clara, CA, 95054 |

Attention: | General Counsel |

Telephone No.: | (408) 855-5700 |

| |

With a copy to: | Fenwick & West LLP |

| 801 California Street |

| Mountain View, CA 94041 |

Attention: | David Bell |

Telephone No.: | (650) 335-7130 |

Email: | dbell@fenwick.com |

| |

Attention: | David Michaels |

Telephone No.: | (650) 335-7258 |

Email: | dmichaels@fenwick.com |

If to the Holders, to the address on the signature page to this Agreement.

Section 6.2 Entire Agreement. This Agreement and any documents and agreements executed in connection with the Transactions embody the entire agreement and understanding of the parties hereto with respect to the subject matter hereof and supersede all prior and contemporaneous oral or written agreements, representations, warranties, contracts, correspondence, conversations, memoranda and understandings between or among the parties or any of their agents, representatives or Affiliates relative to such subject matter, including, without limitation, any term sheets, emails or draft documents.

Section 6.3 Assignment; Binding Agreement. This Agreement shall inure to the benefit of and be binding upon the parties and their successors and assigns. No party shall assign this Agreement or any rights or obligations hereunder or, in the case of the Holders, any of the Exchanged Notes held by such Holders, without the prior written consent of the Company (in the case of assignment by a Holder) or the applicable Holders (in the case of assignment by the Company).

Section 6.4 Further Assurances. The parties hereto each hereby agree to execute and deliver, or cause to be executed and delivered, such other documents, instruments and agreements, and take such other actions, including giving any further assurances, as any party may reasonably request in connection with the Transactions contemplated by and in this Agreement. In addition, subject to the terms and conditions set forth in this Agreement, each of the parties shall use its reasonable best efforts (subject to, and in accordance with, applicable law) to take promptly, or to cause to be taken, all actions, and to do promptly, or to cause to be done, and to assist and to cooperate with the other parties in doing, all things necessary, proper or advisable under applicable laws to consummate and make effective the Transactions contemplated hereby, including the obtaining of all necessary, proper or advisable consents, approvals or waivers from third parties and the execution and delivery of any additional instruments reasonably necessary, proper or advisable to consummate the Transactions contemplated hereby.

Section 6.5 Waiver; Consent. This Agreement may not be changed, amended, terminated, augmented, rescinded or discharged (other than in accordance with its terms), in whole or in part, except by a writing executed by the parties hereto. No waiver of any of the provisions or conditions of this Agreement or any of the rights of a party hereto shall be effective or binding unless such waiver shall be in writing and signed by the party claimed to have given or consented thereto. Except to the extent otherwise agreed in writing, no waiver of any term, condition or other provision of this Agreement, or any breach thereof shall be deemed to be a waiver of any other term, condition or provision or any breach thereof, or any subsequent breach of the same term, condition or provision, nor shall any forbearance to seek a remedy for any non-compliance or breach be deemed to be a waiver of a party’s rights and remedies with respect to such non-compliance or breach.

Section 6.6 Construction. References in the singular shall include the plural, and vice versa, unless the context otherwise requires. References in the masculine shall include the feminine and neuter, and vice versa, unless the context otherwise requires. Headings in this Agreement are for convenience of reference only and shall not limit or otherwise affect the meanings of the provisions hereof. Neither party, nor its respective counsel, shall be deemed the drafter of this Agreement for purposes of construing the provisions of this Agreement, and all language in all parts of this Agreement shall be construed in accordance with its fair meaning, and not strictly for or against either party.

Section 6.7 Governing Law; Waiver of Jury Trial. This Agreement shall in all respects be construed in accordance with and governed by the substantive laws of the State of New York, without reference to its choice of law rules. Each of the Company and the Undersigned irrevocably waive any and all right to trial by jury with respect to any legal proceeding arising out of the Transactions contemplated by this Agreement.

Section 6.8 Counterparts; Electronic Signatures. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be delivered via electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

Section 6.9 Third Party Beneficiaries. Nothing herein shall grant to or create in any person not a party hereto, or any such person’s dependents or heirs, any right to any benefits hereunder, and no such party shall be entitled to sue any party to this Agreement with respect thereto.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties hereto has caused this Agreement to be executed as of the date first above written.

| | | | | |

|

| |

| CHEGG, INC. |

| |

| By: | |

| Name: | Andrew Brown |

| Title: | Chief Financial Officer |

[Signature Page to Exchange Agreement]

IN WITNESS WHEREOF, each of the parties hereto has caused this Agreement to be executed as of the date first above written.

| | |

|

|

[LEGAL NAME OF SIGNATORY]:

|

|

| (in its capacities described in the first paragraph hereof) |

| By: |

| Name: |

| Title: |

| Address: |

|

[Signature Page to Exchange Agreement]

EXHIBIT A

Exchanging Beneficial Owners

| | | | | |

| Holder Name, Address, Email and Phone Number | Exchanged Notes[1] |

| |

| |

| |

| | | | | |

| |

[1] Insert aggregate principal of Outstanding Notes to be exchanged. |

EXHIBIT B

Instructions for Delivery of Exchange Consideration

See attached

v3.23.2

Cover Page

|

Aug. 22, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 22, 2023

|

| Entity Registrant Name |

Chegg, Inc

|

| Entity File Number |

001-36180

|

| Entity Tax Identification Number |

20-3237489

|

| Entity Address, Address Line One |

3990 Freedom Circle

|

| Entity Address, City or Town |

Santa Clara,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95054

|

| City Area Code |

408

|

| Local Phone Number |

855-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

CHGG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001364954

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

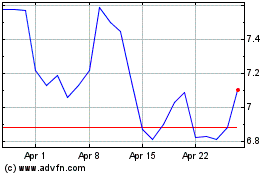

Chegg (NYSE:CHGG)

Historical Stock Chart

From Apr 2024 to May 2024

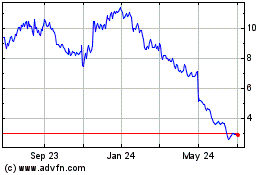

Chegg (NYSE:CHGG)

Historical Stock Chart

From May 2023 to May 2024