Charles River Laboratories International, Inc. (NYSE: CRL) today

reported its results for the second quarter of 2010. For the

quarter, net sales were $292.1 million, a decline of 5.2% from

$308.2 million in the second quarter of 2009. Foreign currency

translation reduced the sales growth rate by 0.1%. A modest sales

increase in the Research Models and Services (RMS) segment was

offset by lower sales for the Preclinical Services (PCS)

segment.

On a GAAP basis, net income attributable to common shareholders

for the second quarter of 2010 was $14.5 million, or $0.22 per

diluted share, compared to net income of $34.2 million, or $0.52

per diluted share, for the second quarter of 2009.

On a non-GAAP basis, net income was $32.1 million for the second

quarter of 2010, compared to $43.1 million for the same period in

2009, a decrease of 25.5%. Second-quarter diluted earnings per

share on a non-GAAP basis were $0.49, a decrease of 25.8% compared

to $0.66 per share in the second quarter of 2009. Both the GAAP and

non-GAAP results were impacted by lower sales volume and higher

costs related to the Company’s enterprise resource planning (ERP)

initiative, offset in part by cost-savings actions implemented

throughout 2009 and in the first quarter of 2010.

James C. Foster, Chairman, President and Chief Executive

Officer, said, “We are disappointed that market demand for

outsourced preclinical services did not rebound during the second

quarter as we had previously expected. We continue to have

extensive discussions with our biopharmaceutical clients, who

maintain their intentions to build larger, strategic partnerships

with us and increase the amount of outsourced activity. However,

the timing of these decisions remains unclear and we do not believe

that it is imminent. While our results provide reassurance that

preclinical demand appears to have stabilized, positive indications

such as the increased number of inquiries and improved June

bookings are offset by their value, which is lower due to pricing.

Therefore, we now expect PCS sales to be flat sequentially for the

remainder of the year, and have tempered our RMS outlook to reflect

lower sales of research models associated with preclinical studies.

As a result, we have lowered our sales and EPS guidance for

2010.”

Second-Quarter Segment

Results

Research Models and Services (RMS)

Sales for the RMS segment were $167.1 million in the second

quarter of 2010, an increase of 0.9% from $165.7 million in the

second quarter of 2009. Foreign currency translation reduced the

sales growth rate by 1.0%. Excluding the effect of foreign

exchange, RMS sales improved by 1.9% as strong growth of In Vitro

products and contributions from the Piedmont and Cerebricon

acquisitions (May and August 2009, respectively) were partially

offset by lower sales of large models. The sequential decline in

RMS sales from the first quarter of 2010 was driven primarily by

foreign exchange, particularly the weakening of the Euro, as well

as the large models business.

In the second quarter of 2010, the RMS segment’s GAAP operating

margin was 28.3% compared to 30.7% for the second quarter of 2009.

On a non-GAAP basis, the operating margin decreased to 29.1% from

31.9% in the second quarter of 2009. The margin decline was

primarily attributable to lower sales volume of large models, as

well as higher information technology and compensation costs.

Preclinical Services (PCS)

Second-quarter 2010 net sales for the PCS segment were $125.0

million, a decrease of 12.3% from $142.5 million in the second

quarter of 2009. The PCS sales decline was due primarily to

continued measured demand for our services from large

pharmaceutical and biotechnology companies, as well as stable but

lower than historical prices. Significantly lower sales of our

clinical Phase I services also contributed. The sales decline was

partially offset by the positive effect of foreign currency

translation, which increased the growth rate by 0.8%.

A greater proportion of short-term, less complex studies in the

sales mix, lower sales of clinical Phase I services and the

continued impact of lower prices, partially offset by cost-saving

actions, resulted in lower operating margins for the PCS segment.

The second-quarter 2010 GAAP operating margin declined to 3.8% from

11.5% in the second quarter of 2009. On a non-GAAP basis, the

operating margin declined to 12.0% from 17.2% in the second quarter

of 2009. The PCS operating margin did improve sequentially by 270

basis points on a non-GAAP basis and 400 basis points on a GAAP

basis when compared to the first quarter of 2010, driven primarily

by the Company’s plan to suspend operations at its PCS

Massachusetts facility and transition clients to other sites within

the global PCS network.

Six-Month

Results

For the first six months of 2010, net sales decreased by 3.3% to

$589.4 million from $609.7 million in the same period in 2009.

Foreign currency translation benefited net sales growth by

1.6%.

On a GAAP basis, net income attributable to common shareholders

was $31.8 million, or $0.48 per diluted share, for the first half

of 2010, compared to $59.6 million, or $0.91 per diluted share, for

the same period in 2009.

On a non-GAAP basis, net income for the first six months of 2010

was $61.5 million, or $0.93 per diluted share, compared to $81.3

million, or $1.24 per diluted share, for the same period in

2009.

Research Models and Services (RMS)

For the first six months of 2010, RMS net sales were $339.3

million, an increase of 3.7% from first-half 2009 net sales of

$327.2 million, with foreign currency translation contributing 1.0%

to the increase. The RMS segment’s GAAP operating margin was 28.7%

in the first half of 2010, compared to 30.1% for the prior-year

period. On a non-GAAP basis, the operating margin was 29.8%

compared to 31.7% in the first six months of 2009.

Preclinical Services (PCS)

For the first six months of 2010, PCS net sales were $250.1

million, a decrease of 11.5% from first-half 2009 net sales of

$282.5 million. Foreign currency translation benefited net sales

growth by 2.4%. On a GAAP basis, the PCS segment operating margin

was 1.8% in the first half of 2010, compared to 9.5% in the

prior-year period. On a non-GAAP basis, the operating margin was

10.7% in the first half of 2010 compared to 16.4% for the same

period in 2009.

Items Excluded from Non-GAAP

Results

Items excluded from non-GAAP results in the second quarter of

2010 and 2009 were as follows:

($ in millions) 2Q10

2Q09 Amortization of intangible assets

$ 6.0 $ 7.2 Severance related to

cost-saving actions 2.1

1.7 Impairment and other charges (1)

0.0 0.2

Operating losses for PCS

Massachusetts, PCS Arkansas andclinical Phase I Scotland

3.5 1.1

Costs associated with evaluation of acquisitions

8.3 0.4 Convertible debt

accounting 3.2

2.7 Tax expense from cash repatriation

2.7 --

(1) In the second quarter of 2009, these items were related

primarily to costs associated with the Company’s divestiture of its

clinical Phase I business in Scotland on May 15, 2009.

Items excluded from non-GAAP results in the first half of 2010

and 2009 are as follows:

($ in millions) 1H10

1H09 Amortization of intangible assets

$ 13.2 $ 13.4 Severance related

to cost-saving actions 4.8

8.8 Impairment and other charges (1)

0.9 1.8

Operating losses for PCS

Massachusetts, PCS Arkansas andclinical Phase I Scotland

7.0 2.7

Costs associated with evaluation of acquisitions

8.4 0.6 Convertible debt

accounting 6.3

5.1 Tax expense from cash repatriation

2.7 --

(1) In the first half of 2010, these items were related

primarily to an asset impairment associated with the Company’s

planned disposition of its PCS facility in Arkansas. In the first

half of 2009, these items were related primarily to an asset

impairment charge and costs associated with the Company’s

divestiture of its clinical Phase I business in Scotland and

additional miscellaneous expenses.

2010 Guidance

The Company is reducing its forward-looking guidance for 2010,

which was originally provided on February 8, 2010. This guidance

now assumes that PCS sales in the second half of 2010 will remain

flat when compared to the first half of the year. RMS sales for the

remaining two quarters of the year are expected to decline

moderately from the second-quarter 2010 level, due largely to

continued softness in demand for research models used in toxicology

and normal seasonality. For the full year, RMS sales are expected

to remain flat to slightly above the 2009 level. The sales guidance

has also been updated to reflect negative movements in foreign

currency translation, which is now expected to reduce sales growth

by approximately 1.0% compared to 2009.

2010 GUIDANCE REVISED

PRIOR Net sales 2%-3% decrease

Low single-digitgrowth

GAAP EPS estimate $ 0.71 - $0.81 $ 1.57

- $1.77 Amortization of intangible assets $ 0.27

$ 0.30

Severance costs and operating

losses primarilyattributable to suspension of PCS

Massachusettsoperations

$ 0.16 $ 0.20 Impairment and other

charges (1) $ 0.01 -- Costs

associated with the evaluation of acquisitions (2) $

0.58 -- Convertible debt accounting

$ 0.13 $ 0.13 Tax expense from cash

repatriation $ 0.04 -- Non-GAAP

EPS estimate $ 1.90 - $2.00 $ 2.20 -

$2.40

(1) These items are primarily related to an asset impairment in

the first half of 2010 associated with the Company’s planned

disposition of its PCS facility in Arkansas.

(2) This item is an estimate of the advisory fees, breakup fee

and related deal costs primarily associated with the proposed

acquisition of WuXi PharmaTech (Cayman) Inc.

Webcast

Rescheduled

Charles River Laboratories has rescheduled its live webcast to

Monday, August 2, at 8:30 a.m. ET to discuss matters relating to

this press release. To participate, please go to ir.criver.com and

select the webcast link. You can also find the associated slide

presentation and reconciliations of non-GAAP financial measures to

comparable GAAP financial measures on the website.

Use of Non-GAAP Financial

Measures

This press release contains non-GAAP financial measures, such as

non-GAAP earnings per diluted share, which exclude amortization of

intangible assets and other charges related to our acquisitions,

expenses associated with evaluating acquisitions (including costs

related to the termination of the proposed acquisition of WuXi),

charges and operating losses attributable to our businesses we plan

to close or divest, severance costs associated with our 2009 and

2010 cost-saving actions, tax expense associated with the

repatriation of cash into the United States, and the additional

interest recorded as a result of the adoption in 2009 of an

accounting standard related to our convertible debt accounting

which increased interest and depreciation expense. We exclude these

items from the non-GAAP financial measures because they are outside

our normal operations. There are limitations in using non-GAAP

financial measures, as they are not prepared in accordance with

generally accepted accounting principles, and may be different than

non-GAAP financial measures used by other companies. In particular,

we believe that the inclusion of supplementary non-GAAP financial

measures in this press release helps investors to gain a meaningful

understanding of our core operating results and future prospects

without the effect of these often-one-time charges, and is

consistent with how management measures and forecasts the Company's

performance, especially when comparing such results to prior

periods or forecasts. We believe that the financial impact of our

acquisitions (and in certain cases, the evaluation of such

acquisitions, whether or not ultimately consummated) is often large

relative to our overall financial performance, which can adversely

affect the comparability of our results on a period-to-period

basis. In addition, certain activities, such as business

acquisitions, happen infrequently and the underlying costs

associated with such activities do not recur on a regular basis.

Non-GAAP results also allow investors to compare the Company’s

operations against the financial results of other companies in the

industry who similarly provide non-GAAP results. The non-GAAP

financial measures included in this press release are not meant to

be considered superior to or a substitute for results of operations

prepared in accordance with GAAP. The Company intends to continue

to assess the potential value of reporting non-GAAP results

consistent with applicable rules and regulations. Reconciliations

of the non-GAAP financial measures used in this press release to

the most directly comparable GAAP financial measures are set forth

in the text of this press release, and can also be found on the

Company’s website at ir.criver.com.

Caution Concerning

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as “anticipate,” “believe,” “expect,” “will,” “may,”

“estimate,” “plan,” “outlook,” and “project” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These statements

also include statements regarding our projected 2010 financial

performance including sales and earnings; the future demand for

drug discovery and development products and services (particularly

in light of the challenging economic environment), our expectations

regarding stock repurchases; the development and performance of our

services and products; market and industry conditions including the

outsourcing of these services and present spending trends by our

customers; and Charles River’s future performance as delineated in

our forward-looking guidance, and particularly our expectations

with respect to sales and foreign exchange impact. Forward-looking

statements are based on Charles River’s current expectations and

beliefs, and involve a number of risks and uncertainties that are

difficult to predict and that could cause actual results to differ

materially from those stated or implied by the forward-looking

statements. Those risks and uncertainties include, but are not

limited to: the ability to successfully integrate businesses we

acquire; negative trends in research and development spending,

negative trends in the level of outsourced services, or other cost

reduction actions by our customers; the ability to convert backlog

to sales; special interest groups; contaminations; industry trends;

new displacement technologies; USDA and FDA regulations; changes in

law; continued availability of products and supplies; loss of key

personnel; interest rate and foreign currency exchange rate

fluctuations; changes in tax regulation and laws; changes in

generally accepted accounting principles; and any changes in

business, political, or economic conditions due to the threat of

future terrorist activity in the U.S. and other parts of the world,

and related U.S. military action overseas. A further description of

these risks, uncertainties, and other matters can be found in the

Risk Factors detailed in Charles River's Annual Report on Form 10-K

as filed on February 19, 2010, as well as other filings we make

with the Securities and Exchange Commission. Because

forward-looking statements involve risks and uncertainties, actual

results and events may differ materially from results and events

currently expected by Charles River, and Charles River assumes no

obligation and expressly disclaims any duty to update information

contained in this news release except as required by law.

About Charles River

Accelerating Drug Development. Exactly. Charles River provides

essential products and services to help pharmaceutical and

biotechnology companies, government agencies and leading academic

institutions around the globe accelerate their research and drug

development efforts. Our approximately 8,000 employees worldwide

are focused on providing clients with exactly what they need to

improve and expedite the discovery, development through

first-in-human evaluation, and safe manufacture of new therapies

for the patients who need them. To learn more about our unique

portfolio and breadth of services, visit www.criver.com.

CHARLES RIVER LABORATORIES INTERNATIONAL, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (dollars in

thousands, except for per share data)

Three Months Ended

Six Months Ended

June 26,2010

June 27,2009

June 26,2010

June 27,2009

Total net sales $ 292,104 $ 308,159 $ 589,449 $ 609,685 Cost

of products sold and services provided

191,740

193,696

389,168 387,002

Gross margin 100,364 114,463 200,281 222,683 Selling, general and

administrative 66,127 56,582 129,368 118,760 Amortization of

intangibles

6,033

7,219 13,207

13,368 Operating income 28,204 50,662 57,706

90,555 Interest income (expense) (6,843 ) (4,942 ) (12,453 ) (9,546

) Other income (expense)

(736 )

1,565 (1,147

) 1,303 Income before

income taxes 20,625 47,285 44,106 82,312 Provision for income taxes

6,530 13,630

13,011 23,788

Net income 14,095 33,655 31,095 58,524 Noncontrolling interests

359 499

741 1,035 Net

income attributable to common shareowners

$

14,454 $ 34,154

$ 31,836 $

59,559 Earnings per common share Basic $

0.22 $ 0.53 $ 0.49 $ 0.91 Diluted $ 0.22 $ 0.52 $ 0.48 $ 0.91

Weighted average number of common shares outstanding Basic

65,289,617 65,046,023 65,381,634 65,467,929 Diluted 65,874,284

65,222,498 66,017,118 65,615,498

CHARLES RIVER LABORATORIES

INTERNATIONAL, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) (dollars in thousands)

June 26,2010

December 26,2009

Assets Current assets Cash and cash equivalents $ 219,077 $

182,574 Trade receivables, net 218,695 196,947 Inventories 96,571

102,723 Other current assets

73,705

113,357 Total current assets 608,048 595,601 Property,

plant and equipment, net 837,580 865,743 Goodwill, net 500,585

508,235 Other intangibles, net 144,025 160,292 Deferred tax asset

12,926 18,978 Other assets

53,473

55,244 Total assets

$

2,156,637 $ 2,204,093

Liabilities and Equity Current liabilities Current portion

of long-term debt & capital leases $ 26,774 $ 35,413 Accounts

payable 29,681 31,232 Accrued compensation 49,215 45,522 Deferred

revenue 61,651 72,390 Accrued liabilities 59,570 49,997 Other

current liabilities

19,169

15,219 Total current liabilities 246,060 249,773

Long-term debt & capital leases 409,441 457,419 Other long-term

liabilities

107,119 123,077

Total liabilities

762,620

830,269 Total equity

1,394,017

1,373,824 Total liabilities and equity

$ 2,156,637 $

2,204,093 CHARLES RIVER LABORATORIES INTERNATIONAL,

INC. SELECTED BUSINESS SEGMENT INFORMATION (UNAUDITED)

(dollars in thousands)

Three Months Ended

Six Months Ended

June 26,2010

June 27,2009

June 26,2010

June 27,2009

Research Models and Services Net sales $ 167,140 $ 165,682 $

339,345 $ 327,172 Gross margin 71,346 71,206 145,625 139,519 Gross

margin as a % of net sales 42.7 % 43.0 % 42.9 % 42.6 % Operating

income 47,258 50,894 97,242 98,338 Operating income as a % of net

sales 28.3 % 30.7 % 28.7 % 30.1 % Depreciation and amortization

8,811 8,049 18,532 15,722 Capital expenditures 6,245 6,307 11,205

13,931

Preclinical Services Net sales $ 124,964 $

142,477 $ 250,104 $ 282,513 Gross margin 29,018 43,257 54,656

83,164 Gross margin as a % of net sales 23.2 % 30.4 % 21.9 % 29.4 %

Operating income 4,728 16,336 4,465 26,882 Operating income as a %

of net sales 3.8 % 11.5 % 1.8 % 9.5 % Depreciation and amortization

14,778 14,851 29,319 29,148 Capital expenditures 2,187 14,130 6,520

31,131

Unallocated Corporate Overhead $

(23,782 ) $ (16,568 ) $ (44,001 ) $ (34,665 )

Total Net sales $ 292,104 $ 308,159 $ 589,449 $ 609,685

Gross margin 100,364 114,463 200,281 222,683 Gross margin as a % of

net sales 34.4 % 37.1 % 34.0 % 36.5 % Operating income 28,204

50,662 57,706 90,555 Operating income as a % of net sales 9.7 %

16.4 % 9.8 % 14.9 % Depreciation and amortization 23,589 22,900

47,851 44,870 Capital expenditures 8,432 20,437 17,725 45,062

CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

RECONCILIATION OF GAAP TO NON-GAAP SELECTED BUSINESS

SEGMENT INFORMATION (UNAUDITED) (1) (dollars in

thousands)

Three Months Ended

Six Months Ended

June 26,2010

June 27,2009

June 26,2010

June 27,2009

Research Models and Services Net sales $ 167,140 $ 165,682 $

339,345 $ 327,172 Operating income 47,258 50,894 97,242 98,338

Operating income as a % of net sales 28.3 % 30.7 % 28.7 % 30.1 %

Add back: Amortization related to acquisitions 1,324 1,745 3,724

2,632 Severance

-

139 -

2,848 Operating income, excluding specified

charges (Non-GAAP) $ 48,582 $ 52,778 $ 100,966 $ 103,818 Non-GAAP

operating income as a % of net sales 29.1 % 31.9 % 29.8 % 31.7 %

Preclinical Services Net sales $ 124,964 $ 142,477 $

250,104 $ 282,513 Operating income 4,728 16,336 4,465 26,882

Operating income as a % of net sales 3.8 % 11.5 % 1.8 % 9.5 % Add

back: Amortization related to acquisitions 4,710 5,474 9,483 10,735

Severance 2,118 1,535 4,774 4,311 Impairment and other charges

(2) (41 ) 85 945 1,612 Operating losses for PCS Arkansas,

PCS Massachusetts & Phase 1 Scotland

3,538

1,139 7,009

2,682 Operating income, excluding

specified charges (Non-GAAP) $ 15,053 $ 24,569 $ 26,676 $ 46,222

Non-GAAP operating income as a % of net sales 12.0 % 17.2 % 10.7 %

16.4 %

Unallocated Corporate Overhead $

(23,782 ) $ (16,568 ) $ (44,001 ) $ (34,665 ) Add back: Severance

25 5 41 1,653 Impairment and other charges

(2) - 86 - 183

Costs associated with the evaluation of acquisitions 7,280 410

7,397 639 Convertible debt accounting

(3)

54 53

107 97 Unallocated

corporate overhead, excluding specified charges (Non-GAAP) $

(16,423 ) $ (16,014 ) $ (36,456 ) $ (32,093 )

Total Net sales $ 292,104 $ 308,159 $ 589,449 $ 609,685

Operating income 28,204 50,662 57,706 90,555 Operating income as a

% of net sales 9.7 % 16.4 % 9.8 % 14.9 % Add back: Amortization

related to acquisitions 6,034 7,219 13,207 13,367 Severance 2,143

1,679 4,815 8,812 Impairment and other charges

(2) (41 ) 171

945 1,795 Operating losses for PCS Arkansas, PCS Massachusetts

& Phase 1 Scotland 3,538 1,139 7,009 2,682 Costs associated

with the evaluation of acquisitions 7,280 410 7,397 639 Convertible

debt accounting

(3) 54

53 107

97 Operating income, excluding specified

charges (Non-GAAP) $ 47,212 $ 61,333 $ 91,186 $ 117,947 Non-GAAP

operating income as a % of net sales 16.2 % 19.9 % 15.5 % 19.3 %

(1) Charles River management believes

that supplementary non-GAAP financial measures provide useful

information to allow investors to gain a meaningful understanding

of our core operating results and future prospects, without the

effect of one-time charges and other items which are outside our

normal operations, consistent with the manner in which management

measures and forecasts the Company’s performance. The supplementary

non-GAAP financial measures included are not meant to be considered

superior to, or a substitute for results of operations prepared in

accordance with GAAP. The Company intends to continue to assess the

potential value of reporting non-GAAP results consistent with

applicable rules, regulations and guidance.

(2) For

the three months ended June 27, 2009, these items were related

primarily to costs associated with the Company’s divestiture of its

clinical Phase I business in Scotland on May 15, 2009. For the six

months ended June 26, 2010, these items were related primarily to

an asset impairment associated with the Company’s planned

disposition of its PCS facility in Arkansas. For the six months

ended June 27, 2009, these items were related primarily to an asset

impairment charge and costs associated with the Company’s

divestiture of its clinical Phase I business in Scotland and

additional miscellaneous expenses.

(3) This item

includes the impact of convertible debt accounting adopted at the

beginning of 2009, which increased depreciation expense.

CHARLES

RIVER LABORATORIES INTERNATIONAL, INC. RECONCILIATION OF

GAAP EARNINGS TO NON-GAAP EARNINGS (1) (dollars in

thousands, except for per share data)

Three Months Ended

Six Months Ended

June 26,2010

June 27,2009

June 26,2010

June 27,2009

Net income attributable to common shareholders $ 14,454 $

34,154 $ 31,836 $ 59,559 Add back: Amortization related to

acquisitions 6,034 7,219 13,207 13,367 Severance 2,143 1,679 4,815

8,812 Impairment and other charges

(2) (41 ) 171 945 1,795

Operating losses for PCS Arkansas, PCS Massachusetts & Phase 1

Scotland 3,538 1,139 7,009 2,682 Costs associated with the

evaluation of acquisitions 8,313 410 8,430 639 Convertible debt

accounting, net

(3) 3,166 2,688 6,282 5,085 Tax expense from

repatriation 2,690 - 2,690 - Tax effect

(8,182

) (4,331 )

(13,760 ) (10,620

) Net income, excluding specified charges (Non-GAAP)

$ 32,115 $

43,129 $ 61,454

$ 81,319 Weighted

average shares outstanding - Basic 65,289,617 65,046,023 65,381,634

65,467,929 Effect of dilutive securities: Stock options and

contingently issued restricted stock 584,667 173,182 635,484

144,342 Warrants

-

3,293 -

3,227 Weighted average shares outstanding -

Diluted

65,874,284

65,222,498 66,017,118

65,615,498 Basic earnings

per share $ 0.22 $ 0.53 $ 0.49 $ 0.91 Diluted earnings per share $

0.22 $ 0.52 $ 0.48 $ 0.91 Basic earnings per share,

excluding specified charges (Non-GAAP) $ 0.49 $ 0.66 $ 0.94 $ 1.24

Diluted earnings per share, excluding specified charges (Non-GAAP)

$ 0.49 $ 0.66 $ 0.93 $ 1.24

(1) Charles River

management believes that supplementary non-GAAP financial measures

provide useful information to allow investors to gain a meaningful

understanding of our core operating results and future prospects,

without the effect of one-time charges and other items which are

outside our normal operations, consistent with the manner in which

management measures and forecasts the Company’s performance. The

supplementary non-GAAP financial measures included are not meant to

be considered superior to, or a substitute for results of

operations prepared in accordance with GAAP. The Company intends to

continue to assess the potential value of reporting non-GAAP

results consistent with applicable rules, regulations and guidance.

(2) For the three months ended June 27, 2009, these

items were related primarily to costs associated with the Company’s

divestiture of its clinical Phase I business in Scotland on May 15,

2009. For the six months ended June 26, 2010, these items were

related primarily to an asset impairment associated with the

Company’s planned disposition of its PCS facility in Arkansas. For

the six months ended June 27, 2009, these items were related

primarily to an asset impairment charge and costs associated with

the Company’s divestiture of its clinical Phase I business in

Scotland and additional miscellaneous expenses.

(3)

For the three and six months ended June 26, 2010, this includes the

impact of convertible debt accounting adopted at the beginning of

2009, which increased interest expense by $3,113 and $6,175 and

depreciation expense by $54 and $107, respectively. For the three

and six months ended June 27, 2009, this item includes the impact

of convertible debt accounting which increased interest expense by

$2,906 and $5,766, capitalized interest by $271 and $778 and

depreciation expense by $53 and $97, respectively.

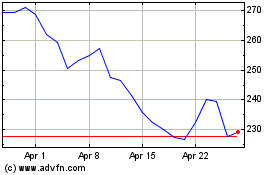

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From May 2024 to Jun 2024

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jun 2023 to Jun 2024