Charles River Laboratories International, Inc. (NYSE: CRL) today

reported its results for the second quarter and first six months of

2008. For the quarter, net sales increased 14.5% to $352.1 million

from $307.4 million in the second quarter of 2007. Both the

Research Models and Services (RMS) and Preclinical Services (PCS)

business segments reported significantly higher sales, with the RMS

segment showing particular strength due to continued demand from

pharmaceutical and biotechnology companies. Foreign exchange

contributed 4.1% to the net sales growth. On a GAAP basis, net

income for the second quarter of 2008 was $50.2 million, or $0.71

per diluted share, compared to $38.0 million, or $0.55 per diluted

share, for the second quarter of 2007. On a non-GAAP basis, net

income was $55.4 million for the second quarter of 2008, compared

to $43.8 million for the same period in 2007, an increase of 26.4%.

Second-quarter diluted earnings per share on a non-GAAP basis were

$0.79, an increase of 23.4% compared to $0.64 per share in the

second quarter of 2007. Non-GAAP earnings per share in the second

quarter of 2008 excluded $7.6 million of amortization of intangible

assets related to acquisitions, a charge of $2.8 million primarily

related to the Company�s disposition of its legacy preclinical

facility in Worcester, Massachusetts, and a gain of $3.3 million as

a result of the Company�s curtailment of its U.S. defined benefit

pension plan. For the second quarter of 2007, non-GAAP results

excluded $8.2 million of amortization of intangible assets and

stock-based compensation related to acquisitions and a charge of

$0.9 million related to the exit of the Worcester facility. James

C. Foster, Chairman, President and Chief Executive Officer, said,

�A continuation of strong market demand for our broad portfolio of

essential products and services enabled us to sustain our momentum

in the second quarter. We believe that this demand will continue,

as pharmaceutical and biotechnology customers maintain their focus

on the discovery of new therapies and rely on Charles River�s

scientific expertise to enhance the efficiency of their research.

We are optimistic that we will effectively capitalize on these

opportunities, as we increasingly provide the support which is

crucial to our clients� drug discovery and development efforts.

Therefore, we are confident that we will achieve our increased

sales and non-GAAP earnings guidance for 2008.� Research Models and

Services (RMS) Sales for the RMS segment were $172.8 million in the

second quarter of 2008, an increase of 20.2% from $143.8 million in

the second quarter of 2007. Sales growth was broad based, with

strong global demand from pharmaceutical and biotechnology

companies for research models and services, as well as In Vitro

Detection products. In the second quarter of 2008, the RMS

segment�s GAAP operating margin decreased to 30.2% compared to

31.5% in the second quarter of 2007. The decrease was due primarily

to an increase in operating expenses in Japan, which are not

expected to continue at that level, as well as a greater proportion

of services in the sales mix. On a non-GAAP basis, which excluded

charges of $0.6 million for acquisition-related amortization and

$0.6 million for an asset impairment related to our Vaccine

business in Mexico, the operating margin was 30.9% compared to

31.7% for the same period in the prior year. Non-GAAP results in

the second quarter of 2007 excluded $0.4 million of amortization

related to acquisitions. Preclinical Services (PCS) Second-quarter

2008 net sales for the PCS segment were $179.3 million, an increase

of 9.6% from $163.6 million in the second quarter of 2007.

Continuing strong demand for general and specialty toxicology

services drove significantly higher sales at the Company�s U.S.

flagship facilities in Massachusetts and Nevada, and Clinical

Services Northwest benefited from demand for its Phase I services.

The sales gains were partially offset by less favorable preclinical

study mix and some study delays, as well as capacity constraints at

other preclinical facilities. The segment�s profits were affected,

as expected, by the additional costs associated with the transition

to the new preclinical facility in Nevada and the negative impact

of foreign exchange in Canada resulted in lower operating margins

for the PCS segment compared to the second quarter of 2007. The

second-quarter 2008 GAAP operating margin declined to 16.1% from

16.8% in the same period in the prior year. On a non-GAAP basis,

which excluded $7.0 million of acquisition-related amortization and

a charge of $2.2 million associated with the Company�s disposition

of its Worcester, Massachusetts facility, the operating margin

declined to 21.2% from 22.0% in the second quarter of 2007. As

expected, the second-quarter GAAP and non-GAAP operating margins

improved sequentially from the first quarter of 2008 by 230 and 290

basis points respectively. The improvement was attributable

primarily to improved margins in Nevada as that facility ramps up

and Clinical Services Northwest, which benefited from higher sales.

Six-Month Results For the first six months of 2008, net sales

increased by 15.2% to $689.8 million, from $598.6 million in the

same period in 2007. Foreign exchange contributed approximately

4.1% to the sales growth rate. On a GAAP basis, net income was

$95.3 million, or $1.35 per diluted share, for the first half of

2008, compared to $74.7 million, or $1.10 per diluted share, for

the same period in 2007. On a non-GAAP basis, net income for the

first six months of 2008 was $106.2 million, or $1.51 per diluted

share, compared to $87.0 million, or $1.28 per diluted share, for

the same period in 2007. For the first six months of 2008, non-GAAP

net income excluded $15.2 million of acquisition-related

amortization, a charge of $3.5 million primarily related to the

Company�s disposition of its Worcester, Massachusetts facility, and

a gain of $3.3 million as a result of the Company�s pension

curtailment. Non-GAAP net income for the first half of 2007

excluded acquisition-related charges of $16.1 million and charges

of $1.7 million related to the exit of the Worcester facility.

Research Models and Services (RMS) For the first six months of

2008, RMS net sales were $341.4 million, an increase of 19.0% from

first-half 2007 net sales of $286.9 million. The RMS segment�s GAAP

operating margin was 31.6% in the first half of 2008, compared to

32.2% for the year-ago period. On a non-GAAP basis, the operating

margin was 32.1% compared to 32.4% in the first six months of 2007.

Preclinical Services (PCS) For the first six months of 2008, PCS

net sales were $348.4 million, an increase of 11.7% over first-half

2007 net sales of $311.8 million. On a GAAP basis, the PCS segment

operating margin was 15.0% in the first half of 2008, compared to

16.3% in the year-ago period. On a non-GAAP basis, the operating

margin was 19.8% in the first half of 2008 compared to 21.7% for

the same period in 2007. 2008 Guidance The Company is increasing

its sales and non-GAAP earnings per share guidance and reducing

GAAP earnings per share guidance for 2008. The reduction of GAAP

earnings guidance is due primarily to a $0.04 charge for

revaluation of a deferred tax asset for our convertible debt, due

to a change in Massachusetts tax law. The charge will be excluded

from non-GAAP results. The revised forward-looking guidance, which

includes the anticipated acquisition of NewLab BioQuality AG by the

end of the third quarter of 2008, is based on current foreign

exchange rates. 2008 GUIDANCE � REVISED � PRIOR Net sales growth

12% - 14% 10% - 13% GAAP EPS estimate $2.59 - $2.65 $2.59 - $2.69

Amortization of intangible assets $0.30 $0.30 Revaluation of

deferred tax asset, impairment and other charges $0.07 - $0.08

$0.01 - $0.02 Gain on curtailment of U.S. defined benefit pension

plan ($0.03) ($0.04) Non-GAAP EPS estimate $2.94 - $3.00 $2.87 -

$2.97 Company to Acquire NewLab BioQuality AG Charles River has

entered into an agreement to acquire privately-held NewLab

BioQuality AG (NewLab) for approximately $53 million in cash.

NewLab, a Dusseldorf, Germany-based contract service organization,

provides safety and quality control services to biopharmaceutical

clients. NewLab is expected to achieve revenues in a range of

$20-$23 million in 2008. The transaction is expected to close by

the end of the third quarter of 2008, subject to customary

regulatory approvals, and is expected to be neutral to earnings per

share in 2008 and slightly accretive in 2009. Charles River

Biopharmaceutical Services, which provides services to support the

development and manufacture of biologics, is a world leader in cell

bank manufacture from research through full-scale production, and a

premier provider of testing to determine the potency of biologics,

of drug product release testing, and of clinical-scale vaccine

manufacture. Complementing these services, NewLab enhances Charles

River�s capabilities in process validation services, which mimic

new manufacturing processes to verify that potentially hazardous

contaminants have been removed; in consulting services, which help

manufacturers meet regional Good Manufacturing Practice (GMP)

guidance on new drugs; and assists in designing International

Conference on Harmonisation (ICH)-compliant stability testing

programs. Together, Charles River and NewLab expect to provide the

most comprehensive service package in the biopharmaceutical

industry at a time when biologic drugs are becoming an increasing

proportion of therapeutics in development. Board Increases Stock

Repurchase Authorization Charles River�s Board of Directors has

increased the existing authorization for the repurchase of Charles

River common stock by $200.0 million. In addition to the remaining

balance of $30.7 million as of August 1, 2008, the amount currently

available under the authorization is $230.7 million. The stock

purchases will be made from time to time on the open market,

through block trades or otherwise in compliance with Rule 10b-18 of

the federal securities laws. Depending on market conditions and

other factors, these repurchases may be commenced or suspended at

any time or from time to time without prior notice. Funds for the

repurchases are expected to come from cash on hand or cash

generated by operations. During the second quarter of 2008, the

Company repurchased approximately 535,000 shares of common stock at

a total cost of $32.8 million. There are currently no specific

plans for the shares that have been or may be purchased under the

program. As of August 1, 2008, Charles River had approximately 67.8

million shares of common stock outstanding. Webcast Charles River

Laboratories has scheduled a live webcast on Wednesday, August 6,

at 8:30 a.m. ET to discuss matters relating to this press release.

To participate, please go to ir.criver.com and select the webcast

link. You can also find the associated slide presentation and

reconciliations of non-GAAP financial measures to comparable GAAP

financial measures on the website. Use of Non-GAAP Financial

Measures This press release contains non-GAAP financial measures,

such as non-GAAP earnings per diluted share from continuing

operations, which exclude amortization of intangible assets and

other charges related to our acquisitions, charges related to the

disposition of our Worcester facility, an impairment of our Vaccine

business in Mexico, the impact of the revaluation of a deferred tax

asset as a result of changes to a Massachusetts tax law, and gains

attributable to the curtailment of our U.S. pension plan. We

exclude these items from the non-GAAP financial measures because

they are outside our normal operations. There are limitations in

using non-GAAP financial measures, as they are not prepared in

accordance with generally accepted accounting principles, and may

be different than non-GAAP financial measures used by other

companies. In particular, we believe that the inclusion of

supplementary non-GAAP financial measures in this press release

helps investors to gain a meaningful understanding of our core

operating results and future prospects without the effect of

one-time charges, and is consistent with how management measures

and forecasts the Company's performance, especially when comparing

such results to prior periods or forecasts. We believe that the

financial impact of our acquisitions is often large relative to our

overall financial performance, which can adversely affect the

comparability of our results on a period-to-period basis. In

addition, certain activities, such as business acquisitions, happen

infrequently and the underlying costs associated with such

activities do not recur. Non-GAAP results also allow investors to

compare the Company�s operations against the financial results of

other companies in the industry who similarly provide non-GAAP

results. The non-GAAP financial measures included in this press

release are not meant to be considered superior to or a substitute

for results of operations prepared in accordance with GAAP. The

Company intends to continue to assess the potential value of

reporting non-GAAP results consistent with applicable rules and

regulations. Reconciliations of the non-GAAP financial measures

used in this press release to the most directly comparable GAAP

financial measures are set forth in the text of this press release,

and can also be found on the Company�s website at ir.criver.com.

Caution Concerning Forward-Looking Statements This news release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

�anticipate,� �believe,� �expect,� �will,� �may,� �estimate,�

�plan,� �outlook,� and �project� and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These statements also include

statements regarding our projected 2008 sales and earnings; the

future demand for drug discovery and development products and

services, including the outsourcing of these services; the impact

of specific actions intended to improve overall operating

efficiencies and profitability; the timing of the opening of new

and expanded facilities; our future stock purchase activities;

future cost reduction activities by our customers; and Charles

River�s future performance as delineated in our forward-looking

guidance, and particularly our expectations with respect to sales

growth. In addition, these statements include the intended

acquisition of NewLab and the expected impact on our revenues and

earnings. Forward-looking statements are based on Charles River�s

current expectations and beliefs, and involve a number of risks and

uncertainties that are difficult to predict and that could cause

actual results to differ materially from those stated or implied by

the forward-looking statements. Those risks and uncertainties

include, but are not limited to: the ability to successfully

consummate the acquisition of NewLab; a decrease in research and

development spending, a decrease in the level of outsourced

services, or other cost reduction actions by our customers; the

ability to convert backlog to sales; special interest groups;

contaminations; industry trends; new displacement technologies;

USDA and FDA regulations; changes in law; continued availability of

products and supplies; loss of key personnel; interest rate and

foreign currency exchange rate fluctuations; changes in tax

regulation and laws; changes in generally accepted accounting

principles; and any changes in business, political, or economic

conditions due to the threat of future terrorist activity in the

U.S. and other parts of the world, and related U.S. military action

overseas. A further description of these risks, uncertainties, and

other matters can be found in the Risk Factors detailed in Charles

River's Annual Report on Form 10-K as filed on February 20, 2008,

as well as other filings we make with the Securities and Exchange

Commission. Because forward-looking statements involve risks and

uncertainties, actual results and events may differ materially from

results and events currently expected by Charles River, and Charles

River assumes no obligation and expressly disclaims any duty to

update information contained in this news release except as

required by law. About Charles River Accelerating Drug Development.

Exactly. Charles River provides essential products and services to

help pharmaceutical and biotechnology companies, government

agencies and leading academic institutions around the globe

accelerate their research and drug development efforts. Our more

than 8,800 employees worldwide are focused on providing clients

with exactly what they need to improve and expedite the discovery,

development through first-in-human evaluation, and safe manufacture

of new therapies for the patients who need them. To learn more

about our unique portfolio and breadth of services, visit

www.criver.com. CHARLES RIVER LABORATORIES INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (dollars in

thousands, except for per share data) � Three Months Ended Six

Months Ended June 28, 2008 June 30, 2007 June 28, 2008 June 30,

2007 � Total net sales $ 352,134 $ 307,435 $ 689,819 $ 598,634 Cost

of products sold and services provided � 214,147 � � 186,479 � �

421,455 � � 362,105 � Gross margin 137,987 120,956 268,364 236,529

Selling, general and administrative 61,064 56,092 120,370 109,109

Amortization of intangibles � 7,600 � � 8,139 � � 15,171 � � 15,994

� Operating income 69,323 56,725 132,823 111,426 Interest income

(expense) (1,207 ) (2,595 ) (1,873 ) (4,654 ) Other income

(expense) � (267 ) � (1,069 ) � (1,104 ) � (920 ) Income before

income taxes and minority interests 67,849 53,061 129,846 105,852

Provision for income taxes � 17,920 � � 15,101 � � 34,846 � �

30,411 � Income before minority interests 49,929 37,960 95,000

75,441 Minority interests � 258 � � (119 ) � 341 � � (373 ) Income

from continuing operations 50,187 37,841 95,341 75,068 Loss from

discontinued businesses, net of tax � - � � 115 � � - � � (349 )

Net income (loss) $ 50,187 � $ 37,956 � $ 95,341 � $ 74,719 � �

Earnings (loss) per common share Basic: Continuing operations $

0.75 $ 0.57 $ 1.41 $ 1.13 Discontinued operations $ - $ - $ - $

(0.01 ) Net income $ 0.75 $ 0.57 $ 1.41 $ 1.12 Diluted: Continuing

operations $ 0.71 $ 0.55 $ 1.35 $ 1.10 Discontinued operations $ -

$ - $ - $ (0.01 ) Net income $ 0.71 $ 0.55 $ 1.35 $ 1.10 � Weighted

average number of common shares outstanding Basic 67,328,432

66,830,155 67,416,639 66,587,863 Diluted 70,363,643 68,517,657

70,464,092 67,971,898 CHARLES RIVER LABORATORIES INTERNATIONAL,

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in

thousands) � � June 28, 2008 December 29, 2007 Assets Current

assets Cash and cash equivalents $ 262,438 $ 225,449 Trade

receivables, net 240,009 213,908 Inventories 93,602 88,023 Other

current assets 80,328 79,477 Current assets of discontinued

businesses � 563 � 1,007 Total current assets 676,940 607,864

Property, plant and equipment, net 826,835 748,793 Goodwill, net

1,121,900 1,120,540 Other intangibles, net 135,512 148,905 Deferred

tax asset 65,342 89,255 Other assets 60,382 85,993 Long-term assets

of discontinued businesses � 4,187 � 4,187 Total assets $ 2,891,098

$ 2,805,537 � Liabilities and Shareholders� Equity Current

liabilities Current portion of long-term debt $ 210,042 $ 25,051

Accounts payable 43,523 36,715 Accrued compensation 52,517 53,359

Deferred revenue 94,889 102,021 Accrued liabilities 72,792 61,366

Other current liabilities 26,293 23,268 Current liabilities of

discontinued businesses � 719 � 748 Total current liabilities

500,775 302,528 Long-term debt 312,260 484,998 Other long-term

liabilities � 128,980 � 154,044 Total liabilities � 942,015 �

941,570 Minority interests 3,208 3,500 Total shareholders� equity �

1,945,875 � 1,860,467 Total liabilities and shareholders� equity $

2,891,098 $ 2,805,537 CHARLES RIVER LABORATORIES INTERNATIONAL,

INC. SELECTED BUSINESS SEGMENT INFORMATION (UNAUDITED) (dollars in

thousands) � � Three Months Ended Six Months Ended June 28, 2008

June 30, 2007 June 28, 2008 June 30, 2007 Research Models and

Services Net sales $ 172,848 $ 143,803 $ 341,444 $ 286,871 Gross

margin 76,429 63,109 152,685 126,763 Gross margin as a % of net

sales 44.2 % 43.9 % 44.7 % 44.2 % Operating income 52,199 45,268

108,012 92,289 Operating income as a % of net sales 30.2 % 31.5 %

31.6 % 32.2 % Depreciation and amortization 7,016 5,663 13,675

11,232 Capital expenditures 23,510 10,688 33,656 17,772 �

Preclinical Services Net sales $ 179,286 $ 163,632 $ 348,375 $

311,763 Gross margin 61,558 57,847 115,679 109,766 Gross margin as

a % of net sales 34.3 % 35.4 % 33.2 % 35.2 % Operating income

28,849 27,426 52,117 50,870 Operating income as a % of net sales

16.1 % 16.8 % 15.0 % 16.3 % Depreciation and amortization 16,004

15,569 31,678 29,913 Capital expenditures 40,667 38,724 70,225

69,564 � � Unallocated Corporate Overhead $ (11,725 ) $ (15,969 ) $

(27,306 ) $ (31,733 ) � � Total Net sales $ 352,134 $ 307,435 $

689,819 $ 598,634 Gross margin 137,987 120,956 268,364 236,529

Gross margin as a % of net sales 39.2 % 39.3 % 38.9 % 39.5 %

Operating income (loss) 69,323 56,725 132,823 111,426 Operating

income as a % of net sales 19.7 % 18.5 % 19.3 % 18.6 % Depreciation

and amortization 23,020 21,232 45,353 41,145 Capital expenditures

64,177 49,412 103,881 87,336 CHARLES RIVER LABORATORIES

INTERNATIONAL, INC. RECONCILIATION OF GAAP TO NON-GAAP SELECTED

BUSINESS SEGMENT INFORMATION (UNAUDITED) (dollars in thousands) � �

Three Months Ended Six Months Ended June 28, 2008 June 30, 2007

June 28, 2008 June 30, 2007 Research Models and Services Net sales

$ 172,848 $ 143,803 $ 341,444 $ 286,871 Operating income 52,199

45,268 108,012 92,289 Operating income as a % of net sales 30.2 %

31.5 % 31.6 % 32.2 % Add back: Amortization related to acquisitions

594 371 1,128 745 Impairment and other charges � 634 � � - � � 634

� � - � Operating income, excluding specified charges (Non-GAAP) $

53,427 $ 45,639 $ 109,774 $ 93,034 Non-GAAP operating income as a %

of net sales 30.9 % 31.7 % 32.1 % 32.4 % � Preclinical Services Net

sales $ 179,286 $ 163,632 $ 348,375 $ 311,763 Operating income

28,849 27,426 52,117 50,870 Operating income as a % of net sales

16.1 % 16.8 % 15.0 % 16.3 % Add back: Amortization related to

acquisitions 7,006 7,768 14,043 15,249 Impairment and other charges

� 2,187 � � 863 � � 2,873 � � 1,682 � Operating income, excluding

specified charges (Non-GAAP) $ 38,042 $ 36,057 $ 69,033 $ 67,801

Non-GAAP operating income as a % of net sales 21.2 % 22.0 % 19.8 %

21.7 % � � Unallocated Corporate Overhead $ (11,725 ) $ (15,969 ) $

(27,306 ) $ (31,733 ) Add back: Stock-based compensation related to

Inveresk acquisition - 18 - 88 Pension curtailment � (3,276 ) � - �

� (3,276 ) � - � Unallocated corporate overhead, excluding

specified charges (Non-GAAP) $ (15,001 ) $ (15,951 ) $ (30,582 ) $

(31,645 ) � � Total Net sales $ 352,134 $ 307,435 $ 689,819 $

598,634 Operating income 69,323 56,725 132,823 111,426 Operating

income as a % of net sales 19.7 % 18.5 % 19.3 % 18.6 % Add back:

Amortization related to acquisition 7,600 8,139 15,171 15,994

Stock-based compensation related to Inveresk acquisition - 18 - 88

Impairment and other charges 2,821 863 3,507 1,682 Pension

curtailment � (3,276 ) � - � � (3,276 ) � - � Operating income,

excluding specified charges (Non-GAAP) $ 76,468 $ 65,745 $ 148,225

$ 129,190 Non-GAAP operating income as a % of net sales 21.7 % 21.4

% 21.5 % 21.6 % � � Charles River management believes that

supplementary non-GAAP financial measures provide useful

information to allow investors to gain a meaningful understanding

of our core operating results and future prospects, without the

effect of one-time charges, consistent with the manner in which

management measures and forecasts the Company�s performance. The

supplementary non-GAAP financial measures included are not meant to

be considered superior to, or a substitute for results of

operations prepared in accordance with GAAP. The Company intends to

continue to assess the potential value of reporting non-GAAP

results consistent with applicable rules and regulations. CHARLES

RIVER LABORATORIES INTERNATIONAL, INC. RECONCILIATION OF GAAP

EARNINGS TO NON-GAAP EARNINGS (dollars in thousands, except for per

share data) � Three Months Ended Six Months Ended June 28, 2008

June 30, 2007 June 28, 2008 June 30, 2007 � Net income (loss) $

50,187 $ 37,956 $ 95,341 $ 74,719 Less: Discontinued operations � -

� � (115 ) � - � � 349 � Net income from continuing operations

50,187 37,841 95,341 75,068 Add back: Amortization related to

acquisitions 7,600 8,139 15,171 15,994 Stock-based compensation

related to Inveresk acquisition - 18 - 88 Impairment and other

charges 2,821 863 3,507 1,682 Pension curtailment (3,276 ) - (3,276

) - Tax effect � (1,962 ) � (3,061 ) � (4,567 ) � (5,845 ) Net

income from continuing operations, excluding specified charges

(Non-GAAP) $ 55,370 � $ 43,800 � $ 106,176 � $ 86,987 � � Weighted

average shares outstanding - Basic 67,328,432 66,830,155 67,416,639

66,587,863 Effect of dilutive securities: 2.25% senior convertible

debentures 1,454,072 203,034 1,438,261 - Stock options and

contingently issued restricted stock 1,271,120 1,350,004 1,318,566

1,250,385 Warrants � 310,019 � � 134,464 � � 290,626 � � 133,650 �

Weighted average shares outstanding - Diluted � 70,363,643 � �

68,517,657 � � 70,464,092 � � 67,971,898 � � Basic earnings (loss)

per share $ 0.75 $ 0.57 $ 1.41 $ 1.12 Diluted earnings (loss) per

share $ 0.71 $ 0.55 $ 1.35 $ 1.10 � Basic earnings per share,

excluding specified charges (Non-GAAP) $ 0.82 $ 0.66 $ 1.57 $ 1.31

Diluted earnings per share, excluding specified charges (Non-GAAP)

$ 0.79 $ 0.64 $ 1.51 $ 1.28 � � Charles River management believes

that supplementary non-GAAP financial measures provide useful

information to allow investors to gain a meaningful understanding

of our core operating results and future prospects, without the

effect of one-time charges, consistent with the manner in which

management measures and forecasts the Company�s performance. The

supplementary non-GAAP financial measures included are not meant to

be considered superior to, or a substitute for results of

operations prepared in accordance with GAAP. The Company intends to

continue to assess the potential value of reporting non-GAAP

results consistent with applicable rules and regulations.

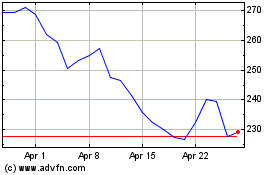

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jul 2023 to Jul 2024