Kendle Announces Acquisition of Phase II-IV Clinical Services Business of Charles River Laboratories International, Inc.

May 09 2006 - 10:30PM

PR Newswire (US)

- Advances Company's competitive position to world's fourth largest

provider of Phase II-IV clinical services CINCINNATI, May 9

/PRNewswire-FirstCall/ -- Kendle (NASDAQ:KNDL), a leading global

full-service clinical research organization (CRO), today announced

the signing of a definitive agreement to acquire the Phase II-IV

Clinical Services business of Charles River Laboratories

International, Inc. (NYSE:CRL) creating the world's fourth largest

provider of Phase II-IV clinical development services. With this

move, Kendle strengthens its position as one of the leading global

players in the clinical development industry, adding attractive

therapeutic expertise, diversifying its customer base and expanding

its capacity to deliver global trials. The transaction is expected

to close in the third quarter of 2006, subject to customary closing

conditions and regulatory approvals. The company will host a

conference call and Webcast Wednesday, May 10, 2006, at 11:30 a.m.

Eastern Time to discuss the acquisition (see below for details).

(Logo: http://www.newscom.com/cgi-bin/prnh/20030429/KNDLLOGO ) "We

are excited by this move, which is an important component of our

overall growth strategy designed to significantly enhance our

global competitive position and accelerate Kendle to a $500 million

organization," said Candace Kendle, PharmD, Chairman and Chief

Executive Officer. "Our customers will benefit from our

strengthened global project leadership capability, expanded

therapeutic expertise in the fastest-growing areas of clinical

development and enhanced depth in North America and a number of key

European markets. We look forward to completing the integration of

our new operations into Kendle under our four service brands, and

adding value for our customers through our combined organization."

The acquisition adds approximately $103 million in unaudited net

service revenues to Kendle's 2005 performance, representing

significant growth relative to 2005 actual results and putting

Kendle ahead of its long-term strategic plan to outperform the

market as a leading global CRO. The strategic combination will

offer biopharmaceutical customers the benefit of a broadened

therapeutic base, stronger global footprint and an expanded depth

of global clinical development services. The move also strengthens

the company's global project leadership expertise, which has been a

cornerstone of its growth and success. The acquired operations will

operate under the Kendle name. The acquisition provides Kendle with

a broadened strategic platform for growth to capitalize on the

increasing demand for global clinical development services. The

acquired assets bring the following key attributes to the expanded

Kendle: * Strong and growing backlog * Therapeutic expertise in

high-value categories such as oncology, infectious disease,

respiratory, cardiovascular and ophthalmology * Attractive customer

base providing very little overlap with Kendle's existing customers

* Skilled and experienced workforce with significant therapeutic

and global project leadership expertise, providing increased

capacity to deliver global trials The agreement provides for the

purchase of 100 percent of the stock of the Phase II-IV Clinical

Services business for approximately $215 million in cash. This

amount is subject to working capital adjustments to be determined

at closing. Kendle intends to finance the transaction with a

combination of cash on hand and debt. Kendle has obtained a

commitment for financing necessary to complete the acquisition from

UBS Investment Bank, which is also acting as Kendle's exclusive

financial advisor in connection with the transaction. Investor

Conference Call and Webcast Kendle will host a telephone conference

call and Webcast to discuss the acquisition on Wednesday, May 10,

at 11:30 a.m. Eastern Time. Conference Call Details Dial-in:

800-399-0069 (United States and Canada) 706-643-3694 (Outside North

America) Replay: 706-645-9291 Conference ID Number 9068977 Webcast

Please go to http://www.kendle.com/ or

http://www.videonewswire.com/event.asp?id=33899 . The Webcast will

be archived at http://www.kendle.com/ (click on "Investors")

shortly after the call. The conference call and archived Webcast

will be available until 5 p.m. Eastern Time on Friday, June 9.

About Kendle Kendle International Inc. (NASDAQ:KNDL) is among the

world's leading global clinical research organizations. We deliver

innovative and robust clinical development solutions -- from

first-in-human studies through market launch and surveillance -- to

help the world's biopharmaceutical companies maximize product life

cycles and grow market share. Our global clinical development

business is focused on five regions - North America, Europe,

Asia/Pacific, Latin America and Africa - to meet customer needs.

With the expertise of our associates worldwide, Kendle has

conducted clinical trials or provided regulatory, pharmacovigilance

and validation services in 70 countries. Additional information and

investor kits are available upon request from Kendle, 1200 Carew

Tower, 441 Vine Street, Cincinnati, OH 45202 or from the Company's

Web site at http://www.kendle.com/. Information provided herein,

which is not historical information, such as statements about

accelerating the Company's efforts to grow to a $500 million

organization, broadening our strategic platform for growth,

enhancing our global competitive position, are forward-looking

statements pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. All such forward-looking

statements, are based largely on management's expectations and are

subject to and qualified by risks and uncertainties that could

cause actual results and events currently expected by the Company

to differ materially from those expressed or implied by such

statements. These risks and uncertainties include, without

limitation, the acquisition may not be consummated by the expected

closing or at all, receipt of regulatory approval and financing

without unexpected delays, timely implementations and execution of

integration plans, the acquisition may involve unexpected costs,

the combined company may be unable to achieve cost-cutting

synergies, the businesses may suffer as a result of uncertainty

surrounding the acquisition, the Company's ability to manage growth

and to continue to attract and retain qualified personnel, the

Company's ability to complete additional acquisitions and to

integrate newly acquired businesses, cancellation or delay of

contracts, ability to maintain existing customer relationships or

enter into new ones, the economic climate nationally and

internationally as it affects the drug development operations and

other factors beyond the control of the Company described in the

Company's filings with the Securities and Exchange Commission

including Quarterly Reports on Form 10-Q and the Annual Report on

Form 10-K. All information in this release is current as of May 9,

2006. The Company undertakes no duty to update any forward-looking

statement to conform the statement to actual results or changes in

the Company's expectations.

http://www.newscom.com/cgi-bin/prnh/20030429/KNDLLOGO

http://photoarchive.ap.org/ DATASOURCE: Kendle CONTACT: Patty

Frank, Investors, +1-513-763-1992, Lori Dorer, Media,

+1-513-345-1685, both of Kendle Web site: http://www.kendle.com/

Copyright

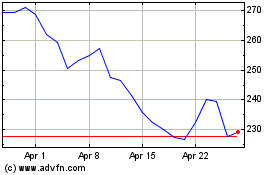

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Charles River Laboratories (NYSE:CRL)

Historical Stock Chart

From Jul 2023 to Jul 2024