CGI Group Inc. (TSX:GIB.A)(NYSE:GIB)

Fiscal 2011 Year-over-Year Highlights

-- Revenue of $4.32 billion, up 18.9% on a constant currency basis;

-- Bookings of $4.9 billion, or 113% of revenue;

-- Adjusted EBIT of $562.0 million, up 9.8%;

-- Adjusted EBIT margin of 13.0%;

-- Net Earnings of $435.1 million, up 19.9%;

-- Net Earnings margin of 10.1%, up from 9.7%;

-- Diluted EPS of $1.58, up 34 cents or 27.4%;

-- Cash provided by continuing operating activities of $571.2 million or

$2.07 per diluted share;

-- Investment of $305.0 million in share buyback;

-- Net debt reduced by $113.4 million;

-- Return on equity 19.5%; return on invested capital of 14.1%.

Note: All figures are in Canadian dollars. F2011 and Q4

MD&A, financial statements and accompanying notes can be found

at www.cgi.com/investors and have been filed with both SEDAR in

Canada and EDGAR in the U.S. All non-GAAP measures are outlined on

page 3 of the MD&A.

CGI Group Inc. (TSX:GIB.A)(NYSE:GIB) generated revenue of $4.32

billion for the fiscal year ended September 30, 2011 compared with

$3.73 billion in fiscal 2010, representing an increase of 15.8%.

Foreign exchange fluctuations unfavourably impacted revenue by

$116.1 million or 3.1% compared with the same period last year.

Excluding this impact, revenue growth was 18.9%.

Adjusted EBIT in F2011 was $562.0 million, compared with $511.9

million in F2010, an increase of 9.8%. Adjusted EBIT margin was

13.0%.

Net earnings were $435.1 million compared with $362.8 million in

F2010, an increase of 19.9%. Net earnings margin was 10.1% in

F2011, compared with 9.7% in the previous year.

Diluted earnings per share were $1.58 compared with $1.24 in

F2010, an increase of 27.4%.

For the fiscal year, CGI generated $571.2 million in cash from

operations, or 13.2% of revenue, representing $2.07 per diluted

share.

During the fiscal year, the Company acquired 16.4 million shares

as part of its previous and current Normal Course Issuer Bid for

$305.0 million, at an average price of $18.63. In addition, the

Company reduced its net debt by $113.4 million during the fiscal

year finishing with net debt of $897.4 million, representing a net

debt to capitalization of 26.8%.

In fiscal 2011, new contract signings totaled $4.9 billion or

113% of revenue. The Company's backlog at year-end was $13.5

billion or 3.1 times our 2011 revenue.

----------------------------------------------------------------------------

In $ 000's except percentages and share data

----------------------------------------------------------------------------

FY2011 FY2010

----------------------------------------------------------------------------

Revenue 4,323,237 3,732,117

----------------------------------------------------------------------------

Year-over-year growth 15.8% (2.4%)

----------------------------------------------------------------------------

Year-over-year growth at constant currency 18.9% 3.4%

----------------------------------------------------------------------------

Adjusted EBIT 561,952 511,902

----------------------------------------------------------------------------

Adjusted EBIT margin 13.0% 13.7%

----------------------------------------------------------------------------

Net earnings 435,065 362,766

----------------------------------------------------------------------------

Net earnings margin 10.1% 9.7%

----------------------------------------------------------------------------

Basic EPS 1.64 1.27

----------------------------------------------------------------------------

Diluted EPS 1.58 1.24

----------------------------------------------------------------------------

Cash provided by continuing operating

activities 571,215 552,367

----------------------------------------------------------------------------

Weighted average number of outstanding shares

(diluted) 275,286,534 292,919,950

----------------------------------------------------------------------------

Number of outstanding shares at September 30 260,663,199 271,292,950

----------------------------------------------------------------------------

Net debt 897,418 1,010,816

----------------------------------------------------------------------------

Net debt to capitalization ratio 26.8% 30.6%

----------------------------------------------------------------------------

Return on equity 19.5% 16.4%

----------------------------------------------------------------------------

Return on invested capital 14.1% 16.3%

----------------------------------------------------------------------------

Bookings 4,875,328 4,643,200

----------------------------------------------------------------------------

Backlog 13,455,638 13,320,078

----------------------------------------------------------------------------

Q4 F2011 Results

For the fourth quarter of fiscal 2011, CGI generated revenue of

$1.03 billion, compared with $1.01 billion in the year ago period,

representing an increase of 2.4%. On a constant currency basis,

this represents growth of 5.3%. Foreign exchange fluctuations

unfavourably impacted revenue by $29.2 million or 2.9% compared

with the same period last year.

Net earnings in the fourth quarter were $73.1 million and

diluted earnings per share were 27 cents. This compares with $84.1

million or 30 cents per share in the year ago period. This reflects

a pre-tax charge of $45.4 million related to the advancement of

real estate consolidation plans, workforce adjustments and a

non-cash impairment charge related to business solutions.

Excluding this charge, adjusted EBIT in Q4-2011 was $148.2

million, or 14.4% of revenue compared with $149.1 million or 14.8%

of revenue in the same period last year.

Net earnings in the fourth quarter would have been $104.8

million, representing a margin of 10.2%. This compares with Q4 2010

net earnings of $101.1 million, or 10.0% of revenue.

Diluted earnings per share would have been 39 cents, compared

with 36 cents in the fourth quarter of 2010, representing an

increase of 8.3%.

"While the restructuring charge in the fourth quarter was

necessary to improve our competitive position, it will be accretive

to earnings per share in fiscal 2012," said Michael E. Roach,

President and CEO. "We delivered strong and balanced results in

fiscal 2011 and have entered fiscal 2012 in an excellent position

both strategically and operationally."

Cash provided by operating activities totaled $192.8 million in

the fourth quarter or 18.7% of revenue representing $0.71 per

share.

In the fourth quarter, new contract signings totaled $1.5

billion, or 143% of revenue, composed primarily of new bookings in

the government and financial services sectors.

"Despite ongoing uncertainty in the US federal marketplace, we

have seen a significant increase in contract awards as CGI Federal

delivered a record book-to-bill of 269% in the quarter," added Mr.

Roach. "We remain convinced that CGI is well-positioned to continue

growing our government business globally, and specifically in the

US as the flow of contract awards returns to more normalized

levels."

The following table presents the Q4 results for both 2010 and

2011:

----------------------------------------------------------------------------

In $ 000's except percentages, share data and DSO

----------------------------------------------------------------------------

Q4-2011 Q4-2010

----------------------------------------------------------------------------

Revenue 1,031,565 1,007,056

----------------------------------------------------------------------------

Year-over-year growth 2.4% 8.7%

----------------------------------------------------------------------------

Year-over-year growth at constant currency 5.3% 13.8%

----------------------------------------------------------------------------

Adjusted EBIT 102,772 139,801

----------------------------------------------------------------------------

Adjusted EBIT margin 10.0% 13.9%

----------------------------------------------------------------------------

Net earnings 73,093 84,076

----------------------------------------------------------------------------

Net earnings margin 7.1% 8.3%

----------------------------------------------------------------------------

Basic EPS 0.28 0.31

----------------------------------------------------------------------------

Diluted EPS 0.27 0.30

----------------------------------------------------------------------------

Cash from operating activities 192,782 158,473

----------------------------------------------------------------------------

Weighted average number of outstanding shares

(diluted) 271,305,183 281,951,998

----------------------------------------------------------------------------

DSO (Days of sales outstanding) 53 47

----------------------------------------------------------------------------

Bookings 1,472,188 1,082,620

----------------------------------------------------------------------------

As part of its Normal Course Issuer Bid, the Company acquired

3.3 million shares for $63.8 million during the fourth quarter of

2011 at an average price of $19.13 per share. This brings the

cumulative total number of shares purchased under the current

Normal Course Issuer Bid to approximately 9.7 million shares or 42%

of the authorized limit for the current buyback program, which runs

into February 2012.

Q4 and Full-Year F2011 Results Conference Call

Senior management will host a conference call to discuss results

at 9 a.m. EST this morning. Participants may access the call by

dialing (866) 223-7781 or on the Web at www.cgi.com/investors.

Supporting slides for the call will also be available. For those

unable to participate on the live call, a podcast and copy of the

slides will be archived for download at www.cgi.com/investors.

About CGI

Founded in 1976, CGI Group Inc. is one of the largest

independent information technology and business process services

firms in the world. CGI and its affiliated companies employ

approximately 31,000 professionals. CGI provides end-to-end IT and

business process services to clients worldwide from offices and

centers of excellence in Canada, the United States, Europe and Asia

Pacific. As at September 30, 2011, CGI's revenue was $4.3 billion

and its order backlog was $13.5 billion. CGI shares are listed on

the TSX (GIB.A) and the NYSE (GIB) and are included in both the Dow

Jones Sustainability Index and the FTSEXGood Index. Website:

www.cgi.com.

Non-GAAP financial metrics used in this release: Constant

currency growth, adjusted EBIT, net debt to capitalization, DSO,

ROE and ROIC

CGI reports its financial results in accordance with GAAP.

However, management believes that these non-GAAP measures provide

useful information to investors regarding the Company's financial

condition and results of operations as they provide additional

measures of its performance. Additional details for these non-GAAP

measures can be found on page 3 of our MD&A which is posted on

CGI's website, and filed with SEDAR and EDGAR.

Forward-Looking Statements

All statements in this press release that do not directly and

exclusively relate to historical facts constitute "forward-looking

statements" within the meaning of that term in Section 27A of the

United States Securities Act of 1933, as amended, and Section 21E

of the United States Securities Exchange Act of 1934, as amended,

and are "forward-looking information" within the meaning of section

138.3 and following of the Ontario Securities Act. These statements

and this information represent CGI's intentions, plans,

expectations and beliefs, and are subject to risks, uncertainties

and other factors, of which many are beyond the control of the

Company. These factors could cause actual results to differ

materially from such forward-looking statements or forward-looking

information. These factors include but are not restricted to: the

timing and size of new contracts; acquisitions and other corporate

developments; the ability to attract and retain qualified members;

market competition in the rapidly evolving IT industry; general

economic and business conditions; foreign exchange and other risks

identified in the press release, in CGI's Annual Report on Form

40-F filed with the U.S. Securities and Exchange Commission (filed

on EDGAR at www.sec.gov), the Company's Annual Information Form

filed with the Canadian securities authorities (filed on SEDAR at

www.sedar.com), as well as assumptions regarding the foregoing. The

words "believe," "estimate," "expect," "intend," "anticipate,"

"foresee," "plan," and similar expressions and variations thereof,

identify certain of such forward-looking statements or

forward-looking information, which speak only as of the date on

which they are made. In particular, statements relating to future

performance are forward-looking statements and forward-looking

information. CGI disclaims any intention or obligation to publicly

update or revise any forward-looking statements or forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable law. Readers are

cautioned not to place undue reliance on these forward-looking

statements or on this forward-looking information. You will find

more information about the risks that could cause our actual

results to differ significantly from our current expectations in

the Risks and Uncertainties section.

Contacts: Colin Brown Manager, Investor

Relationscolin.brown@cgi.com 514-841-3634www.cgi.com/newsroom

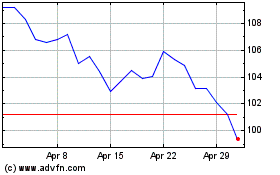

CGI (NYSE:GIB)

Historical Stock Chart

From Jun 2024 to Jul 2024

CGI (NYSE:GIB)

Historical Stock Chart

From Jul 2023 to Jul 2024