CGI reports strong margin and EPS growth in Q3-F2010

July 27 2010 - 6:30AM

PR Newswire (Canada)

MONTREAL, July 27 /CNW/ -- Q3-F2010 year-over-year highlights from

continuing operations: - Revenue of $901.6 million, up 0.7% on a

constant currency basis; - Bookings of $838 million; - Adjusted

EBIT of $124.5 million, up 10.0%; - Adjusted EBIT margin of 13.8%,

up from 11.9% - Earnings of $85.9 million, up 12.0%; - Earnings

margin of 9.5%, up from 8.1%; - Diluted EPS of 30 cents, up 20%; -

Cash from operating activities of $102.8 million; - Backlog of

$11.4 billion. Note: All figures are in Canadian dollars and from

continuing operations. Q3 F2010 MD&A, financial statements and

accompanying notes may be found at www.cgi.com/investors and have

been filed with both SEDAR in Canada and EDGAR in the U.S. Stock

Market Symbols GIB.A (TSX) GIB (NYSE) MONTREAL, July 27 /CNW

Telbec/ - CGI Group Inc. (TSX: GIB.A; NYSE: GIB) reported fiscal

2010 third quarter revenue of $901.6 million. Foreign exchange

fluctuations unfavourably impacted revenue by $55.3 million, or

5.8% compared with the same period last year. Sequentially, and

year-over-year, revenue was stable on a constant currency basis.

Adjusted EBIT was $124.5 million compared with $113.1 million in

the same quarter last year, representing an increase of 10.0%

year-over-year. This represents an adjusted EBIT margin of 13.8% up

from 11.9% in the third quarter of 2009. Net earnings were $85.9

million or 9.5% of revenue compared with $76.7 million in the same

quarter last year, representing an increase of 12.0%

year-over-year. Diluted earnings per share were 30 cents, up 20.0%

compared with 25 cents in the same period last year. The Company

generated $102.8 million in cash from operating activities, or

11.4% of revenue for the third quarter. On a last twelve months

basis, CGI has generated $586.3 million or approximately $1.96 in

cash per diluted share. Normal Course Issuer Bid The Company

purchased 7.1 million CGI shares during the quarter for $111.8

million. Since the beginning of the fiscal year on October 1, 2009,

27,483,385 shares were purchased at an average price of $14.31 for

a total investment of $393.3 million. On January 27, 2010 the

Company's Board of Directors authorized the renewal of the Normal

Course Issuer Bid for the purchase of up to an additional 10% of

the Company's public float of shares, or approximately 25 million

shares during the next year. As at June 30, 2010 the Company has

purchased 40% of its allowable amount.

-------------------------------------------------------------------------

In millions of Canadian dollars from continuing operations except

earnings per share and where noted Q3 F2010 Q3 F2009

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Revenue 901.6 950.4

-------------------------------------------------------------------------

Adjusted EBIT 124.5 113.1 Margin 13.8% 11.9%

-------------------------------------------------------------------------

Earnings before income taxes 120.2 111.1 Margin 13.3% 11.7%

-------------------------------------------------------------------------

Earnings 85.9 76.7 Margin 9.5% 8.1%

-------------------------------------------------------------------------

Earnings per share (diluted) 0.30 0.25

-------------------------------------------------------------------------

Weighted average number of outstanding shares (diluted) 290,226,120

311,500,173

-------------------------------------------------------------------------

Interest on long-term debt 4.4 3.5

-------------------------------------------------------------------------

Days of sales outstanding (DSO) 36 41

-------------------------------------------------------------------------

Return on invested capital 16.8% 13.8%

-------------------------------------------------------------------------

Return on equity 16.1% 14.3%

-------------------------------------------------------------------------

Bookings 838 1,059

-------------------------------------------------------------------------

Backlog 11,358 11,772

-------------------------------------------------------------------------

During the quarter, the Company booked $838 million in new contract

wins, extensions and renewals, bringing the total bookings over the

last twelve months to $4.1 billion, for a book-to-bill of 113%. At

the end of June 2010, the Company's backlog of signed orders stood

at $11.4 billion. This represents 3.1 times annual revenue. "We

continue to see a gradual return of discretionary spending on

strategic IT initiatives," said Michael E. Roach, President and

Chief Executive Officer. "The strength of our cash generation

ability combined with the significant and consistent growth in

earnings per share afford us the operating flexibility to expand

and deepen our business relationships with both new and existing

clients on a global basis." "Our commitment to operational

excellence and adherence to sound business fundamentals continue to

surface shareholder value," added Mr. Roach. At the end of the

fiscal third quarter, the Company had over $1.7 billion in

available capital, including $394.6 million in cash and an unused

$1.3 billion under its line of credit secured through 2012.

Acquisition of Stanley, Inc. On July 12, 2010, CGI announced the

extension of its tender offer for shares of Stanley (NYSE: SXE)

until August 2, 2010 because certain conditions to the Offer

(including the review and approval by the Committee on Foreign

Investment in the United States pursuant to the Exon-Florio

Amendment to Section 721 of the Defense Production Act of 1950 and

the approval by the Defense Security Service of the United States

Department of Defense of a plan to operate Stanley's business

pursuant to a "FOCI" (foreign ownership, control or influence)

mitigation agreement that does not impose certain restrictions or

conditions) were not yet satisfied before the expiration of the

Offer. At the time of the extension, 84% of the shares had been

tendered. These conditions have still not been met. The Company

remains committed to disclosing further details as appropriate.

Third Quarter F2010 Results Conference Call Management will host a

conference call to discuss results at 9:00 a.m. Eastern time this

morning. Participants may access the call by dialing (866) 223-7781

or on the Web at www.cgi.com/investors. Supporting slides for the

call will also be available. For those unable to participate on the

live call, a podcast and copy of the slides will be archived for

download at www.cgi.com/investors. About CGI Founded in 1976, CGI

Group Inc. is one of the largest independent information technology

and business process services firms in the world. CGI and its

affiliated companies employ approximately 26,000 professionals. CGI

provides end-to-end IT and business process services to clients

worldwide from offices in Canada, the United States, Europe and

Asia Pacific as well as from centers of excellence in North

America, Europe and India. As of June 30, 2010, CGI's order backlog

was $11.4 billion. CGI shares are listed on the NYSE (GIB) and the

TSX (GIB.A) and are included in both, the Dow Jones Sustainability

World Index and the FTSE4Good Index. Website: www.cgi.com. Use of

Non-GAAP Financial Information CGI reports its financial results in

accordance with GAAP. However, management believes that certain

non-GAAP measures provide useful information to investors regarding

the Company's financial condition and results of operations as they

provide additional measures of its performance. Explanations as

well as reconciliations of these non-GAAP measures with the GAAP

financial statements are provided in the MD&A which is posted

on CGI's website, and filed with SEDAR and EDGAR. Forward-Looking

Statements All statements in this press release that do not

directly and exclusively relate to historical facts constitute

"forward-looking statements" within the meaning of that term in

Section 27A of the United States Securities Act of 1933, as

amended, and Section 21E of the United States Securities Exchange

Act of 1934, as amended, and are "forward-looking information"

within the meaning of Canadian securities laws. These statements

and this information represent CGI's intentions, plans,

expectations and beliefs, and are subject to risks, uncertainties

and other factors, of which many are beyond the control of the

Company. These factors could cause actual results to differ

materially from such forward-looking statements or forward-looking

information. These factors include but are not restricted to: the

timing and size of new contracts; acquisitions and other corporate

developments; the ability to attract and retain qualified members;

market competition in the rapidly evolving IT industry; general

economic and business conditions; foreign exchange and other risks

identified in the press release, in CGI's Annual Report on Form

40-F filed with the U.S. Securities and Exchange Commission (filed

on EDGAR at www.sec.gov), the Company's Annual Information Form

filed with the Canadian securities authorities (filed on SEDAR at

www.sedar.com), as well as assumptions regarding the foregoing. The

words "believe," "estimate," "expect," "intend," "anticipate,"

"foresee," "plan," and similar expressions and variations thereof,

identify certain of such forward-looking statements or

forward-looking information, which speak only as of the date on

which they are made. In particular, statements relating to future

performance are forward-looking statements and forward-looking

information. CGI disclaims any intention or obligation to publicly

update or revise any forward-looking statements or forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable law. Readers are

cautioned not to place undue reliance on these forward-looking

statements or on this forward-looking information. You will find

more information about the risks that could cause our actual

results to differ significantly from our current expectations in

the Risks and Uncertainties section. Lorne Gorber, Vice-President,

Global Communications and Investor Relations, 514 841-3355,

lorne.gorber@cgi.com

Copyright

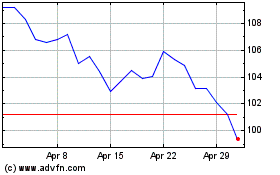

CGI (NYSE:GIB)

Historical Stock Chart

From May 2024 to Jun 2024

CGI (NYSE:GIB)

Historical Stock Chart

From Jun 2023 to Jun 2024