Amerigroup, Centene, Molina Are Big Texas Medicaid Winners

August 02 2011 - 12:08PM

Dow Jones News

Medicaid insurers Amerigroup Corp. (AGP), Centene Corp. (CNC)

and Molina Healthcare Inc. (MOH) were big winners in a closely

watched contest for business in Texas that could add billions in

new revenue for the industry.

The Texas wins helped some companies regain ground Tuesday after

slumping in recent days on concerns about pressure on premiums and

the state of Georgia taking back money after record-keeping

problems caused overpayments. Shares of Amerigroup--which dropped

29% between Friday and Monday after it disclosed the Georgia

issues--recently traded up 4.2% to $50.09.

Centene rose 3% to $32.55, while Molina slipped six cents to

$22.13.

"The Texas announcement will remind the market that Medicaid is

a growth industry, and despite the vicious stock movements

recently, the overall thesis of these plans doubling revenue

between now and 2014 hasn't changed," Citigroup analyst Carl

McDonald said.

Amerigroup, Centene and Molina could pick up the most new

business in Texas, which announced on Monday tentative awards to

several public and private health firms that will play an expanding

role in providing Medicaid coverage for the poor. Bigger,

diversified insurers UnitedHealth Group Inc. (UNH) and Aetna Inc.

(AET) also won new business, but not as much, according to analyst

estimates, while nonprofits also picked up new members.

HealthSpring Inc. (HS) also added a modest amount of new

business, analysts estimated.

The state said insurers will start providing service in expanded

areas on March 1 next year. The awards are subject to working out

final contracts with the state.

Analysts' initial estimates varied, but they generally saw big

potential revenue gains for the Medicaid insurers. Citigroup's

McDonald, for example, estimated Centene will add $1.1 billion

while Amerigroup adds $1 billion and Molina adds $625 million.

Stifel analyst Thomas Carroll had similar estimates for

Amerigroup and Molina, but estimated $666 million in added revenue

for Centene. He said estimates are preliminary, since rates are not

yet final. He also upgraded his rating on Amerigroup to buy from

hold

WellCare Health Plans Inc. (WCG) was surprisingly excluded from

the market expansion, Carroll added, though he acknowledged that

"there is plenty of future Medicaid business to go around."

The Texas Medicaid awards follow wins in Louisiana last week for

Amerigroup, Centene and UnitedHealth and wins earlier in July in

Kentucky for WellCare, Coventry Health Care Inc. (CHV) and

Centene.

Among the Texas winners, Centene reiterated its earnings

guidance for 2011, which it said incorporates start-up costs

associated with the Texas award.

The big managed-care companies didn't fare as well in Texas as

the Medicaid-specialized firms, though McDonald estimated about

$489 million in added revenue for United and $28 million for Aetna.

He thinks WellPoint Inc. (WLP), meantime, lost $65.6 million in

revenue there.

Their performance raises the question "of whether the Medicaid

M&A strategies of these companies need to evolve before they

miss out on one of the few significant growth opportunities in the

industry," McDonald said.

WellPoint shares recently traded down 1.7% to $64.35 while Aetna

traded down 1.9% to $39.55 and UnitedHealth slipped 2.2% to

$46.96.

-By Jon Kamp, Dow Jones Newswires; 617-654-6728;

jon.kamp@dowjones.com

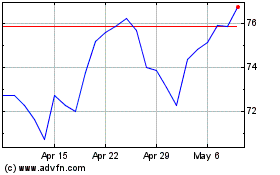

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024