For Medicaid Managed-Care Companies, Opportunities Despite Risk

July 14 2010 - 4:16PM

Dow Jones News

Ongoing state budget crises and eventual implementation of the

health overhaul should mean a healthier environment for Medicaid

managed-care companies, even though the industry faces funding

risks as well.

Shares of Medicaid-focused health insurers have been pressured

recently, reflecting investor concern over state budgets and

Congress's failure so far to extend enhanced federal matching

subsidies to states.

Nonetheless, companies like Amerigroup Corp. (AGP), Molina

Healthcare Inc. (MOH) and Centene Corp. (CNC) stand to gain

business as more budget-troubled states seek help keeping Medicaid

costs down--and later, as millions more people gain coverage as a

result of the health overhaul.

"While state budgets are still in terrible shape, we think

Medicaid stock valuations will improve because it is one of the few

areas of managed care with significant top-line growth potential

over the next few years," Citigroup analyst Carl McDonald said

Wednesday, initiating coverage of Amerigroup, Centene and Molina

with buy ratings.

"States continue to turn to managed care to cover a greater

number of enrollees, and health reform has the potential to boost

the Medicaid population by over 30% in 2014," he said. "In

addition, the Medicaid plans have a significant amount of net cash

... relative to their current market cap."

Medicaid plans may have to do with state rate increases that lag

medical cost trends, although this shouldn't hurt stock valuations

much, according to McDonald, who expects larger insurers to acquire

pure-play Medicaid plans as a means to enter or expand their

presence in the business.

In addition to gaining more Medicaid beneficiaries, the Medicaid

managed-care companies also may compete for the business of

individuals who receive subsidies to purchase private insurance in

the state health exchanges that will be established by 2014, per

the overhaul law.

Near term, state budget pressures provide both opportunity and

risks for Medicaid managed-care companies, Deutsche Bank analyst

Scott Fidel said.

"The clear risk is that Medicaid rates will remain under

pressure in 2011-2012 while the opportunity is that the states will

accelerate the migration of their Medicaid populations into managed

care, strengthening the overall (bid request) pipeline," Fidel

said. He expects the companies to benefit near-term from moderating

medical cost increases.

Molina, Centene and Amerigroup all traded higher Wednesday,

possibly on Citi's coverage announcement. Molina was up 9% over the

past month, while Amerigroup was down 5% and Centene down about

5.4%. WellCare Health Plans Inc. (WCG), which also provides

Medicaid plans, was up 1% late in the afternoon and down about 12%

over the past month.

-By Dinah Wisenberg Brin, Dow Jones Newswires, 215-656-8285;

dinah.brin@dowjones.com

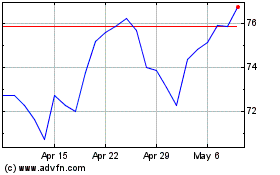

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024