Centene Corporation (NYSE: CNC) today announced its financial

results for the quarter and year ended December 31, 2007. The

results exclude the benefit of the July 1 through December 31, 2007

period rate increase for Georgia which was in our previous guidance

and will now be recognized in the first quarter of 2008. Our

updated guidance disclosed later in this press release reflects

this change. As previously announced, premium taxes are now

separately disclosed as a component of both revenues and operating

expenses on our statement of operations. Related financial ratios

included in this release exclude premium taxes. Additionally, we

have reclassified and reported our Kansas and Missouri health

plans, collectively FirstGuard, as discontinued operations. Unless

specifically noted, the discussions below are in the context of

continuing operations, and therefore, exclude the FirstGuard

operations. � � � � 2007 Highlights � � Q4 � � Full Year Total

Revenues (in millions) $ 777.4 $ 2,919.3 Medicaid/SCHIP HBR 84.0 %

83.2 % Diluted EPS (as reported) $ 0.07 $ 0.92 Diluted EPS

(excluding restructuring charges) $ 0.20 $ 1.09 � � � � Fourth

Quarter Summary 2007 fourth quarter earnings impacted by the

inability to recognize the July 1, 2007 Georgia rate increase until

the 2008 first quarter. Quarter-end Medicaid Managed Care

membership of 1.1 million. Revenues of $777.4 million, a 25.8%

increase over the 2006 fourth quarter. Earnings per diluted share

of $0.20 (excluding restructuring charges), compared to $0.21 in

the 2006 fourth quarter. Health Benefits Ratio (HBR) for Centene�s

Medicaid and SCHIP populations, which reflects medical costs as a

percent of premium revenues, of 84.0%. Medicaid Managed Care

G&A expense ratio of 11.8% and Specialty Services G&A ratio

of 15.4%. Total operating cash flows of $37.5 million. Days in

claims payable of 49.1. Other Events Recognized previously

announced restructuring charge totaling $9.4 million pre-tax. Began

participating in the state of South Carolina�s conversion to

managed care. Michael F. Neidorff, Centene�s Chairman and Chief

Executive Officer, stated, �We concluded the fourth quarter of 2007

with solid revenue, membership and earnings results. Additionally,

our cash flows were strong, our Medicaid HBR improved to 84.0%, a

decrease of 140 basis points from the 2006 fourth quarter, and our

G&A was consistent with our expectations. �In Ohio, our core

Medicaid program growth was in line. Medical costs in the ABD

population, not unexpectedly, continue to be challenging as we work

to manage the integration of these members into our network. Over

time, we believe that targeted margins are achievable as we reach

critical mass and are able to more effectively manage their care.

�In Texas, we experienced growing membership in both SCHIP and the

Texas STAR Plus (SSI) program. We are on track for the launch of

the state�s Foster Care program on April 1, 2008. �As we commence

2008, we will focus on growing our revenue stream to external third

party vendors through our specialty company products and PBM. We

are optimistic about the prospects for growth in both new and

existing markets in Medicaid managed care and in our specialty

businesses,� concluded Neidorff. The following table depicts

membership in Centene�s managed care organizations, by state, at

December 31, 2007 and 2006: � � � � � � � � � � � � 2007 � � 2006

Georgia 287,900 308,800 Indiana 154,600 183,100 New Jersey 57,300

58,900 Ohio 128,700 109,200 South Carolina 31,800 � Texas 354,400

298,500 Wisconsin 131,900 164,800 Total 1,146,600 1,123,300 � � � �

� � � � � � The following table depicts membership in Centene�s

managed care organizations, by member category, at December 31,

2007 and 2006: � � � � � � 2007 � � 2006 Medicaid 848,100 887,300

SCHIP 224,400 216,200 SSI 74,100 19,800 Total 1,146,600 (a)

1,123,300 (b) � (a) 1,111,500 at-risk; 35,100 ASO � (b) 1,112,700

at-risk; 10,600 ASO � � Statement of Operations For the 2007 fourth

quarter, revenues from continuing operations increased 25.8% to

$777.4 million from $617.8 million in the 2006 fourth quarter. The

increase was mainly driven by membership growth in Texas and Ohio,

which are the two markets that added SSI products in 2007. The

fourth quarter included an approximate $4.2 million reduction of

premium revenue and pre-tax earnings due to a prior period true-up

with the State of Indiana. The HBR for Centene�s Medicaid and SCHIP

populations, which reflects medical costs as a percent of premium

revenues, was 84.0%, an increase from 81.3% in the 2007 third

quarter. The increase resulted from pharmacy and other general

seasonality and the previously mentioned premium true-up in

Indiana. G&A expense as a percent of premium and service

revenues for the Medicaid Managed Care segment was 11.8% in the

fourth quarter of 2007 compared to 10.4% in the fourth quarter of

2006. The increase in the Medicaid Managed Care G&A expense

ratio for the three months ended December 31, 2007 primarily

reflects our previously announced restructuring charge recorded in

the fourth quarter. The pre-tax restructuring charge for asset

impairment and severance totaled $9.4 million and increased our

G&A ratio by 1.3%. Operating earnings were $0.3 million,

including the restructuring charge. Excluding the restructuring

charge, operating earnings were $9.7 million compared to $9.8

million in the 2006 fourth quarter. Reported GAAP earnings per

diluted share from continuing operations were $0.07, or $0.20

excluding restructuring charges, compared to $0.21 in the 2006

fourth quarter. Net earnings per diluted share (including

discontinued operations) were $0.03. For the year ended December

31, 2007, revenues from continuing operations increased 48.8% to

$2.9 billion from $2.0 billion for the same period in the prior

year. Medicaid Managed Care G&A expenses as a percent of

premium and service revenues decreased to 11.1% in the year ended

December 31, 2007, compared to 11.4% in the year ended December 31,

2006. Excluding the $12.4 million of restructuring charges,

earnings from operations increased to $66.5 million in the year

ended December 31, 2007 from $27.8 million in the year ended

December 31, 2006. Net earnings from continuing operations,

excluding the restructuring charges, were $49.0 million or $1.09

per diluted share in 2007. Balance Sheet and Cash Flow At December

31, 2007, the Company had cash and investments of $659.2 million,

including $626.2 million held by its regulated entities and $33.0

million held by its unregulated entities. Medical claims

liabilities totaled $335.9 million, representing 49.1 days in

claims payable, unchanged from September 30, 2007. Total debt was

$207.4 million and debt to capitalization was 33.3%. Outlook The

table below depicts the Company�s guidance for the 2008 first

quarter and full year. � � � � � � Q1 2008 � � 2008 Low � � High

Low � � High Revenue (in millions) (1) $ 785 $ 795 $ 3,370 $ 3,470

Earnings per diluted share $ 0.59 $ 0.64 $ 2.04 $ 2.14 � � (1)

Revenue net of premium tax � � Eric R. Slusser, Centene�s Chief

Financial Officer, stated, �This guidance reflects normal

seasonality, previously mentioned start-up costs in Texas, South

Carolina and Florida of approximately $0.09, and the state of

Wisconsin�s decision to carve-out pharmacy benefits from our

premium, effective February 1, 2008. This guidance also includes

premium rate increases of 1.5% in Ohio, effective January 1, 6.3%

in Indiana, effective January 1, 3.5% in Wisconsin, effective

February 1, and a 3.8% rate increase in Georgia retroactive to July

1, 2007.� Conference Call As previously announced, the Company will

host a conference call Friday, February 8, 2008, at 7:30 A.M.

(Eastern Time) to review the financial results for the fourth

quarter ended December 31, 2007, and to discuss its business

outlook. Michael F. Neidorff and Eric R. Slusser will host the

conference call. Investors are invited to participate in the

conference call by dialing 800-273-1254 in the U.S. and Canada,

706-679-8592 from abroad, or via a live internet broadcast on the

Company's website at www.centene.com, under the Investor Relations

section. A replay will be available for on-demand listening shortly

after the completion of the call until 11:59 P.M. (Eastern Time) on

February 22, 2008 at the aforementioned URL, or by dialing

800-642-1687 in the U.S. and Canada, or 706-645-9291 from abroad,

and entering access code 34562229. Non-GAAP Financial Presentation

The Company is providing certain non-GAAP financial measures in

this release as the Company believes these figures are helpful in

allowing individuals to more accurately assess the ongoing nature

of the Company's operations and measure the Company's performance

more consistently. The 2007 non-GAAP information presented above in

the �highlights� table, third bullet under "Fourth Quarter Summary"

and fourth, fifth and seventh bullets under "Statement of

Operations" excludes the second quarter contribution to our

charitable foundation with a portion of the proceeds from the sale

of FirstGuard Missouri as well as the fourth quarter charges for

fixed asset impairment and severance for an organizational

realignment, collectively, restructuring charges. This exclusion

has been made in the non-GAAP financial measures as management

believes these 2007 restructuring charges are not indicative of

future company operations. The Company uses the presented non-GAAP

financial measures internally to focus management on

period-to-period changes in the Company's core business operations.

Therefore, the Company believes this information is meaningful in

addition to the information contained in the GAAP presentation of

financial information. The presentation of this additional non-GAAP

financial information is not intended to be considered in isolation

or as a substitute for the financial information prepared and

presented in accordance with GAAP. The following tables reconcile

the Company�s Statement of Operations for the three months and year

ended December 31, 2007 on a GAAP basis to a non-GAAP basis. The

2007 non-GAAP basis excludes the restructuring charges mentioned

above (in thousands, except share data). � Three Months Ended

December 31, 2007 GAAP � Restructuring Charges � Non-GAAP � Total

revenues $ 777,439 $ � $ 777,439 Expenses: Medical costs 629,437 �

629,437 Cost of services 15,532 � 15,532 General and administrative

expenses 110,978 9,392 101,586 Premium tax expense � 21,145 � � � �

� 21,145 � Total operating expenses � 777,092 � � 9,392 � � 767,700

� Earnings (loss) from operations 347 (9,392 ) 9,739 Investment and

other income, net � 2,102 � � � � � 2,102 � Earnings (loss) before

income taxes 2,449 (9,392 ) 11,841 Income tax expense (benefit) �

(584 ) � (3,523 ) � 2,939 � Net earnings from continuing operations

3,033 (5,869 ) 8,902 Discontinued operations, net of income tax �

(1,560 ) � � � � (1,560 ) Net earnings (loss) $ 1,473 � $ (5,869 )

$ 7,342 � � Diluted earnings per common share from continuing

operations $ 0.07 $ 0.20 � Year Ended December 31, 2007 GAAP �

Restructuring Charges (1) � Non-GAAP � Total revenues $ 2,919,292 $

� $ 2,919,292 Expenses: Medical costs 2,324,486 � 2,324,486 Cost of

services 61,454 � 61,454 General and administrative expenses

399,687 12,392 387,295 Premium tax expense � 79,572 � � � � 79,572

Total operating expenses � 2,865,199 � 12,392 � � 2,852,807

Earnings (loss) from operations 54,093 (12,392 ) 66,485 Investment

and other income, net � 9,543 � � � � 9,543 Earnings (loss) before

income taxes 63,636 (12,392 ) 76,028 Income tax expense (benefit) �

22,367 � (4,663 ) � 27,030 Net earnings from continuing operations

41,269 (7,729 ) 48,998 Discontinued operations, net of income tax �

32,133 � � � � 32,133 Net earnings (loss) $ 73,402 $ (7,729 ) $

81,131 � Diluted earnings per common share from continuing

operations $ 0.92 $ 1.09 � (1) For the year ended December 31,

2007, restructuring charges include a $3,000 pre-tax contribution

of a portion of the FirstGuard sale proceeds to the Company�s

charitable foundation. Premium Tax Presentation The following table

shows the Company�s Medicaid/SCHIP HBR and the Medicaid Managed

Care G&A ratio on a net basis as reported as well as on a gross

basis for analytical purposes. On a net basis, the HBR is

calculated as Medical costs divided by Premium revenues and the

G&A ratio is recorded as G&A expense divided by the sum of

Premium revenue and Service revenue. On a gross basis, the HBR is

calculated as Medical costs divided by the sum of Premium revenues

and Premium tax and the G&A ratio is recorded as G&A

expense plus Premium tax expense, divided by Total revenues. � � �

� � � Premium Taxes (in thousands) Medicaid/SCHIP HBR Medicaid

Managed Care G&A Ratio Current (Net) � � Gross Current (Net) �

� Gross 2007 Q1 $ 17,816 84.5 % 82.0 % 10.2 % 12.7 % Q2 19,874 82.8

80.3 11.4 13.9 Q3 20,737 81.3 78.9 11.0 13.5 Q4 � 21,145 84.0 81.2

11.8 14.3 Total Year $ 79,572 83.2 80.6 11.1 13.6 � 2006 Q1 $ 3,250

81.8 % 80.9 % 12.6 % 13.4 % Q2 5,806 84.8 83.5 12.5 13.8 Q3 12,590

84.4 82.2 11.0 13.2 Q4 � 16,315 85.4 82.9 10.4 12.8 Total Year $

37,961 84.3 82.5 11.4 13.2 About Centene Corporation Centene

Corporation is a leading multi-line healthcare enterprise that

provides programs and related services to individuals receiving

benefits under Medicaid, including the State Children�s Health

Insurance Program (SCHIP) and Supplemental Security Income (SSI).

The Company operates health plans in Georgia, Indiana, New Jersey,

Ohio, South Carolina, Texas and Wisconsin. In addition, the Company

contracts with other healthcare and commercial organizations to

provide specialty services including behavioral health, life and

health management, long-term care, managed vision, nurse triage,

pharmacy benefits management and treatment compliance. Information

regarding Centene is available via the Internet at www.centene.com.

The information provided in this press release contains

forward-looking statements that relate to future events and future

financial performance of Centene. Subsequent events and

developments may cause the Company's estimates to change. The

Company disclaims any obligation to update this forward-looking

financial information in the future. Readers are cautioned that

matters subject to forward-looking statements involve known and

unknown risks and uncertainties, including economic, regulatory,

competitive and other factors that may cause Centene's or its

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Actual results may

differ from projections or estimates due to a variety of important

factors, including Centene's ability to accurately predict and

effectively manage health benefits and other operating expenses,

competition, changes in healthcare practices, changes in federal or

state laws or regulations, inflation, provider contract changes,

new technologies, reduction in provider payments by governmental

payors, major epidemics, disasters and numerous other factors

affecting the delivery and cost of healthcare. The expiration,

cancellation or suspension of Centene's Medicaid Managed Care

contracts by state governments would also negatively affect

Centene. (Tables Follow) � CENTENE CORPORATION AND SUBSIDIARIES �

CONSOLIDATED BALANCE SHEETS (In thousands, except share data) �

December 31, 2007 � 2006 (Unaudited) ASSETS Current assets: Cash

and cash equivalents of continuing operations $ 268,584 $ 253,370

Cash and cash equivalents of discontinued operations � � � 17,677 �

Total cash and cash equivalents 268,584 271,047 Premium and related

receivables 90,072 74,379 Short-term investments, at fair value

(amortized cost $46,392 and $57,031, respectively) 46,269 56,790

Other current assets 41,414 17,279 Current assets of discontinued

operations, other than cash � � � 32,327 � Total current assets

446,339 451,822 Long-term investments, at fair value (amortized

cost $314,681 and $117,620, respectively) 317,041 116,052

Restricted deposits, at fair value (amortized cost $27,056 and

$24,512, respectively) 27,301 24,355 Property, software and

equipment, net 138,139 110,688 Goodwill 141,030 129,881 Other

intangible assets, net 13,205 15,555 Other assets 36,067 9,209

Long-term assets of discontinued operations � � � 37,418 � Total

assets $ 1,119,122 $ 894,980 � LIABILITIES AND STOCKHOLDERS� EQUITY

Current liabilities: Medical claims liabilities $ 335,856 $ 249,864

Accounts payable and accrued expenses 105,096 63,893 Unearned

revenue 44,016 33,816 Current portion of long-term debt and notes

payable 971 971 Current liabilities of discontinued operations �

861 � 39,407 � Total current liabilities 486,800 387,951 Long-term

debt 206,406 174,646 Other liabilities 10,869 5,853 Long-term

liabilities of discontinued operations � � � 107 � Total

liabilities 704,075 568,557 Stockholders� equity: Common stock,

$.001 par value; authorized 100,000,000 shares; issued and

outstanding 43,667,837 and 43,369,918 shares, respectively 44 44

Additional paid-in capital 221,693 209,340 Accumulated other

comprehensive income: Unrealized gain (loss) on investments, net of

tax 1,571 (1,251 ) Retained earnings � 191,739 � 118,290 � Total

stockholders� equity � 415,047 � 326,423 � Total liabilities and

stockholders� equity $ 1,119,122 $ 894,980 � � CENTENE CORPORATION

AND SUBSIDIARIES � CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands, except share data) � � Three Months Ended December 31, �

Year Ended December 31, 2007 � 2006 2007 � 2006 (Unaudited)

(Unaudited) Revenues: Premium $ 736,895 $ 581,217 $ 2,759,018 $

1,844,452 Premium tax 21,145 16,315 79,572 37,961 Service � 19,399

� � 20,263 � � 80,702 � � 79,581 � Total revenues � 777,439 � �

617,795 � � 2,919,292 � � 1,961,994 � Expenses: Medical costs

629,437 495,712 2,324,486 1,555,658 Cost of services 15,532 15,396

61,454 60,506 General and administrative expenses 110,978 80,527

399,687 280,067 Premium tax expense � 21,145 � � 16,315 � � 79,572

� � 37,961 � Total operating expenses � 777,092 � � 607,950 � �

2,865,199 � � 1,934,192 � Earnings from operations 347 9,845 54,093

27,802 Other income (expense): Investment and other income 6,212

6,251 25,169 16,416 Interest expense � (4,110 ) � (3,100 ) �

(15,626 ) � (10,636 ) Earnings before income taxes 2,449 12,996

63,636 33,582 Income tax expense � (584 ) � 3,745 � � 22,367 � �

12,642 � Net earnings from continuing operations 3,033 9,251 41,269

20,940 Discontinued operations, net of income tax (benefit) expense

of $1,621, $3,904, $(30,899) and $9,335 respectively � (1,560 ) �

4,582 � � 32,133 � � (64,569 ) Net earnings (loss) $ 1,473 � $

13,833 � $ 73,402 � $ (43,629 ) � Net earnings (loss) per common

share: Basic: Continuing operations $ 0.07 $ 0.21 $ 0.95 $ 0.49

Discontinued operations � (0.04 ) � 0.11 � � 0.74 � � (1.50 ) Basic

earnings (loss) per common share $ 0.03 � $ 0.32 � $ 1.69 � $ (1.01

) Diluted: Continuing operations $ 0.07 $ 0.21 $ 0.92 $ 0.47

Discontinued operations � (0.04 ) � 0.10 � � 0.72 � � (1.45 )

Diluted earnings (loss) per common share $ 0.03 � $ 0.31 � $ 1.64 �

$ (0.98 ) � Weighted average number of common shares outstanding:

Basic 43,574,811 43,263,237 43,539,950 43,160,860 Diluted

44,951,016 44,631,117 44,823,082 44,613,622 � CENTENE CORPORATION

AND SUBSIDIARIES � CONSOLIDATED STATEMENTS OF CASH FLOWS (In

thousands) � Year Ended December 31, 2007 � 2006 (Unaudited) Cash

flows from operating activities: Net earnings (loss) $ 73,402 $

(43,629 ) Adjustments to reconcile net earnings (loss) to net cash

provided by operating activities� Depreciation and amortization

27,807 20,600 Stock compensation expense 15,781 14,904 Gain on sale

of FirstGuard Missouri (7,472 ) � Impairment loss 7,207 88,268

Deferred income taxes (10,223 ) (6,692 ) Changes in assets and

liabilities� Premium and related receivables 1,663 (39,765 ) Other

current assets (6,253 ) 5,352 Other assets (348 ) 91 Medical claims

liabilities 56,287 108,003 Unearned revenue 10,085 20,035 Accounts

payable and accrued expenses 31,234 28,136 Other operating

activities � 3,070 � � (271 ) Net cash provided by operating

activities � 202,240 � � 195,032 � Cash flows from investing

activities: Purchase of property, software and equipment (53,937 )

(50,318 ) Purchase of investments (606,366 ) (319,322 ) Sales and

maturities of investments 456,738 286,155 Proceeds from asset sales

14,102 � Investments in acquisitions and equity method investee,

net of cash acquired � (36,001 ) � (66,772 ) Net cash used in

investing activities � (225,464 ) � (150,257 ) Cash flows from

financing activities: Proceeds from exercise of stock options 5,464

6,953 Proceeds from borrowings 212,000 94,359 Payment of long-term

debt and notes payable (181,981 ) (17,355 ) Excess tax benefits

from stock compensation � 3,043 Common stock repurchases (9,541 )

(7,833 ) Debt issue costs � (5,181 ) � (253 ) Net cash provided by

financing activities � 20,761 � � 78,914 � Net (decrease) increase

in cash and cash equivalents � (2,463 ) � 123,689 � Cash and cash

equivalents, beginning of period � 271,047 � � 147,358 � Cash and

cash equivalents, end of period $ 268,584 � $ 271,047 � � Interest

paid $ 11,945 $ 10,680 Income taxes paid $ 7,348 $ 16,418 �

Supplemental schedule of non-cash investing and financing

activities: Property acquired under capital leases $ 1,736 $ 366 �

CENTENE CORPORATION � CONTINUING OPERATIONS SUPPLEMENTAL FINANCIAL

DATA � � Q4 � Q3 � Q2 � Q1 2007 2007 2007 2007 MEMBERSHIP Medicaid

Managed Care: Georgia 287,900 286,200 281,400 291,300 Indiana

154,600 156,300 161,700 176,700 New Jersey 57,300 58,300 59,100

59,100 Ohio 128,700 127,500 128,200 118,300 South Carolina 31,800

29,300 31,100 � Texas 354,400 347,000 333,900 318,500 Wisconsin

131,900 132,700 136,100 139,400 TOTAL 1,146,600 1,137,300 1,131,500

1,103,300 � Medicaid 848,100 841,600 846,900 839,600 SCHIP 224,400

223,500 216,500 211,200 SSI 74,100 72,200 68,100 52,500 TOTAL

1,146,600 1,137,300 1,131,500 1,103,300 � Specialty Services(a):

Arizona 99,900 99,000 95,200 93,600 Kansas 39,000 35,600 37,500

36,600 TOTAL 138,900 134,600 132,700 130,200 � (a) Includes

behavioral health contracts only. � REVENUE PER MEMBER(b) $ 210.34

$ 201.05 $ 193.09 $ 178.55 � CLAIMS(b) Period-end inventory 312,700

265,400 281,000 317,600 Average inventory 288,700 319,900 248,200

228,600 Period-end inventory per member 0.28 0.24 0.26 0.29 � (b)

Revenue per member and claims information are presented for the

Medicaid Managed Care segment. � � Q4 � � Q3 � � Q2 � � Q1 2007

2007 2007 2007 � DAYS IN CLAIMS PAYABLE (c) 49.1 49.1 46.2 45.6 (c)

Days in Claims Payable is a calculation of Medical Claims

Liabilities at the end of the period divided by average claims

expense per calendar day for such period. � CASH AND INVESTMENTS

(in millions) Regulated $ 626.2 $ 593.6 $ 527.9 $ 491.0 Unregulated

� 33.0 � � 45.9 � � 65.8 � � 71.8 � TOTAL $ 659.2 � $ 639.5 � $

593.7 � $ 562.8 � � DEBT TO CAPITALIZATION (d) 33.3 % 33.1 % 34.0 %

35.3 % (d) Debt to Capitalization is calculated as follows: total

debt divided by (total debt + equity). HEALTH BENEFITS RATIO BY

CATEGORY: � � Three Months Ended December 31, � � Year Ended

December 31, 2007 � 2006 2007 � 2006 Medicaid and SCHIP 84.0 % 85.4

% 83.2 % 84.3 % SSI 94.5 92.2 92.0 88.0 Specialty Services 74.9

80.5 78.2 82.6 GENERAL AND ADMINISTRATIVE EXPENSE RATIO BY BUSINESS

SEGMENT: � � Three Months Ended December 31, � � Year Ended

December 31, 2007 � 2006 2007 � 2006 Medicaid Managed Care 11.8 %

10.4 % 11.1 % 11.4 % Specialty Services 15.4 14.5 15.4 17.1 MEDICAL

CLAIMS LIABILITIES (In thousands) � Four rolling quarters of the

changes in medical claims liabilities are summarized as follows: �

Balance, December 31, 2006 $ 249,864 Incurred related to: Current

period 2,340,716 Prior period � (16,230 ) Total incurred �

2,324,486 � Paid related to: Current period 2,009,881 Prior period

� 228,613 � Total paid � 2,238,494 � Balance, December 31, 2007 $

335,856 � Centene�s claims reserving process utilizes a consistent

actuarial methodology to estimate Centene�s ultimate liability. Any

reduction in the �Incurred related to: Prior period� claims may be

offset as Centene actuarially determines �Incurred related to:

Current period.� As such, only in the absence of a consistent

reserving methodology would favorable development of prior period

claims liability estimates reduce medical costs. Centene believes

it has consistently applied its claims reserving methodology in

each of the periods presented.

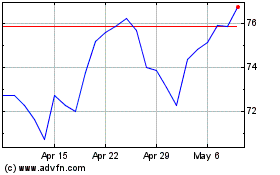

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

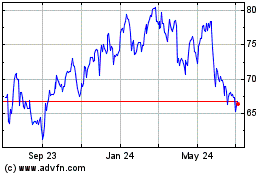

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024